Last updated: March 17th, 2020 3:52 PM

Last updated: March 17th, 2020 3:52 PM

GSTR 2 Filing Procedure - GST Portal

All entities having GST registration are required to file GSTR 2 return. The first GSTR 2 return for the month of July 2017 is due on or before the 31st of October, 2017. Filing GSTR 2 return is more complex than filing GSTR 1 return, as details of the input tax credit as uploaded by suppliers must be matched with the purchase invoice ledger maintained by the business. In this article, we look at the procedure for filing GSTR 2 return on the GST portal and using LEDGERS GST software. In case you need help with GST return filing, get in touch with an IndiaFilings Advisor.Basics of GSTR2 Return Filing

Before starting to file GSTR2 return on the GST Portal, the tax return preparer must be familiar with the following concepts of GST return filing.GSTR-2A

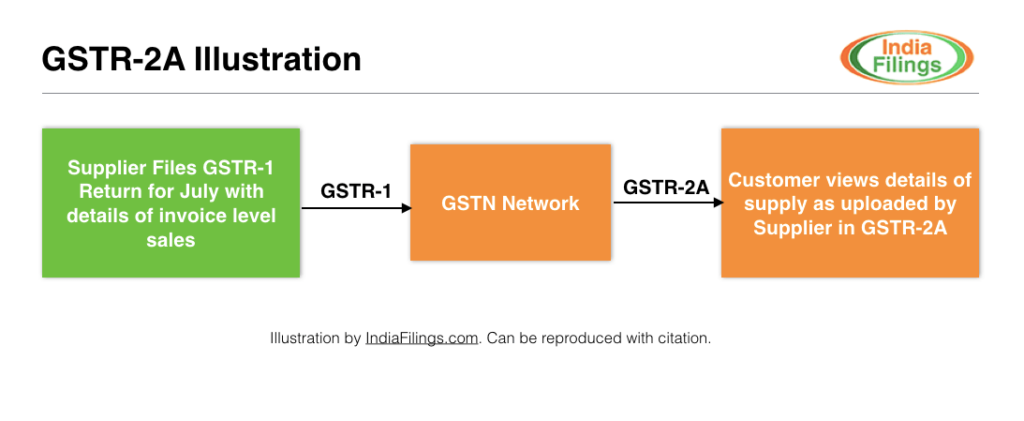

GSTR-2A is auto-drafted for all taxpayers having GST registration based on the GSTR-1 return filed by all other taxpayers. For, instance, if a business named Computer Systems sold Rs.1 lakh worth of computer to a business named Excellent Education, then Computer Systems shall file GSTR1 providing the details of the transaction. The details provided by Computer Systems should reflect in Excellent Education in GSTR-2A. GSTR-2A Illustration

