Updated on: June 12th, 2023 4:40 PM

Updated on: June 12th, 2023 4:40 PM

GSTR-5A Return Filing

Form GSTR-5A is a Return that the Online Information and Database Access or Retrieval (OIDAR) service providers must file. These services are provided to unregistered persons or customers from places outside India to persons in India. It is a monthly return. The due date for filing is by the 20th of the month after the tax period for which the return pertains or by the date extended by the Commissioner.Modes of Preparing Form GSTR-5A

The following modes can prepare GSTR-5A:- Online entry data on the GST Portal after logging in.

- Use third-party applications from Application Software Providers (ASPs) through GST Suvidha Providers (GSPs).

Pre-Requisites for Filing Form GSTR-5A

Here are the prerequisites for filing GSTR-5A.- The taxpayer should be a registered OIDAR service provider and should possess a valid GSTIN.

- The taxpayer should have a valid User ID and Password.

- The taxpayer should have a valid and non-expired/ non-revoked PAN-based Digital Signature (DSC) for filing with DSC.

Form GSTR-5A Filing Procedure

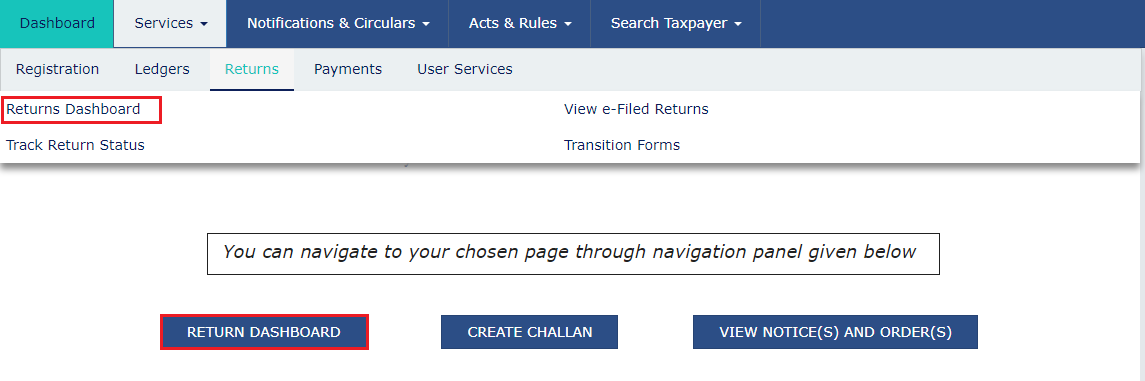

Given below are the steps to create and file details for GSTR-5A. Step 1: Log in to the Portal The taxpayer has to log into the official GST Portal. Step 2: Enter the details The taxpayer has to enter their username and password. Step 3: Click Returns Dashboard Select the 'Returns' option from the 'Services' tab and click 'Returns Dashboard'. An alternate step to do this is to click the 'Returns Dashboard' link on the Dashboard. The 'File Returns' page appears on the screen. Step 4: Select Financial Year and Return Filing Period

Select the 'Financial Year and Return Filing Period' for which the return has to be filed from the drop-down list.

Step 5: Click Search

The taxpayer has to click the 'Search' button.

Step 4: Select Financial Year and Return Filing Period

Select the 'Financial Year and Return Filing Period' for which the return has to be filed from the drop-down list.

Step 5: Click Search

The taxpayer has to click the 'Search' button.

Step 6: Click Prepare Online

The File Returns page appears with the due date of filing the returns, which the taxpayer must file using separate tiles. In the GSTR-5A tile, click the 'Prepare Online' button.

Step 6: Click Prepare Online

The File Returns page appears with the due date of filing the returns, which the taxpayer must file using separate tiles. In the GSTR-5A tile, click the 'Prepare Online' button.

Step 7: Enter the Details

Step 7: Enter the Details

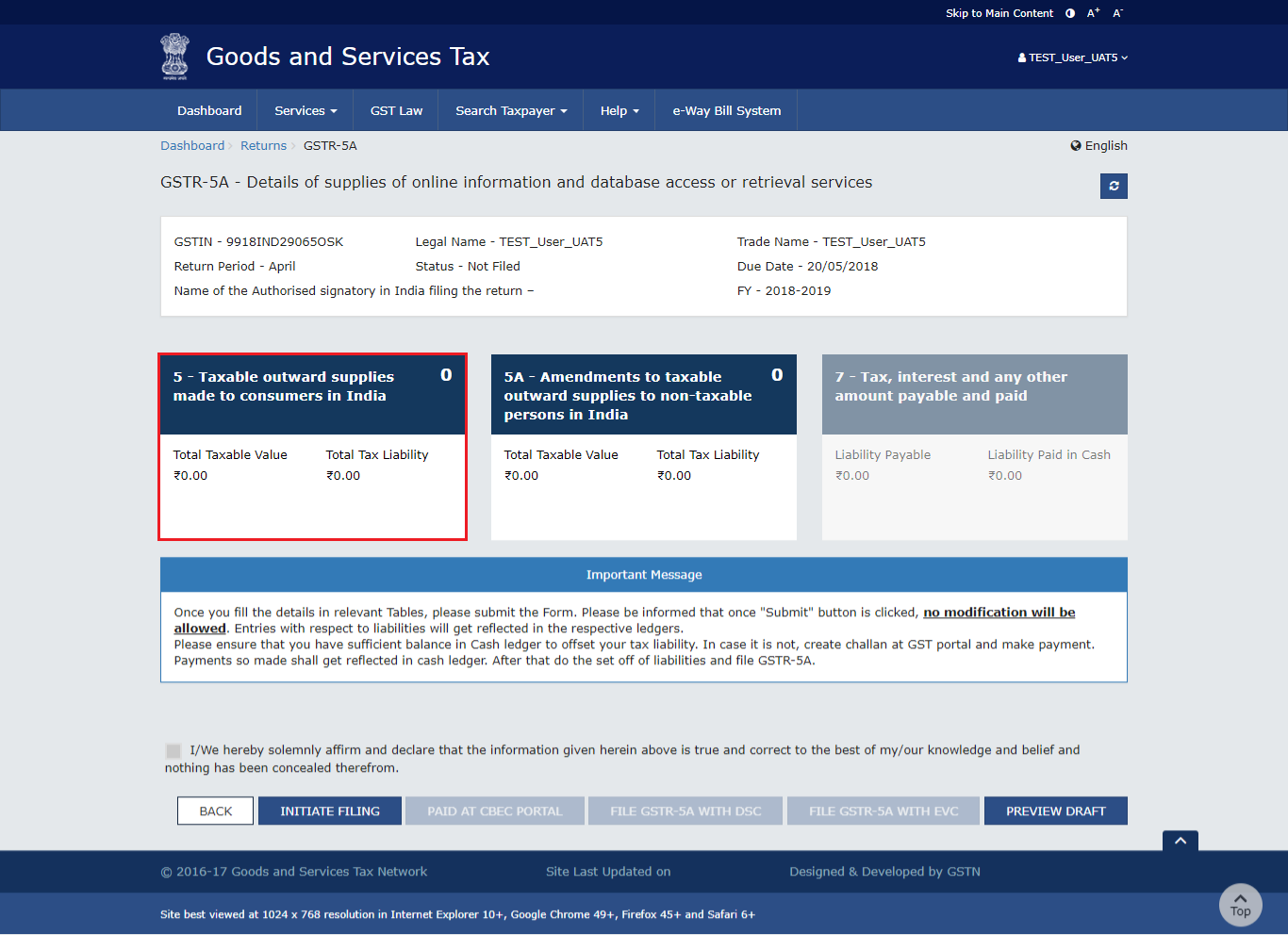

- In the 'Taxable outward supplies made to consumers in India' tab, taxpayers can add details of taxable outward supplies that are made to consumers in India.

