Updated on: February 8th, 2020 4:08 PM

Updated on: February 8th, 2020 4:08 PM

Gym or Fitness Centre Business Plan

Over the past decade, many high-end fitness centres have been successfully started across India due to the rising health consciousness. Demand for gyms from fitness conscious consumers have also been key to making gyms and fitness centres a profitable business opportunity. Opening a fitness centre requires careful planning and research, and in this article, we look at the process of starting a gym or fitness centre in India along. A business plan for starting a gym or fitness centre is also attached to this article.

Gym or Fitness Center Business Model

The first decision to be taken by the Entrepreneur while starting a gym or fitness centre is the format for the fitness centre. Fitness centres can be broadly classified as follows based on the format:

- Gym with cardio and weightlifting equipment

- Fitness Studio for catering to Zumba, Aerobics, Martial Arts or other classes

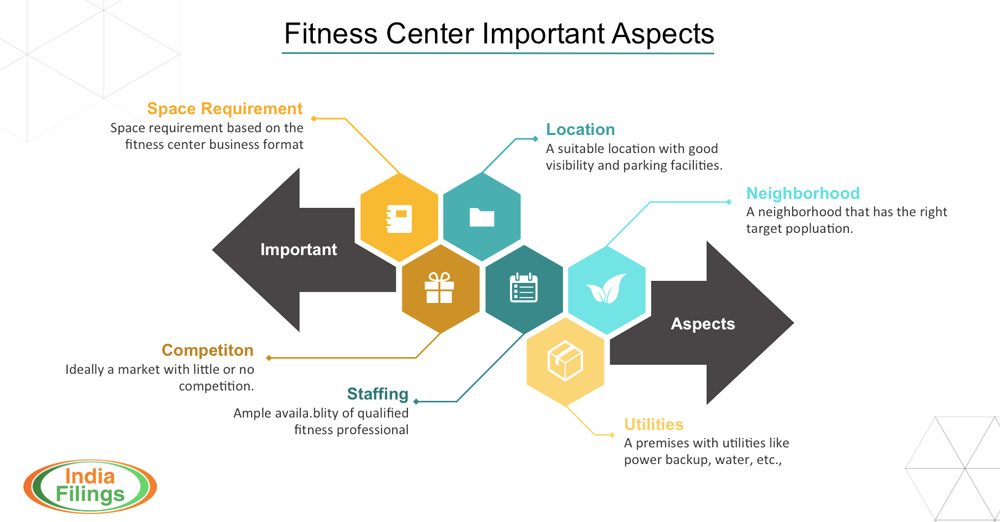

Based on the target population, market, competition, trained staff availability and vision of the Entrepreneur, the Entrepreneur can choose a format for the fitness centre. Once, the business format is decided, a location for the fitness centre must be decided. While choosing a location for the fitness centre, it is important to keep in mind the following:

[caption id="attachment_2549" align="aligncenter" width="893"] Fitness Center Business Plan Important Aspects

Fitness Center Business Plan Important Aspects

The Entrepreneur must decide the business model for the gym or fitness centre with careful research and proper planning. The decision taken at this stage will have implications throughout the fitness centre's business life-cycle. Hence, making the right decisions at this stage will ensure the fitness centre is very profitable to operate.

Fitness Centre - Business Registrations

Once the Entrepreneur has decided on a business format and business model, the process for obtaining business registrations can commence. It is recommended that fitness centres be set up as a Private Limited Company or Limited Liability Partnership to ensure transferability and limited liability protection features are available for the promoters. The transferability will ensure the easy transfer process of the fitness centre to another promoter if the need arises. Limited liability protection will limit the personal liability of the promoters from any unforeseen liability created in the fitness centre.

After completing the business registration, the tax registration, a person must obtain the tax registration. The services provided by a fitness centre will attract service tax. Hence, service tax registration must be obtained by the fitness centre once annual turnover crosses Rs.9 lakhs. In addition to service tax registration, it is also advisable for the fitness centre to obtain SSI Registration to be eligible for subsidies and schemes promoted by the Government.

