Last updated: December 17th, 2024 3:42 PM

Last updated: December 17th, 2024 3:42 PM

GSTR 4 Return - Online Filing Guide

The GST Composition Scheme makes it easy for small businesses to maintain GST compliance by providing a simpler GST filing form, quarterly GST returns filing and no responsibility on the business for collecting GST on supplies. All taxpayers registered under the GST Composition scheme should file GSTR 4 returns every quarter. Dealers enrolled under the GST Composition Scheme file one GST returns every 3 months instead of 3 GST returns every month. Since composition scheme dealers cannot claim GST input tax credit, GSTR 4 is a consolidated form and details of purchases and supplies are filed in the same form. In this article, we look at GSTR 4 return in detail along with the procedure for filing GSTR 4 return .GSTR 4 Format

To prepare GSTR 4 format as per the requirements of the GST Portal, you can use LEDGERS GST Software. Download the excel tool provided below, upload details of invoices and upload it to LEDGERS to prepare GSTR 4 return.Download GSTR 4 Excel Format

Who should file GSTR 4 Return?

Only businesses having GSTIN that are enrolled under the GST Composition Scheme are required to file GSTR 4 return. Regular taxpayers must file GSTR 1, GSTR 2 and GSTR 3 return on the 10th, 15th and 20th of each month, respectively.What is the due date for filing GSTR 4 Return?

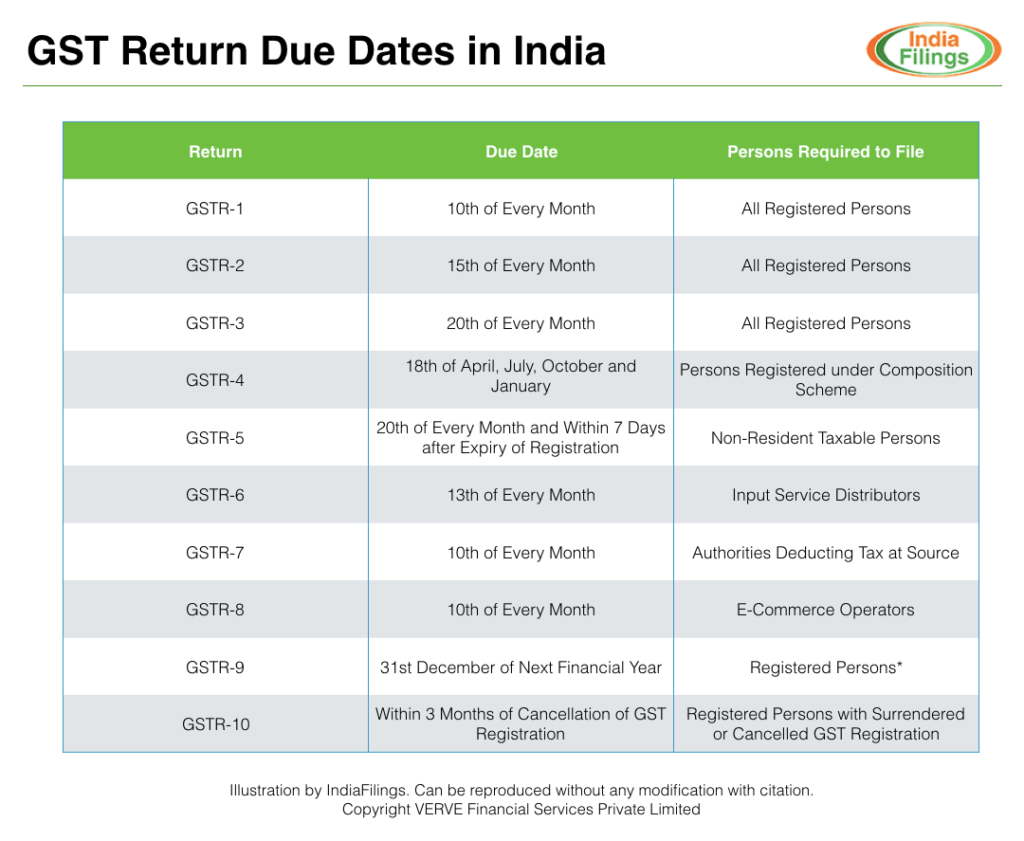

GSTR 4 Return must be filed between the 11th and 18th of every April, July, October and January. The chart below shows the due date for filing all types of GST returns in India. GST Return Filing Due Dates