GSTR-2A Illustration

GSTR-2A Reconcilliation

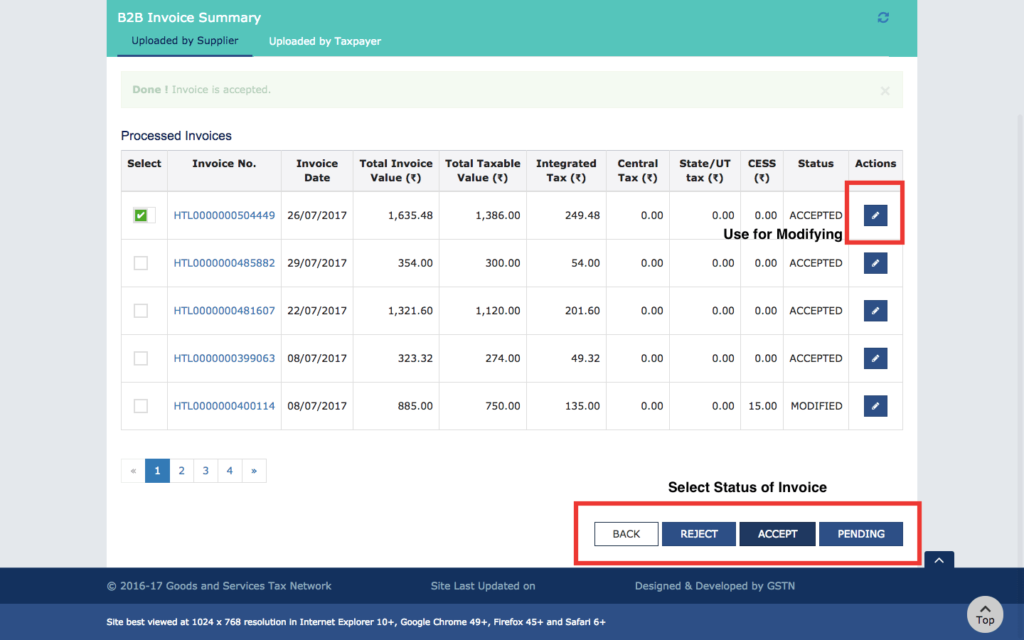

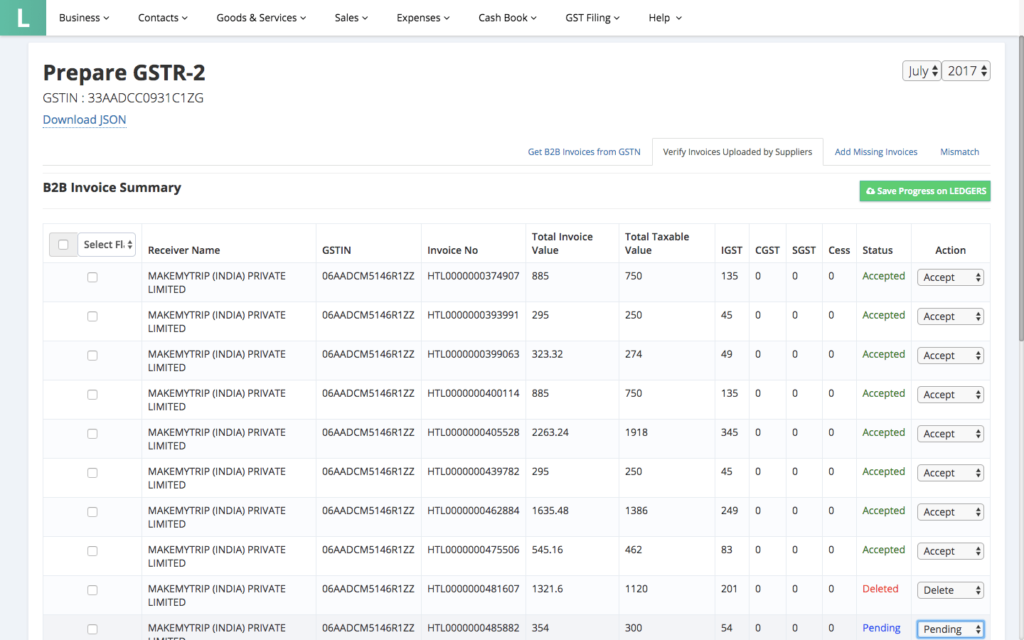

Once the GSTR-2A return is downloaded from the GST Portal into the GST Offline tool of LEDGERS GST Software, the data downloaded from GSTR-2 must be matched with the purchase invoices maintained by the taxpayer. Based on the matching of GSTR-2A and purchase invoices, the taxpayers can take the following actions with respect to the data uploaded by the supplier:Accept

If an invoice shown under GSTR-2A is accepted, then the input tax credit as uploaded by the supplier is provided to the taxpayer. For accepting an invoice as shown in GSTR-2A, no additional information is required. LEDGERS GST Software has powerful features for auto-reconciliation and can help you quickly reconcile thousands of invoices uploaded by suppliers without any errors.Modify

The individual can use the option 'Modify' if the supplier uploaded the details incorrectly. However, invoice number and date cannot be changed by the taxpayer. Only, information like taxable value, place of supply, IGST, SGST, CGST and Cess can be modified. If the taxpayer wishes to modify an invoice, the taxpayer would be required to submit the information to be modified.Add