- In the "Amendments to taxable outward supplies to non-taxable persons in India" tab, the taxpayer has to enter the details of an amendment to taxable outward supplies to non-taxable people in India.

Step 2: Click Add Details

The taxpayer has to click the 'Add Details' button to add details for a new POS.

Step 2: Click Add Details

The taxpayer has to click the 'Add Details' button to add details for a new POS.

Step 3: Select the Place of Supply

The taxpayer has to select 'Place of Supply' from the drop-down list.

Step 4: Enter the Taxable Value

The taxpayer has to enter the 'Taxable Value'.

Step 5: Select Rate

The taxpayer has to select the 'Rate' from the drop-down list.

Step 6: Click Add

The taxpayer has to click the 'Add' button. The details are added. For states that have two rate supplies, click the 'Add Details' button again to add details.

Step 3: Select the Place of Supply

The taxpayer has to select 'Place of Supply' from the drop-down list.

Step 4: Enter the Taxable Value

The taxpayer has to enter the 'Taxable Value'.

Step 5: Select Rate

The taxpayer has to select the 'Rate' from the drop-down list.

Step 6: Click Add

The taxpayer has to click the 'Add' button. The details are added. For states that have two rate supplies, click the 'Add Details' button again to add details.

Step 7: Click Save

The taxpayer has to click the 'Save' button.

Step 7: Click Save

The taxpayer has to click the 'Save' button.

