Last updated: December 17th, 2024 3:35 PM

Last updated: December 17th, 2024 3:35 PM

GSTR 2 Return Filing - Procedure to File on GST Portal

GSTR 2 return must be filed by all regular taxpayers registered under GST before the 15th of each month after filing GSTR 1. In GSTR 2, the taxpayer must provide details of purchases made during the last month under various categories. Since details of sales are filed by all GST taxpayers before the 10th of every month, most of the data in GSTR 2 will be auto-populated. The taxpayer would have to verify the data on the portal and provide limited additional information. In this article, we look at the procedure for filing GSTR 2 return on the GST portal.GSTR 2 Format

To prepare and file GSTR 2 return, you can use LEDGERS GST Software. Just download the provided format for populate invoice data and upload it into LEDGERS. Based on the invoice data and purchase invoice data, GSTR 2 return will be prepared automatically.GSTR 2 Excel Format

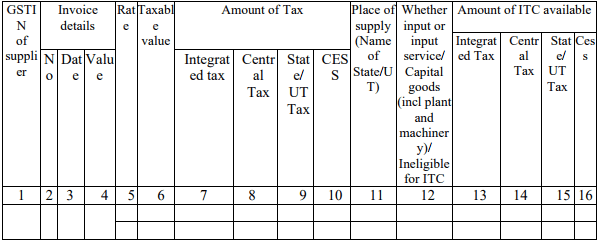

Inward Supplies from Registered Persons

[caption id="attachment_33460" align="aligncenter" width="818"] GSTR 2 Inward Supplies from Registered Persons

In the first table, the taxpayer must provide details of all purchases made during the last month from suppliers having GSTIN. Based on the GSTR 1 data filed by all taxpayers, most of this information would be auto-populated. However, the taxpayer can also add additional purchases that are not reflected by providing the following information:

GSTR 2 Inward Supplies from Registered Persons

In the first table, the taxpayer must provide details of all purchases made during the last month from suppliers having GSTIN. Based on the GSTR 1 data filed by all taxpayers, most of this information would be auto-populated. However, the taxpayer can also add additional purchases that are not reflected by providing the following information:

- GSTIN of supplier

- Invoice number

- Invoice date

- Invoice value

- Applicable GST rate

- Taxable value

- Amount of IGST applicable

- Amount of SGST applicable

- Amount of CGST applicable

- GST Cess applicable

- Place of supply

- Whether the item is ineligible for Input Tax Credit

- Amount of Input Tax Credit available under the following credits if applicable

- Integrated Goods and Services Tax

- Central Goods and Services Tax

- State Goods and Services Tax

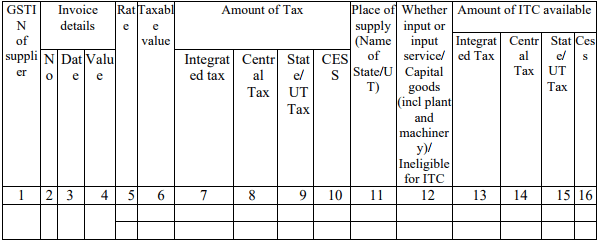

Inward Supplies on Which Reverse Charge is Applicable

In a supply transaction, normally the recipient pays the supplier a consideration equal to the value of the supply + applicable GST. The supplier would then remit the GST collected from the customer to the Government. In a reverse charge transaction, the supplier would not collect GST. The customer would pay the GST applicable on the transaction directly to the Government. In this table, the taxpayer is required to disclose such transactions wherein the taxpayer was required to pay GST under reverse charge. [caption id="attachment_33461" align="aligncenter" width="778"] GSTR 2 Inward Supplies from Registered Persons

For supplies attracting GST reverse charge, the above information shown in the table must be provided. It is important to note that dealers registered under the GST composition scheme are required to pay GST on a reverse charge basis for all inward supplies.

GSTR 2 Inward Supplies from Registered Persons

For supplies attracting GST reverse charge, the above information shown in the table must be provided. It is important to note that dealers registered under the GST composition scheme are required to pay GST on a reverse charge basis for all inward supplies.

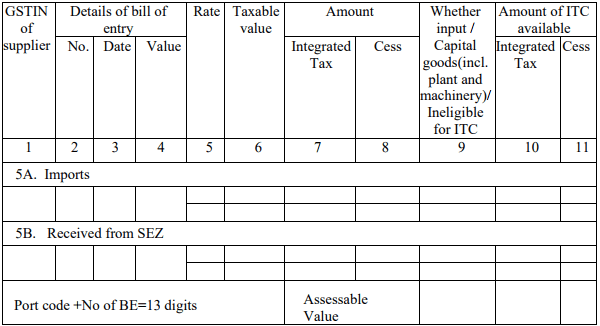

The input of Capital Goods Received from Overseas

[caption id="attachment_33462" align="aligncenter" width="793"] GSTR 2 Input of Capital Goods

In this table, the taxpayer must provide details of all inward supplies of capital goods received from overseas or from SEZ units on a bill of entry. For most taxpayers, this table would not be applicable in most months, unless there is a purchase of capital goods from abroad. If a supply is received in the previous month, then the following information pertaining to the supply must be submitted by the taxpayer:

GSTR 2 Input of Capital Goods

In this table, the taxpayer must provide details of all inward supplies of capital goods received from overseas or from SEZ units on a bill of entry. For most taxpayers, this table would not be applicable in most months, unless there is a purchase of capital goods from abroad. If a supply is received in the previous month, then the following information pertaining to the supply must be submitted by the taxpayer:

- GSTIN of supplier

- Details of Bill of Entry

- Bill of Entry Number

- Bill of Entry Date

- Bill of Entry Value

- GST Rate Applicable

- Taxable Value

- Amount of Integrated Tax applicable

- Amount of GST cess applicable

- Whether the item is eligible for Input Tax Credit

- Amount of IGST Input Tax Credit Claim

- Amount of GST Cess claim

Click here to continue reading this article and know how to file GSTR 2 return.

Popular Post

In the digital age, the convenience of accessing important documents online has become a necessity...

The Atalji Janasnehi Kendra Project that has been launched by the Government of Karnataka...

The Indian Divorce Act governs divorce among the Christian couples in India. Divorce...

When an individual has more than a single PAN card, it may lead to that person being heavily penalised, or worse,...

Employees Provident Fund (PF) is social security and savings scheme for employee in India. Employers engaged...