Last updated: December 17th, 2019 4:55 PM

Last updated: December 17th, 2019 4:55 PM

Himachal Pradesh Liquor License

In Himachal Pradesh, liquor license is a document that permits a manufacturer or business to sell alcoholic beverages at a particular place. Liquor license is granted by the Excise and Taxation Department of the respective state. It is illegal for any person to manufacture, dispense or sell intoxicating alcohol without a valid liquor license. The government has set various rules and regulations under the Himachal Pradesh Excise Act, making it mandatory to acquire a liquor license for bars, restaurants, hotels, clubs etc. In this article, we look at the procedure for obtaining a Himachal Pradesh liquor license in detail.Himachal Pradesh Excise Act

As per the provisions under the Himachal Pradesh Excise Act, an application form has to be requested for manufacture or sale of any liquor which includes foreign liquor, country spirit, Denatured spirit, and rectified spirit. The prescribed authority after examining may permit the use or sale of liquor in the form of license.Purpose of Liquor License

Any person is required to obtain a liquor license for the following purposes:- The liquor license is needed to evade the unlawful trade of liquor in a particular state.

- The liquor license is required to manage the sale of alcohol.

- It is prohibited for any person to manufacture, distribute or retail intoxicating liquor without possessing a license issued by the respective state supervisor of the Division of Alcohol and Tobacco Control.

Eligibility Criteria

To apply for a Liquor license in the state of Himachal Pradesh, the applicant needs to satisfy the following conditions:- The individual should be age twenty-one years or above and should be an India citizen or a Person of Indian Origin.

- Any partnership firm containing the partners is citizens of India. And the change in the partnership will not be entertained after the settlement of shop or group of shops except legal permission from the Excise Commissioner required.

- The individual should not be a defaulter or blacklisted or debarred from holding an excise license under the provision of Rule 13 of these rules or under the provision of any law made under the Act.

- A person who has been convicted by a criminal court of a non-bailable offence.

- An existing license holding person who has violated the terms and conditions of his license.

- A person who was a defaulter in the payment of excise revenue to the State Government.

Applicable Fee for Liquor License

The appropriate license and renewal charges for the types of liquor license in Himachal Pradesh are given below.| S.No | License Category | License fee and Renewal fee per annum |

| 1. | L-1 (Wholesale vend of Foreign Liquor, Foreign Beer or spirit for trade only.) | Rs. 2 lakhs excluding such other fee as may be prescribed. |

| 2. | L-1-A, (Storage of Foreign Liquor) | Rs.75,000/- excluding such other fee as may be prescribed. |

| 3. | L-1-B Licenses (i) Wholesale of Foreign Liquor to L-1 only. (ii) (ii) exclusively for Beer | (i) Rs.1.50 per P.L. on Foreign Spirit and Re. 0.50 per B.L. of RTD Beverage subject to the minimum of Rs. 50,000/- (ii) Re. 0.50 per B.L. subject to the minimum of Rs. 30,000/- |

| 4. | L-1-BB (wholesale of imported foreign liquor) from outside India to L-1 & L-2 as well as to the Club and Bar license holders. | (i) Rs. 23 /- per P.L. of Foreign Spirit. (ii) (ii) Rs. 4.67 per bottle of 650 mls. Capacity or Rs. 7.20 per B.L. of Imported Beer with alcoholic content up to 5% v/v. (iii) Rs. 7.67 per bottle of 650 mls. Capacity or Rs. 11.80 per B.L. of Imported Beer with alcoholic content above 5% v/v but not exceeding 8.25 % v/v. (iv) Rs. 3/- per bottle of Imported Wine containing alcoholic contents up to 20%. (v) Rs. 5/- per bottle of Imported Wine containing alcoholic contents above 20% but not exceeding 30% v/v. subjected to a minimum of Rs.25,000/- (Twenty Five Thousand) |

| 5. | L-1-C (Wholesale of foreign liquor by distiller or bottler only). | Rs. 2,25,000/- |

| 6. | L-2A (Ahata with L-2 vend) | Rs. 10,000/- |

| 7. | L-3, L-4 & L-5 (Combined) Areas (a) (i) Shimla town including Kasumpti, New Shimla, Khalini, Vikasnagar, areas along National Highway up to Parwanoo, Chharabra & Kufri. (ii) Areas from Katrain to Kothi in Kullu District. (iii) All district headquarter towns and localities adjacent in Himachal Pradesh. (excluding Kinnaur and Lahaul and Spiti district headquarters) Palampur, Dalhousie, Chail and Kasauli. (b) All other areas. | For hotels where a number of Rooms are:- 10 to 50 Rs.0.75 lakhs Rs.0.75 lakhs Rs.0.745 lakhs Rs.0.40 lakhs |

