Last updated: February 27th, 2023 12:26 PM

Last updated: February 27th, 2023 12:26 PM

Guide to Indian Private Limited Company for Foreigners - Foreign Nationals and Foreign Companies

India as one of the fastest growing economies in the world attracts plenty of Foreign Direct Investment (FDI) and Private Equity capital. According to a recent report by Nomura, a Japanese Brokerage firm, FDI into India is likely to have hit high of $34.9 billion in financial year 2015, a massive 61.6 per cent jump from $21.6 billion in the previous fiscal. With the world's second largest population and a large talent pool of skilled IT professionals, India continues to be an attractive destination for investment amongst Foreign Companies and Foreign Nationals. In this article, we provide a comprehensive guide to Indian Private Limited Company and India entry strategy for foreign nationals and foreign companies.

Overview of India Entry Strategies for Foreign Companies / Foreign Nationals

Following are the available types of entry strategies into India:Incorporation of a Private Limited Company or Limited Company

Incorporation of a private limited company is the easiest and fastest type of India entry strategy for foreign nationals and foreign companies. Foreign direct investment of upto 100% into a private limited company or limited company is under the automatic route, wherein no Central Government permission is required. Hence, incorporation of a private limited company as a wholly owned subsidiary of a foreign company or joint venture is the cheapest, easiest and fastest entry strategy for foreign companies and foreign nationals into India.

Incorporation of a Limited Liability Partnership

Incorporation of a Limited Liability Partnership (LLP) is also an India entry strategy for foreign nationals or foreign citizens as 100% FDI in LLP is now allowed. An LLP, however, cannot have shareholders and must be represented by Partners - thereby making it an ideal choice for investment vehicles and professional firms.

Through Proprietorship Firms or Partnership Firms

Proprietorship firms or Partnership firms are the most basic types of business entities mostly used by very small businesses or unorganised players. Foreign investment into a proprietorship firm or partnership firm requires prior RBI approval. Hence, proprietorship firms or partnership firms are not suitable for a foreign company or foreign national investment into India.

Registration of Branch Office, Liaison Office or Project Office

Registration of Branch Office, Liaison Office or Project Office requires RBI and/or Government approval. Therefore, the cost and time taken for registration of branch office, liaison office or project office for a foreign company is higher than the cost and time associated with incorporation of a private limited company. Further, foreign nationals cannot open branch office, liaison office or project office. Hence, this option is limited to being an India entry strategy only for foreign companies.

FDI in Private Limited Company

Foreign Direct Investment (FDI) into an Indian Private Limited Company or Limited Company is allowed upto 100% in most sectors. Only a very few sectors require prior Central Government approval for investment by foreign company or foreign national. The following sectors require Government Approval for investment by Foreign Company or Foreign National:

- Petroleum sector (except for private sector oil refining), Natural gas / LNG pipelines.

- Investing in companies in Infrastructure

- Defence and strategic industries

- Atomic minerals

- Print Media

- Broadcasting

- Postal Services

- Courier Services

- Establishment and operation of Satellite

- Development of Integrated township

- Tea Sector

- Asset Reconstruction Companies

Incorporation of Private Limited Company for Foreign Companies and Foreign Nationals

The following are the steps involved in the incorporation of a Indian Private Limited Company for foreign nationals or foreign companies:

Management and Shareholding Structure

A private limited company must have a minimum of two Shareholders and two Directors. A shareholder can be a person or a corporate entity. However, a Director has to be a person. Foreign nationals are allowed to become Directors of an Indian Private Limited Company.

The Board of Directors of the Indian Private Limited Company must have one Director who is both an Indian Citizen and Indian Resident. However, there is no requirement for the Indian Director to be a shareholder in the Company. Hence, most foreign companies or foreign nationals prefer to incorporate a company in India with three Directors - two Foreign National Directors and one Indian National Director.

The 100% shares of the Indian Company can be held by a combination of Foreign Companies and/or Foreign Nationals. Indian private limited companies require a minimum of two shareholders mandatorily. Hence, one corporate entity or person cannot hold all the shares of an Indian Private Limited Company.