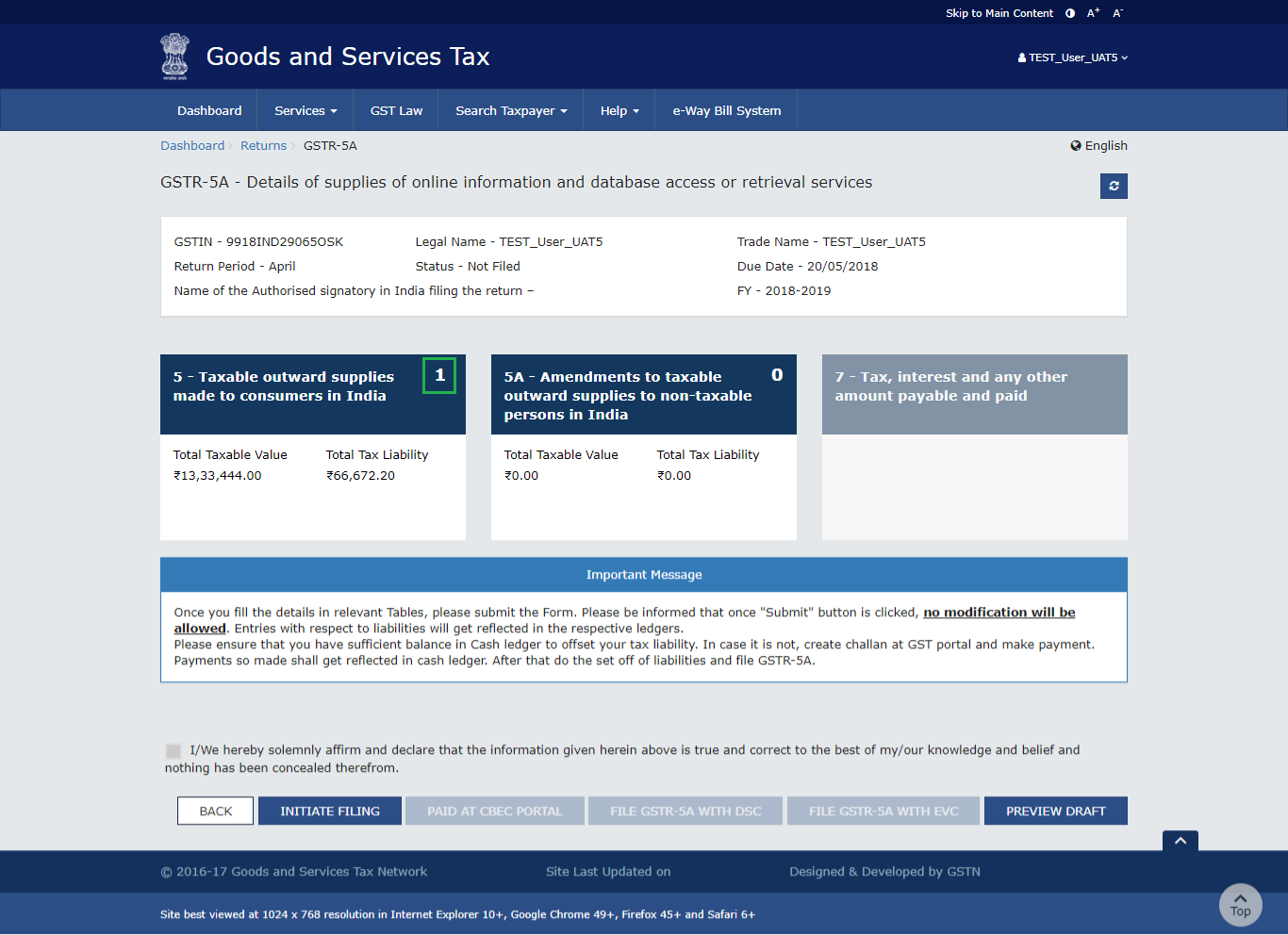

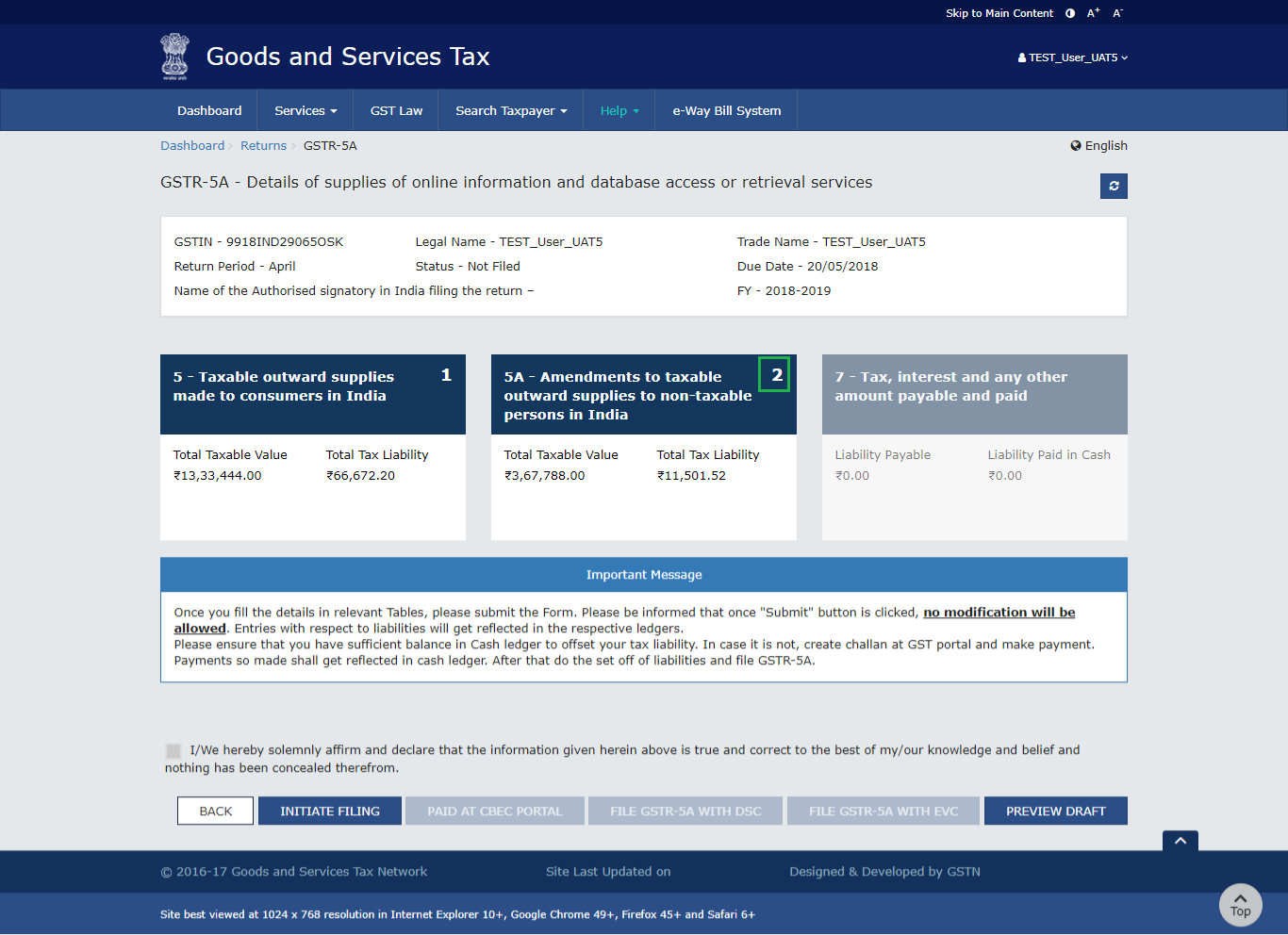

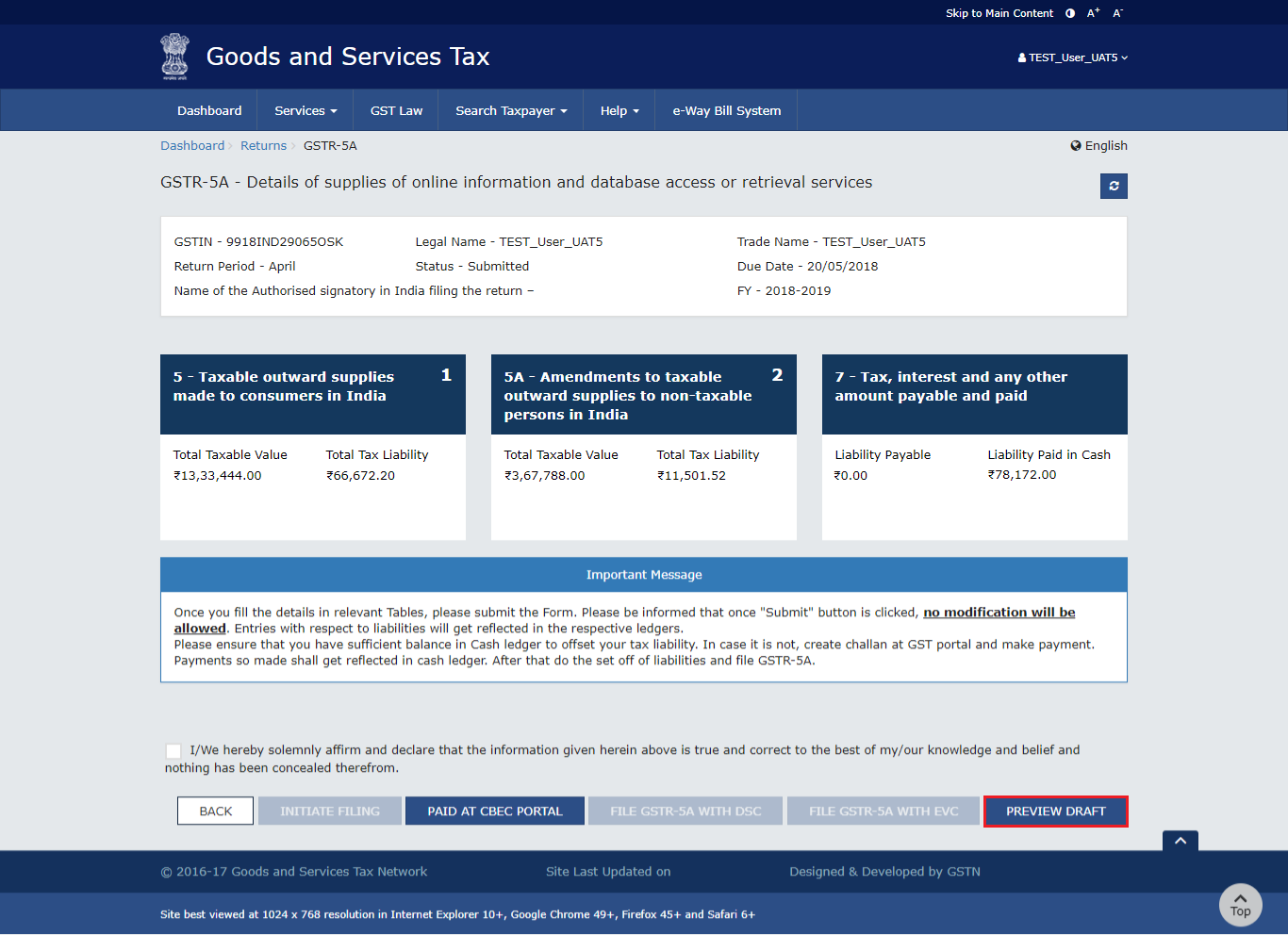

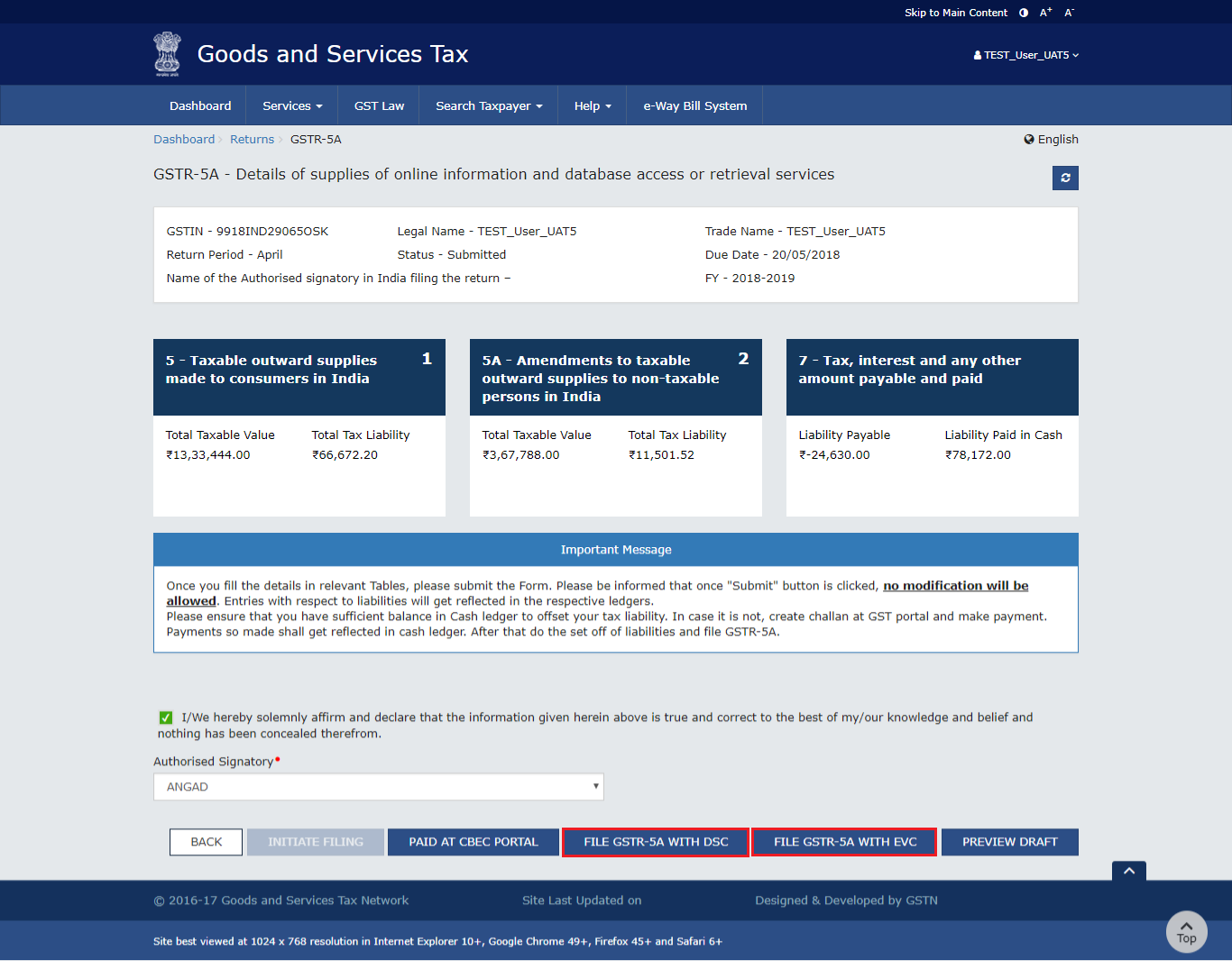

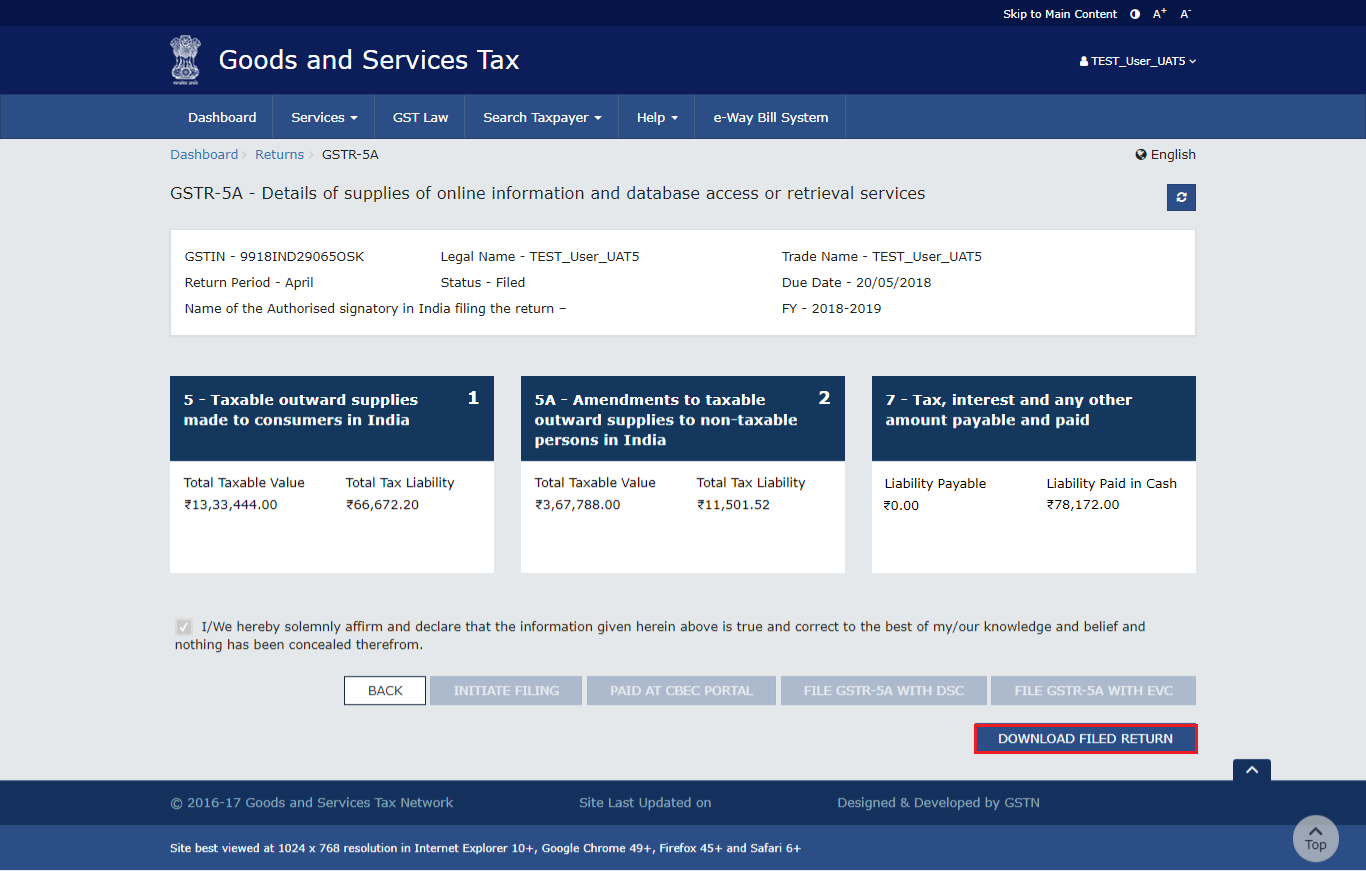

The taxpayer is directed to the GSTR-5A landing page that displays the Total Taxable Value and Total Tax Liability. Similarly, details of state-wise supplies made to consumers during the tax period can be added.

