Updated on: December 16th, 2022 4:25 PM

Updated on: December 16th, 2022 4:25 PM

GSTR-3B Due Date 2020

As the spread of Corona Virus increased across the globe causing destruction of lives, livelihoods and the economy. To provide support during this situation, governments across countries support their people by providing essential needs 24x7. The Government of India (GoI) has also stepped up to support people and industries through various schemes, reduction in taxes, and cutting down late fees. Among the many, the Central Board of Indirect Taxes and Customs (CBIC) extended the filing of Form GSTR-3B till June and July depending upon the principal place of business and also waived the late filing fees. The CBIC implemented the extension and wave off of filing through Section 128 and Section 47 of Central Goods and Services Act 2017.Late Fee Wave Off and Extension in Filing GSTR-3B 2020

The following category of registered taxpayers shall have a wave-off for the said tax period. However, the category of taxpayers should also meet the required conditions as instructed through Notification NO.31/2020. The implementation shall come into force from 20th March 2020. The following table describes the condition, tax period, condition to avail wave off and for whom it applies:|

S. No. |

Categories of Registered Persons |

Tax Period |

Rate of Interest |

Condition for Wave Off |

|

1 |

For taxpayers with an annual turnover of more than Rs.5 crore in the previous financial year | February 2020, March 2020, April 2020 | No tax applies for the first 15 days from the due date. After 15 days 9% | If the taxpayer files GSTR-3B on or before 24th June 2020 |

|

2 |

For taxpayers with an annual turnover of Rs.1.5 crore to Rs.5 crore in the previous financial year | Nil | February 2020, March 2020 | If the taxpayer filed GSTR-3B furnished on or before 29th June 2020 |

| April 2020 | If the taxpayer filed GSTR-3B furnished on or before 30th June 2020 | |||

|

3 |

Taxpayers with an annual turnover of up to Rs.1.5 crore in the previous financial year | Nil | February 2020 | If the taxpayer filed GSTR-3B furnished on or before 30th June 2020 |

| March 2020 | If the taxpayer filed GSTR-3B furnished on or before 3rd July 2020 | |||

| April 2020 | If the taxpayer filed GSTR-3B furnished on or before 6th July 2020 |

Extension of Filing GSTR-3B

As per Notification No.36/2020 released by CBIC on 3rd April, the extension of filing GSTR-3B has been categorized as per the taxpayer's place of business.For Taxpayers above Rs.5 Crore

For taxpayers with an annual return of more than Rs.5 Crore, the individual can file the GSTR-3B on or before 27th June 2020 for the month of May 2020. The taxpayer shall file the Form GSTR-3B through the GST Portal.For Taxpayers up to Rs.5 Crore

The CBIC notified the following due dates for taxpayers up to Rs.5 Crore as per the place of business: Part A|

S. No. |

Principal Place of Business (States) |

Filing Period |

Due Date |

Form |

| 1 | Chhattisgarh, Madhya Pradesh, Gujarat, Maharashtra, Karnataka, Goa, Kerala, Tamil Nadu, Telangana, Andhra Pradesh, Daman and Diu and Dadra and Nagar Haveli, Puducherry, Andaman and Nicobar Islands or Lakshadweep | May 2020 | 12th July 2020 | Form-3B |

Part B

|

S. No. |

Principal Place of Business (States/UTs) |

Filing Period |

Due Date |

Form |

| 1 | Himachal Pradesh, Punjab, Uttarakhand, Haryana, Rajasthan, Uttar Pradesh, Bihar, Sikkim, Arunachal Pradesh, Nagaland, Manipur, Mizoram, Tripura, Meghalaya, Assam, West Bengal, Jharkhand, Odisha, Jammu and Kashmir, Ladakh, Chandigarh or Delhi | May 2020 | 14th July 2020 | Form-3B |

Providing the Details of Input Tax Credit

On 3rd April 2020, the CBIC implemented Central Goods and Services Tax (Fourth Amendment) Rules, 2020. The CBIC implemented the rules for Form GST CMP-02, Form GST ITC-03 and for Form GSTR-3 for implement constructive changes. The CGST Rules states that, if the taxpayer belonging any category applies to avail the extension or waving off late fee benefits for the tax period of February, March, April, May, June, July, and August 2020, the taxpayer must file along with cumulative adjustment of Input Tax Credit for the months, the taxpayer availed benefits.Due Date for Filing GSTR-3B 2019

