Last updated: December 16th, 2022 5:29 PM

Last updated: December 16th, 2022 5:29 PM

GSTR-3B Offline Utility

GSTR-3B is a monthly self-declaration that has to be filed by every person who has registered for GST. Every registered taxpayer needs to file a separate GSTR-3B for each GSTIN they possess including nil returns. To help the taxpayer prepare their GSTR-3B return offline, Goods and Service Tax Network (GSTN) has provided the Excel-based GSTR-3B Offline Utility. Taxpayers can prepare their GSTR-3B return process by uploading JSON file generated from the Offline utility to GST portal. The taxpayer can use the excel sheet prepared by GSTR-3B offline utility every month as many times without any restriction. In this article, we will look at the procedure to prepare GSTR-3B return using Offline Utility in detail. Know more on How to File GSTR-3B.Import of E-way Bill Data

It is essential for taxpayers to validate the data of their transactions before proceeding with the process of filing returns, as it saves time and unnecessary data entry. To cater to this purpose, the GST portal has now been integrated with the E-way Bill Portal (EWB). The integration enables the users to import the B2B and B2C invoice sections and the HSN-wise summary of outward supplies section. Using these details, the taxpayers may verify the data and complete the filing. The feature has been introduced considering the major data gaps between self-declared liability in Form-GSTR-1 and Form GSTR-3B. A similar rule also applies to Input Tax Credit (ITC) claimed in GSTR-3B, as it could be compared with the credit available in Form GSTR-2A. Data validation and comparison can be pursued through the following tabs of the portal:- Liability other than export/reverse charge

- Liability due to reverse charge

- Liability due to export and SEZ supplies.

- ITC credit claimed and due

No Late Fee for GSTR-1 & GSTR-3B Return

The biggest relief extended to small businesses by the 31st GST Council is the waiver of late fee for filing GSTR-1 and GSTR-3B return. The GST Council has announced: “Late fee shall be completely waived for all taxpayers in case FORM GSTR-1, FORM GSTR-3B &FORM GSTR-4 for the months/quarters July 2017 to September 2018, are furnished after 22.12.2018 but on or before 31.03.2019.” Thus, filing of Form GSTR-1, GSTR-3B and GSTR-4 will not attract any late fee penalty until 31st March 2019.GST Annual Return Due Date Extended

All entities having GST registration are required to file GST annual return in form GSTR-9. The due date for filing GST annual return is usually 31st December of each year for the financial year ended on 31st March of the same calendar year. As GST is newly introduced in India, the Government has decided to extend the due date for GST annual return filing to 30th June 2019. The due date for filing GST annual return was originally extended up to 31st March 2019, which has been further extended to 30th June 2019 by the GST Council.Features of GSTR-3B Offline Utility

Details for following sections of GSTR-3B return can be added by the taxpayer using the GSTR-3B Offline Utility:- Details of Outward Supplies and Inward supplies liable to reverse charge.

- Aspects of inter-State supplies made to unregistered persons, taxable composition persons and UIN holders.

- Eligible ITC.

- Values of exempt, nil-rated and non-GST inward supplies.

- Interest and the late fee payable.

Basic System Configurations

To use GSTR-3B Offline Utility tool efficiently, ensure that your system has following basic configuration.- System Requirement: The GSTR-3B Offline Utility tool functions work best on Windows 7 and above, the GSTR-3B Offline Utility tool does not work on Linux and Mac.

- MS Excel: Microsoft Excel 2007 and above is needed for running GSTR-3B Offline Utility tool. Alternatively, for any below version, the tool will open in a default browser.