GST Return Filing Due Dates

Procedure for Preparing GSTR 4 Return

The return can be filed online using LEDGERS GST Software. In case you are preparing GSTR 4 return manually, the following guide can be followed for calculating the major sections of the return.Inward Supplies Received from Registered Persons

Since composition taxable persons are not eligible to collect GST from customers, the emphasis is placed on inward supplies in GSTR 4 return. In the first table, the taxpayer must provide details of inward supplies including supplies on which tax is to be paid on reverse charge. Note: Dealers registered under composition scheme are required to pay GST on reverse charge basis when the purchase is made from an unregistered dealer. In the above table, the taxpayer must provide details of inward supplies under the following heads:

In the above table, the taxpayer must provide details of inward supplies under the following heads:

- GSTIN of supplier

- Invoice number

- Invoice date

- Invoice value

- GST rate

- Taxable value

- Amount of IGST, if applicable

- Amount of CGST, if applicable

- Amount of SGST, if applicable

- Place of supply

- GST Cess

- 4A. Inward supplies received from a registered supplier (other than supplies attracting reverse charge)

- 4B. Inward supplies received from a registered supplier (attracting reverse charge)

- 4C. Inward supplies received from an unregistered supplier

- 4D. Import of service

Amendments to Inward Supplies

In this section, the taxpayer must declare amendments to details of inward supplies furnished in returns for earlier tax periods, if any. In case there were no amendments to a purchase invoice declared in an earlier tax period, this table can be left blank. [caption id="attachment_33426" align="aligncenter" width="766"] Amendments to Inward Supplies

If there was an amendment to an earlier invoice, then the following information must be furnished in the GSTR 4 return:

Amendments to Inward Supplies

If there was an amendment to an earlier invoice, then the following information must be furnished in the GSTR 4 return:

- Details of Original Invoice

- GSTIN of Supplier

- Invoice Date

- Invoice Number

- Details of Revised Invoice

- GSTIN of Supplier

- Revised Invoice Number

- Revised Invoice Date

- Revised Invoice Value

- Applicable GST Rate

- Taxable Value

- Amount of IGST applicable

- Amount of CGST applicable

- Amount of SGST applicable

- GST Cess applicable

- Place of Supply

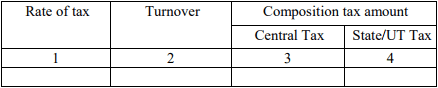

Tax on Outward Supplies

Based on the turnover of the business, dealers registered under composition scheme are required to pay a flat rate GST. In this section, the taxpayer must declare the amount of turnover recorded in the tax period and the composition GST rate applicable. Based on the rate applicable, the GST is split between CGST and SGST.

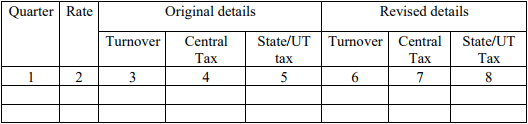

Amendments to Outward Supply Details

In case the taxpayer must change details of turnover that was filed in a previous GSTR 4 return, this section needs to be completed. If there are no amendments, then the following details need not be provided.

Popular Post

In the digital age, the convenience of accessing important documents online has become a necessity...

The Atalji Janasnehi Kendra Project that has been launched by the Government of Karnataka...

The Indian Divorce Act governs divorce among the Christian couples in India. Divorce...

When an individual has more than a single PAN card, it may lead to that person being heavily penalised, or worse,...

Employees Provident Fund (PF) is social security and savings scheme for employee in India. Employers engaged...