Last updated: November 10th, 2022 4:40 PM

Last updated: November 10th, 2022 4:40 PM

GSTR 8 Return Filing

GSTR 8 is a type of GST return being filed by the e-commerce operator who are required to deduct TCS (Tax Collected at Source) under GST. GSTR 8 filing will comprise details like the supplies affected through the e-commerce platform and the amount of tax collected at source (TCS) from e-commerce sellers and their GSTIN. To help taxpayers prepare their GSTR 8 return offline, Goods and Service Tax Network (GSTN) has provided an Excel-based GSTR 8 offline utility. The e-commerce operators can prepare their GSTR 8 form details offline by generating JSON file. Once the return is prepared using the offline utility, it is to be uploaded on GST Portal for filing GSTR 8. In this article, we look at the procedure to file GSTR 8 return using the offline utility in detail.Note on GSTR 8 Return

GSTR 8 filing is due on the 10th of each month for e-commerce operators registered for TCS. The TCS (Tax Collection at Source) is a tax collection mechanism similar to TDS, wherein the e-commerce operators collect and remit tax on behalf of the Government when a supplier supplies goods or services through its portal. The information provided by e-commerce operators on GSTR-8 is made available to e-commerce sellers on their GSTR 2 filing. Note: On the fifteenth of each month, while filing GSTR 2, all e-commerce sellers have to verify the transaction details and TCS information supplied by the e-commerce company on the GST platform.Features of GSTR 8 Offline Utility

- Using Offline Utility, the e-commerce operator can able to prepare the GSTR 8 details of Table 4 and Table 3 in offline mode.

- Most of the business validations and data entry are inbuilt into the GSTR 8 offline utility, reducing errors upon upload to GST Portal.

Worksheet -Tabs in GSTR 8 Offline Utility

There are five worksheet tabs in GSTR 8 Offline Utility as given below:- Read Me

- Home

- 3 TCS

- 4 Amend

- Suppliers Master

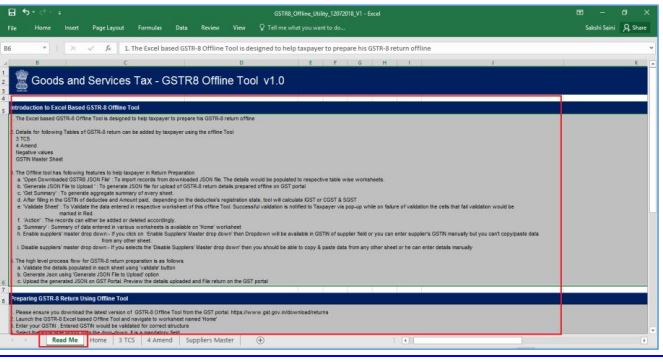

Read Me Worksheet Tab

The ReadMe Worksheet Tab contains an introduction and helps instructions for the taxpayer (e-commerce operator) to fill data in GSTR 8 Offline Utility.Home Worksheet Tab

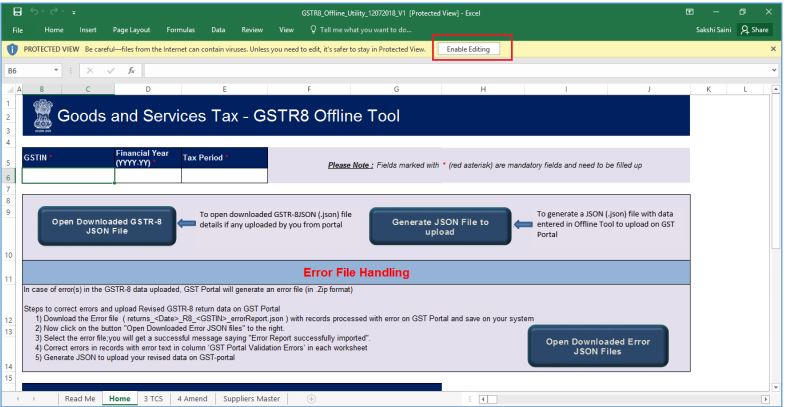

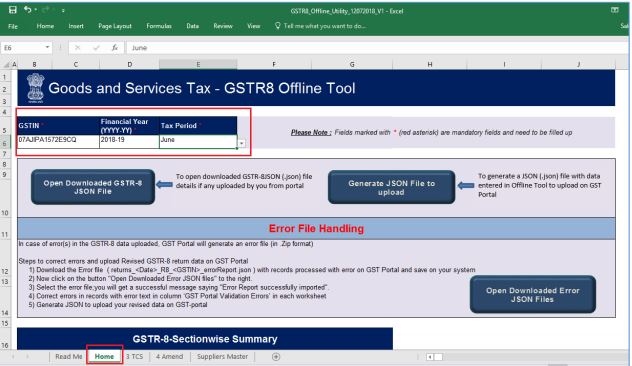

The Home Worksheet Tab is the main page of the GSTR 8 offline utility tool. It can be used to perform the following functions:- To enter mandatory details — GSTIN, Financial Year and Tax Period

- Generate JSON file, for upload of GSTR 8 return details prepared offline on GST portal

- Generate Summary of data provided in various worksheets

- Import and open the error file downloaded from GST portal

- Import and open data files downloaded from GST portal

3 TCS Worksheet Tab

The 3 TCS Worksheet Tab contains Table 3. It is used to perform the following three functions:- Enter Tax Collected at Source (TCS) details.

- Validate the entered TCS details using the Validate Sheet button.

- Navigation to the home page using the go home button.

4 Amend Worksheet Tab

The 4 Amend Worksheet Tab contains Table 4. It is used to perform the following functions:- Enter Amendment details related to previous tax periods.

- Note: Column D and E, GSTIN of Supplier, can be filled using the Enable/Disable.

- Suppliers’ Master drop down toggle button.

- Validate the entered Amendment details using the Validate Sheet button.

- Navigation to the home page using the Go Home button.

