Last updated: December 14th, 2022 10:34 AM

Last updated: December 14th, 2022 10:34 AM

GSTR-3B Return - Online Filing Procedure

GSTR-3B return must be filed by all persons having GST registration up to 30th June 2018. GSTR-3B return is due on the 20th of each month. In the 27th GST Council Meeting, a decision is expected on the filing of the GSTR-3B return. In this article, we look at GSTR-3B return filing in detail along with the procedure for filing online.Import of E-way Bill Data

It is essential for taxpayers to validate the data of their transactions before proceeding with the process of filing returns, as it saves time and unnecessary data entry. To cater to this purpose, the GST portal has now been integrated with the E-way Bill Portal (EWB). The integration enables the users to import the B2B and B2C invoice sections and the HSN-wise summary of the outward supplies section. Using these details, the taxpayers may verify the data and complete the filing. The feature has been introduced considering the major data gaps between self-declared liability in Form GSTR 1 and Form GSTR 3B. A similar rule also applies to Input Tax Credit (ITC) claimed in GSTR 3B, as it could be compared with the credit available in Form GSTR 2A. Data validation and comparison can be pursued through the following tabs of the portal:- Liability other than export/reverse charge.

- Liability due to reverse charge.

- Liability due to export and SEZ supplies.

- ITC credit claimed and due.

GSTR-3B Return Due Dates

GSTR 3B return is due on the 20th of each month, upto June 2018. Entities who have not filed GSTR-3B return for July will have to pay a penalty of Rs.200 per day.GSTR-3B Filing Format

You can easily prepare GSTR 3B in the format to be filed on the GST Portal using LEDGERS GST Software. To prepare GSTR 3B, download the excel file, populate the invoice information and upload it to LEDGERS GST Software. Based on the invoices, GSTR-3B for the month of July and August will be prepared by the system automatically.Download GSTR 3B Excel Format

Who should file GSTR-3B return?

GSTR-3B return must be filed by all persons registered under GST until the further orders from GSTN upto the month of June 2018.What is the due date for filing GSTR-3B return?

GSTR-3B return is due on the 20th of each month.What is the penalty for not filing GSTR-3B return?

The penalty for not filing GSTR-3B return is Rs.50 per day, in case the taxpayer had any transactions during the return filing period. The penalty would be Rs.20 for not filing NIL GST return.What details must be provided in GSTR-3B return?

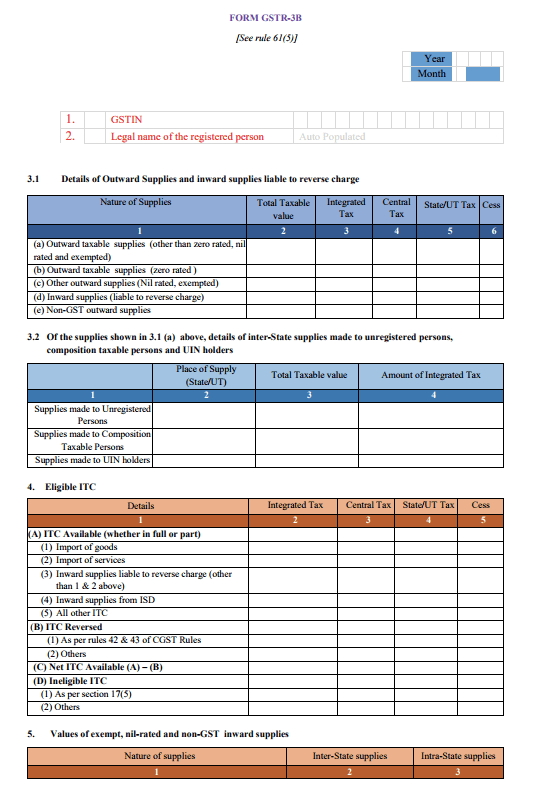

GSTR-3B is a simplified GST return, in which outward supplies and inward supplies are not matched. Hence, the taxpayer, while filing GSTR-3B return is required to furnish details of both outward supplies and inward supplies. The table below shows the details that must be submitted in GSTR-3B return.3.1 Details of outward supplies and inward supplies liable to reverse charge

| Nature of Supplies |

Total Taxable Value |

Integrated Tax |

Central Tax |

State/UT Tax |

Cess |

|

1 |

2 |

3 |

4 |

5 |

6 |

| (a) Outward taxable supplies (other than zero-rated, nil rated and exempted) | |||||

| (b) Outward taxable supplies (zero-rated ) | |||||

| (c) Other outward supplies (Nil rated, exempted) | |||||

| (d) Inward supplies (liable to reverse charge) | |||||

| (e) Non-GST outward supplies |

3.2 Of the supplies shown in 3.1 (a) above, details of inter-State supplies made to unregistered persons, composition taxable persons and UIN holders

| Place of Supply (State/UT) | Total Taxable value | Amount of Integrated Tax | |

| Supplies made to Unregistered Persons | |||

| Supplies made to Composition Taxable Persons | |||

| Supplies made to UIN holders |

4. Eligible Input Tax Credit (ITC)

|

Integrated Tax |

Central Tax |

State/UT Tax |

Cess |

|

| (A) ITC Available (whether in full or part) | ||||

| (1) Import of goods | ||||

| (2) Import of services | ||||

| (3) Inward supplies liable to reverse charge (other than 1 & 2 above) | ||||

| (4) Inward supplies from ISD | ||||

| (5) All other ITC | ||||

| (B) ITC Reversed | ||||

| (1) As per rules 42 & 43 of CGST Rules | ||||

| (2) Others | ||||

| (C) Net ITC Available (A) - (B) | ||||

| (D) Ineligible ITC | ||||

| (1) As per section 17(5) | ||||

| (2) Others |

- Import of goods.

