Last updated: August 15th, 2021 8:41 AM

Last updated: August 15th, 2021 8:41 AM

Highlights of 43rd GST Council Meeting

The Goods and Service Tax (GST) council held its 43rd GST council meeting, via video conferencing, on 28th May 2021. The meeting was held under the Chairmanship of Finance Minister Nirmala Sitharaman. The council decided to exempt certain covid-19 relief material from IGST till 31st August 2021. The council also decided that certain drugs used to fight black fungus will also be given exemption. The key recommendations made by the GST council, during the meeting, are highlighted in the present article.Key Highlights of 43rd GST Council Meeting

The biggest decision of the 43rd GST Council Meeting was on reducing the compliance burden on taxpayers,- To provide relief to small taxpayers, an amnesty scheme has been recommended for reducing the late fee

- GST Return Filing Late fee also rationalized for future tax periods

- Import of Covid-related relief items exempt from IGST till August 31st, 2021. Amphotericin B, used for treating Mucormycosis, will also be exempt from IGST.

- Annual return filings will continue to be optional for small taxpayers for the financial year 2021.

Import Of Covid-Related Items Exempted From IGST

IGST exemption has been provided on the import of all COVID relief materials and medicines (including free of cost) till 31st August 2021. Also, the medicine for Black fungus – Amphotericin B is included in the exemption list. The Following list of specified COVID-19 related goods is exempted from IGST.- Medical oxygen,

- Oxygen concentrators

- Oxygen storage and transportation equipment

- Certain diagnostic markers test kits

- COVID-19 vaccines

Covid 19 Reliefs - GST Rate of COVID vaccines

The 43rd GST Council decided to keep the GST rate of 5% as it is on COVID vaccines. Also, the Council ruled out the possibility of notifying COVID-related relief materials as zero-rated goods.Measures for Trade facilitation

The key recommendations made by the 43rd GST Council for Trade facilitation is as follows:Amnesty Scheme for small taxpayers

A GST Amnesty scheme has been announced for small taxpayers who delayed GSTR-3B filing to reduce the late fee. Also, the maximum late fee for small taxpayers is reduced for GST Returns to be filed in the future. To provide relief to the taxpayers, a late fee for non-furnishing FORM GSTR3B for the tax periods from July 2017 to April 2021 has been reduced as under:- Late fee capped to a maximum of Rs 500/- (Rs. 250/- each for CGST & SGST) per return for taxpayers, who did not have any tax liability for the said tax periods

- Late fee capped to a maximum of Rs 1000/- (Rs. 500/- each for CGST & SGST) per return for other taxpayers

Rationalization of the late fee imposed under section 47 of the CGST Act

To reduce the burden of late fee on smaller taxpayers, the upper cap of late fee is being rationalized to align late fee with tax liability/ turnover of the taxpayers, as follows:Late fee for Delay in Furnishing of FORM GSTR-3B & FORM GSTR1

The late fee for delay in furnishing of FORM GSTR-3B and FORM GSTR1 to be capped, per return, as below: For taxpayers having a nil tax liability- For taxpayers having nil tax liability in GSTR-3B or nil outward supplies in GSTR-1, the late fee to be capped at Rs 500 (Rs 250 CGST + Rs 250 SGST)

- For taxpayers having Annual Aggregate Turnover (AATO) in preceding year upto Rs 1.5 crore, the late fee to be capped to a maximum of Rs 2000 (1000 CGST+1000 SGST)

- For taxpayers having AATO in the preceding year between Rs 1.5 crore to Rs 5 crore, the late fee to be capped to a maximum of Rs 5000 (2500 CGST+2500 SGST)

- For taxpayers having AATO in the preceding year above Rs 5 Crores, the late fee to be capped to a maximum of Rs 10000 (5000 CGST+5000 SGST)

Late fee for delay in furnishing of FORM GSTR-4

The late fee for delay in furnishing of FORM GSTR-4 by composition taxpayers to be capped to Rs 500 (Rs 250 CGST + Rs 250 SGST) per return, if the tax liability is nil in the return, and Rs 2000 (Rs 1000 CGST + Rs 1000 SGST) per return for othersLate fee payable for delayed furnishing of FORM GSTR-7

Late fee payable for delayed furnishing of FORM GSTR-7 to be reduced to Rs.50/- per day (Rs. 25 CGST + Rs 25 SGST) and to be capped to a maximum of Rs 2000/- (Rs. 1,000 CGST + Rs 1,000 SGST) per returnCOVID-19 Related Relief Measures for Taxpayers