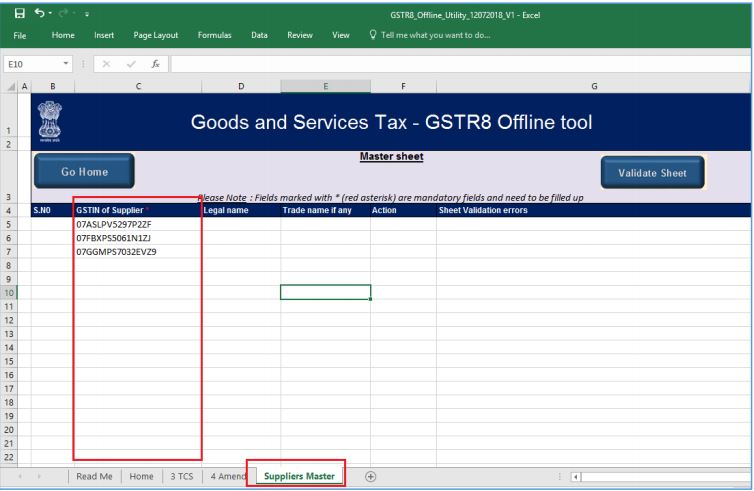

Suppliers Master Worksheet Tab

The Suppliers Master worksheet Tab contains GSTIN Master Sheet. It is used to perform the following functions:- Provide details of the suppliers, which would be then readily available in a drop-down, to easily fill the GSTIN of supplier column in Table 3 and Table 4 of the worksheet.

- Validate the provided details using the Validate Sheet button.

- Move to the Home page using the Go Home button.

Basic System Configurations

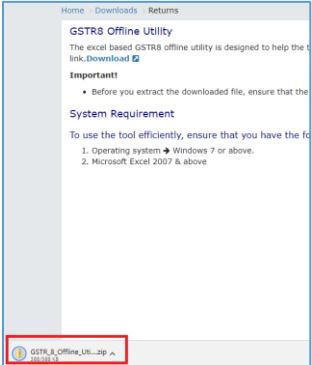

To use GSTR 8 Offline Utility tool efficiently, ensure that your system has following basic configuration.- System Requirement: The GSTR 8 Offline Utility tool functions work best on Windows 7 and above, the GSTR 8 Offline Utility tool does not work on Linux and Mac.

- MS Excel: Microsoft Excel 2007 and above is needed for running GSTR 8 Offline Utility tool. Alternatively, for any below version, the tool will open in a default browser.

Download GSTR 8 Offline Utility from the GST Portal

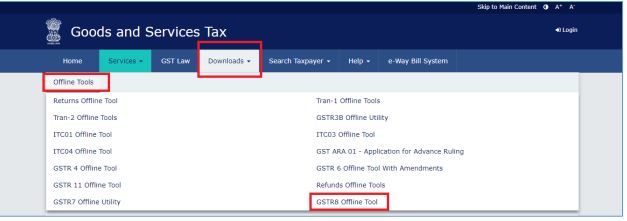

Downloading the GSTR 8 Offline Utility tool is a one-time activity; however, it may require an update in future if the Tool is updated at the GST Portal. Note: You need to check the version of the GSTR 8 Offline Utility tool used by you with the one available for download on the GST Portal at regular intervals. Follow the steps by step guidelines given here to download and install GSTR 8 Offline Utility tool in your computer: Note: The taxpayer can download the GSTR 8 Offline Utility from the GST Portal without login to the Portal. Step 1: You need to access the home page of Goods and Service Tax (GST) web portal. Step 2: You need to select the Downloads option from the GST portal home page. From the list of offline tools, select the GSTR 8 Offline Utility. [caption id="attachment_69771" align="aligncenter" width="627"] Image 1 GSTR 8 Return Filing

Step 3: The GSTR 8 Offline Utility tool page will be displayed. Click on the Download option to download the file.

[caption id="attachment_69772" align="aligncenter" width="341"]

Image 1 GSTR 8 Return Filing

Step 3: The GSTR 8 Offline Utility tool page will be displayed. Click on the Download option to download the file.

[caption id="attachment_69772" align="aligncenter" width="341"] Image 2 GSTR 8 Return Filing

Step 4: A confirmation message will be displayed. Click on the PROCEED button to download the GSTR 8 Offline Utility from the GST Portal.

[caption id="attachment_69773" align="aligncenter" width="276"]

Image 2 GSTR 8 Return Filing

Step 4: A confirmation message will be displayed. Click on the PROCEED button to download the GSTR 8 Offline Utility from the GST Portal.

[caption id="attachment_69773" align="aligncenter" width="276"] Image 3 GSTR 8 Return Filing

Step 5: The GSTR 8 Offline Tool will be downloaded in the Downloads folder.

[caption id="attachment_69774" align="aligncenter" width="312"]

Image 3 GSTR 8 Return Filing

Step 5: The GSTR 8 Offline Tool will be downloaded in the Downloads folder.

[caption id="attachment_69774" align="aligncenter" width="312"] Image 4 GSTR 8 Return Filing

Image 4 GSTR 8 Return Filing

GSTR 8 Offline Utility Installation Procedure

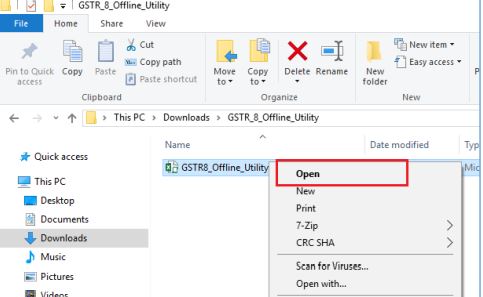

Once the GSTR 8 Offline Utility is downloaded, you need to unzip these downloaded files prepare return offline. The procedure to install the GSTR 8 Offline Utility is explained in detail below: Step 1: Unzip the downloaded files and extract the files from the downloaded zip folder GSTR GSTR8_Offline_Utility folder. Step 2: Once the folder is unzipped, you can see GSTR8_Offline_Utility excel file. Right-click on the excel file to open. The excel file will be opened. [caption id="attachment_69776" align="aligncenter" width="483"] Image 5 GSTR 8 Return Filing

Step 3: You need to click on the Enable Editing option and enable content button in the excel sheet.

