Last updated: November 3rd, 2021 3:13 PM

Last updated: November 3rd, 2021 3:13 PM

Haryana Property Tax

Property tax is a tax levied by the Municipal Corporation on the value of a property or real estate. Owners of residential properties in Haryana are liable to pay property tax to the Municipal Corporation which is regulated by the Department of Directorate of Urban Local Bodies of Haryana. The tax imposed on property varies from state to state. This article hopes to guide on the various aspects of Property tax in Haryana in detail.Types of property tax

The following are the kinds of property that are liable to be taxed in Haryana.- Residential

- Commercial

- Industrial

- Institutional

- Government properties

- Vacant land.

Uses of Property Tax

In Haryana, Property Tax is one of the primary revenue sources for Municipal Corporations. All residential, commercial, industrial, institutional, government properties and vacant lands situated within the limits of the Municipal Corporation are assessed for tax and are expected to pay Property Tax. Property Tax is evaluated once in every five years, whereas additional assessments are made every year and a citizen may object to assessment.Required Document

The applicant will be expected to submit the property tax invoice details at the time of making payment for property tax.Eligibility Criteria

The following eligible persons are required to pay property tax.- A person whose age is above 18 years of age.

- An individual who is a permanent resident in the state of Haryana.

- Any person who owns a property in Haryana is entitled to pay a property tax.

Haryana Property Tax Slab

Property tax slabs in Haryana on residential properties, commercial properties, vacant land are as follows:Property tax on Residential properties

| Area (in square yard) | Rate (in Rs. per square yard) |

| Up to 300 square yard | Rs. 1 per square yard |

| From 301 to 500 square yard | Rs. 4 per square yard |

| From 501 to 1000 square yard | Rs. 6 per square yard |

| From 1001 sq. yard to 2 acres | Rs. 7 per square yard |

| More than 2 acres | Rs. 10 per square yard |

Commercial Spaces (Office spaces, multiplexes)

| Area (in square yard) | Rate (in Rs. per square yard) |

| Up to 1000 square yard | Rs.12 per square yard |

| More than 1000 square yard | Rs.15 per square yard |

Commercial property (Shops on ground floor)

| Area (in square yard) | Rate (in Rs. per square yard) |

| Up to 50 square yard | Rs. 24 per square yard |

| From 51 to 100 square yard | Rs. 36 per square yard |

| From 101 to 500 square yards | Rs. 48 per square yard |

Vacant land (Commercial/ Industrial/ Institutional Properties)

| Plot size | Rate (in Rs. per square yard) |

| Up to 500 square yard | Exempted |

| 101 and above | Rs. 5 per square yard |

| 501 and above | Rs. 2 per square yard |

Rebate and Exemption on Property Tax

- One time rebate of 30 per cent of the tax is granted to those property owners who clear all their property tax dues or arrears within forty-five days from notification of the rates.

- Rebate of 10 per cent to those assesses who pay their total tax for the assessment year by the 31st of July of that particular year.

- Every building and land attached to any religious property like a temple, gurudwara, mosque or church is exempted from property tax.

- 50% rebate is given to state government buildings with exceptions such as the construction of boards/ corporations/ undertakings/ autonomous bodies.

Online Property Tax Payment Procedure

To make an online payment for property tax in the state of Haryana, follow the steps mentioned below:Visit Official Portal

Step 1: The applicant should visit the official website of Directorate of Urban Local Bodies of Haryana Government.Online Services for Property Tax

Step 2: Click on "Property tax" option which can be seen below the online services. [caption id="attachment_62537" align="aligncenter" width="729"] Haryana Property Tax - Online Service

