Last updated: August 23rd, 2024 2:42 PM

Last updated: August 23rd, 2024 2:42 PM

GSTR 3B

Navigating the complexities of GST compliance is crucial for businesses in India, and understanding GSTR-3B is an essential part of this process. GSTR-3B is a monthly self-declaration that every registered taxpayer must file. It plays a significant role in summarizing the details of input tax credits and taxes paid on outward supplies. In this article, we will explore what GSTR-3B is, delve into the specifics of its due dates, and provide insights into its filing process to ensure you remain compliant with GST regulations.What is GSTR 3B?

GSTR-3B is a self-declared summary GST return that all taxpayers must file monthly (or quarterly under the QRMP scheme). This return summarizes the sales details, the Input Tax Credit (ITC) claimed, and the net tax payable. Each GSTIN must file a separate GSTR-3B and any GST liability must be paid by the filing date or its due date, whichever comes first. Once submitted, GSTR-3B cannot be revised. It's important to note that filing GSTR-3B is mandatory, even if there is no tax liability for that period.Who Should File GSTR-3B?

- Regular Taxpayers: Any individual or entity registered under the GST regime and not covered by any specific exceptions must file GSTR-3B. This includes manufacturers, traders, service providers, and others who conduct taxable activities.

Who is Exempt from Filing GSTR-3B?

- Composition Scheme Taxpayers: Businesses that have opted for the GST Composition Scheme, which allows them to pay GST at a fixed turnover rate and reduces compliance burdens, are exempt from filing GSTR-3B.

- Input Service Distributors (ISDs): ISDs are not required to file GSTR-3B because they have a different mechanism for distributing the credit of input services to branches.

- Non-resident Taxable Persons: Individuals or businesses that reside outside India but make taxable supplies in India. They have different filing requirements tailored to non-residents.

- Non-resident Suppliers of OIDAR Services: These businesses outside India provide Online Information and Database Access or Retrieval (OIDAR) services to non-taxable online recipients in India. They are subject to simplified registration and compliance mechanisms.

GSTR-3B Due Date

Up to December 2019: The due date for filing GSTR-3B was the 20th of the subsequent monthCurrent Due Dates

- GSTR 3b due date monthly: From January 2020: The due dates have been changed. For monthly filers, the due date is either the 20th of every month.

- GSTR 3b due date for quarterly return: For quarterly filers under the QRMP scheme starting from 1st January 2021, the due date is the 22nd or 24th of the month following the quarter, depending on the State/UT of the principal place of business.

- Group 1 States/UTs: The due date is the 22nd of the month following the end of the quarter. This group typically includes states and UTs in the northern and western parts of India.

- Group 2 States/UTs: The due date is the 24th of the month following the end of the quarter. This group generally includes states and UTs in the southern and eastern parts of India.

Key Compliance Notes

- Timely Payment and Filing: Taxes must be paid and GSTR-3B filed within the specified deadline to avoid penalties.

- Penalties for Late Filing: A late fee and interest at 18% per annum are applicable for delayed filings.

- Late Fee and Interest Charges: These charges apply even if the tax was paid on time but the GSTR-3B was filed after the deadline.

- Monthly Filing Requirement: Even taxpayers who file quarterly GSTR-1 returns are required to pay tax and file GSTR-3B monthly, unless opting for the QRMP scheme.

Late Fees and Interest Penalties for Delayed GSTR-3B Filing

A late fee applies if GSTR-3B is filed after its due date, calculated as follows:- Rs. 50 per day of delay for general cases.

- Rs. 20 per day of delay for taxpayers with no monthly tax liability.

Prerequisites for Filing GSTR-3B

Businesses required to file monthly GST returns, such as GSTR-1, GSTR-2, and GSTR-3, must also submit the GSTR-3B form. This form can be filed online via the GSTN portal. Payment of tax due can be made using challans at banks or through online payment methods. To verify and submit your GSTR-3B, you will need:- An OTP is sent to your registered mobile number for verification using an Electronic Verification Code (EVC),

- A Class 2 or higher Digital Signature Certificate (DSC),

- Or, you can opt to use an Aadhaar-based e-signature to file your GST returns.

Details Featured in GSTR-3B

The GSTR-3B form consists of six tables that capture various types of transactions and tax details required from taxpayers. Here is a breakdown of what each table entails:- Table 1: This table captures information on inward supplies (purchases) and outward supplies (sales) that are liable to reverse charge.