[caption id="attachment_69777" align="aligncenter" width="787"]

Image 5 GSTR 8 Return Filing

Step 3: You need to click on the Enable Editing option and enable content button in the excel sheet.

[caption id="attachment_69777" align="aligncenter" width="787"] Image 6 GSTR 8 Return Filing

Image 6 GSTR 8 Return Filing

Procedure to Prepare GSTR 8 Return Utility

You need to perform following steps to prepare GSTR 8 return utility:- Add table-wise details in the Worksheet.

- Generate JSON File to upload.

- Upload the generated GSTR 8 JSON File on GST Portal.

- Preview Form GSTR 8 on the GST Portal.

- Open Downloaded Error GSTR 8 JSON File.

- Open Downloaded GSTR 8 JSON File.

Add Table-wise details in the Worksheet

Step 1: Launch GSTR 8 Excel based Offline, a pop-up window will appear; it will ask the taxpayer to open saved version Yes/No.- By clicking on No, GSTR 8 excel based offline will open with no saved data.

- By clicking on yes, GSTR 8 excel based offline will open with data saved in the last session.

Image 6a GSTR 8 Return Filing

Step 4: Go to the Home tab and enter GSTIN, select the applicable Financial Year from the Year drop-down list for which the GSTR 8 need to prepare. Select the tax period from the drop-down menu.

[caption id="attachment_69779" align="aligncenter" width="632"]

Image 6a GSTR 8 Return Filing

Step 4: Go to the Home tab and enter GSTIN, select the applicable Financial Year from the Year drop-down list for which the GSTR 8 need to prepare. Select the tax period from the drop-down menu.

[caption id="attachment_69779" align="aligncenter" width="632"] Image 7 GSTR 8 Return Filing

Step 5: After selecting the financial year and tax period, select the suppliers master tab and provide GSTIN and other details of suppliers. This will help the taxpayer to easily populate data in Table 3 and Table 4 of GSTR 8.

[caption id="attachment_69780" align="aligncenter" width="754"]

Image 7 GSTR 8 Return Filing

Step 5: After selecting the financial year and tax period, select the suppliers master tab and provide GSTIN and other details of suppliers. This will help the taxpayer to easily populate data in Table 3 and Table 4 of GSTR 8.

[caption id="attachment_69780" align="aligncenter" width="754"] Image 8 GSTR 8 Return Filing

Note: Providing details in the Suppliers Master sheet is not mandatory. You can also update the details directly in Table 3 and 4 without updating the details in suppliers Master.

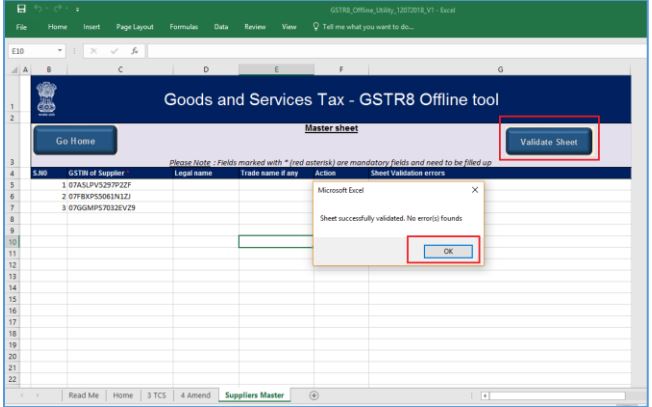

Step 6: After providing details in the Supplier’s Master sheet, click on the Validate Sheet option. A small window with no errors will appear. Click on OK button.

Image 8 GSTR 8 Return Filing

Note: Providing details in the Suppliers Master sheet is not mandatory. You can also update the details directly in Table 3 and 4 without updating the details in suppliers Master.

Step 6: After providing details in the Supplier’s Master sheet, click on the Validate Sheet option. A small window with no errors will appear. Click on OK button.

Image 9 GSTR 8 Return Filing

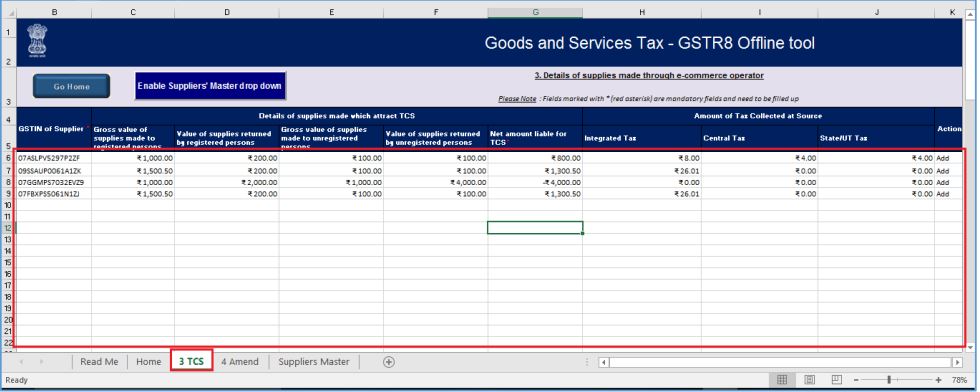

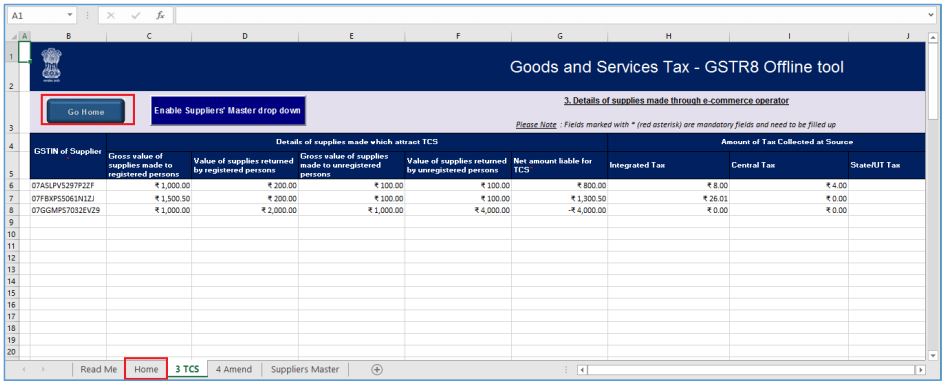

Step 7: Once the validation is successful, go to 3 TCS tab and provide data in Columns B to K.

