Updated on: December 19th, 2019 4:51 PM

Updated on: December 19th, 2019 4:51 PM

HDFC Gold Loan

HDFC bank offers gold loan under Sampoorna Bharosa Gold Loan scheme which provides loan against gold jewellery which can be used for several requirements such as marriage, business expansion, education of the child, building a property, etc. Under this scheme, individuals can avail gold loan by pledging of gold ornaments, which includes gold coins sold by banks. In this article, we look at the HDFC gold loan in detail.Eligibility Criteria

The following are the eligibility criteria for availing gold loans from HDFC bank:- The applicant should be within the age group between 21 to 60 years at the time of applying for the loan.

- The applicant should be an employee of a company or public sector undertaking, which includes central, state and local bodies.

- Any employee should have worked continuously for 1 to 2 years with the current employer.

- The applicant should possess a minimum income of Rs.15,000. Rs.20,000 for employees in Mumbai, Delhi, Bengaluru, Chennai, Hyderabad, Pune, Kolkata, Ahmedabad, Cochin.

Features of the HDFC gold loan

The features of the HDFC gold Loan are as follows:- An individual can avail a minimum loan amount of Rs. 50,000 and the maximum amount of about Rs.40 lakhs.

- Under this scheme, the loan amount will be sanctioned within 1 hour from the approval of the application.

- The borrowers are provided with the facility of easy and quick loan sanctions with competitive interest rates on the overdraft, term loan and EMI based loan.

- HDFC bank offers special interest rates and priority processing for availing the loan for the agricultural purpose.

Amount of Loan

The borrower can obtain the minimum loan amount of Rs. 50,000 and the loan above Rs.50,000 will be processed depending on the quantity of gold pledged.HDFC Gold Loan Calculator

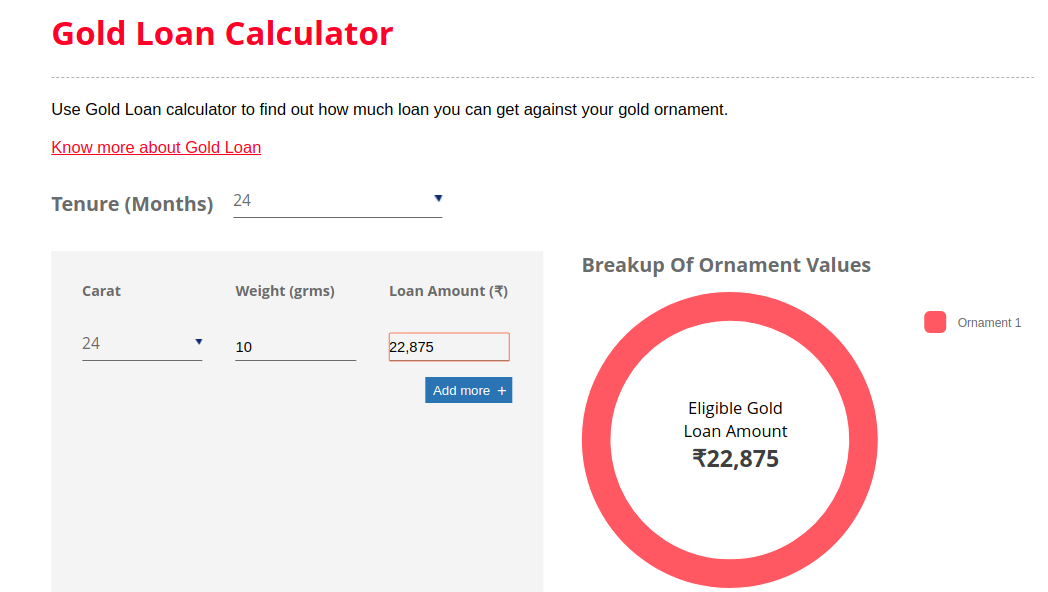

HDFC gold loan calculator is available online and able to know about the loan amount against gold ornaments. [caption id="attachment_82806" align="aligncenter" width="1048"] HDFC Gold Loan- Image 1

The individual can access the HDFC official portal with the required details such as tenure, carat and weight. After entering the details, the available loan amount is displayed for the borrower.