- Table 2:Details of interstate supplies made to unregistered persons, Unique Identification Number (UIN) holders, and composition dealers are recorded here.

- Table 3: This table is dedicated to the Input Tax Credit (ITC), detailing credits received and utilized.

- Table 4: This includes information on nil-rated, exempt, and non-GST inward supplies.

- Table 5: Payment of tax: this table summarizes the tax payable and the tax paid during the period, including segregation by tax type (CGST, SGST, IGST, Cess).

- Table 6: This table is for capturing the credit received from Tax Collected at Source (TCS) and Tax Deducted at Source (TDS).

GSTR-3B vs GSTR-2A & GSTR-2B

- GSTR-3B is a summary GST return filed monthly that includes details of sales and input tax credits (ITC). Reconciliation with GSTR-2A and GSTR-2B is crucial:

- GSTR-2A: A real-time dynamic report that reflects ITC as suppliers upload invoices. Reconciliation helps:

- Avoid notices from tax authorities by preventing excess ITC claims.

- Ensure no eligible ITC is missed.

- Encourage suppliers to upload their invoices if missing, enhancing compliance.

- GSTR-2B: A static monthly statement that provides a snapshot of ITC available and not available for a given month. Using GSTR-2B for reconciliation ensures:

- Accurate ITC claims in GSTR-3B.

- Improved compliance and GST compliance rating.

Information Preparation for Filing GSTR 3B

Before filing GSTR 3B return on the GST portal, the taxpayer must prepare the following information.Step 1: Prepare details of outward taxable supplies

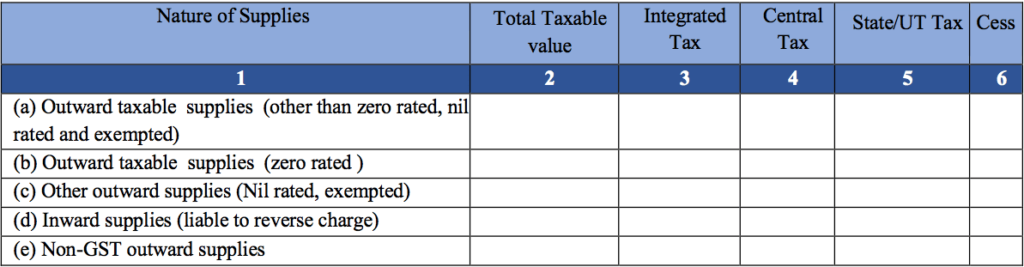

GSTR 3B Details of Outward Supplies

In the first table, details of outward supplies and inward supplies liable to reverse charge must be provided. You can prepare this information by compiling details from all sales invoices issued during the month of July for the GSTR 3B return due in August. In case you are using LEDGERS GST software, this information will be auto-populated for you.

GSTR 3B Details of Outward Supplies

In the first table, details of outward supplies and inward supplies liable to reverse charge must be provided. You can prepare this information by compiling details from all sales invoices issued during the month of July for the GSTR 3B return due in August. In case you are using LEDGERS GST software, this information will be auto-populated for you.

Outward taxable supplies (other than zero-rated, nil rated and exempted)

In this row, the registered user shall provide information about all invoices issued by the company that is NOT zero-rated, nil rated and exempted. Hence, this row will contain details of all invoices for which GST was levied. The information about GST must be broken down further into taxable value, integrated tax, central tax, state tax and cess. In the field for taxable value, mention the total bill amount. If IGST was payable on the taxable value, mention the same in the field for integrated tax. If CGST and SGST was applicable, it must be mentioned in the fields for central tax and state tax. Finally, if any cess was applicable, it must be mentioned in the GST cess field. Important: The supplier is liable for payment of GST on the issuance of invoice, so the fields need to be completed based on the invoices issued and not based on payment received.Outward taxable supplies (zero-rated)

Exports and sales to SEZ units are zero rated. Hence, in this row details relating to exports and supplies made to SEZ units must be mentioned. As mentioned above, the details must be categorised by taxable value, integrated tax, central tax and cess.Other outward supplies (Nil rated, exempted)

In this field, Nil rated and exempted supplies must be mentioned. Hence, goods or services which attract nil or 0% GST rate should be mentioned. As IGST, CGST and SGST component are not be applicable for exempt supplies, it would be zero, while the taxable value of such invoices issued must be mentioned.Inward supplies (liable to reverse charge)