Image 9 GSTR 8 Return Filing

Step 7: Once the validation is successful, go to 3 TCS tab and provide data in Columns B to K.

- Column B - GSTIN of Supplier details.

- Column C - the Gross value of supplies made to registered persons.

- Column D - Value of supplies returned by registered persons.

- Column E- the Gross value of supplies made to unregistered persons.

- Column F- Value of supplies returned by unregistered persons.

- Columns G - Net amount liable for TCS.

- Column H - Integrated Tax.

- Column I - Central Tax.

- Column J - State/UT.

- When you go to Column K, a drop-down list with two options: Add and Delete will be displayed. Select Add for each row with TCS data.

Image 10 GSTR 8 Return Filing

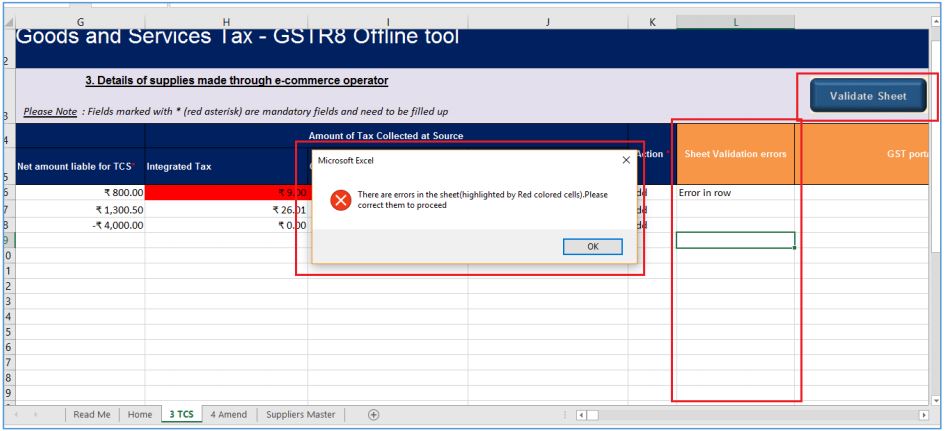

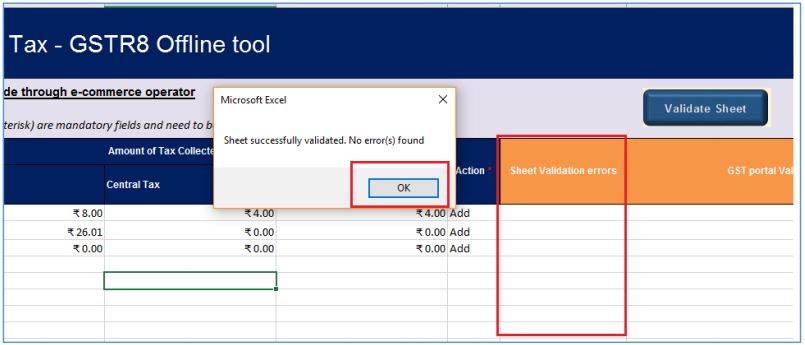

Step 8: Once you have provided all the TCS details, click on the Validate Sheet button.

Image 10 GSTR 8 Return Filing

Step 8: Once you have provided all the TCS details, click on the Validate Sheet button.

Image 11 GSTR 8 Return Filing

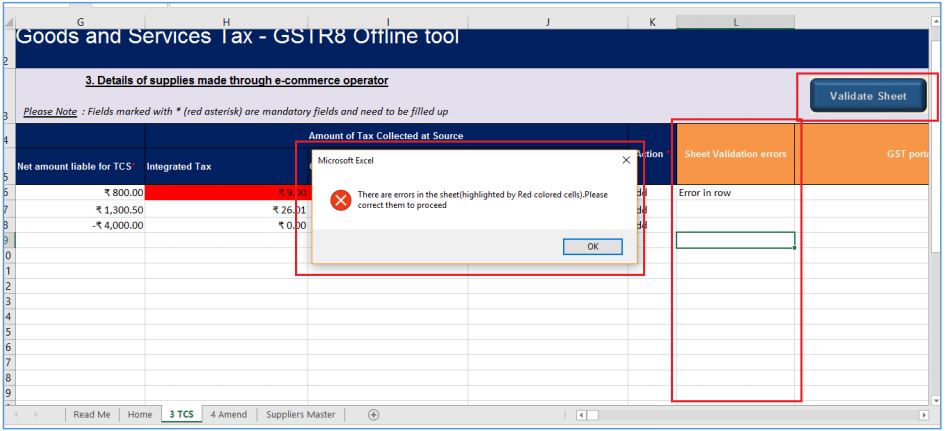

Note: In case of successful validation, Column HL of this sheet will be empty, and you can directly proceed further. In case of unsuccessful validation, error-intimation popup will appear, and the cells of the Column L will show “Error found in a row”. Close the popup by clicking OK.

Image 11 GSTR 8 Return Filing

Note: In case of successful validation, Column HL of this sheet will be empty, and you can directly proceed further. In case of unsuccessful validation, error-intimation popup will appear, and the cells of the Column L will show “Error found in a row”. Close the popup by clicking OK.