| 8. | L-4 & L-5 (Combined) (a) Areas specified in 6(a)(i), (ii) & (iii) (b) Areas mentioned in 6(b) | Rs. 0.90 lac. Rs. 0.40 lac |

| 9. | L-4-A & L-5A (combined) (a) Areas specified in 6(a) (i) (ii) & (iii) (b) Areas mentioned in 6(b) | Rs. 0.40 lac. Rs. 0.30 lac. |

| 10. | (i) L-9 (ii) L-9A | Rs. 1,000/- Rs. 1,500/- |

| 11. | L-10.BB retail vend of beer, wine, cider and RTD beverages in Departmental stores etc. (allowed to take supplies from L.1 and S.1A license holders) | Rs. 15,000/- |

| 12. | L-12 for the sale of Medicated Wines. | Rs. 50/- |

| (i) L-13 for wholesale vend of C.L. (ii) Additional godown of wholesale vend of C.L | Rs. 50,000/- Rs. 15,000/- | |

| 13. | L-17 License (Wholesale and retail vend of denatured spirit.) (i) upto quantity of 1000 Bulk litres. (ii) Above quantity of 1000 Bls. | Rs.1000/- Rs. 2000/- |

| 14. | L-19 license (Wholesale and retail vend of rectified spirit). | Rs. 100/- |

Prescribed Authority

The prescribed authority is issuing permits for the sale or manufacture of liquor in the form of liquor license are specified below.Documents Required for License

The prescribed report for applying Himachal Pradesh Liquor license is given below.- Identity proof and Address Proof of applicant.

- Premises Address Proof.

- No Objection Certificate from the fire department.

- No Objection Certificate from the local municipal corporation.

- Application with business details.

- List of Directors details in case of a company.

- MOA and AOA if the applicant is holding a company.

- Copy of Latest Income Tax return.

- Photograph of an authorised person.

- The affidavit from the sanctioned person stating that he has no criminal record or any offence punishable under the respective state act and also he is not a defaulter in paying any dues to the department.

Documents Required for Partnership firm

The prescribed documents are to be submitted whether obtaining a license under the partnership firm.- Registered Partnership Deed.

- General Power of Attorney by the Partners to the applicant for excise purpose.

- List of Partners with Local and Permanent Address Proof.

- Income Tax Return of Partnership Firm (Last three years).

- Balance-Sheet of Firm.

- Character Certificate of the applicant seven each partner (granted by the officer, not below the rank of S.D.O./D.S.P distributed within six months from the date of application.

- Declaration of Firm’s Partner that who will present in Excise Department.

- Affidavit relating no dues of excise or any other Government Department.

- Affidavit relating applicant partnership firm or candidate has not punished under N.D.P.S., Excise Act, Molasses Act, I.P.C Affidavit relating firm is not blacklisted in any state.

- Sales Tax Registration and Sale tax Clearance Certificate from the concerned Sales Tax Authority where the firm is presently working.

- Three copies of blue Prints of the labelled map of the proposed site and its premises and its inside places. The plan must be certified by the applicant, Enquiry officer, District Excise Officer & Deputy commissioner of the district.

- Enquiry report of Excise Officer.

- No Objection Certificate about Law and Order from proposed area’s S.D.O. Certificate from Enquiry Officer that proposed site is as per tourist rules.

- Any other documents which required by licensing /Sanctioning Authority.