Download GSTR-3B Offline Utility from the GST Portal

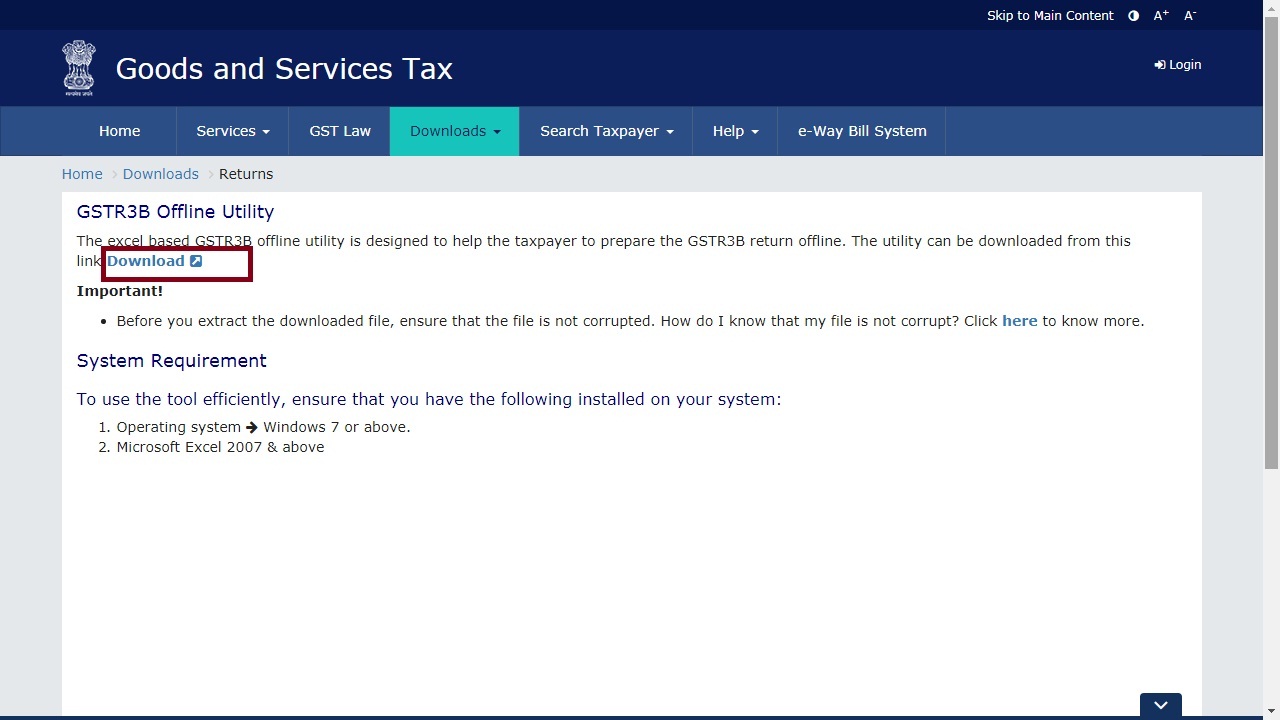

Downloading the GSTR-3B Offline Utility tool is a one-time activity; however, it may require an update in future if the Tool is updated at the GST Portal. Note: You need to check the version of the GSTR-3B Offline Utility tool used by you with the one available for download on the GST Portal at regular intervals. Follow the steps by step guidelines given here to download and install GSTR-3B Offline Utility tool in your computer: Note: The taxpayer can download the GSTR-3B Offline Utility from the GST Portal without logging into the Portal. Step 1: Access the home page of Goods and Service Tax (GST) web portal. Step 2: You need to select the Downloads option from the GST home page. From the list of offline tools, you need to select GSTR-3B Offline Utility. Image 1 GSTR 3B Offline Utility

Step 3: The GSTR-3B Offline Utility tool page will be displayed. Click on the Download option to download the file.

Image 1 GSTR 3B Offline Utility

Step 3: The GSTR-3B Offline Utility tool page will be displayed. Click on the Download option to download the file.

Image 2 GSTR 3B Offline Utility

Step 4: A confirmation message will be displayed on the screen. Click on the PROCEED button to download the GSTR-3B Offline Utility from the GST Portal.

Image 2 GSTR 3B Offline Utility

Step 4: A confirmation message will be displayed on the screen. Click on the PROCEED button to download the GSTR-3B Offline Utility from the GST Portal.

Image 3 GSTR 3B Offline Utility

The progress of the download will be displayed in a new browser tab. You can track the progress of offline tool download.

Step 5: Browse and select the location where you want to save the downloaded GSTR 3B offline files.

Image 3 GSTR 3B Offline Utility

The progress of the download will be displayed in a new browser tab. You can track the progress of offline tool download.

Step 5: Browse and select the location where you want to save the downloaded GSTR 3B offline files.

Image 4 GSTR 3B Offline Utility

Image 4 GSTR 3B Offline Utility

GSTR-3B Offline Utility Installation Procedure

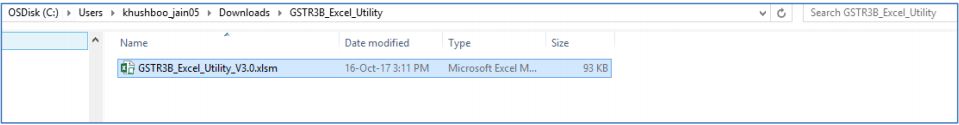

Once the GSTR-3B Offline Utility is downloaded, you need to unzip these downloaded files on your system. The procedure to install the GSTR-3B Offline Utility is explained in detail below: Step 1: You need to unzip the downloaded files and extract the files from the downloaded zip folder GSTR3_Excel_Utility.zip. Zip folder consists of the GSTR3B_Excel_Utility file as depicted in the image below: Image 5 GSTR 3B Offline Utility

Step 2: Once the folder is unzipped, double-click the GSTR3B_Excel_Utility file. The excel file will be opened.

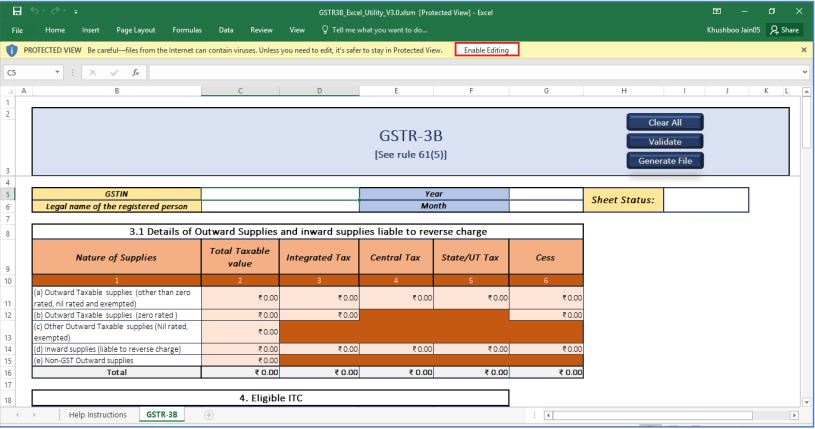

Step 3: Click on the Enable Editing button in the excel sheet.

Step 4: You have to click on the Enable Content button in the excel sheet.

Image 5 GSTR 3B Offline Utility

Step 2: Once the folder is unzipped, double-click the GSTR3B_Excel_Utility file. The excel file will be opened.

Step 3: Click on the Enable Editing button in the excel sheet.

Step 4: You have to click on the Enable Content button in the excel sheet.