Add can be used to add invoices that suppliers have failed to upload to the GST Portal. To add an invoice, the taxpayer must provide details like invoice number, supplier GSTIN, invoice date, taxable value, IGST, CGST, SGST and Cess charged. Any invoice added by the taxpayer will be shown to the supplier for acceptance or rejection.Reject

Reject can be used if the taxpayer has not entered into such a transaction as mentioned by the supplier on the GSTR-2A. Reject will be useful when a supplier has quoted a wrong GSTIN while uploading the invoices.Pending

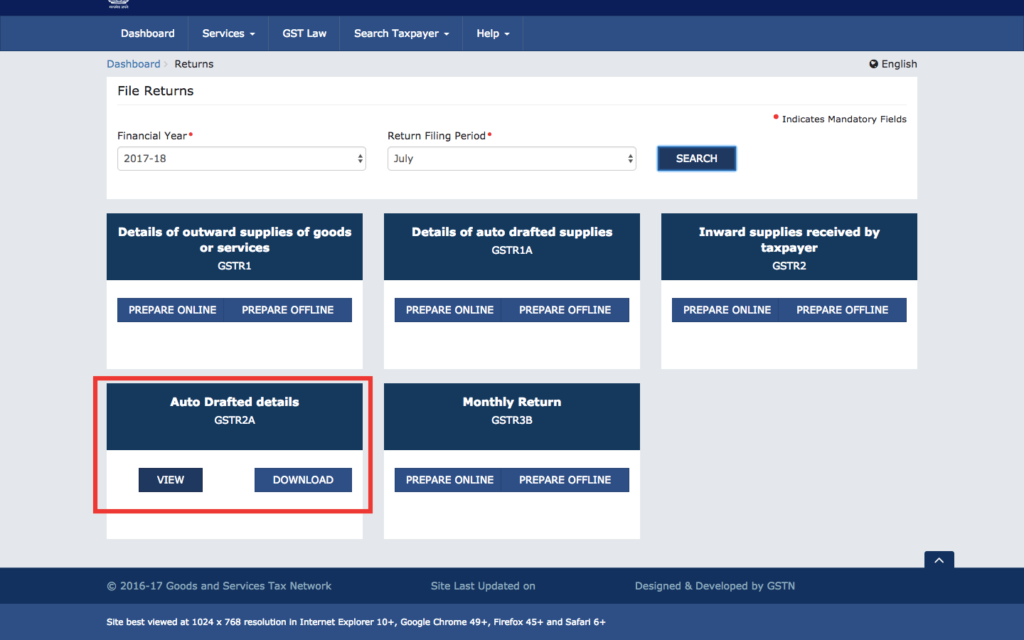

Pending can be used if the taxpayer has received the invoice but is yet to make a payment on the invoice. For instance, if a supplier has issued an invoice and dispatch goods in the month of July, but the customer is yet to accept the goods, then the invoice can be kept pending. Invoices kept pending will not be eligible for the input tax credit. They will remain in pending until cleared by the taxpayer.Step 1: View or Download GSTR-2A

All taxpayers registered on the GST Portal can view their GSTR-2A return by logging into their GST Portal, accessing their dashboard and clicking on View auto-drafted GSTR-2A. The Portal shows the taxpayer a summary of suppliers with the ability to drill-down further. In case you wish to use the GST offline tool for preparing GST return, click on the download button to download the GSTR-2A data in ZIP file format for preparing GSTR-2 return using GST offline tool. GSTR-2A View Invoices

GSTR-2A View Invoices

GSTR-2A Invoice Level Detail

Filing of GSTR2 return starts with viewing and downloading GSTR-2A. Hence, it is important for all taxpayers to be familiar with downloading GSTR-2A return from the Government website.

