Last updated: December 17th, 2024 3:37 PM

Last updated: December 17th, 2024 3:37 PM

GSTR 3 Return Filing - Process for Filing on GST Portal

GSTR 3 return must be filed by all taxpayers registered under GST on or before the 20th of every month. Prior to filing GSTR 3 return, the taxpayer must file GSTR 1 return on the 10th and GSTR 2 return on the 15th. In this article, we look at the procedure for filing GST return on the GST portal in detail.How to Prepare GSTR 3 Return

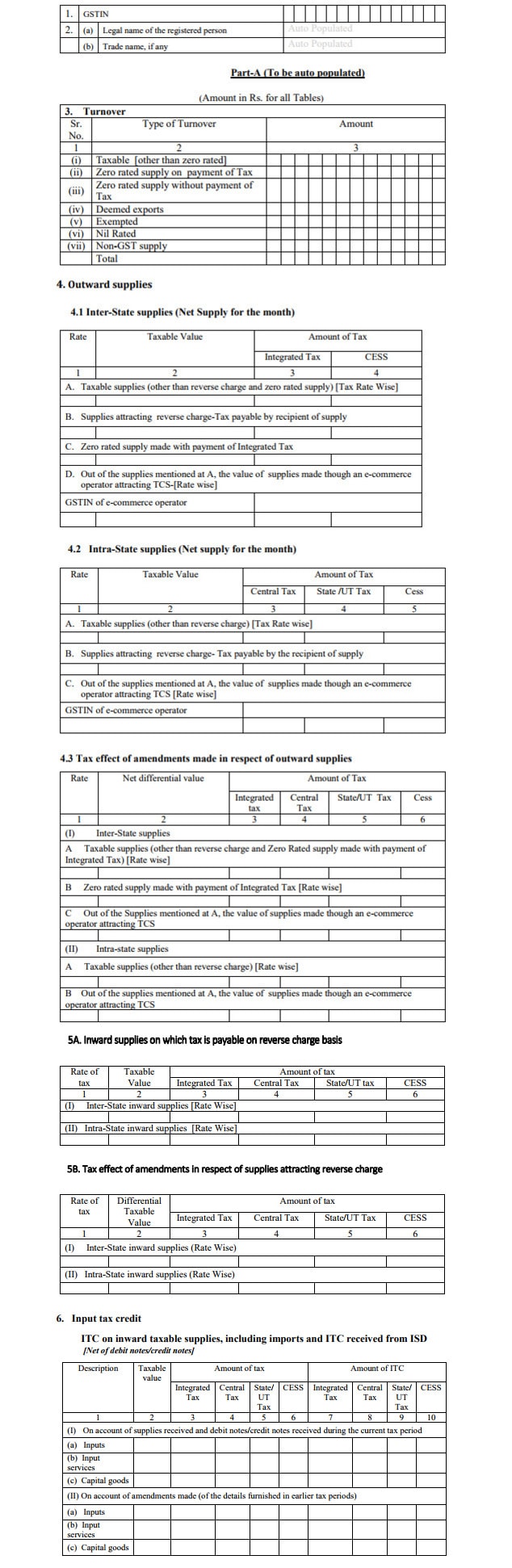

You can prepare GSTR 3 return online using LEDGERS GST Software. In case you need an offline edition to prepare GST returns, you can download the below-attached format, update sales information, purchase information and upload it to LEDGERS for automatic GSTR 3 return preparation.GSTR 3 - Part A

GSTR 3 has two parts namely, GSTR 3 - Part A and GSTR 3 - Part B. The following information present in GSTR 3 Part A will be auto-completed based on GSTR 1 and GSTR 2 return filed by the taxpayer and all other GST-registered taxpayers. Hence, the taxpayer would only have to provide the information requested in GSTR 3 - Part B. [caption id="attachment_33485" align="aligncenter" width="634"] GSTR 3 Return Format

GSTR 3 Return Format

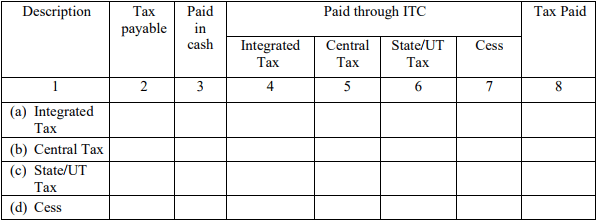

Tax Payable and Tax Paid

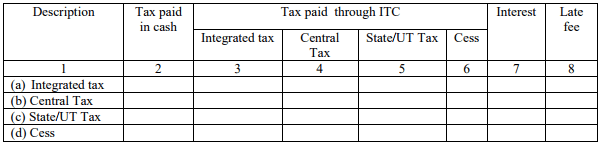

In this table, the taxpayer must provide information about the GST payable and amount of GST paid in cash during the previous month. In addition, if the taxpayer has any input tax credit claim for IGST or CGST and SGST or Cess, the same can be set off against the GST liability. [caption id="attachment_33484" align="aligncenter" width="748"] GSTR 3 Tax Payable and Tax Paid

GSTR 3 Tax Payable and Tax Paid

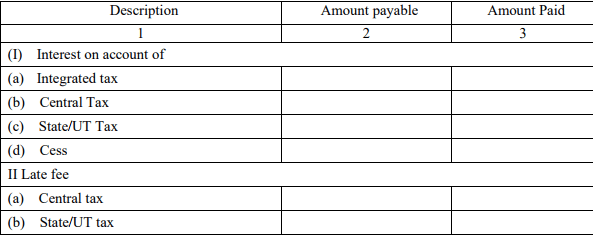

Interest and Late Fee

In the following table, details of interest and late fees payable by the taxpayer will be auto-populated. The taxpayer must provide details of interest on late fee payments made under the heads of IGST, CGST, SGST and Cess. [caption id="attachment_33486" align="aligncenter" width="774"] GSTR 3 Interest and Late Fee

GSTR 3 Interest and Late Fee

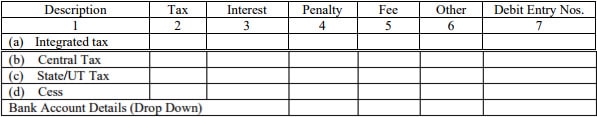

Refund Claimed from Electronic Cash Ledger

Taxpayers can apply for GST refund using GSTR 3 filing. In this table, the taxpayer can provide details of the refund claim under the heads of integrated tax, central tax, state tax and Cess. Further, the taxpayer must also provide details of the type of refund claim under the following heads:- Refund of excess tax

- Refund of interest paid

- Refund of the penalty paid

- Refund of fee paid

- Other refund

GSTR 3 Refund Application

Click here to know the list of documents required for GST refund.

GSTR 3 Refund Application

Click here to know the list of documents required for GST refund.

Debit Entries in Electronic Cash or Credit Ledger

In the following table, debit entries in electronic cash or electronic credit ledger for tax and interest payment is auto-populated after submission of GST return. [caption id="attachment_33488" align="aligncenter" width="730"] GSTR 3 Debit to Credit Ledger

Simplify the GST registration & GST return filing process with IndiaFilings experts!

GSTR 3 Debit to Credit Ledger

Simplify the GST registration & GST return filing process with IndiaFilings experts!

Popular Post

In the digital age, the convenience of accessing important documents online has become a necessity...

The Atalji Janasnehi Kendra Project that has been launched by the Government of Karnataka...

The Indian Divorce Act governs divorce among the Christian couples in India. Divorce...

When an individual has more than a single PAN card, it may lead to that person being heavily penalised, or worse,...

Employees Provident Fund (PF) is social security and savings scheme for employee in India. Employers engaged...