Image 6 GSTR 3B Offline Utility

Step 5: You can now prepare GSTR-3B to return offline and generate JSON file using the Offline utility and upload the same to GST portal.

Image 6 GSTR 3B Offline Utility

Step 5: You can now prepare GSTR-3B to return offline and generate JSON file using the Offline utility and upload the same to GST portal.

Image 7 GSTR 3B Offline Utility

Image 7 GSTR 3B Offline Utility

Procedure to Prepare GSTR-3B Return Utility

The procedure to prepare GSTR-3B return utility is explained in detail below. You need to perform the following four steps to prepare GSTR-3B return utility.- Enter details in the GSTR-3B worksheet.

- Validate the details entered using 'Validate' button.

- Generate JSON file using 'Generate File.

- Upload the generated JSON on GST Portal.

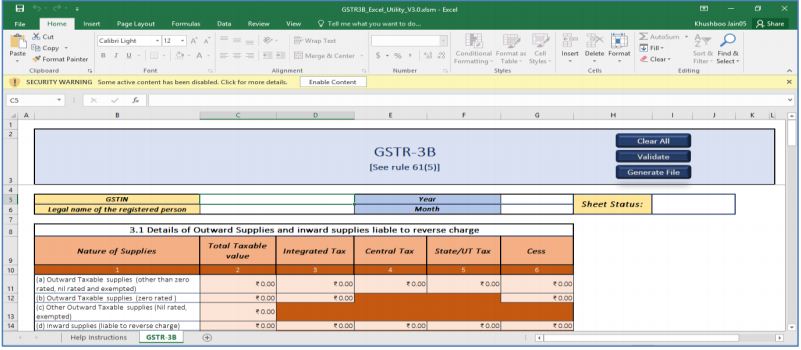

Enter details in the GSTR-3B worksheet of GSTR-3B Offline Utility

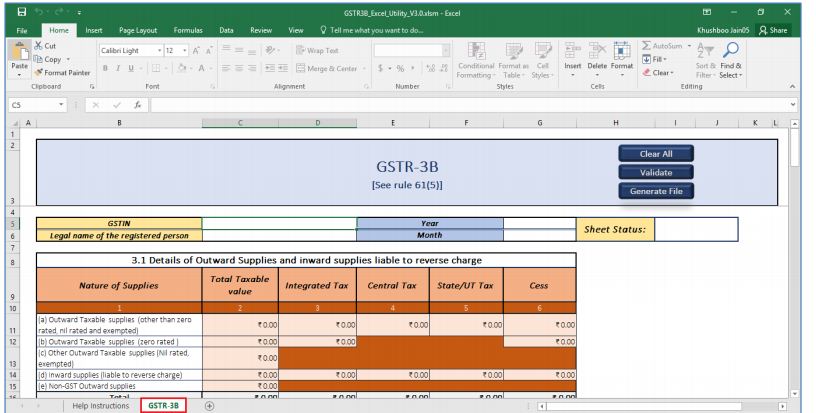

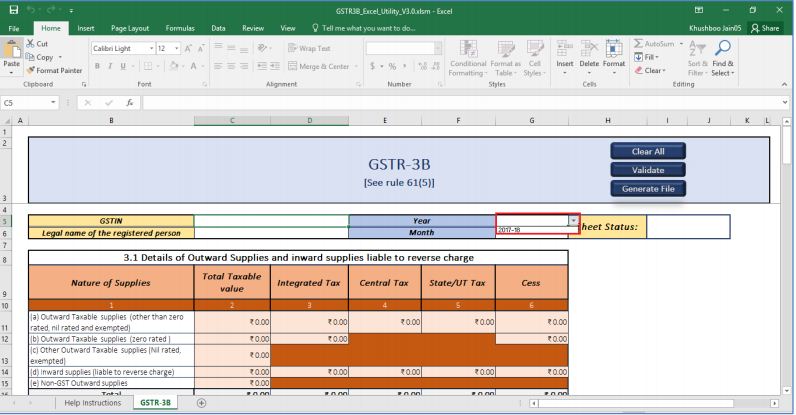

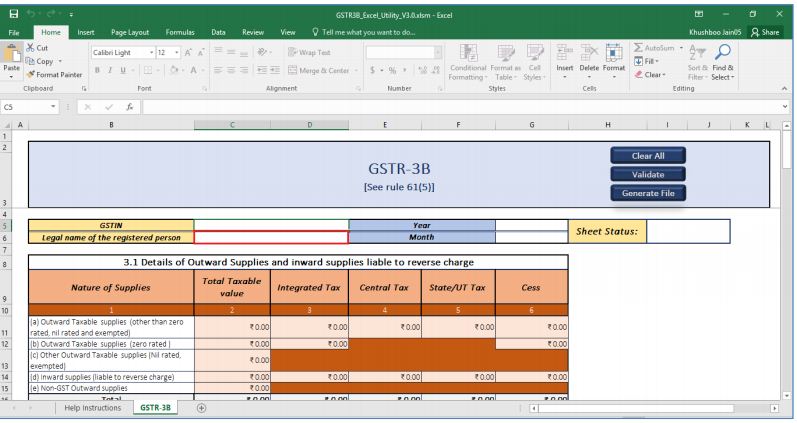

Step 1: You need to Launch the GSTR-3B Excel based Offline Utility and navigated to worksheet GSTR-3B. Image 8 GSTR 3B Offline Utility