The taxpayer is directed to the GSTR-5A landing page that displays the Total Taxable Value and Total Tax Liability. Similarly, details of state-wise supplies made to consumers during the tax period can be added.

B. Amendments to taxable outward supplies to non-taxable persons in India

Given below are the steps to add details of an amendment to taxable outward supplies to non-taxable people in India.

Step 1: Click Amendments to taxable outward supplies to non-taxable Persons

The taxpayer has to click the 'Amendments to taxable outward supplies to non-taxable persons' tile. It appears as given below.

B. Amendments to taxable outward supplies to non-taxable persons in India

Given below are the steps to add details of an amendment to taxable outward supplies to non-taxable people in India.

Step 1: Click Amendments to taxable outward supplies to non-taxable Persons

The taxpayer has to click the 'Amendments to taxable outward supplies to non-taxable persons' tile. It appears as given below.

Step 2: Adding Details

The following details have to be added by the taxpayer.

Step 2: Adding Details

The following details have to be added by the taxpayer.

- Select the Financial Year

- Select the Months

- Select the Place of Supply

- Click the Search button

- Enter Taxable Value

- Select the Rate

- Enter the amount of Cess

- Click the 'Add' button

The amended records appear on the screen. Click the 'Delete' button to delete the record. After making all the changes, click the 'Save' button.

The amended records appear on the screen. Click the 'Delete' button to delete the record. After making all the changes, click the 'Save' button.

Step 3: Amending Details

Step 3: Amending Details

- Select the Financial Year

- Select the Months

- Select the Place of Supply

- Click the Search button

The results appear on the screen. Click the 'Edit' button to edit the results.

The results appear on the screen. Click the 'Edit' button to edit the results.

The taxpayer has to click the 'Save' button.

The taxpayer has to click the 'Save' button.

The taxpayer gets redirected to the GSTR-5A landing page by clicking the 'Back' button. The 'Amendments to taxable outward supplies to non-taxable persons in India' tile displays the Total Taxable Value and Total Tax Liability.

The taxpayer gets redirected to the GSTR-5A landing page by clicking the 'Back' button. The 'Amendments to taxable outward supplies to non-taxable persons in India' tile displays the Total Taxable Value and Total Tax Liability.

