Last updated: December 17th, 2024 3:38 PM

Last updated: December 17th, 2024 3:38 PM

GSTR-3 Filing - GST Return Due on 20th

GSTR-3 is a type of GST return that must be filed by regular taxpayers on the 20th of every month. GSTR-3 filing can be made on the GST Common Portal after filing GSTR-1 and GSTR- 2 for the month. If GSTR-1 return is not filed, then GSTR-2 return cannot be filed. Hence, all regular taxpayers must file GST returns regularly every month starting with GSTR-1 filing, followed by GSTR-2 and GSTR-3 return filing. In this article, we look at GSTR-3 return filing in detail.Who should file GSTR-3 returns?

All regular taxpayers registered with GST must file GSTR-3 returns. In India, any person undertaking the taxable supply of goods and services over Rs.20 lakhs in most states must register under GST. However, the Ministry of Finance fixed the aggregate turnover limit as Rs.10 lakh in some special category states. In addition to the aggregate turnover criteria, some types of taxable persons under GST like casual taxable persons and non-resident taxable persons should mandatorily obtain GST registration, irrespective of annual turnover criteria. Casual taxable persons and non-resident taxable persons are not required to file GSTR-3 filing. Hence, GSTR-3 return applies to regular taxpayers only. (Check GST registration eligibility).What details must be provided in GSTR-3 filing?

GSTR-3 return is filed after filing of GSTR-1 and GSTR-2 returns. Most of the information to be filed in the returns will be auto-populated based on GSTR-1 and GSTR-2 filings. Only some of the information will have to be verified, edited or added by the taxpayer. The following information in GSTR-3 filing will be auto-populated:- Turnover

- Outward supplies

- Inter-State supplies (Net Supply for the month)

- Intra-State supplies (Net supply for the month)

- Tax effect of amendments made in respect of outward supplies

- Inward supplies attracting reverse charge including import of services (Net of advance adjustments)

- Inward supplies on which tax is payable on a reverse charge basis

- Tax effect of amendments in respect of supplies attracting reverse charge

- Input tax credit

- ITC on inward taxable supplies, including imports and ITC, received from ISD [Net of debit notes/credit notes]

- Addition and reduction of amount in output tax for mismatch and other reasons

- Total tax liability

- Credit of TDS and TCS

- Interest liability

- Late Fee

- Tax payable and paid

- Interest, Late Fee and any other amount (other than tax) payable and paid

- Refund claimed from Electronic cash ledger

- Debit entries in electronic cash/Credit ledger for tax/interest payment

Due Date for Filing

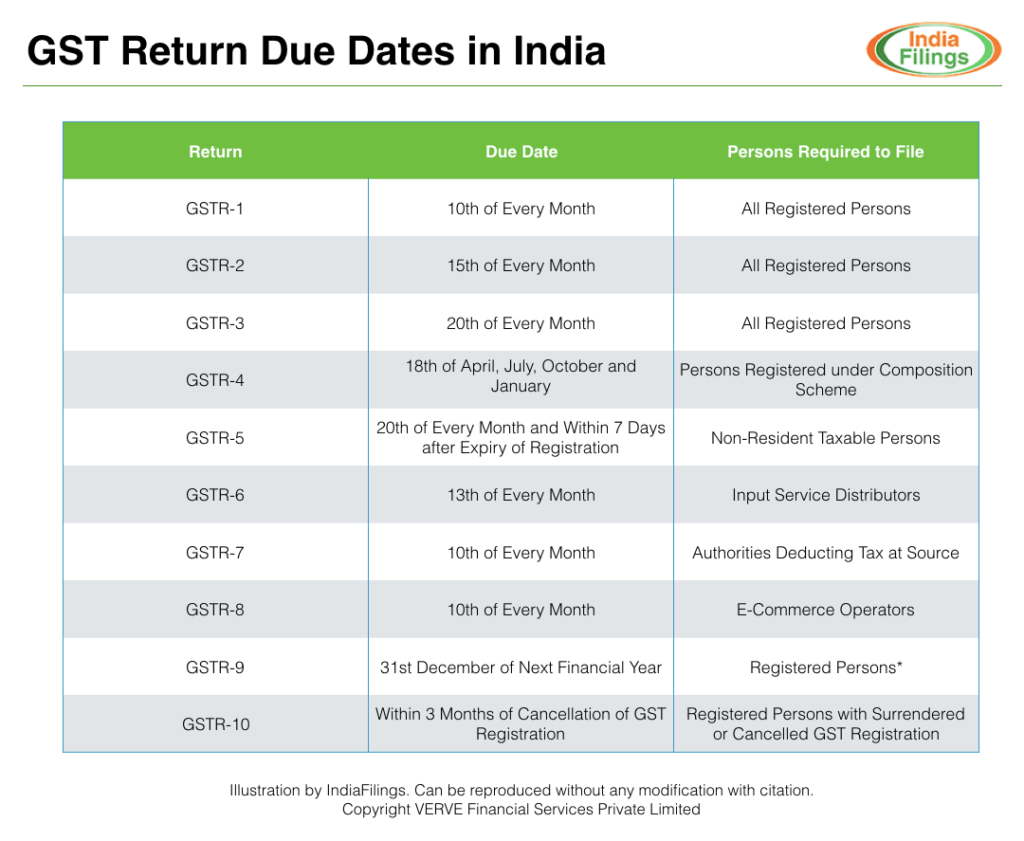

All regular taxpayers must file GSTR-3 return before the 20th of every month. The individual shall file GSTR-1 and GSTR-2 before filing GSTR-1. Hence, the taxpayer can file GSTR-3 returns only after filing GSTR-1 and GSTR-2. The due dates for filing of GST returns for regular taxpayers are as follows: [caption id="attachment_32895" align="aligncenter" width="1024"] GST Return Filing Due Dates

GST Return Filing Due Dates

Penalty for Late Filing

A penalty of Rs.100 per day upto a maximum of Rs.5000 can be levied for late filing of any GST return. If the taxpayer fails to file by the stipulated time period, a penalty of Rs.100 per day shall apply. However, if the taxpayer fails to file GSTR-1 and GSTR-2, a penalty of RS.300 per day shall apply.How to file the GSTR-3 return?

The taxpayer can file it through the GST Common Portal. The taxpayer can log in to their GST common portal account, verify the auto-populated information, edit and add other information to file the return. While filing GSTR-3 return, the authorized person must provide the digital signature as mentioned on the GST account. You can also file GST return through LEDGERS GST Software online. Simplify the GST registration & GST return filing process with IndiaFilings experts!Popular Post

In the digital age, the convenience of accessing important documents online has become a necessity...

The Atalji Janasnehi Kendra Project that has been launched by the Government of Karnataka...

The Indian Divorce Act governs divorce among the Christian couples in India. Divorce...

When an individual has more than a single PAN card, it may lead to that person being heavily penalised, or worse,...

Employees Provident Fund (PF) is social security and savings scheme for employee in India. Employers engaged...