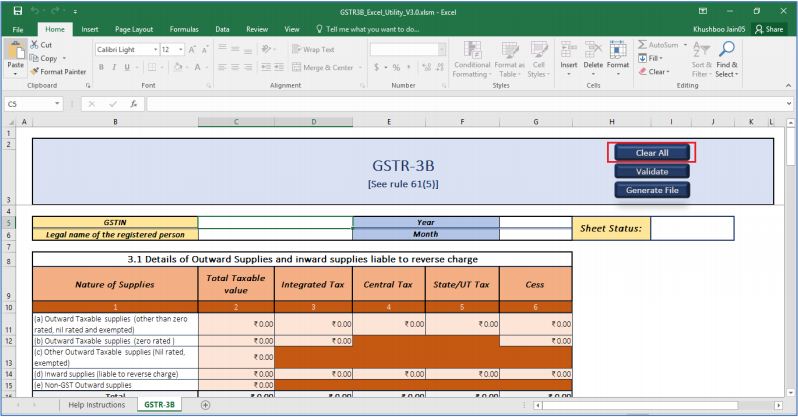

Step 2: Click on the Clear All button to clear any data presented in the excel sheet and to reset the Worksheet. This feature enables to use the same template for multiple tax periods and taxpayers.

Image 8 GSTR 3B Offline Utility

Step 2: Click on the Clear All button to clear any data presented in the excel sheet and to reset the Worksheet. This feature enables to use the same template for multiple tax periods and taxpayers.

Image 9 GSTR 3B Offline Utility

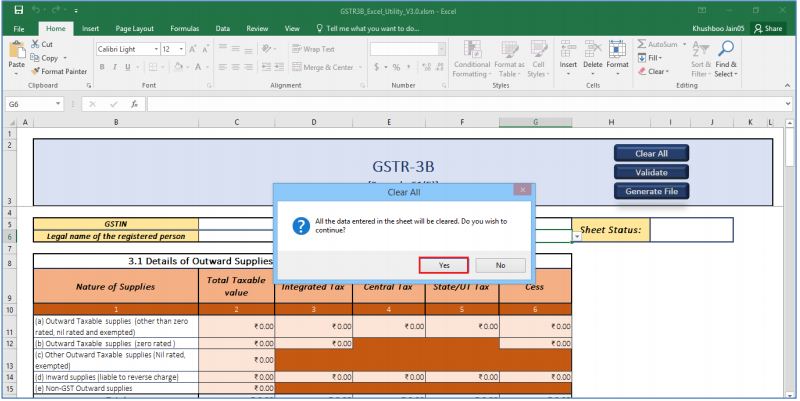

Step 3: By clicking on clear all button, a small window will be displayed. Click on Yes button to proceed further.

Image 9 GSTR 3B Offline Utility

Step 3: By clicking on clear all button, a small window will be displayed. Click on Yes button to proceed further.

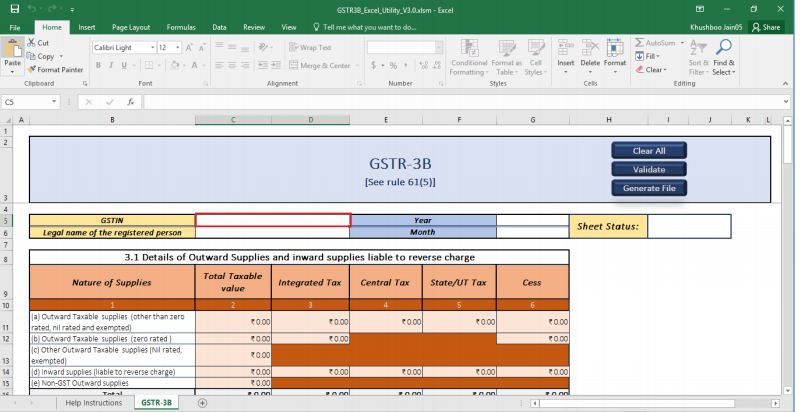

Image 10 GSTR 3B Offline Utility

Step 4: In the GSTIN field, enter the GSTIN. Entered GSTIN would be validated for correct structure.

Image 10 GSTR 3B Offline Utility

Step 4: In the GSTIN field, enter the GSTIN. Entered GSTIN would be validated for correct structure.

Image 11 GSTR 3B Offline Utility

Step 5: Select the applicable Financial Year from the Year drop-down list for which the GSTR-3B needs to be prepared.

Image 11 GSTR 3B Offline Utility

Step 5: Select the applicable Financial Year from the Year drop-down list for which the GSTR-3B needs to be prepared.

Image 12 GSTR 3B Offline Utility

Step 6: In the Legal name of the registered person field, you have to enter the legal name of the registered person. This field is optional and would not lead to validation failure.

Image 12 GSTR 3B Offline Utility

Step 6: In the Legal name of the registered person field, you have to enter the legal name of the registered person. This field is optional and would not lead to validation failure.

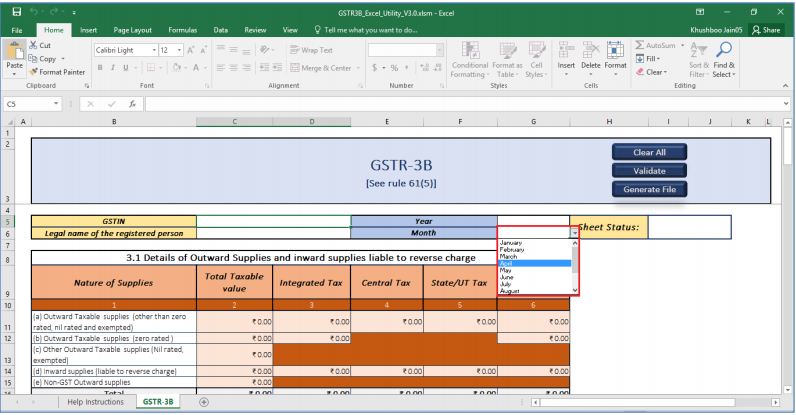

Image 13 GSTR 3B Offline Utility

Step 7: Select the applicable month from the month drop-down list for which the GSTR-3B needs to be prepared.