In this row, details of all inward supplies for which the business is liable to pay GST must be mentioned. Inward supplies liable for reverse charge are transactions wherein the recipient of the supply is made liable for payment of GST. You can break down inward supplies liable for a reverse charge by taxable amount, integrated tax, central tax, state tax and cess.Non-GST outward supplies

Some goods, such as petroleum crude, motor spirit (petrol), high-speed diesel, natural gas, and aviation turbine fuel, have been kept out of GST. This row must mention details of outward supplies of such goods, along with the taxable amount.Step 2: Prepare supplies to unregistered persons, composition dealers and UIN holders

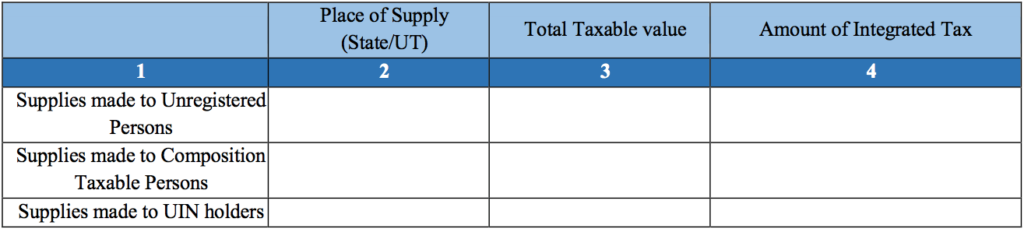

GSTR 3B - Supplies made to unregistered persons

GSTR 3B - Supplies made to unregistered persons

Supplies made to Unregistered Persons

In this table, inter-state supplies made to unregistered persons must be provided. Hence, the portal shall list all the aggregate level details of all B2C transactions. As this table shows the supply breakup in the above table, the value in the first table shall always exceed the value of other tables. In supplies made to unregistered persons, the concerned State should mention the amount of taxable value and integrated tax. The taxpayer can alter the rows based on the number of states the taxpayer provided supplies to the customers.Supplies made to Composition Taxable Persons

In this table, the taxpayer shall mention the supplies made to composition taxable persons along with the state, taxable value, and amount of integrated tax. Composition taxable persons are persons who have GST registration but are not eligible to collect GST.Supplies made to UIN holders

UIN or GST Unique ID is provided to Consulates, Embassies, and UN Bodies. If the taxpayer made supplies to UIN holders outside the state, such details must be provided in this row. Important: This table contains details of interstate supplies ONLY. Hence, only information must be provided in this table if supplies were made outside of the state. If all the supplies were intrastate, then this table would be filled with zeros.Step 3: Prepare details of input tax credit

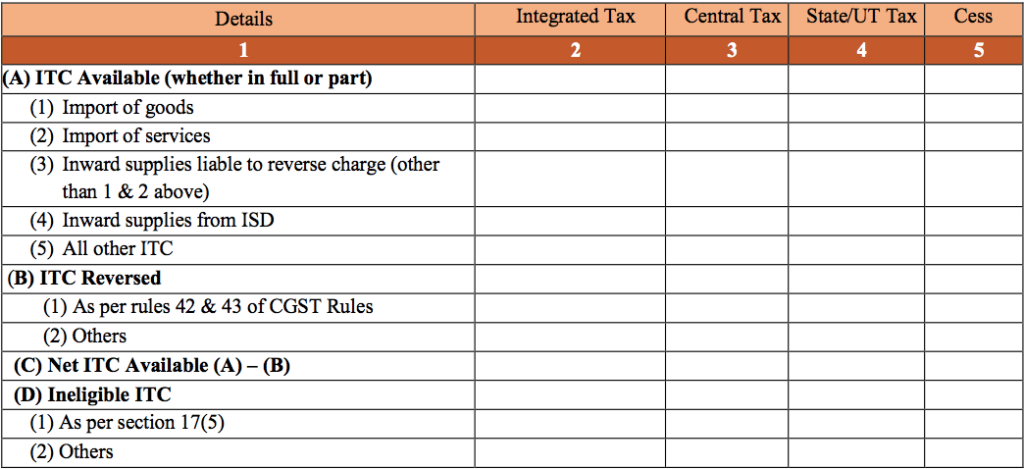

Persons registered under GST are eligible to claim input tax credit for setting off GST liability. To claim input tax credit, the taxpayer must properly enter purchase invoices and track expenditures. In LEDGERS, if you had updated all your purchase invoice details, the following table would be auto-populated. GSTR 3B Input Tax Credit Availed