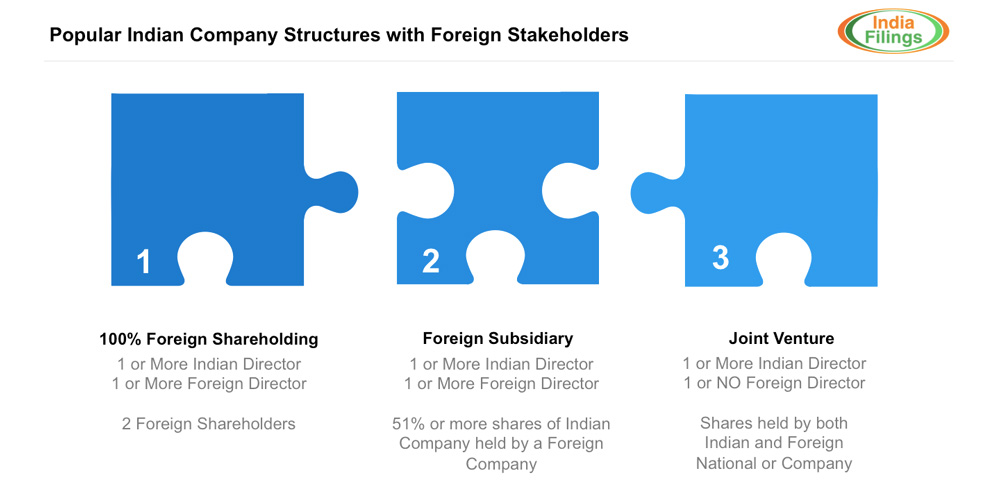

Indian Company Structures with Foreigner Stakeholders

Indian Company Structures with Foreigner Stakeholders

Obtaining Digital Signature for Foreign National Directors

A digital signature is required for filing the incorporation documents and continued compliance documents for a company. Hence, Digital Signatures must be obtained for one or more Director(s) of the company. The following video is a guide to submitting Digital Signature application: [embed]https://www.youtube.com/watch?v=iH-Ipc89cJk[/embed]The following are the documents and information required for obtaining Digital Signature for a foreign national:

- Foreign national is residing in native country

- If native country is a signatory of Hague Convention: For attestation, proof of identity, address proof and photo on DSC application should be notarized by the Public Notary of that foreign country and apostilled by the competent authority of that foreign country.

- If native country is not a signatory of Hague Convention: For attestation, proof of identity, address proof and photo on DSC application should be notarized by the Public Notary of that foreign country and consularized by the competent authority of that foreign country . Documents required: Passport, Application form with Photo (all attested).

- Foreign national residing in India

- The following documents should be certified by Individual's Embassy

- Resident Permit certificate issued by Assistant Foreigner Regional Registration Officer, an officer of Bureau of Immigration India.

- Passport

- Visa

- Application form with Photo(attested)

- The following documents should be certified by Individual's Embassy

- Foreign national neither in India nor in the native country

- The following documents should be certified by the local embassy of the country to which the person belongs:

- Passport

- Visa

- Application form with Photo(attested)

- The following documents should be certified by the local embassy of the country to which the person belongs:

Name Approval

In parallel to the digital signature application process, name approval can be obtained for the proposed company. The name of the Indian Company must be unique and should end with the words "Private Limited". Click here to know more about Naming an Indian Private Limited Company.Filing for Incorporation of a Private Limited Company

Once name approval is obtained, incorporation documents can be filed with the Ministry of Corporate Affairs to incorporate the Company. The incorporation documents to be filed includes affidavits & declarations from Directors, Memorandum of Association, Articles of Association Subscriber Sheet and Registered Office Address proof.

The affidavit and declarations from the Directors contain certain declaration from the Directors. Affidavit and Declaration would have to be executed independently for each of the Director and notarized (For Indian Director & Foreign Director).

Subscribing to the Memorandum of Association (MOA) & Articles of Association (AOA)

By subscribing to the MOA & AOA, the shareholders (either foreign companies or foreign nationals or Indian companies or Indian national) show their intention for becoming a shareholder in the company to be incorporated.

In case a Foreign Company is a subscriber to the MOA & AOA of the proposed Indian Company:The following documents pertaining to the foreign entity subscribing to the shares of the Indian Company must be submitted:

- Board resolution of the Foreign Entity authorising investment in shares of the Indian Company.

- Copy of the certificate of incorporation of the foreign entity.

- Copy of address proof for the foreign company.

On submitting the above documents along with the application for incorporation of a company, the Registrar would issue a Certificate of Incorporation for the Indian Private Limited Company, if the documents submitted are acceptable.

After obtaining the incorporation certificate, the Indian Company can apply for a PAN Card and take the necessary steps for opening a bank account for the company in India.

FAQs for Indian private limited company

What is a private limited company in India?

- A private company must have a minimum of two shareholders and a maximum of 200 shareholders.

- Two directors are required for a private limited company. An Indian citizen must be at least one of the directors.

How many private limited companies are there in India?

What are the advantages and disadvantages of a private limited company?

Popular Post

In the digital age, the convenience of accessing important documents online has become a necessity...

The Atalji Janasnehi Kendra Project that has been launched by the Government of Karnataka...

The Indian Divorce Act governs divorce among the Christian couples in India. Divorce...

When an individual has more than a single PAN card, it may lead to that person being heavily penalised, or worse,...

Employees Provident Fund (PF) is social security and savings scheme for employee in India. Employers engaged...