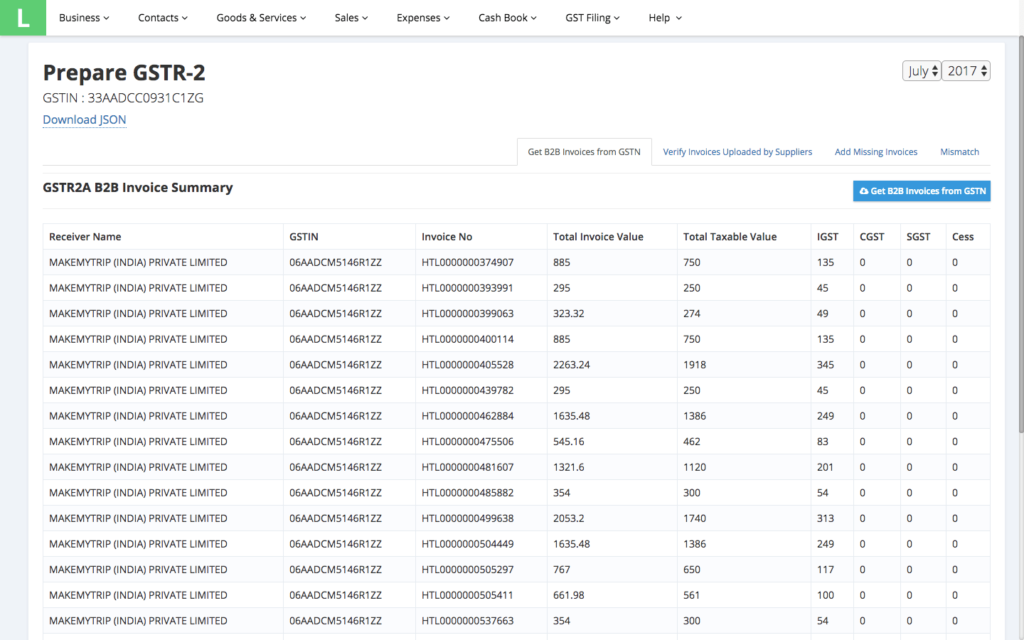

In case you are using LEDGERS GST Software for GSTR-2 filing, GSTR-2A can be directly downloaded from the Government website and made ready for reconciliation by clicking on the GET GSTR-2A button.

GSTR-2A Invoice Level Detail

Filing of GSTR2 return starts with viewing and downloading GSTR-2A. Hence, it is important for all taxpayers to be familiar with downloading GSTR-2A return from the Government website.

In case you are using LEDGERS GST Software for GSTR-2 filing, GSTR-2A can be directly downloaded from the Government website and made ready for reconciliation by clicking on the GET GSTR-2A button.

GSTR-2A LEDGERS GST Software

GSTR-2A LEDGERS GST Software

Step 2: Reconcile GSTR-2A with Purchase Invoices

Reconciliation of GSTR-2A data with purchase invoices or purchases of the taxpayers is the most tedious task, as each and every invoice has to be matched and verified for correctness. In case you are using the GST offline tool, there is no facility for reconciliation with purchase invoices. The taxpayer would have to manually select the action for each invoice, which could be time-consuming. Updating Status of Invoice

If the individual uses LEDGERS GST Software, you can change the status of GSTR-2A invoices in bulk and reconcile to the purchase invoices. Hence, by using LEDGERS time for processing thousands of GST invoices shortens to a few minutes compared to hours on the GST Portal.

Updating Status of Invoice

If the individual uses LEDGERS GST Software, you can change the status of GSTR-2A invoices in bulk and reconcile to the purchase invoices. Hence, by using LEDGERS time for processing thousands of GST invoices shortens to a few minutes compared to hours on the GST Portal.