Image 13 GSTR 3B Offline Utility

Step 7: Select the applicable month from the month drop-down list for which the GSTR-3B needs to be prepared.

Image 14 GSTR 3B Offline Utility

Step 8: Provide details as applicable in Table 3.1 Details of Outward supplies and Inward supplies liable to reverse the charge.

Note: Only CGST amount needs to be provided for applicable sections; an equal SGST amount would be populated based on CGST amount. If the value of SGST amount is not equal, you can change it on the GST portal.

Image 14 GSTR 3B Offline Utility

Step 8: Provide details as applicable in Table 3.1 Details of Outward supplies and Inward supplies liable to reverse the charge.

Note: Only CGST amount needs to be provided for applicable sections; an equal SGST amount would be populated based on CGST amount. If the value of SGST amount is not equal, you can change it on the GST portal.

Image 15 GSTR 3B Offline Utility

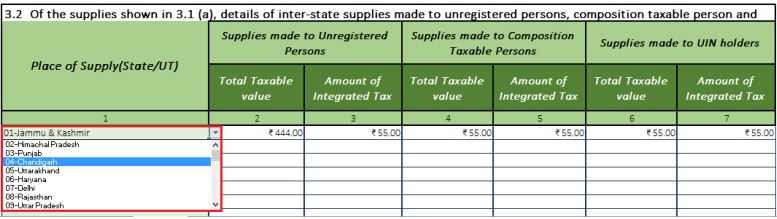

Step 9: Provide details of inter-State supplies made to unregistered persons, taxable composition persons and UIN holders.

Note: The amount provided in Table 3.2 cannot be more than the amount provided in Table 3.1 (a). Table 3.2 will be presented as the last table in the GSTR-3B worksheet.

Image 15 GSTR 3B Offline Utility

Step 9: Provide details of inter-State supplies made to unregistered persons, taxable composition persons and UIN holders.

Note: The amount provided in Table 3.2 cannot be more than the amount provided in Table 3.1 (a). Table 3.2 will be presented as the last table in the GSTR-3B worksheet.

Image 16 GSTR 3B Offline Utility

Step 10: You can select the Place of Supply (State or union territory) from the drop-down menu.

Image 16 GSTR 3B Offline Utility

Step 10: You can select the Place of Supply (State or union territory) from the drop-down menu.

Image 17 GSTR 3B Offline Utility

Step 11: Provide details as applicable in Table 4. Eligible ITC - intergraded tax, Central tax, State/UT tax and Cess.

Image 17 GSTR 3B Offline Utility

Step 11: Provide details as applicable in Table 4. Eligible ITC - intergraded tax, Central tax, State/UT tax and Cess.

Image 18 GSTR 3B Offline Utility

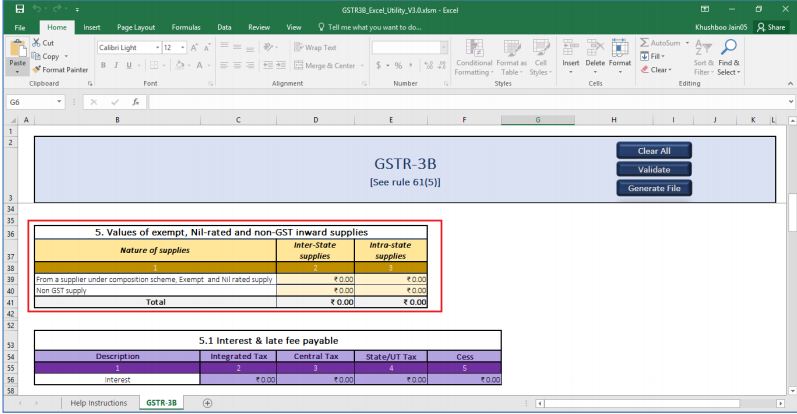

Step 12: Provide details as applicable in Table 5. Values of exempt, nil-rated and non-GST inward supplies.

Image 18 GSTR 3B Offline Utility

Step 12: Provide details as applicable in Table 5. Values of exempt, nil-rated and non-GST inward supplies.

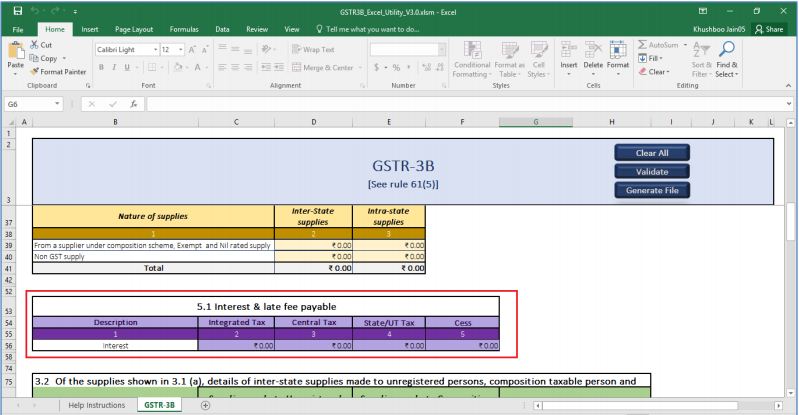

Image 19 GSTR 3B Offline Utility

Step 13: You need to furnish details as applicable in Table 5.1 Interest and the late fee payable. You have to enter only interest amount in this section.