Image 11 GSTR 8 Return Filing

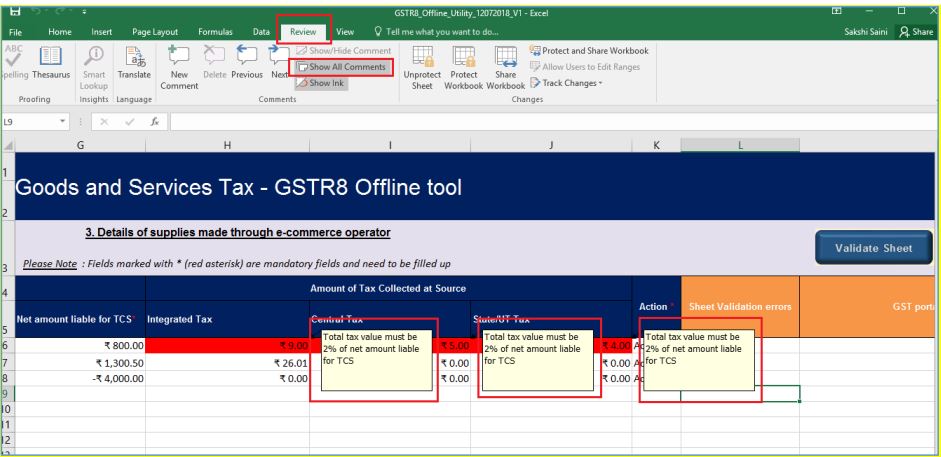

Select the red-highlighted cells to read the error description. A yellow description box will appear. Correct the errors as described in the description box.

Image 11 GSTR 8 Return Filing

Select the red-highlighted cells to read the error description. A yellow description box will appear. Correct the errors as described in the description box.

Image 12 GSTR 8 Return Filing

Step 9: After correcting the errors, again click on the Validate Sheet button. In case no errors were found, Column L of this sheet will be empty and a No errors popup will appear. Click on OK button.

Image 12 GSTR 8 Return Filing

Step 9: After correcting the errors, again click on the Validate Sheet button. In case no errors were found, Column L of this sheet will be empty and a No errors popup will appear. Click on OK button.

Image 13 GSTR 8 Return Filing

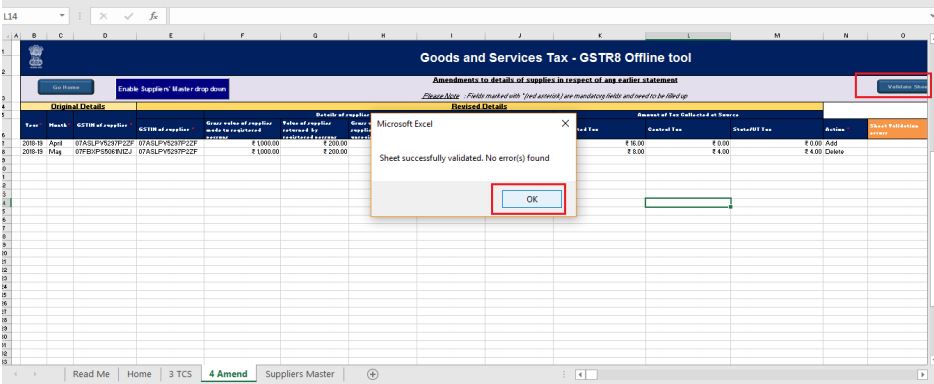

Step 10: If you have to make any amendments related to the previous month(s), go to the 4 Amend tab. Otherwise, you can Generate JSON File to upload on GST Portal.

Image 13 GSTR 8 Return Filing

Step 10: If you have to make any amendments related to the previous month(s), go to the 4 Amend tab. Otherwise, you can Generate JSON File to upload on GST Portal.

Image 14 GSTR 8 Return Filing

Image 14 GSTR 8 Return Filing

Generate JSON File to Upload

To generate JSON File of GSTR 8 return to upload on GST Portal, perform following steps: Step 1: Upon successful validation, you need to click on the Go Home button to redirect to the home page. Image 15 GSTR 8 Return Filing

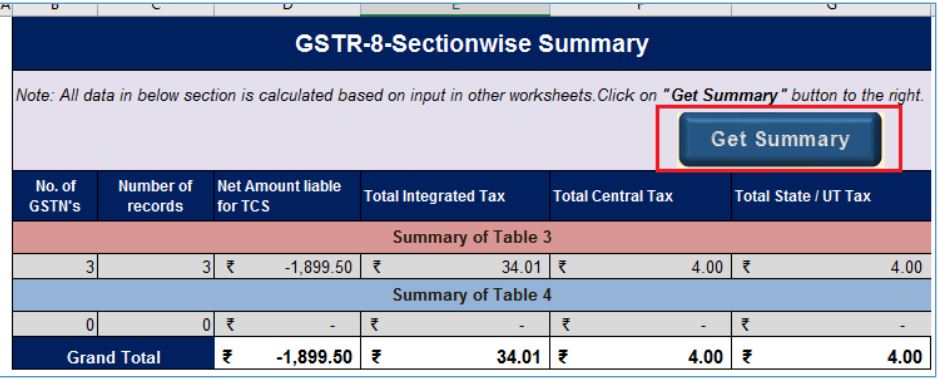

Step 2: On the Home tab, scroll down and select the Get Summary option. Summary of all the entries provided in 3 TCS and 4 Amend sheets will be displayed.

Image 15 GSTR 8 Return Filing

Step 2: On the Home tab, scroll down and select the Get Summary option. Summary of all the entries provided in 3 TCS and 4 Amend sheets will be displayed.