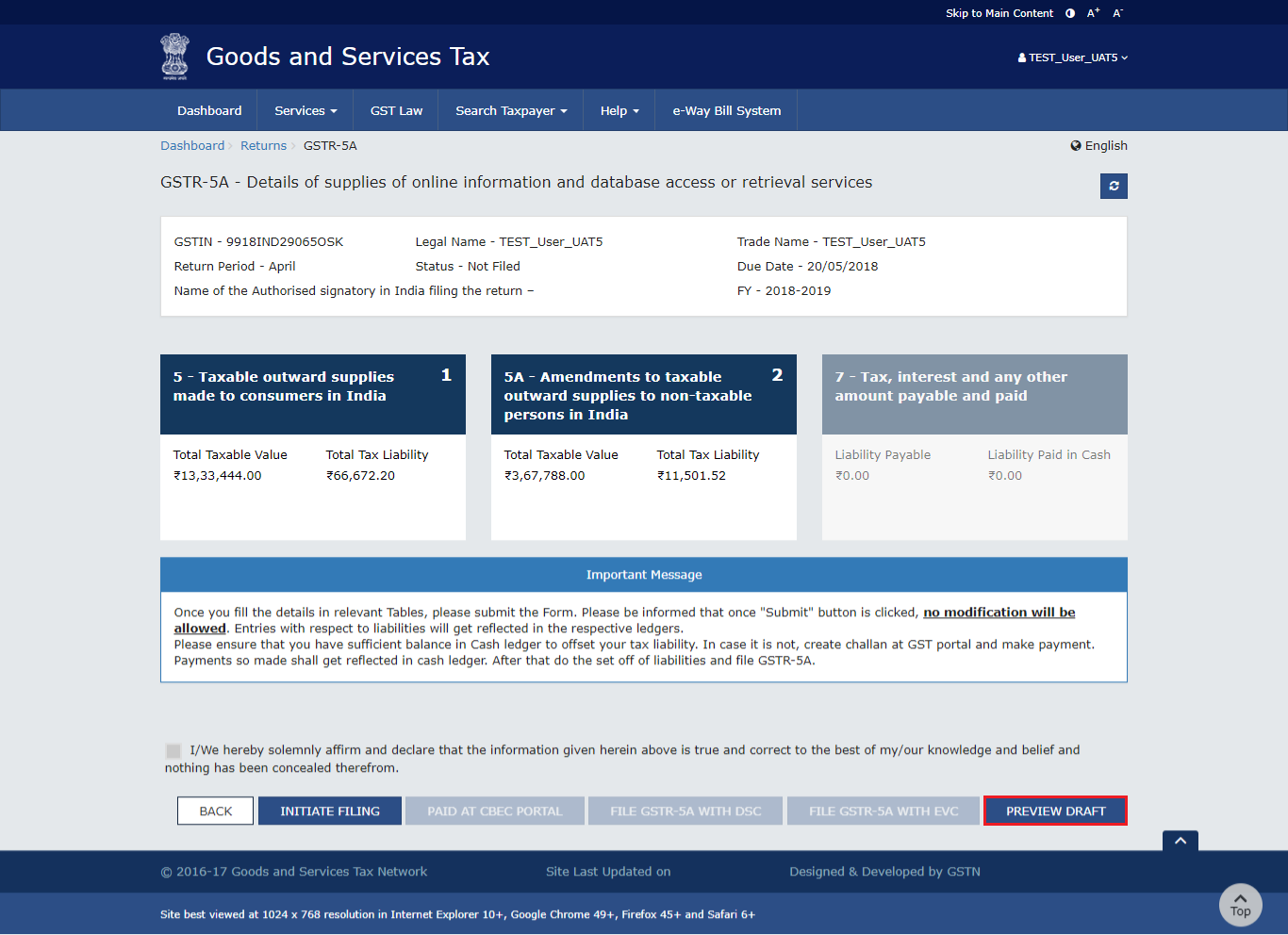

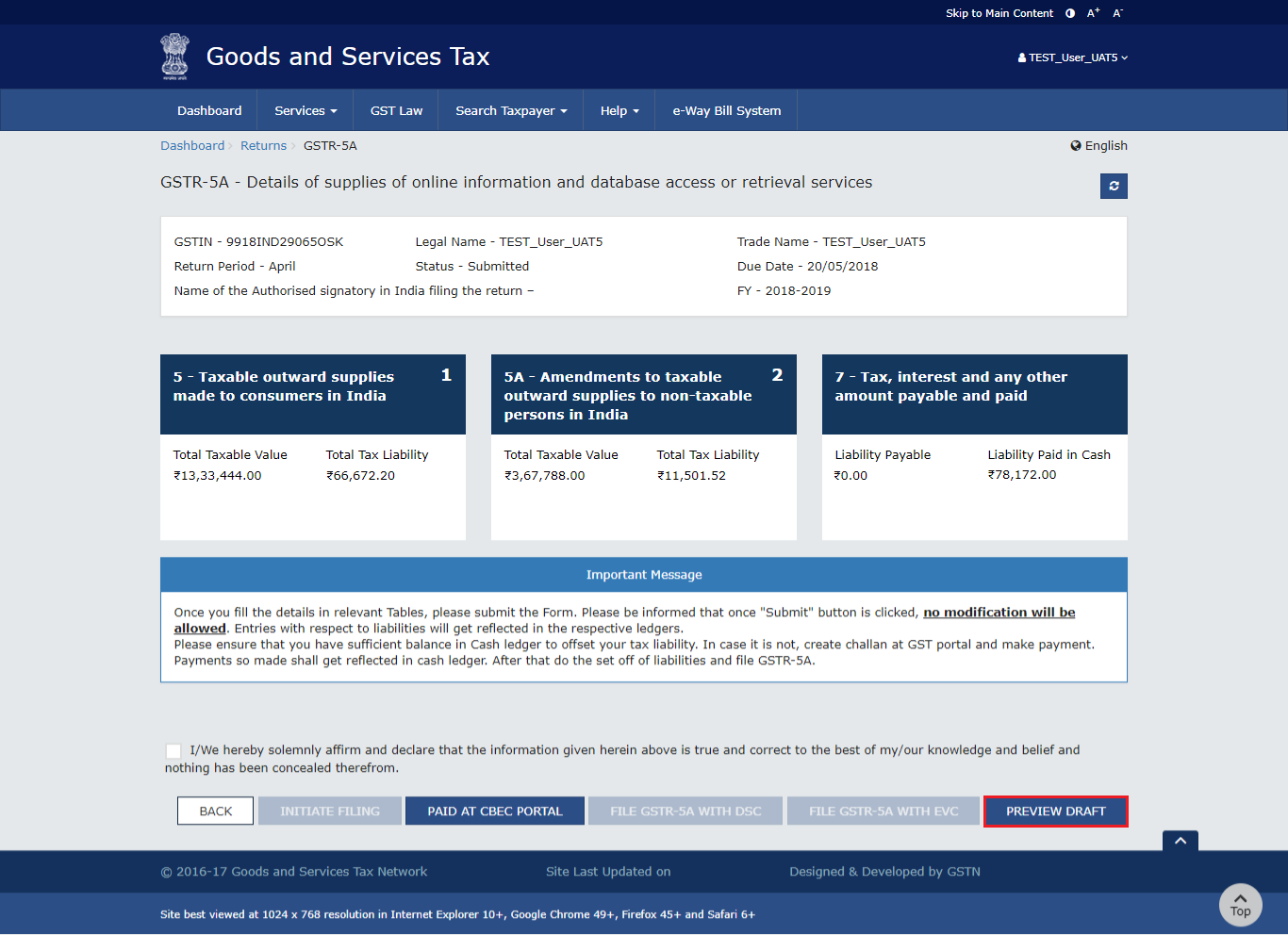

Previewing Draft for GSTR-5A

Given below are the steps to preview the draft for GSTR-5A. Step 1: Click Preview Draft The taxpayer has to click the 'Preview Draft' button to preview the draft for GSTR-5A. The draft is displayed in PDF format.

The draft is displayed in PDF format.

Initiate Filing for GSTR-5A

Here are the steps to initiate filing for GSTR-5A. Step 1: Click Initiate Filing The taxpayer has to click 'Initiate Filing' on the landing page to initiate filing for GSTR-5A.- The 'Initiate Filing' button freezes the information that is filed for that particular month.

- The taxpayer must ensure sufficient balance in the Electronic Cash Ledger to offset the tax liability. In cases where there is not, a challan must be created in the GST Portal and the payment reflected in the Electronic Cash Ledger must be made. Then, proceed to the set-off liabilities and file GSTR-5A.

Step 2: Confirm and Submit

A summary of the information is displayed on the screen. Click the 'Confirm and Submit' button. By clicking this button, it freezes the information that is filed for that particular month.

Step 2: Confirm and Submit

A summary of the information is displayed on the screen. Click the 'Confirm and Submit' button. By clicking this button, it freezes the information that is filed for that particular month.

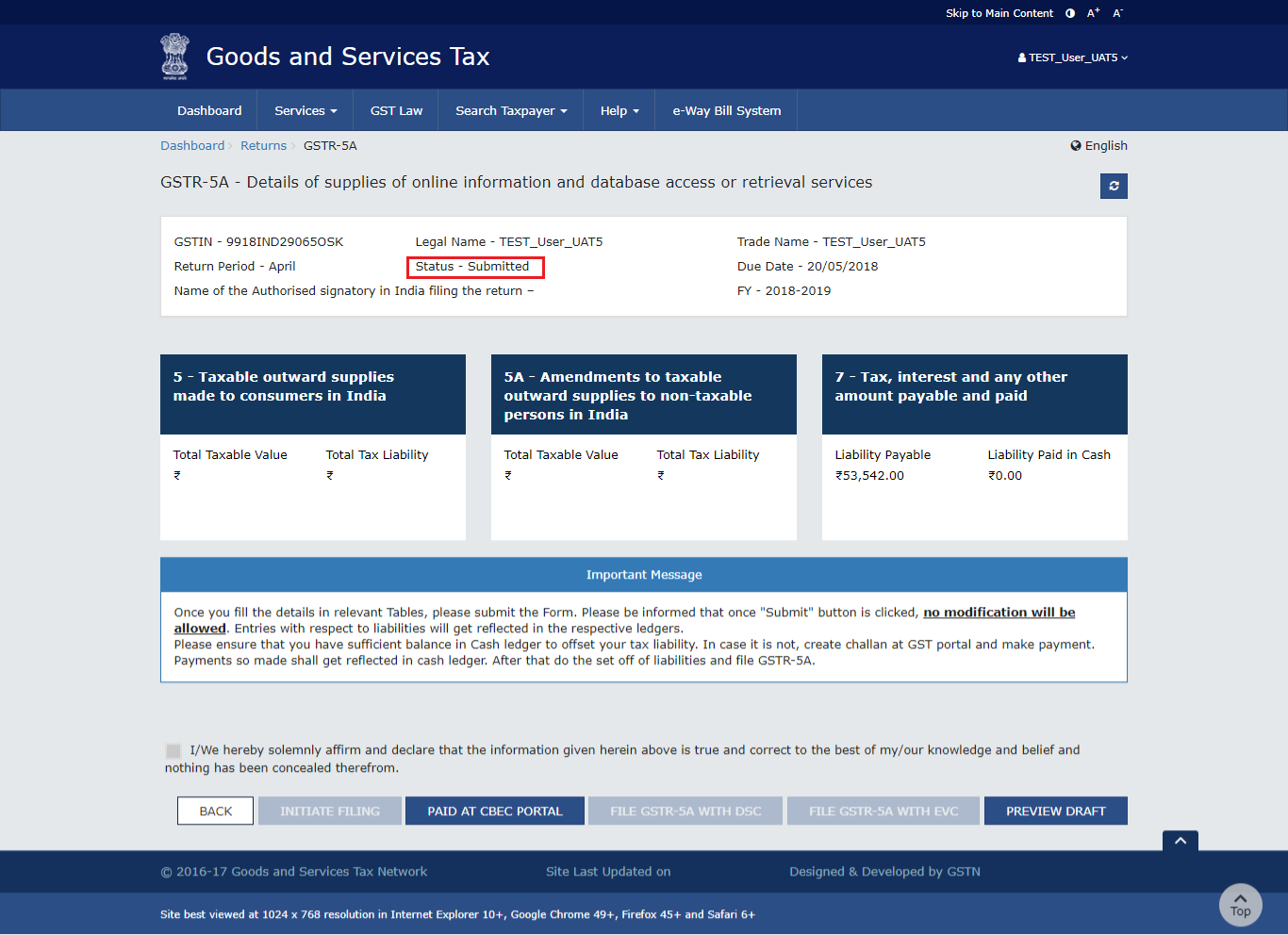

After refreshing the page, the status changes to 'Submitted'.

