Last updated: December 17th, 2024 3:48 PM

Last updated: December 17th, 2024 3:48 PM

Guide to CGST, SGST and IGST

CGST, SGST, and IGST apply to the interstate and intra-state supply of goods and services. GST acts as a destination tax. Hence, the tax base shifts from origin to consumption. The imports or end-use shall hold the responsibility to tax and exports, or the taxation may not apply to the production. Under the present regulation, on a taxable event, multiple tax liabilities may apply such as central excise, in case of manufacturing, service tax in case of sale of service and State VAT in case of sale of goods. Hence to ease the taxation process for the taxpayers, GST shall shift from multiple taxes to a single taxable event.Inter-State vs Intra-State

To understand the concepts of CGST, SGST and IGST, it is first important to understand the concept of inter-state vs intrastate supply of goods and service, under GST. As in every taxable transaction, it is important to distinguish between inter-state vs intra-state supply to determine if CGST or SGST or IGST would be applicable. To determine if a supply is inter-state or intra-state, the location of the supplier and the place of supply must first be determined.Inter-State Supply

Inter-State supply of goods or service is one where the location of supplier of goods/service and place of supply are in different states. In addition, the inter-state supply applies to the following:- The supply of goods or service by an SEZ developer or SEZ unit,

- During the course of import of goods or service,

- Supply when the supplier operates in India,

- The place of supply operates outside India (export) and

Intra-State Supply

An intra-state supply of goods or service applies when the place of supply operates in the same state as the location of the supplier. Intra-state supply does not include the supply of goods/service to SEZ units or developers, imports or exports.How is GST Levied?

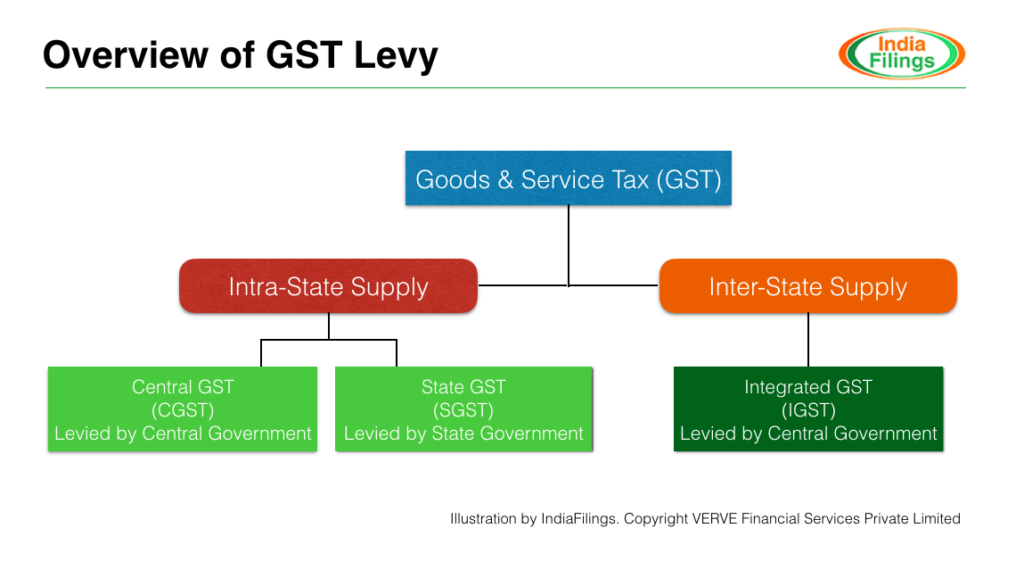

Both the Central Government and the State Government levy GST for the supply of goods and services. The power to tax on supply of goods and services would also be vested in the hands of both, the State and Central Government. However, in case of inter-state supply, the power to tax would be vested with the Central Government, while the revenue of the final transaction would be transferred to the State and the Union similar to the intra-state transaction. The following model shows how GST is levied in India broadly: Illustration- How GST is Levied?

Illustration- How GST is Levied?

Meaning of CGST or Central GST

Central GST or CGST would be levied under the CGST Act on the intra-state supplies of goods and services. Hence in case of intra-state supplies of goods and services, both the Central and State government would combine their levies with an appropriate revenue sharing agreement between them. The power to levy CGST and SGST in Section 8 of the GST Act, states that: The following taxes shall be levied on all intra-state supplies of goods, or services or both, at such rates specified in the Schedule to the said Act on the recommendation of the Council, but not exceeding 14%, each. Such CGST and SGST is to be paid by a taxable person.Highlights of CGST

- CGST applies to both goods and services.

- The Central Government levies CGST through a separate statute on all transactions of goods and services made for a consideration.

- The Central and State Government shall share the proceeds between them.

Meaning of SGST or State GST

As per the SGST Act, the State GST or SGST applies on intra-state supplies of goods and services, that is administered by the respective State Government. SGST liability can be set off against SGST or IGST input tax credit only.Highlights of SGST

- SGST is levied by the State Governments through a statute on all transactions of supply of goods and services.

- SGST would be paid to the accounts of the respective State Government.

Meaning of IGST or Integrated GST

Integrated GST or IGST is the tax levied under the IGST Act on the supply of any goods and services in the course of inter-state trade across India. Further, IGST would include any supply of goods and services in the course of import into India and the export of goods and services from India. IGST will replace the present Central State Tax, which is levied on the inter-state sales of goods. Thus, IGST would be applicable for all inter-state transactions, import and export of goods and services.Highlights of IGST

- Central Government would levy and collect IGST instead of CGST or SGST.

- Levied on inter-state supply of goods and services.

- Includes import of goods and services.

- Exports would be zero-rated.

- IGST would be shared between the Central and State Government.

Calculating CGST, SGST and IGST

The following illustrations show the methodology for calculating CGST and SGST in case of intra-state supply: Let us assume that an almond trader in Mumbai, Maharashtra supplies almonds worth Rs.1 lakh to a shop in Pune, Maharashtra and the rate of CGST is 6% and SGST is 6%. In such a case, the almond trader would charge a CGST of Rs.6000 and SGST of Rs.6000 on the basic value of the product. The trader would then be required to deposit the CGST component into a Central Government account while the SGST portion into the account of the concerned State Government. The following illustrations show the methodology for calculating IGST in case of inter-state supply: Let us assume that an almond trader in Mumbai, Maharashtra supplies almonds worth Rs.1 lakh to a shop in Chennai, Tamil Nadu and the rate of IGST is 12%. In such a case, the almond trader would charge an IGST of Rs.12000 on the basic value of the product. The trader would then be required to deposit the IGST component into a Central Government account.Popular Post

In the digital age, the convenience of accessing important documents online has become a necessity...

The Atalji Janasnehi Kendra Project that has been launched by the Government of Karnataka...

The Indian Divorce Act governs divorce among the Christian couples in India. Divorce...

When an individual has more than a single PAN card, it may lead to that person being heavily penalised, or worse,...

Employees Provident Fund (PF) is social security and savings scheme for employee in India. Employers engaged...