- Import of services.

- Inward supplies liable to reverse charge (other than 1 & 2 above).

- Inward supplies from ISD.

- All other Input tax credit available.

5. Values of exempt, nil-rated and non-GST inward supplies

| Nature of Supplies |

Inter-State Supplies |

Intra-State Supplies |

| From a supplier under composition scheme, Exempt and Nil rated supply | ||

| Non GST supply |

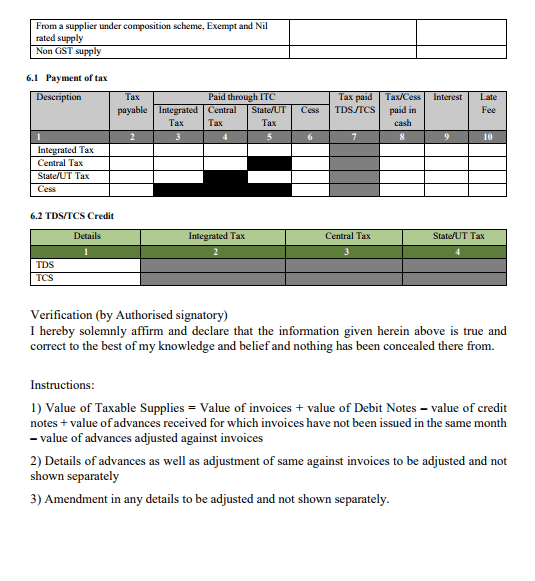

6.1 Payment of tax

| Description |

Tax Payable |

ITC Claim Integrated Tax | ITC Claim Central Tax | ITC Claim State/UT Tax | Cess | Tax Paid TDS/TCS | Tax/Cess Paid in Cash | Interest |

Late Fee |

|

1 |

2 |

3 |

4 |

5 |

6 |

7 |

8 |

9 |

10 |

| Integrated Tax | NA | ||||||||

| Central Tax | NA | NA | |||||||

| State/UT Tax | NA | NA | |||||||

| Cess | NA | NA | NA | NA |

6.2 TDS/TCS Credit

| Details |

Integrated Tax |

Central Tax |

State/UT Tax |

| TDS |

NA |

NA |

NA |

| TCS |

NA |

NA |

NA |

GSTR-3B Return

A sample GSTR-3B return is reproduced below for reference: [caption id="attachment_33248" align="aligncenter" width="537"] GSTR-3B Return Format

[caption id="attachment_33249" align="aligncenter" width="535"]

GSTR-3B Return Format

[caption id="attachment_33249" align="aligncenter" width="535"] GSTR-3B Return Format - Page 2

GSTR-3B Return Format - Page 2

How to file GSTR-3B Return?

GSTR-3B return can be filed online through the GST Common Portal or using LEDGERS GST Software. Based on the invoices raised and purchases invoices recorded, GSTR-3B return can be prepared easily.Staggered Return of GSTR-3B

As per the latest notification on 22nd January 2020, the Ministry of Finance has introduced the staggered manner of filing the returns through GSTR-3B. This decision was taken after the representation from the trade sector based on the difficulties faced by the industries. Currently, the filing of GSTR-3B returns for every taxpayer is 20th of every month. As per the notification, the submission of GSTR-3B is split into 3 different categories, and 3 different deadlines are announced.- If the turnover is above Rs.5 crores in the previous financial year, the last date of filing is 20th of every month without late fees

- If the turnover is less than Rs.5 crores in the previous financial year, it is divided into two categories,

- For the 15 states/UTs including Chhattisgarh, Madhya Pradesh, Gujarat, Daman and Diu, Dadra and Nagar Haveli, Maharashtra, Karnataka, Goa, Lakshadweep, Kerala, Tamil Nadu, Puducherry, Andaman and Nicobar Islands, Telangana and Andhra Pradesh, the last date of filing GSTR-3B is 22nd of every month without late fees.

- For the 22 states/UTs including Jammu and Kashmir, Laddakh, Himachal Pradesh, Punjab, Chandigarh, Uttarakhand, Haryana, Delhi, Rajasthan, Uttar Pradesh, Bihar, Sikkim, Arunachal Pradesh, Nagaland, Manipur, Mizoram, Tripura, Meghalaya, Assam, West Bengal, Jharkhand and Odisha, the last date of filing GSTR-3B is 24th of every month without late fees.

Popular Post

In the digital age, the convenience of accessing important documents online has become a necessity...

The Atalji Janasnehi Kendra Project that has been launched by the Government of Karnataka...

The Indian Divorce Act governs divorce among the Christian couples in India. Divorce...

When an individual has more than a single PAN card, it may lead to that person being heavily penalised, or worse,...

Employees Provident Fund (PF) is social security and savings scheme for employee in India. Employers engaged...