Image 16 GSTR 8 Return Filing

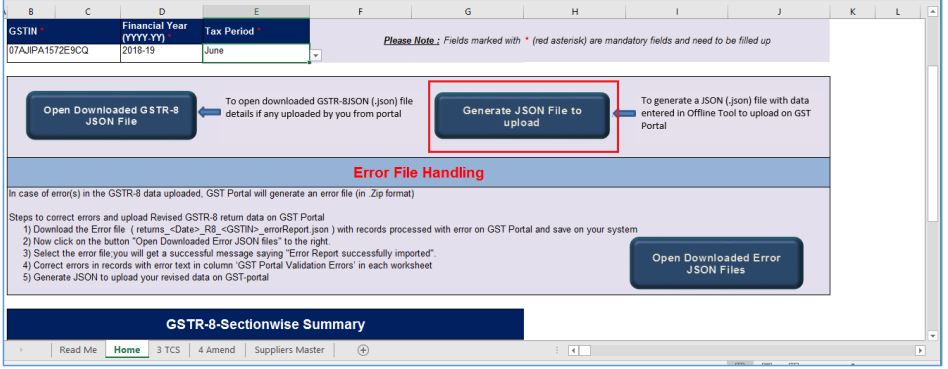

Step 3: Scroll up and click on the Generate JSON File to upload button.

[caption id="attachment_69790" align="aligncenter" width="948"]

Image 16 GSTR 8 Return Filing

Step 3: Scroll up and click on the Generate JSON File to upload button.

[caption id="attachment_69790" align="aligncenter" width="948"] Image 17 GSTR 8 Return Filing

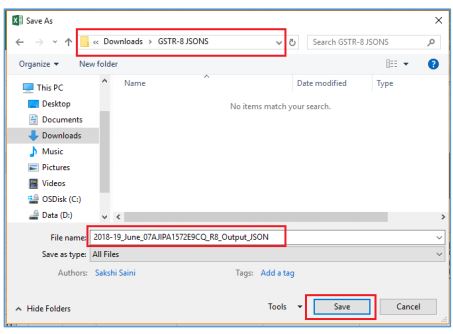

Step 4: A Save As pop-up window will appear. Select the location where you need to save the JSON file, enter the file name and click on the SAVE button.

[caption id="attachment_69791" align="aligncenter" width="453"]

Image 17 GSTR 8 Return Filing

Step 4: A Save As pop-up window will appear. Select the location where you need to save the JSON file, enter the file name and click on the SAVE button.

[caption id="attachment_69791" align="aligncenter" width="453"] Image 18 GSTR 8 Return Filing

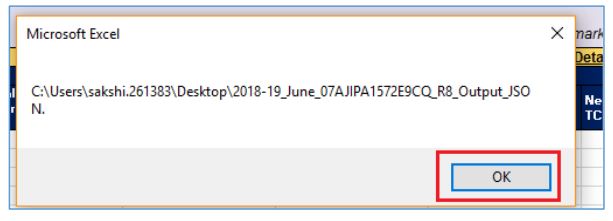

Step 5: A window pop-up will appear with a message that the file has been generated and saved at the desired location and it can be uploaded on the portal. Click on OK button to proceed further.

[caption id="attachment_69792" align="aligncenter" width="613"]

Image 18 GSTR 8 Return Filing

Step 5: A window pop-up will appear with a message that the file has been generated and saved at the desired location and it can be uploaded on the portal. Click on OK button to proceed further.

[caption id="attachment_69792" align="aligncenter" width="613"] Image 19 GSTR 8 Return Filing