GSTR 3B Input Tax Credit Availed

Input Tax Credit Available from Import of Goods

Import of goods is subject to levy of IGST on import. Taxpayers registered under GST can claim the input tax credit for IGST paid on imports. In this table, the taxpayer should mention all the details of all imports of goods for which GST under IGST, CGST, SGST and Cess is paid along with customs duty.Input Tax Credit Available from Import of Services

Import of services into India is also subject to levy of IGST. In this row, the taxpayer should mention the details of the amount paid for the import of services for IGST.Inward Supplies Liable to Reverse Charge

Some types of inward supplies, like OIDAR services, are liable for the reverse charge, wherein the recipient of the goods or service is liable for payment of GST. The taxpayer shall mention the details of any GST payment liable for any such inward supplies.Inward Supplies from ISD

In this row, the taxpayer should mention the input tax credit availed from input service distributors. Hence, the taxpayers can allot Input service distributors to distribute input tax credit. This row would be applicable only for taxpayers who have registered as an input service distributor.All Other Input Tax Credit

Any taxpayer who purchased or received the invoices for goods and services during the month of July shall provide details on this row. The taxpayer shall provide information on integrated tax, central tax, state tax and cess paid based on the details of the taxpayer. To complete this field, it is important to compile all invoices received and calculate the amount of GST tax paid in the month of July.Input Tax Credit Reversed

The input tax credit cannot be availed fully for certain supplies which are used partly for business purposes and partly for other purposes. For such input tax credit, the taxpayer shall reverse the input tax credit as per Rule 42 and Rule 43 of the CGST Rules. Details of input tax credit so reversed must be provided in this row.All Other Input Tax Credit Reversed

In case of reversal of input tax credit for any other reason, the user can provide the details of such reversal in this row with break up of integrated tax, state tax, central tax and cess.Net Input Tax Credit Availed

Based on the information provided above, the GST Portal automatically calculates the net input tax credit available to the taxpayer in row C.Ineligible Input Tax Credit

Certain items like food, beverages, life insurance, health club memberships and more are ineligible for GST input tax credit. Details of such items that were not eligible for the input tax credit must be mentioned in row D.Step 4: Prepare Inward Supplies Exempt from GST

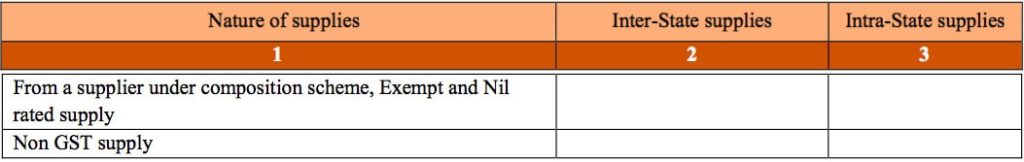

GSTR 3B Inward Supplies Exempt from GST

In this table, details of inward supplies that were exempt from GST must be provided.

In the first row, the taxpayer shall provide the total value of all supplies received from a composition scheme taxable person + purchases of goods or services exempted from GST + goods and services purchased with nil GST rate. The individual shall divide the details between inter-state supplies and intra-state supplies.

In the second row, the taxpayer can mention the details on purchases of all non-GST goods and services, if any. For most taxpayers, this row would be nil.

GSTR 3B Inward Supplies Exempt from GST

In this table, details of inward supplies that were exempt from GST must be provided.

In the first row, the taxpayer shall provide the total value of all supplies received from a composition scheme taxable person + purchases of goods or services exempted from GST + goods and services purchased with nil GST rate. The individual shall divide the details between inter-state supplies and intra-state supplies.

In the second row, the taxpayer can mention the details on purchases of all non-GST goods and services, if any. For most taxpayers, this row would be nil.

Step 5: Prepare details of GST paid

GSTR 3B Payment of Tax

In this table, the taxpayer shall provide the details of tax payable and GST tax paid. The Government portal, auto-populates the tax payable based on the information provided in the previous tables. The taxpayer can also calculate the total tax payable by adding all integrated tax, central tax, state tax and cess payable.