Updating Status of Invoice on LEDGERS

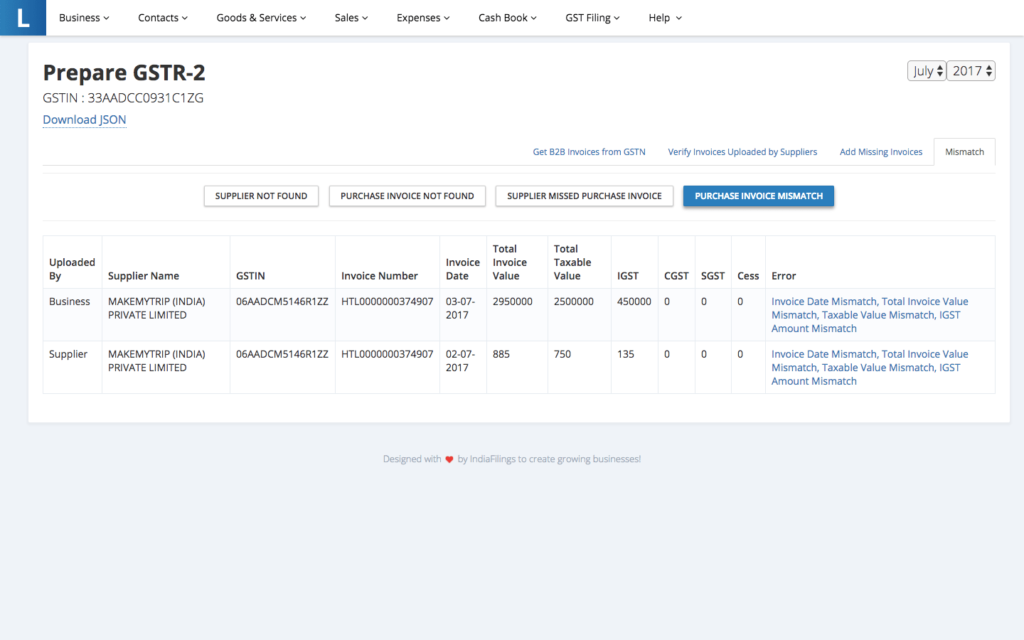

Finally, since the GST Portal does not have the functionality to connect with the purchase invoices, there could be errors in adding or accepting or modifying invoices. On the other hand, while using LEDGERS, the system automatically creates a mismatch report along with details of mismatch, to reduce errors and quickly reconcile thousands of invoices.

Updating Status of Invoice on LEDGERS

Finally, since the GST Portal does not have the functionality to connect with the purchase invoices, there could be errors in adding or accepting or modifying invoices. On the other hand, while using LEDGERS, the system automatically creates a mismatch report along with details of mismatch, to reduce errors and quickly reconcile thousands of invoices.