The 43rd GST Council Meeting has announced the following COVID-19 Related Relief Measures for TaxpayersGST Return Filing Due-Date Extension

The due dates for IFF and GSTR-1 filing for May 2021 are extended by 15 days. Also, the due date for GSTR-4 for FY 2020-21 and ITC-04 for Jan-Mar 2021 is extended up to 31st July 2021 and 30th June 2021, respectively- Now, the taxpayers can cumulatively apply CGST Rule 36(4) for April, May, and June 2021 while filing GSTR-3B of June 2021

- Companies can continue filing GST returns using EVC instead of digital signature till 31st August 2021.

GST Return Filing Late fee waiver and Interest Reduction

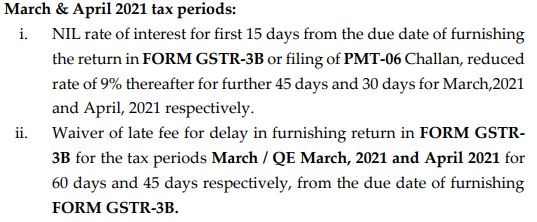

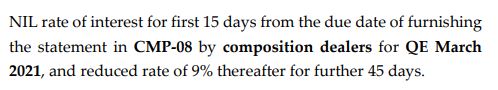

The late fee waiver and interest reduction have been announced for GSTR-3B or PMT-06 filing for March, April, and May 2021 and CMP-08 submission for Jan-Mar 2021 for taxpayers For small taxpayers (aggregate turnover upto Rs. 5 crores)

For large taxpayers (aggregate turnover more than Rs. 5 crores)

For large taxpayers (aggregate turnover more than Rs. 5 crores)

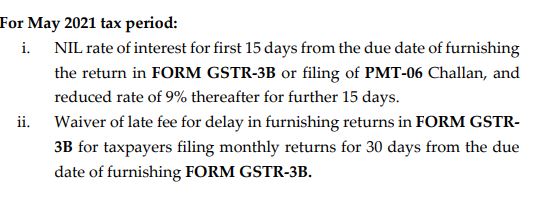

- A lower rate of interest at 9% for the first 15 days after the due date of filing FORM GSTR-3B for the tax period May 2021 is announced

- Waiver of late fee for delay in furnishing FORM GSTR3B for the tax period May 2021 for 15 days from the due date of furnishing FORM GSTR-3B

Relaxations under section 168A of the CGST Act

The time limit for completion of various actions, by any authority or by any person, under the GST Act, which falls during the period from 15th April 2021 to 29th June 2021, to be extended upto 30th June 2021, subject to some exceptionsSimplified Annual Return Filing for FY 2020-21

GST Annual Return (GSTR-9) filing is rationalized and continues to be optional for 2020-21 for small taxpayers with turnover up to Rs.2 crore. Also, GSTR-9C (Reconciliation statement) to be still applicable for taxpayers with an annual turnover of equal to or more than Rs.5 crore, allowing self-certificationOther Reliefs on Goods

To support the LympahticFilarisis (an endemic) elimination program being conducted in collaboration with WHO, the GST rate on Diethylcarbamazine (DEC) tablets has been recommended for reduction to 5% from earlier 12%.Clarifications on GST Rate on Certain Goods

Certain clarifications amendments have been recommended about GST rates.- Liability of IGST on repair value of goods re-imported after repairs

- GST rate of 12% to apply on parts of sprinklers/ drip irrigation systems falling under tariff heading 8424 (nozzle/laterals) to apply even if these goods are sold separately.

Another decision of GST Council

- Rate decisions on items ranging from MRO units of ships to shipping to annuity payments received as deferred payment for construction of the road.

- Compensation cess payable to states this year is Rs 2.7 lakh crore of which Rs 1.58 lakh crore will be given to them via back-to-back loans. Same formula as last year to apply.

- Separate meeting to be held to discuss states' demands regarding extension of compensation period beyond FY22

Popular Post

In the digital age, the convenience of accessing important documents online has become a necessity...

The Atalji Janasnehi Kendra Project that has been launched by the Government of Karnataka...

The Indian Divorce Act governs divorce among the Christian couples in India. Divorce...

When an individual has more than a single PAN card, it may lead to that person being heavily penalised, or worse,...

Employees Provident Fund (PF) is social security and savings scheme for employee in India. Employers engaged...