HDFC Gold Loan- Image 1

The individual can access the HDFC official portal with the required details such as tenure, carat and weight. After entering the details, the available loan amount is displayed for the borrower.

Fees

The charges required for processing your loan application is given in the below table.| Particulars | Fees |

| Loan Processing Charges | 1.5% + GST |

| Valuation Fee | Rs.250 for loan amount up to Rs 1.5 lakhs and Rs. 500 for a loan above Rs 1.5 lakhs |

| Foreclosure charges | 2% per annum as per the applicable rate of interest. |

| Stamp Duty and other statutory charges | As per applicable laws of the State |

| Renewal Processing Fees | Rs.350+GST |

Security

Depending on the loan amount, the gold ornaments pledged as security will be verified for quality and quantity.Loan Tenure

HDFC gold loans can be availed for a minimum period of 6 months to a maximum of 48 months.Rate of Interest

The interest rates charged monthly on HDFC gold loan is Rs.1000 per lakh is calculated based on the rate of 12% per annum.Documents Required

The following are the documents which are necessary for processing the loan:- Identity proof: Copy of voter ID card/passport/driving license/Aadhaar card.

- Address proof: Copy of voter ID card/passport/driving license/Aadhaar card.

- Bank statement for the past three months.

- Salary slip or the latest Form 16

Application Procedure

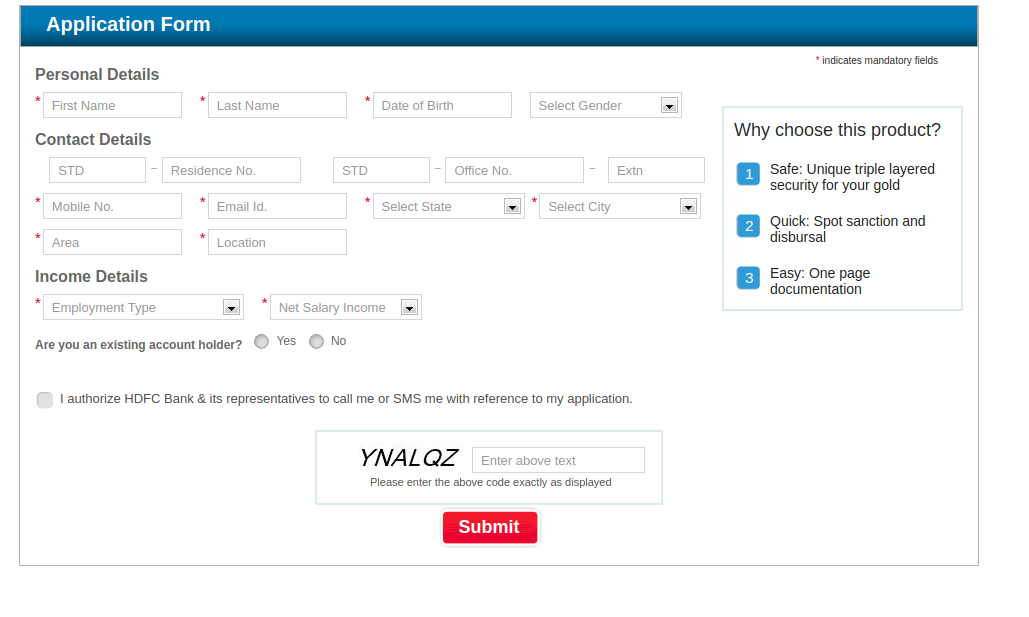

The borrower can directly visit the branch or fill an online application form. Make the application form with the necessary details such as applicant name, address, contact number, email id, pin code, state, city, income details and submit your application by clicking the “Submit” button. The concerned branch will verify the documents and details provided for processing your loan application. [caption id="attachment_82808" align="aligncenter" width="1029"] HDFC Gold Loan - Image 2

HDFC Gold Loan - Image 2

Popular Post

In the digital age, the convenience of accessing important documents online has become a necessity...

The Atalji Janasnehi Kendra Project that has been launched by the Government of Karnataka...

The Indian Divorce Act governs divorce among the Christian couples in India. Divorce...

When an individual has more than a single PAN card, it may lead to that person being heavily penalised, or worse,...

Employees Provident Fund (PF) is social security and savings scheme for employee in India. Employers engaged...