Haryana Property Tax - Online Service

Provide Information

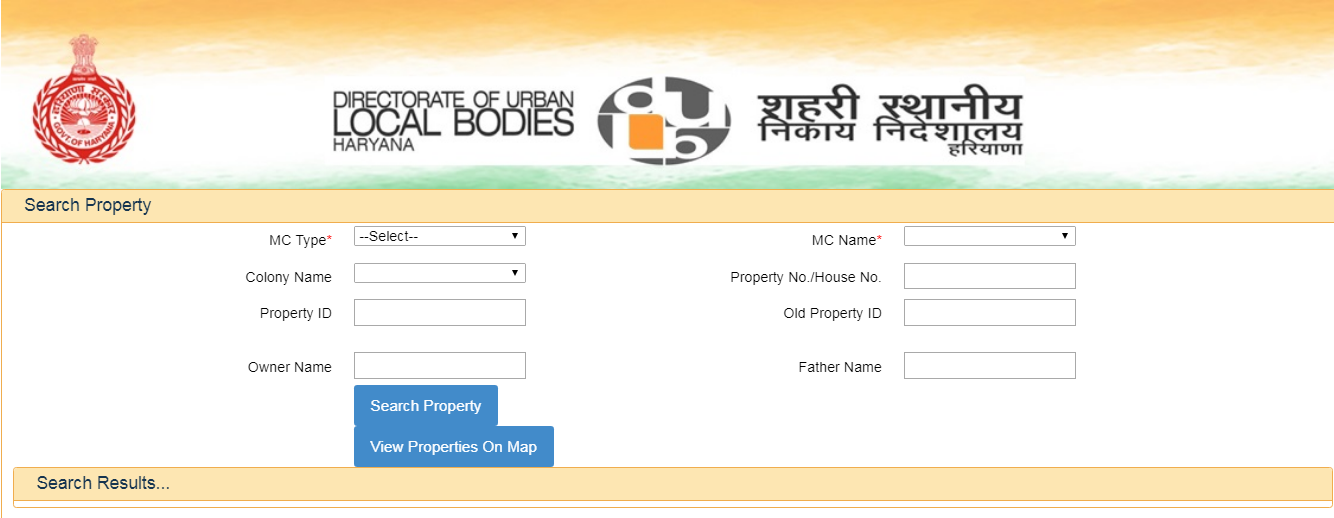

Step 3: On the next page, the applicant has to provide the relevant details of the property such as- Type of Municipal Corporation

- Colony name

- Property ID

- House number

- Owner's name

- Father's Name

Haryana Property Tax - Search Property

Haryana Property Tax - Search Property

View Property Tax Generated

Step 4: Now, the applicant will be able to view the property tax generated on the respective property.Pay Property Tax

Step 5: Click on "Pay property tax" to pay the tax online.Payment Gateway

Step 6: Then, the applicant will be redirected to the payment gateway page to proceed with the payment. Receive Acknowledgement Number Step 7: After making the payment, the applicant will receive the acknowledgement number as the confirmation of payment.Offline Property Tax Payment Procedure

To make an offline payment for property tax in the state of Haryana, follow the steps mentioned below:Approach Municipal Corporation Office

Step 1: The applicant has to approach a nearby municipal corporation in the area.Submit Property Tax Invoice Details

Step 2: Submit the property tax invoice details to the concerned authority of the municipal corporation office.Make Payment

Step 3: Then, make payments in the cash counter as per the estimated amount of your property.Acknowledgement Receipt

Step 4: The applicant will get an acknowledgement for the payment of property tax for further reference.Penalties

In case of late payments done by the taxpayer, the interest at the rate of 1.5% per month will be charged. In case of any wrong declarations or violations of rules, a penalty equal to the amount of tax imposed is payable. Additionally, the interest rate mentioned above is also added with the penalty.Popular Post

In the digital age, the convenience of accessing important documents online has become a necessity...

The Atalji Janasnehi Kendra Project that has been launched by the Government of Karnataka...

The Indian Divorce Act governs divorce among the Christian couples in India. Divorce...

When an individual has more than a single PAN card, it may lead to that person being heavily penalised, or worse,...

Employees Provident Fund (PF) is social security and savings scheme for employee in India. Employers engaged...