Image 19 GSTR 3B Offline Utility

Step 13: You need to furnish details as applicable in Table 5.1 Interest and the late fee payable. You have to enter only interest amount in this section.

Image 20 GSTR 3B Offline Utility

Image 20 GSTR 3B Offline Utility

Validate Details Entered using the Validate button

Step 1: After providing all details, click on the Validate button to validate the GSTR-3B return worksheet. Image 21 GSTR 3B Offline Utility

Image 21 GSTR 3B Offline Utility

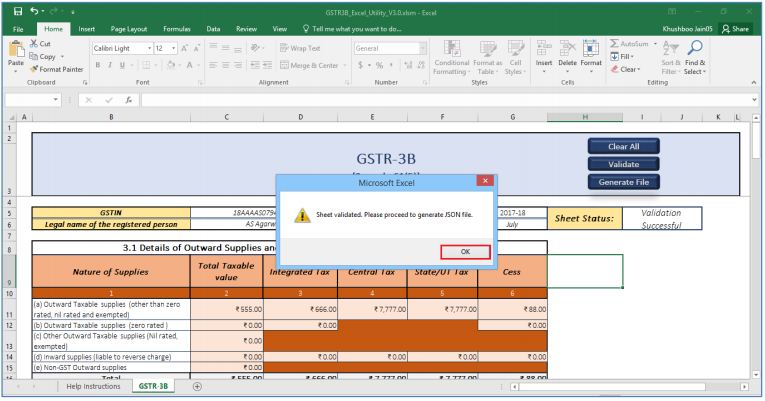

For Successful Validation

In case of successful validation, a pop-up message will be displayed as the sheet is validated and you can proceed to generate JSON file by clicking on the OK button. Image 22 GSTR 3B Offline Utility

For successful validation, the excel sheet status reflects as validation successful as depicted in the image.

Image 22 GSTR 3B Offline Utility

For successful validation, the excel sheet status reflects as validation successful as depicted in the image.

Image 23 GSTR 3B Offline Utility

Image 23 GSTR 3B Offline Utility

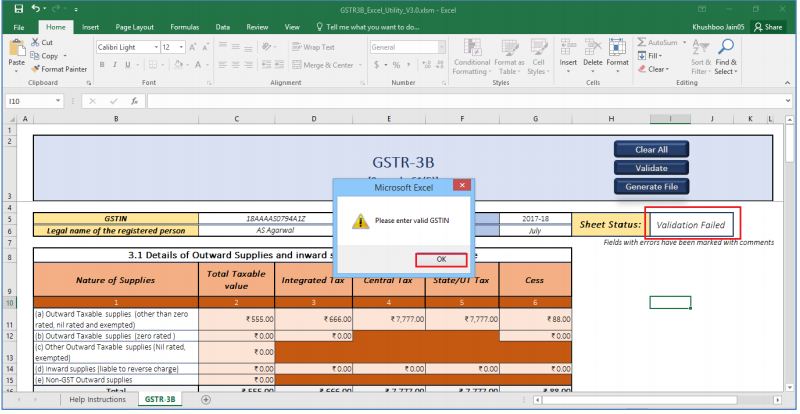

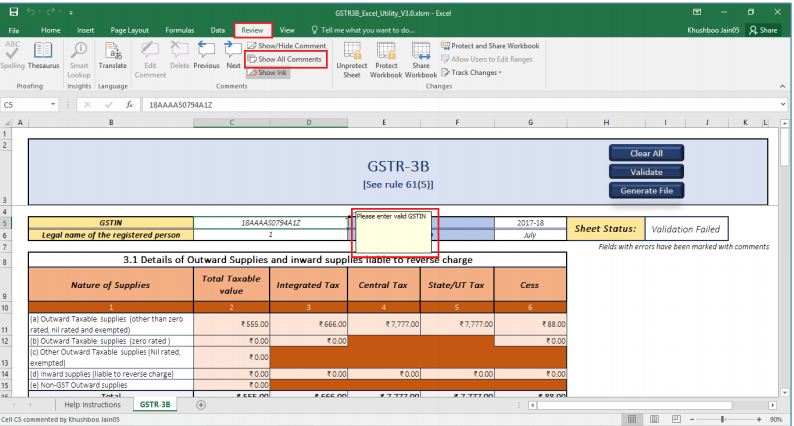

For Unsuccessful Validation

A pop-up message will be displayed with an error message. Click on the OK button. In case of unsuccessful validation, the sheet status reflects as validation failed. Image 24 GSTR 3B Offline Utility

If the validation fails, check for cells that have failed validation and correct errors according to help text.

Note: To view the comments for fields with errors, you can click on the Review tab and select Show All Comments link.

Image 24 GSTR 3B Offline Utility

If the validation fails, check for cells that have failed validation and correct errors according to help text.

Note: To view the comments for fields with errors, you can click on the Review tab and select Show All Comments link.