Image 19 GSTR 8 Return Filing

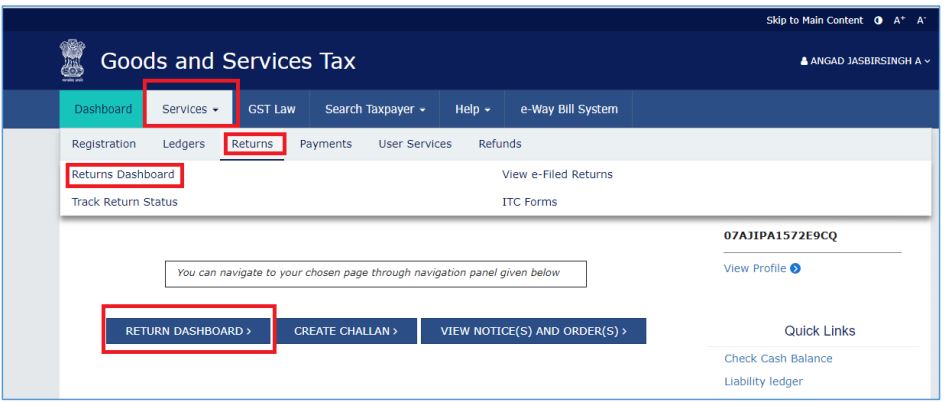

Upload the generated JSON File on GST Portal

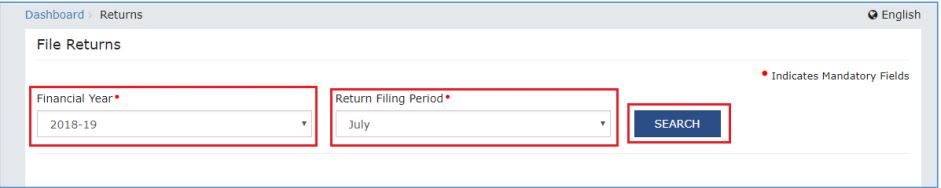

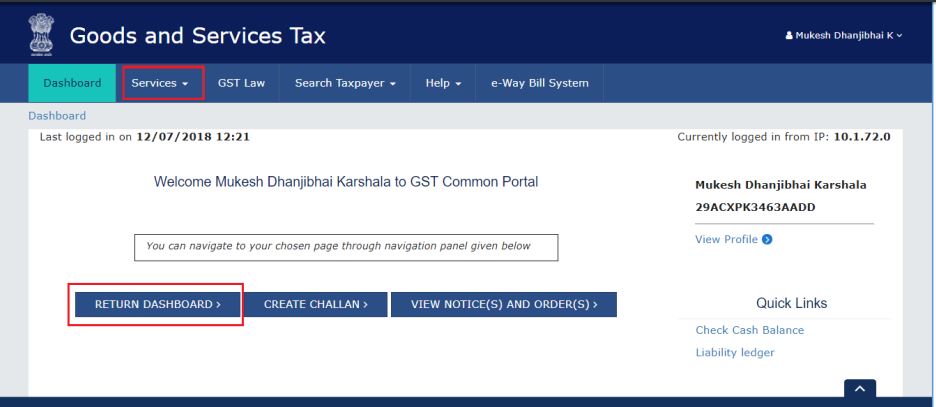

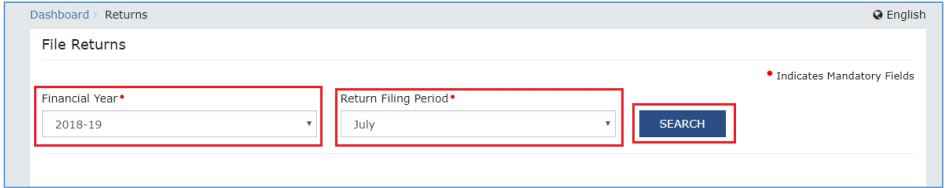

Step 1: To upload Generated JSON file on GST web portal, you need to access the Goods and Service Tax (GST) home page. Step 2: From the main page, click on Service option and then click on Returns option. Now, you need to select the Returns dashboard command. Step 3: The File Returns page will be displayed. From the Financial Year drop-down menu, select the financial year for which the GSTR 8 return has to be uploaded. Image 21 GSTR 8 Return Filing

Step 4: Select the return filing period for which the GSTR 8 return has to be uploaded from the return filing period drop-down list.

Image 21 GSTR 8 Return Filing

Step 4: Select the return filing period for which the GSTR 8 return has to be uploaded from the return filing period drop-down list.

Image 22 GSTR 8 Return Filing

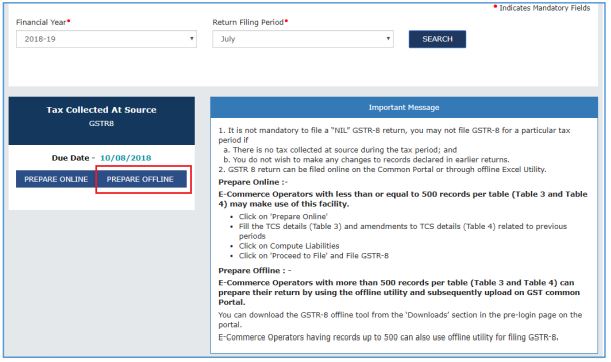

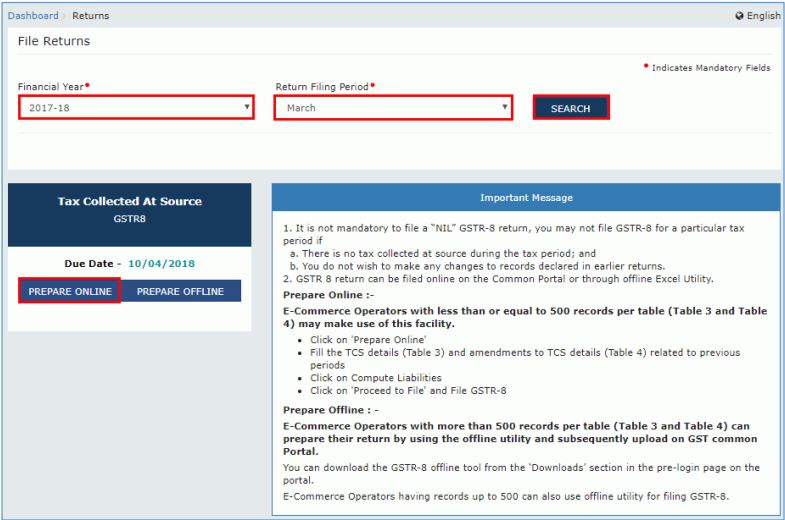

Step 5: After providing details, click on the Search button.

Step 6: Applicable returns of the selected tax period will be displayed. From the GSTR 8 tile, you need to click on the PREPARE OFFLINE option.

[caption id="attachment_69796" align="aligncenter" width="611"]

Image 22 GSTR 8 Return Filing

Step 5: After providing details, click on the Search button.

Step 6: Applicable returns of the selected tax period will be displayed. From the GSTR 8 tile, you need to click on the PREPARE OFFLINE option.

[caption id="attachment_69796" align="aligncenter" width="611"] Image 23 GSTR 8 Return Filing

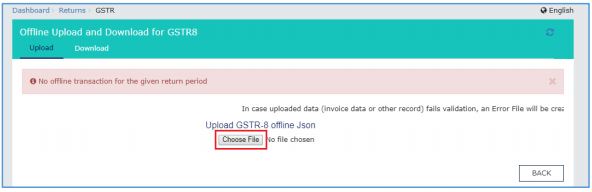

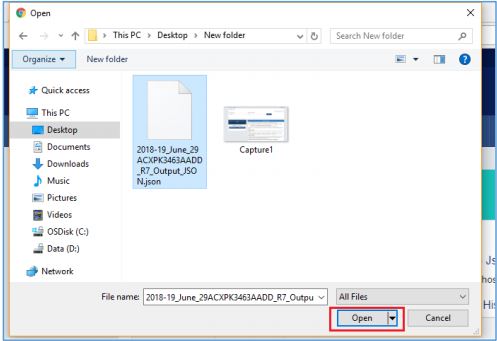

Step 7: Click on the Choose File button to choose the JSON file prepared using the GSTR 8 Offline utility tool.

Step 8: Browse and move to JSON file to be uploaded from the computer. Click on the Open button.