A clearance from the local police department is also mandatory for operating a fitness centre in India. It is necessary to obtain an application from the relevant officer of the police department to operate a fitness centre in the state. The procedure for obtaining Police Department clearance for operating a fitness centre varies from state to state.

Fitness Center - Business Plan

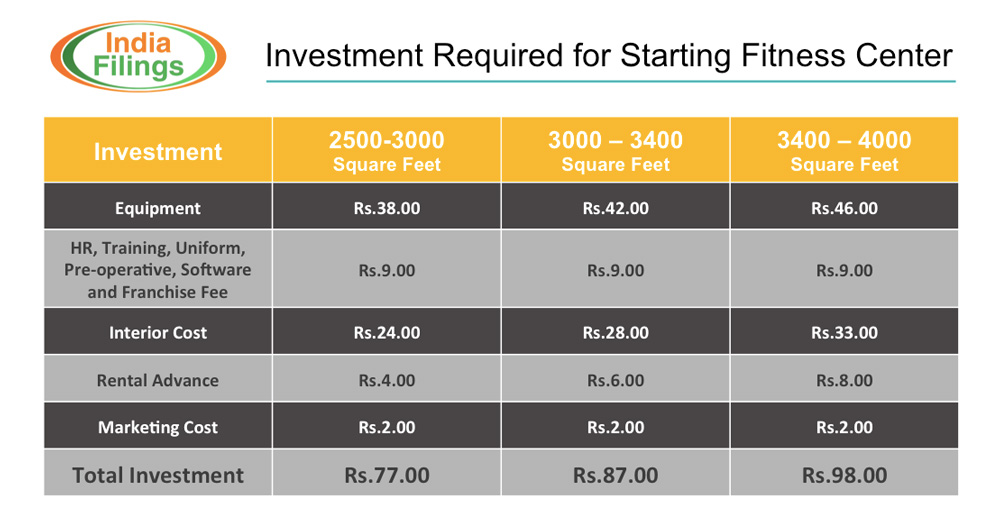

The following is a sample business plan for setting up a fitness centre in India.Investment Required for starting a Fitness Center

[caption id="attachment_2550" align="aligncenter" width="881"] Investment Required for Starting Fitness Center

Investment Required for Starting Fitness Center

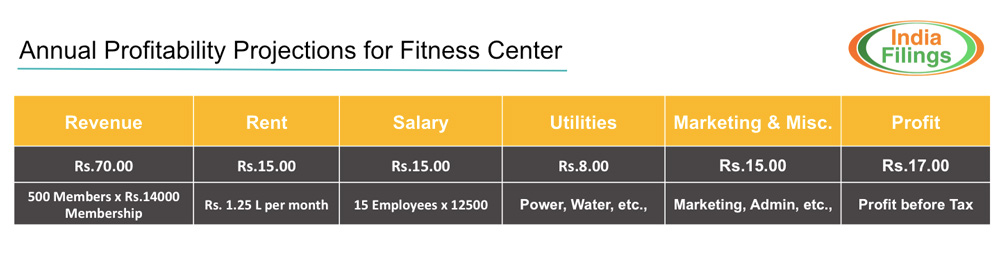

Annual Profitability Projection for Fitness Center in India

[caption id="attachment_2551" align="aligncenter" width="910"] Annual Profitability Projection for Fitness Centre in India

Annual Profitability Projection for Fitness Centre in India

For more information about starting a fitness centre by getting a bank loan, visit IndiaFilings.com

Popular Post

In the digital age, the convenience of accessing important documents online has become a necessity...

The Atalji Janasnehi Kendra Project that has been launched by the Government of Karnataka...

The Indian Divorce Act governs divorce among the Christian couples in India. Divorce...

When an individual has more than a single PAN card, it may lead to that person being heavily penalised, or worse,...

Employees Provident Fund (PF) is social security and savings scheme for employee in India. Employers engaged...