Image 25 GSTR 3B Offline Utility

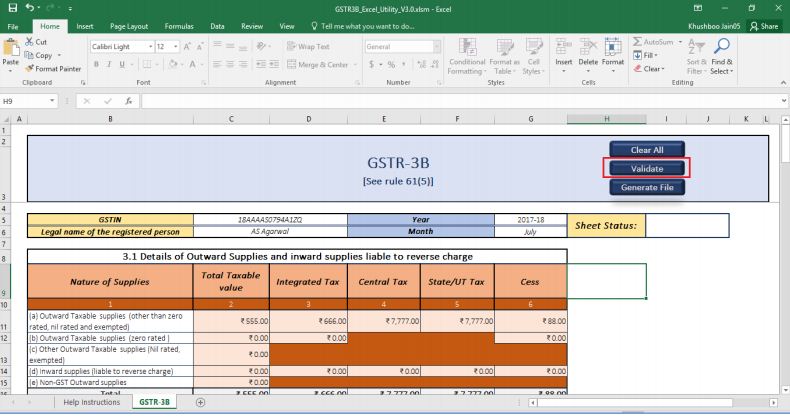

Step 2: Once all errors are rectified, click on the Validate button to validate the GSTR-3B worksheet.

Image 25 GSTR 3B Offline Utility

Step 2: Once all errors are rectified, click on the Validate button to validate the GSTR-3B worksheet.

Image 26 GSTR 3B Offline Utility

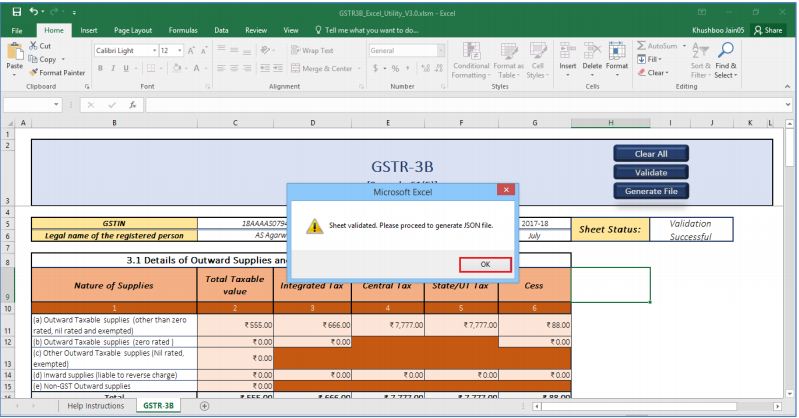

Step 3: A pop-up message will be displayed as the sheet is validated and you can proceed to generate a JSON file. Click on the OK button.

Image 26 GSTR 3B Offline Utility

Step 3: A pop-up message will be displayed as the sheet is validated and you can proceed to generate a JSON file. Click on the OK button.

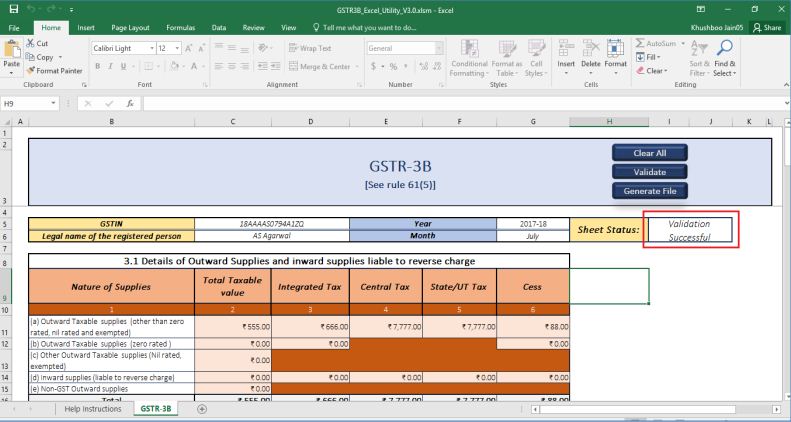

Image 27 GSTR 3B Offline Utility

As stated above, for successful validation, the Sheet Status reflects as Validation Successful.

Image 27 GSTR 3B Offline Utility

As stated above, for successful validation, the Sheet Status reflects as Validation Successful.

Image 28 GSTR 3B Offline Utility

Image 28 GSTR 3B Offline Utility

Generate JSON using Generate File button

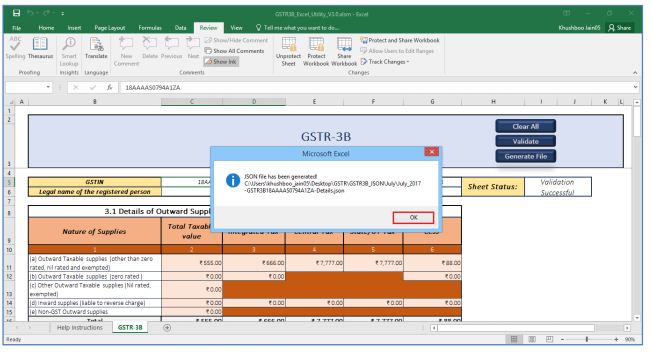

Step 1: Upon successful validation, you need to click on the Generate File button to generate the JSON file and to upload the return file to GST Portal. Image 29 GSTR 3B Offline Utility

Step 2: A confirmation message will be displayed that the JSON file has been generated on your desktop. In this small window, you need to click on the OK button.

Note: JSON would be generated only if the worksheet has been successfully validated.

Image 29 GSTR 3B Offline Utility

Step 2: A confirmation message will be displayed that the JSON file has been generated on your desktop. In this small window, you need to click on the OK button.

Note: JSON would be generated only if the worksheet has been successfully validated.

Image 30 GSTR 3B Offline Utility

Step 3: A folder with a name GSTR will be created on your desktop. By double-clicking on the GSTR folder, you can check the generated JSON file.

Image 30 GSTR 3B Offline Utility

Step 3: A folder with a name GSTR will be created on your desktop. By double-clicking on the GSTR folder, you can check the generated JSON file.