After providing the total tax payable, the GST Portal auto-populates the input tax credit available after calculating in Step 3. If the taxpayer paid any GST, details of such tax payment can be provided in column 8. Interest and late fees will be zero if GSTR 3B is filed on time with GST payment.

GSTR 3B Payment of Tax

In this table, the taxpayer shall provide the details of tax payable and GST tax paid. The Government portal, auto-populates the tax payable based on the information provided in the previous tables. The taxpayer can also calculate the total tax payable by adding all integrated tax, central tax, state tax and cess payable.

After providing the total tax payable, the GST Portal auto-populates the input tax credit available after calculating in Step 3. If the taxpayer paid any GST, details of such tax payment can be provided in column 8. Interest and late fees will be zero if GSTR 3B is filed on time with GST payment.

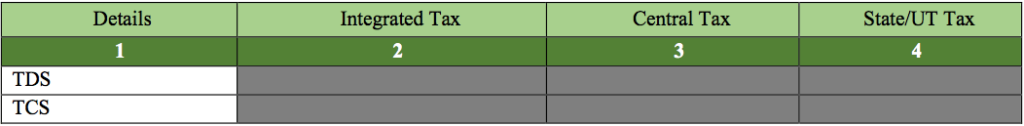

Step 6: Details of TDS and TCS

GSTR 3B TDS & TCS Credit

In this table, the input has been disabled on the GST portal as TDS and TCS provisions have not come into effect. Hence, taxpayers need not worry about calculating TDS or TCS for the GSTR 3B return to be filed in August.

GSTR 3B TDS & TCS Credit

In this table, the input has been disabled on the GST portal as TDS and TCS provisions have not come into effect. Hence, taxpayers need not worry about calculating TDS or TCS for the GSTR 3B return to be filed in August.

Step 7: Filing GSTR 3B on GST Portal

After providing the above-mentioned details manually or through GST software, the user can file GSTR 3B on the GST portal within a few minutes. In case you use LEDGERS GST software, the software shall calculate all of the information above based on the invoices and purchase invoices you generated. Hence, you can simply enter the information provided by us into the GST Portal and click on submit. In case you do not use LEDGERS, you would have to prepare the above information manually to file the same on the GST portal. Also Read - "How to File GSTR 3b online in GST Portal?"LEDGERS GST Software

Using LEDGERS GST software, you can prepare and file a GSTR 3B return in a few clicks. If you are not using LEDGERS GST Software, follow the steps below to calculate and file the GSTR 3B return.Difference between GSTR1 and GSTR 3b

GSTR-1 and GSTR-3B are both crucial forms under India's Goods and Services Tax (GST) system, but they serve different purposes and contain different information. Here’s a breakdown of the key differences between GSTR-1 and GSTR-3B: GSTR-1 is detailed, covering all outward supplies of goods and services. It is filed monthly or quarterly, depending on the taxpayer's turnover. This form serves primarily for reconciling outward supplies.GSTR-3B, in contrast, is a summary return filed monthly by all taxpayers. It provides a consolidated overview of sales and purchases and is crucial for calculating and paying net GST. The reconciliation of GSTR-3B and GSTR-1 is essential for verifying that the data reported in both returns are consistent. This process is a compliance measure and a crucial check to prevent any mismatches that could result in penalties or interest due to inaccuracies. In summary, while GSTR-1 and GSTR-3B serve different purposes—one for detailed transaction reporting and the other for summary tax liability—both are integral to GST compliance. Click here to learn more about the Difference Between GSTR 1 and GSTR 3b Also Read - How to file GSTR 3b Nil ReturnSimplify Your GSTR-3B Filing with IndiaFilings

For expert assistance with your GSTR-3B filing and to ensure full compliance with GST regulations, visit IndiaFilings. Our team of professionals is ready to help you manage your GST returns efficiently and accurately. Click here to start with IndiaFilings and simplify your GST filing process with LEDGERS. [shortcode_14]Popular Post

In the digital age, the convenience of accessing important documents online has become a necessity...

The Atalji Janasnehi Kendra Project that has been launched by the Government of Karnataka...

The Indian Divorce Act governs divorce among the Christian couples in India. Divorce...

When an individual has more than a single PAN card, it may lead to that person being heavily penalised, or worse,...

Employees Provident Fund (PF) is social security and savings scheme for employee in India. Employers engaged...