[caption id="attachment_69797" align="aligncenter" width="592"]

Image 23 GSTR 8 Return Filing

Step 7: Click on the Choose File button to choose the JSON file prepared using the GSTR 8 Offline utility tool.

Step 8: Browse and move to JSON file to be uploaded from the computer. Click on the Open button.

[caption id="attachment_69797" align="aligncenter" width="592"] Image 24 GSTR 8 Return Filing

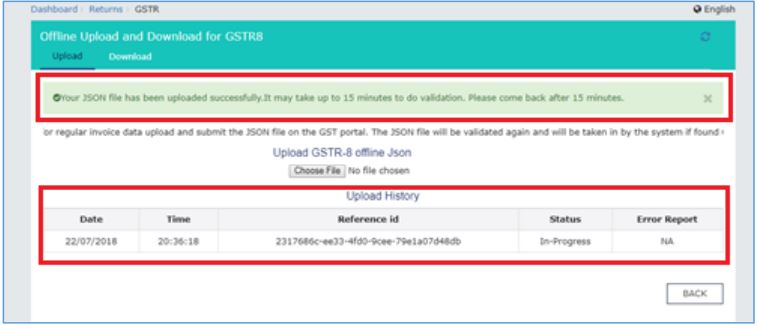

Step 9: The Upload section page will be displayed. A green message will appear for confirming the successful upload and asking you to wait while the GST network validates the uploaded data.

[caption id="attachment_69798" align="aligncenter" width="497"]

Image 24 GSTR 8 Return Filing

Step 9: The Upload section page will be displayed. A green message will appear for confirming the successful upload and asking you to wait while the GST network validates the uploaded data.

[caption id="attachment_69798" align="aligncenter" width="497"] Image 25 GSTR 8 Return Filing

Step 10: Once the validation is completed, one of the following two instances will occur:

If no errors were found, the upload history table would show the Status as “Processed” and Error Report as “NA.

Image 25 GSTR 8 Return Filing

Step 10: Once the validation is completed, one of the following two instances will occur:

If no errors were found, the upload history table would show the Status as “Processed” and Error Report as “NA.

- You can download the uploaded details using Download’ section. Click on the generate file button. A message will be displayed confirming the request and asking you to wait for 20 minutes

- After 20 minutes, a link will be displayed. Click on that option to download the validated zipped file.

- Unzip and save the JSON File in the system.

Image 26 GSTR 8 Return Filing

Click on Generate error report hyperlink. A confirmation message will be displayed, and Columns Status and Error Report will change as shown below:

Image 26 GSTR 8 Return Filing

Click on Generate error report hyperlink. A confirmation message will be displayed, and Columns Status and Error Report will change as shown below:

- Once the error report is generated, download error report link will be displayed in the Column Error Report. Click on the Download error report option to download the zipped error report.

Preview Form GSTR 8 on the GST Portal

Step 1: To preview for GSTR 7 on GST portal, you need to access the home page of Goods and Service Tax (GST). Step 2: From the main page, click on Service option and then click on Returns option. Now, you need to select the Returns dashboard command. Image 27 GSTR 8 Return Filing

Step 3: The File Returns page will be displayed. Select the Financial Year and Return Filing Period (Month) for which you want to file the return from the drop-down list.

Image 27 GSTR 8 Return Filing

Step 3: The File Returns page will be displayed. Select the Financial Year and Return Filing Period (Month) for which you want to file the return from the drop-down list.

Image 28 GSTR 8 Return Filing

Step 4: After providing details, click on the Search button.

Image 28 GSTR 8 Return Filing

Step 4: After providing details, click on the Search button.

Image 29 GSTR 8 Return Filing

Step 5: The GSTR 8 title page will be displayed, with an Important Message box on the right. In the GSTR 8 title, click on the PREPARE ONLINE button.

Image 29 GSTR 8 Return Filing

Step 5: The GSTR 8 title page will be displayed, with an Important Message box on the right. In the GSTR 8 title, click on the PREPARE ONLINE button.

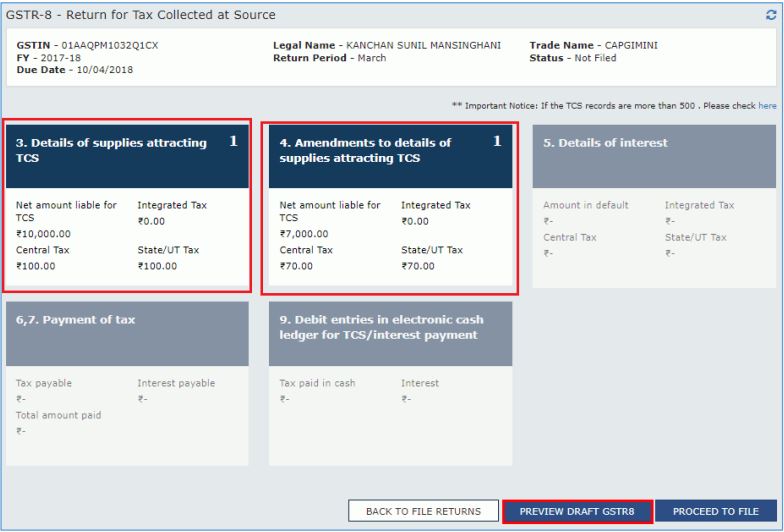

Image 30 GSTR 8 Return Filing

Note: It is endorsed to review the summary of entries made in different sections carefully.

Image 30 GSTR 8 Return Filing

Note: It is endorsed to review the summary of entries made in different sections carefully.

Popular Post

In the digital age, the convenience of accessing important documents online has become a necessity...

The Atalji Janasnehi Kendra Project that has been launched by the Government of Karnataka...

The Indian Divorce Act governs divorce among the Christian couples in India. Divorce...

When an individual has more than a single PAN card, it may lead to that person being heavily penalised, or worse,...

Employees Provident Fund (PF) is social security and savings scheme for employee in India. Employers engaged...