Image 31 GSTR 3B Offline Utility

Image 31 GSTR 3B Offline Utility

Upload Generated JSON on GST Portal

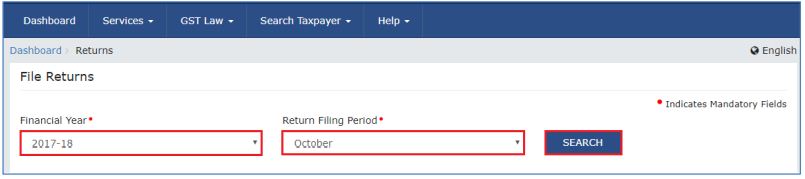

Step 1: To upload Generated JSON file on GST portal, you need to visit the home page of Goods and Service Tax (GST). Step 2: From the home page, click on Service option and then click on Returns option. Now, you need to select the Returns dashboard command. Step 3: The File Returns page will be displayed. In the Financial Year drop-down list, select the financial year for which the GSTR-3B return has to be uploaded. Image 32 GSTR 3B Offline Utility

Step 4: From the Return Filing Period drop-down menu, select the return filing period for which the GSTR-3B return has to be uploaded.

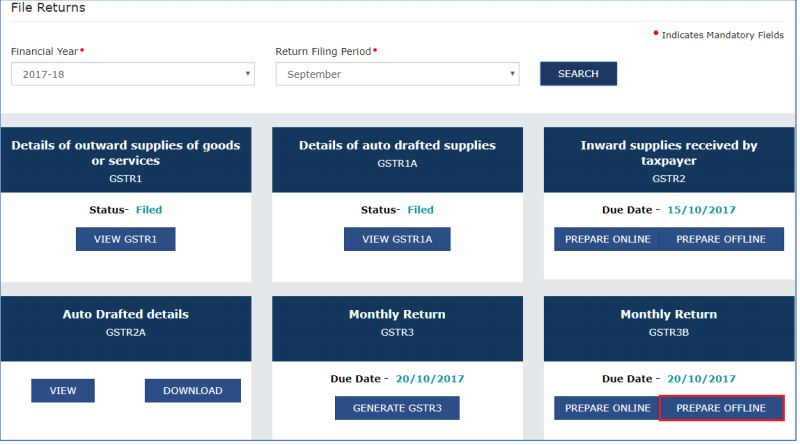

Step 5: After providing, year and period for which the return has to be filed, click on the Search button.

Step 6: Applicable returns of the selected tax period will be displayed. From the GSTR-3B tile, you need to click on the PREPARE OFFLINE option.

Image 32 GSTR 3B Offline Utility

Step 4: From the Return Filing Period drop-down menu, select the return filing period for which the GSTR-3B return has to be uploaded.

Step 5: After providing, year and period for which the return has to be filed, click on the Search button.

Step 6: Applicable returns of the selected tax period will be displayed. From the GSTR-3B tile, you need to click on the PREPARE OFFLINE option.

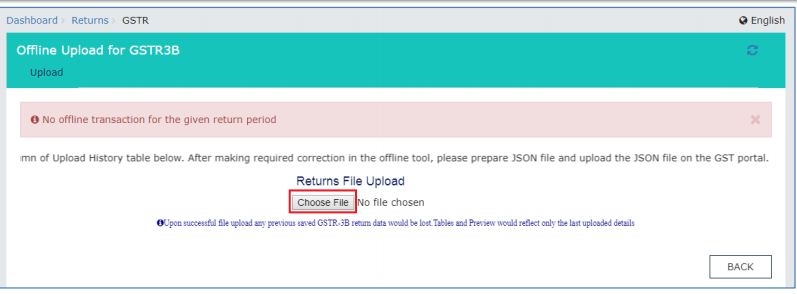

Image 33 GSTR 3B Offline Utility

Step 7: The Upload page will be displayed as given in the image. Click on the Choose File button.

Image 33 GSTR 3B Offline Utility

Step 7: The Upload page will be displayed as given in the image. Click on the Choose File button.

Image 34 GSTR 3B Offline Utility

Step 8: Browse and navigate the JSON file to be uploaded from your computer. Click on the Open button.

The uploaded JSON file would be validated and processed. Upon successful validation and processing, the details entered would be populated in respective Tables. In case of validation failure during processing; errors if any would be shown on the GST Portal.

Note: It is possible to upload JSON multiple times on GST portal till submission. However, earlier uploaded data will be overwritten. Tables and Preview would reflect only the last data uploaded.

Post successful uploading of data on GST Portal, you can preview the form, submit, Offset liability and file GSTR-3B.

Know more about GSTR 3B Penalty Waived

Image 34 GSTR 3B Offline Utility

Step 8: Browse and navigate the JSON file to be uploaded from your computer. Click on the Open button.

The uploaded JSON file would be validated and processed. Upon successful validation and processing, the details entered would be populated in respective Tables. In case of validation failure during processing; errors if any would be shown on the GST Portal.

Note: It is possible to upload JSON multiple times on GST portal till submission. However, earlier uploaded data will be overwritten. Tables and Preview would reflect only the last data uploaded.

Post successful uploading of data on GST Portal, you can preview the form, submit, Offset liability and file GSTR-3B.

Know more about GSTR 3B Penalty Waived

Popular Post

In the digital age, the convenience of accessing important documents online has become a necessity...

The Atalji Janasnehi Kendra Project that has been launched by the Government of Karnataka...

The Indian Divorce Act governs divorce among the Christian couples in India. Divorce...

When an individual has more than a single PAN card, it may lead to that person being heavily penalised, or worse,...

Employees Provident Fund (PF) is social security and savings scheme for employee in India. Employers engaged...