Submitting the form enables the 'Calculation of interest or any other amount', 'Tax, interest and any other amount payable and paid' tile and 'Paid at CBEC Portal' button.

After refreshing the page, the status changes to 'Submitted'.

Submitting the form enables the 'Calculation of interest or any other amount', 'Tax, interest and any other amount payable and paid' tile and 'Paid at CBEC Portal' button.

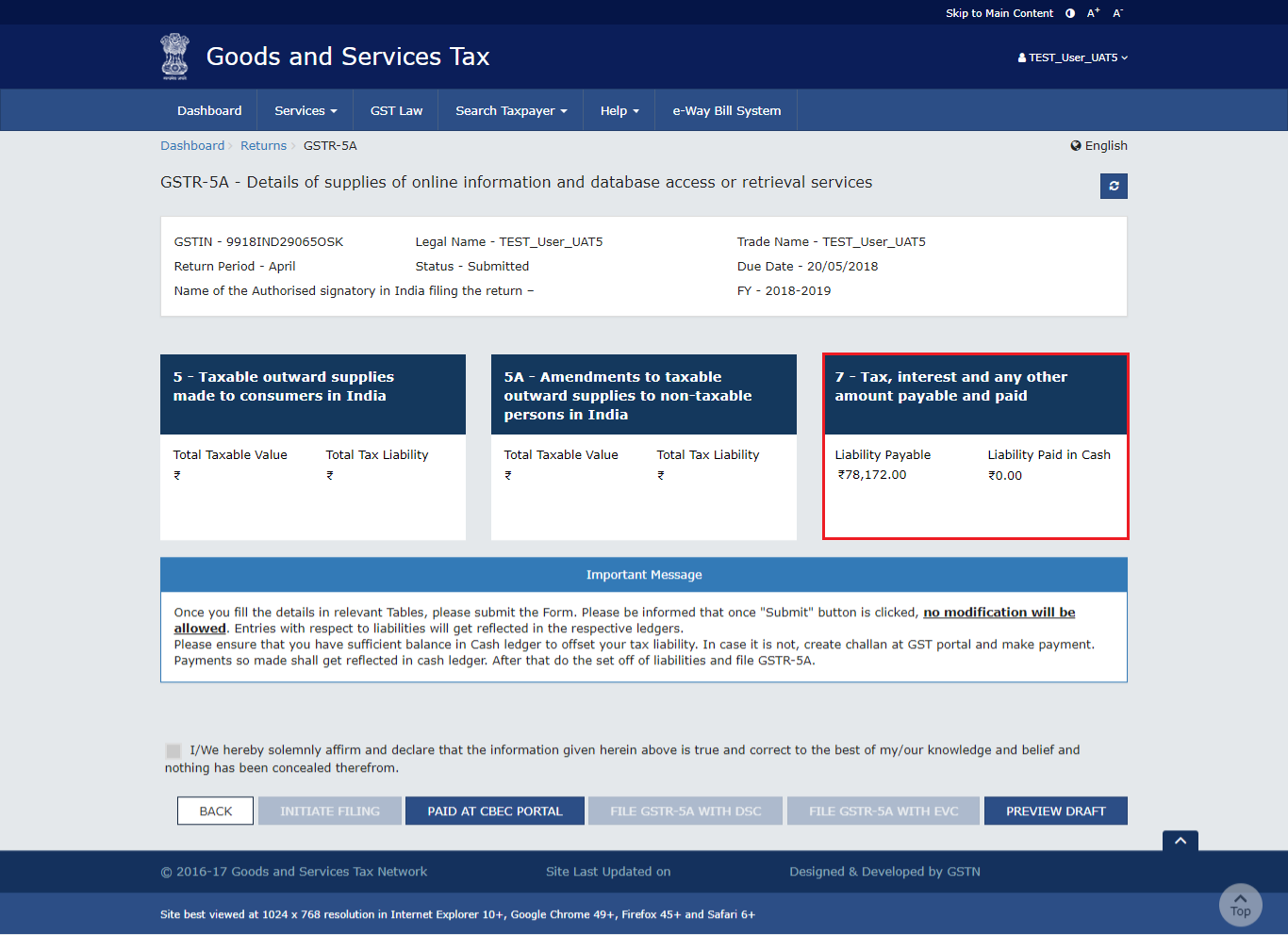

Offset Liabilities

If the taxpayer has not paid the liability of GSTR-5A through CBEC Portal, follow the below-given steps. Step 1: Click the Tax, Interest and any other amount payable and paid tile. The taxpayer has to click 'Tax, Interest and any other amount payable and paid" tile to view the details of interest or any other amount that is payable. Step 2: Click Check Ledger Balance

The taxpayer has to click the 'Check Ledger Balance' button to know the available balance in the Electronic Cash Ledger.

Step 2: Click Check Ledger Balance

The taxpayer has to click the 'Check Ledger Balance' button to know the available balance in the Electronic Cash Ledger.

Step 3: Click Ok

The taxpayer has to click the 'OK' button.

Step 3: Click Ok

The taxpayer has to click the 'OK' button.

Step 4: Click Offset Liability

Click the 'Offset Liability' button after filling in the amount paid in various heads.

Step 4: Click Offset Liability

Click the 'Offset Liability' button after filling in the amount paid in various heads.

Step 5: Click Close

The taxpayer has to click the 'Close' button.

Step 5: Click Close

The taxpayer has to click the 'Close' button.

Step 6: Click Back

The liability is offset, and the debit number is displayed. Click the 'Back' button.

Step 6: Click Back

The liability is offset, and the debit number is displayed. Click the 'Back' button.

Step 7: Preview Draft

Click on the 'Preview Draft' button to preview the draft.

Step 7: Preview Draft

Click on the 'Preview Draft' button to preview the draft.

The form appears in PDF format.

The form appears in PDF format.