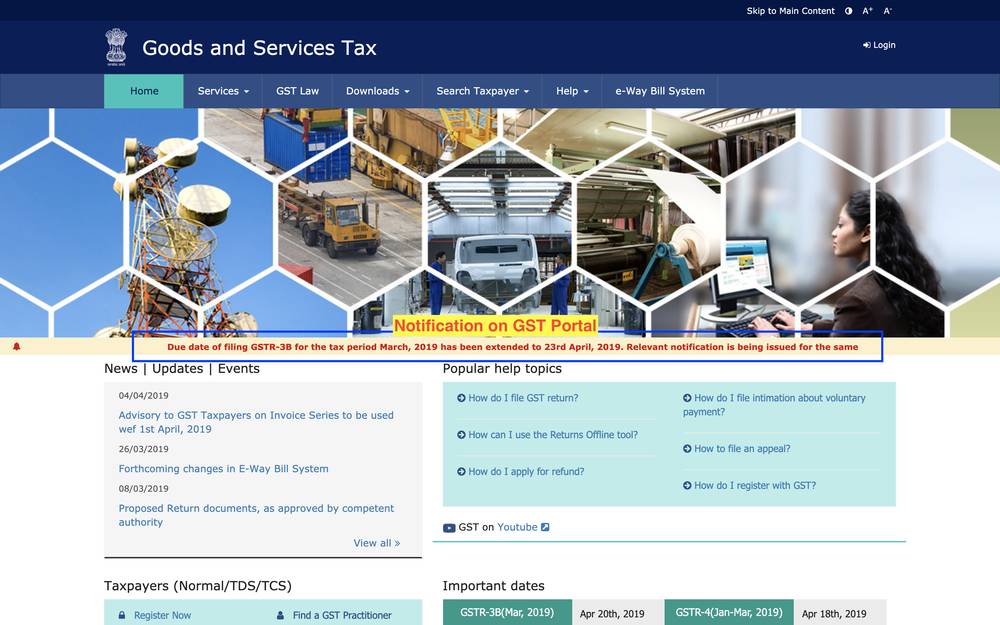

The Ministry of Finance issued a notification to extend the due date of filing GSTR-3B return for the month of July 2019 by a month for selected districts of Bihar, Gujarat, Karnataka, Kerala, Maharashtra, Odisha, Uttarakhand and Jammu & Kashmir. The revised due date is 20th September 2019. The notification is provided below for reference: *Please refer the notification for the districts which are applicable. The government has extended the last date for filing GSTR-3B return for the month of March 2019 by three days to April 23, 2019. The announcement was made on the GST Portal. The announcement on GST Portal read "Due date of filing GSTR-3B for the tax period March, 2019 has been extended to 23rd April, 2019. Relevant notification is being issued for the same". A copy of the screenshot is attached below- GSTR-3B Due Date

As per latest notification from the Ministry of Finance, the due date for submitting Form GSTR-3B is 20th day of subsequent month from October 2019 to March 2010. The description is provided as below:

GSTR-3B Due Date

As per latest notification from the Ministry of Finance, the due date for submitting Form GSTR-3B is 20th day of subsequent month from October 2019 to March 2010. The description is provided as below:

| For the Month of | Due Date |

| October, 2019 | 20th November, 2019 |

| November, 2019 | 20th December, 2019 |

| December, 2019 | 20th January, 2020 |

| January, 2020 | 20th February, 2020 |

| February, 2020 | 20th March, 2020 |

| March, 2020 | 20th April, 2020 |

Due date Extended for Jammu and Kashmir

As per latest notification from the Ministry of Finance (No.66/2019 – Central Tax), the due date for submitting Form GSTR-3B is extended for the businesses in Jammu and Kashmir. The revised due date for the months of July to September 2019 is 20th December 2019. The exact text from notification is reproduced below: “Provided also that the return in FORM GSTR-3B of the said rules for the months of July to September, 2019 for registered persons whose principal place of business is in the State of Jammu and Kashmir, shall be furnished electronically through the common portal, on or before the 20th December, 2019.” The notification can be accessed below: Due date Extended for the States of Assam, Manipur, Meghalaya and Tripura As per latest notification from the Ministry of Finance (No.77/2019 – Central Tax), the due date for submitting Form GSTR-3B is extended for the businesses in the States of Assam, Manipur, Meghalaya and Tripura. The revised due date for the month of November 2019 is 31st December 2019. The exact text from notification is reproduced below: “Provided also that the return in FORM GSTR-3B of the said rules for the month of November, 2019 for registered persons whose principal place of business is in the State of Assam, Manipur, Meghalaya or Tripura, shall be furnished electronically through the common portal, on or before the 31st December, 2019.” The notification can be accessed below:Staggered Return of GSTR-3B

As per the latest notification on 22nd January 2020, the Ministry of Finance has introduced the staggered manner of filing the returns through GSTR-3B. This decision was taken after the representation from the trade sector based on the difficulties faced by the industries. Currently, the filing of GSTR-3B returns for every taxpayer is 20th of every month. As per the notification, the submission of GSTR-3B is split into 3 different categories and 3 different deadlines are announced.- If the turnover is above Rs.5 crores in the previous financial year, the last date of filing is 20th of every month without late fees

- If the turnover is less than Rs.5 crores in the previous financial year, it is divided into two categories,

- For the 15 states/UTs including Chhattisgarh, Madhya Pradesh, Gujarat, Daman and Diu, Dadra and Nagar Haveli, Maharashtra, Karnataka, Goa, Lakshadweep, Kerala, Tamil Nadu, Puducherry, Andaman and Nicobar Islands, Telangana and Andhra Pradesh, the last date of filing GSTR-3B is 22nd of every month without late fees.

- For the 22 states/UTs including Jammu and Kashmir, Ladakh, Himachal Pradesh, Punjab, Chandigarh, Uttarakhand, Haryana, Delhi, Rajasthan, Uttar Pradesh, Bihar, Sikkim, Arunachal Pradesh, Nagaland, Manipur, Mizoram, Tripura, Meghalaya, Assam, West Bengal, Jharkhand and Odisha, the last date of filing GSTR-3B is 24th of every month without late fees.

Popular Post

In the digital age, the convenience of accessing important documents online has become a necessity...

The Atalji Janasnehi Kendra Project that has been launched by the Government of Karnataka...

The Indian Divorce Act governs divorce among the Christian couples in India. Divorce...

When an individual has more than a single PAN card, it may lead to that person being heavily penalised, or worse,...

Employees Provident Fund (PF) is social security and savings scheme for employee in India. Employers engaged...