Purchase Invoice Mismatch

Purchase Invoice Mismatch

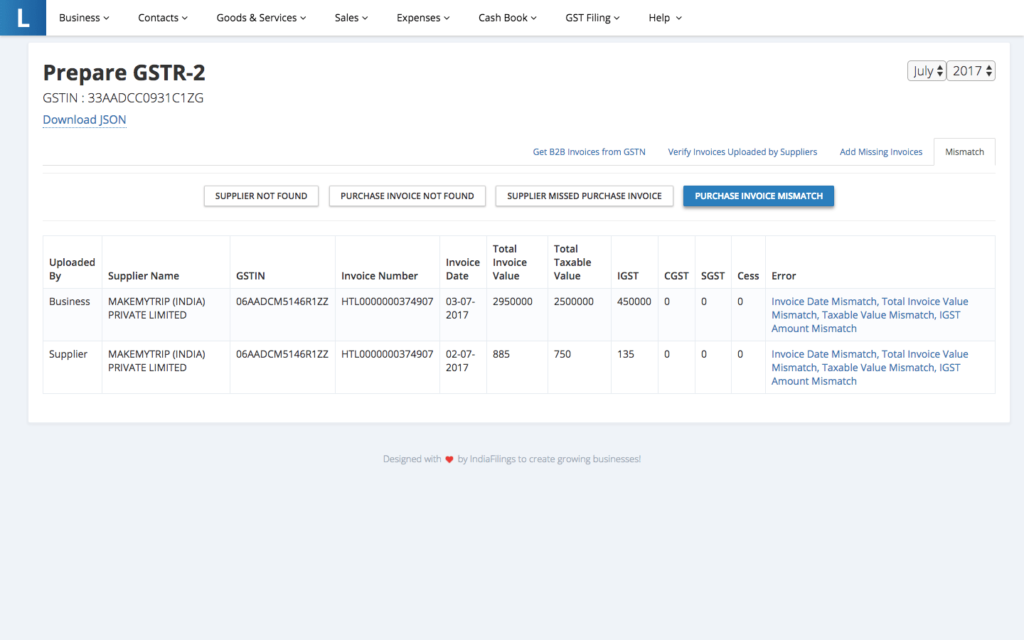

Supplier Missed Purchase Invoices

Supplier Missed Purchase Invoices

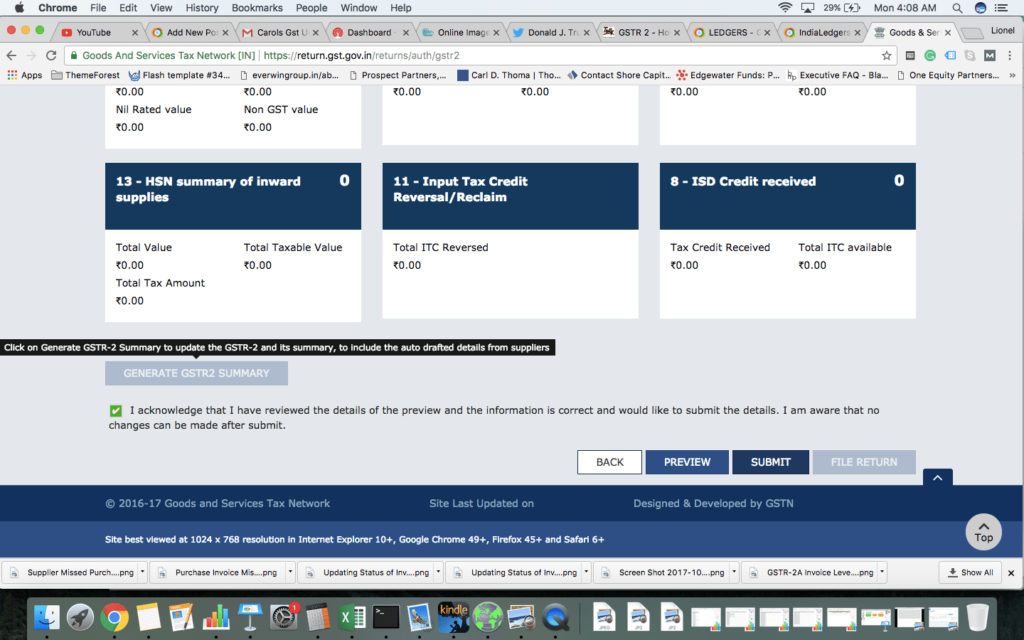

Step 3: Filing GSTR-2 Return

After reconciliation and selecting the status for all GSTR-2A invoices uploaded by suppliers, you can add any invoices missed by the supplier. Once all the data is verified and validated, you can click on Generate GST2 Summary, verify and submit the GST return. GSTR 2 Filing

If you are using LEDGERS GST Software, you can click on File or use the download JSON button to download a file to save all the data updated on LEDGERS into the GST Portal. LEDGERS premium edition users can file GSTR-2 return from LEDGERS directly.

GSTR 2 Filing

If you are using LEDGERS GST Software, you can click on File or use the download JSON button to download a file to save all the data updated on LEDGERS into the GST Portal. LEDGERS premium edition users can file GSTR-2 return from LEDGERS directly.

Popular Post

In the digital age, the convenience of accessing important documents online has become a necessity...

The Atalji Janasnehi Kendra Project that has been launched by the Government of Karnataka...

The Indian Divorce Act governs divorce among the Christian couples in India. Divorce...

When an individual has more than a single PAN card, it may lead to that person being heavily penalised, or worse,...

Employees Provident Fund (PF) is social security and savings scheme for employee in India. Employers engaged...