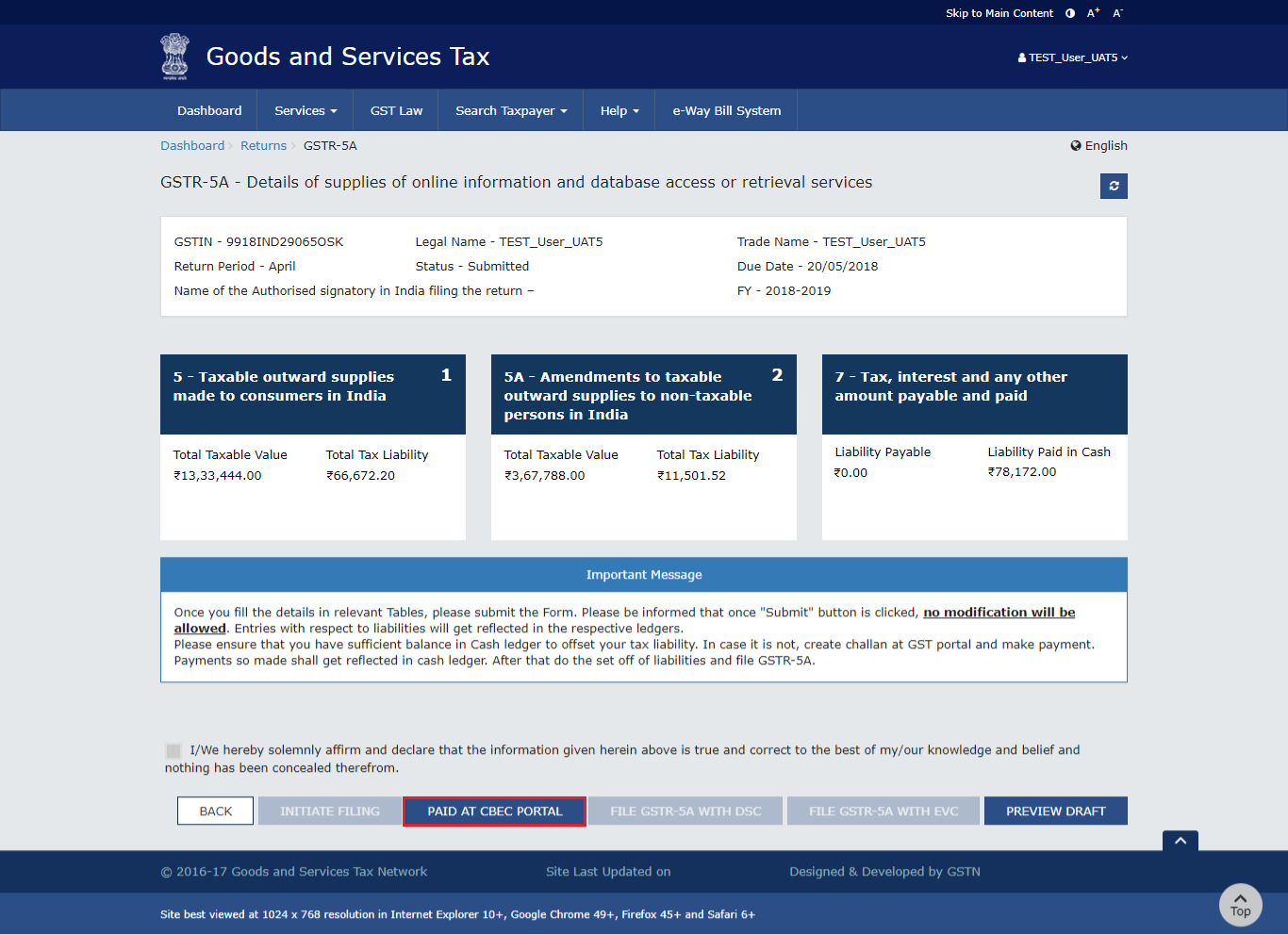

If the taxpayer has paid the liability of GSTR-5A through CBEC Portal, then there is no requirement to opt for net banking to pay the liability through cash. Follow the below-given steps.

Step 1: Click Paid at CBEC Portal

The taxpayer has to click 'Paid at CBEC Portal'.

If the taxpayer has paid the liability of GSTR-5A through CBEC Portal, then there is no requirement to opt for net banking to pay the liability through cash. Follow the below-given steps.

Step 1: Click Paid at CBEC Portal

The taxpayer has to click 'Paid at CBEC Portal'.

Step 2: Click Yes

The taxpayer has to click the 'Yes' radio button.

Step 3: Enter the Reference Number and Date of Payment

The taxpayer must enter the Reference Number and the date of payment as generated in the CBEC Portal.

Step 2: Click Yes

The taxpayer has to click the 'Yes' radio button.

Step 3: Enter the Reference Number and Date of Payment

The taxpayer must enter the Reference Number and the date of payment as generated in the CBEC Portal.

- The Payment Reference Number should be numeric or alphanumeric and up to 25 digits.

- After submitting the details, post the credit entry to the Electronic Liability Register, and the taxpayer can file the return. After filing the return, the tax authorities of CBEC will verify the payment mode.

Step 4: Click Close

The taxpayer has to click the 'Close' button.

Step 4: Click Close

The taxpayer has to click the 'Close' button.

Step 5: Click Preview Draft

The taxpayer has to click the 'Preview Draft' option to have a preview of the draft.

Step 5: Click Preview Draft

The taxpayer has to click the 'Preview Draft' option to have a preview of the draft.

Form GSTR-5A appears in PDF format.

Form GSTR-5A appears in PDF format.

Filing with DSC/ EVC

Filing of GSTR-5A is possible using either DSC/EVC. Step 1: Select the Declaration checkbox The taxpayer has to select the 'Declaration' checkbox. Step 2: Select the Authorized Signatory The taxpayer has to select the 'Authorized Signatory' from the drop-down list. Step 3: File GSTR-5A with DSC or File GSTR-5A with EVC The taxpayer has to either click on 'File GSTR-5A with DSC' or 'File with GSTR-5A with EVC'. Authentication with DSC is possible if the authorized signatory has a DSC issued in an Indian PAN. Following the filing of GSTR-5A, the Authorized Signatory's registered email ID and mobile number receives an acknowledgement through e-mail and SMS. File with DSC

File with DSC

- The taxpayer has to click the 'Proceed' button.

- Select the certificate. Then click the 'Sign' button.

- The taxpayer has to click the 'Proceed' button.

- The taxpayer must enter the OTP sent to the Authorized Signatory's registered email ID and mobile number in the GST Portal and then click the 'Verify' button. A success notification appears on the screen.

Step 4: Click Close

The taxpayer has to click the 'Close' button. The status changes to 'Filed'.

Step 4: Click Close

The taxpayer has to click the 'Close' button. The status changes to 'Filed'.

Following the filing of GSTR-5A, the Authorized Signatory's registered email ID and mobile number receive an acknowledgement through e-mail and SMS.

Following the filing of GSTR-5A, the Authorized Signatory's registered email ID and mobile number receive an acknowledgement through e-mail and SMS.

Download the Form

The taxpayer has to click the 'Download Filed Return' button. The return is available in PDF format for download.

The return is available in PDF format for download.

Popular Post

In the digital age, the convenience of accessing important documents online has become a necessity...

The Atalji Janasnehi Kendra Project that has been launched by the Government of Karnataka...

The Indian Divorce Act governs divorce among the Christian couples in India. Divorce...

When an individual has more than a single PAN card, it may lead to that person being heavily penalised, or worse,...

Employees Provident Fund (PF) is social security and savings scheme for employee in India. Employers engaged...