Application Procedure for Obtaining Liquor License

To apply for Himachal Pradesh Liquor License, follow the steps specified below.Visit Official Portal

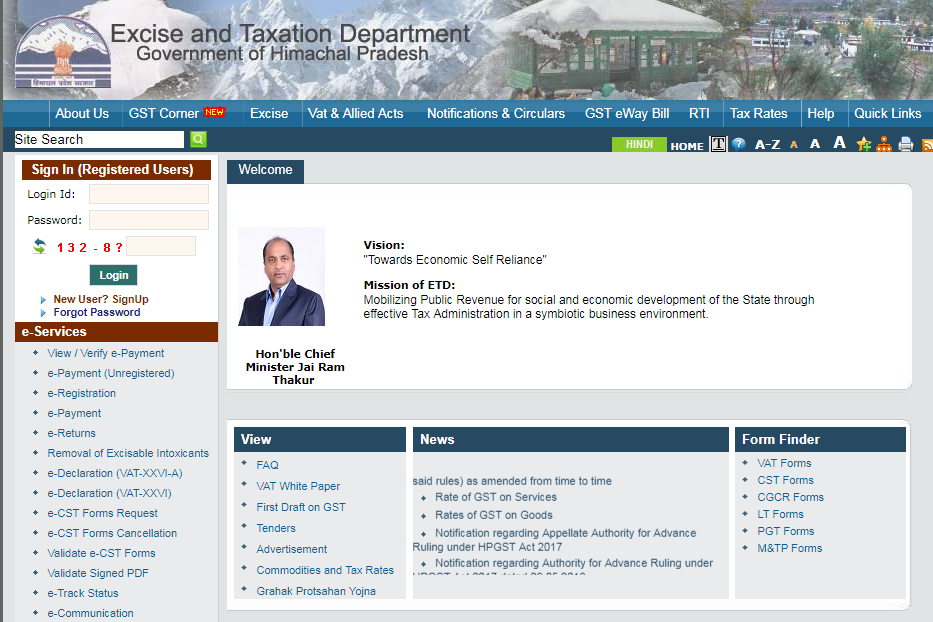

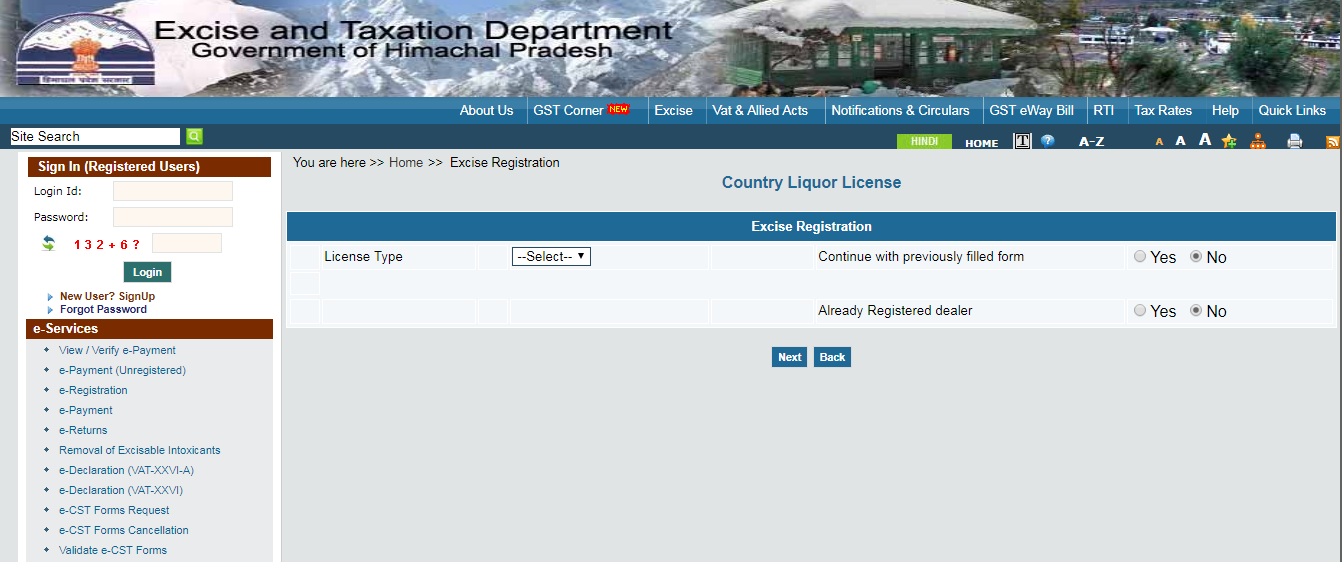

Step 1: Visit the official portal of Himachal Pradesh Excise and Taxation Department. Step 2: Click on “Sign in” button which is visible on the homepage of the portal if registered as the existing user. [caption id="attachment_71372" align="aligncenter" width="667"] Himachal Pradesh Liquor License-Image 1

Himachal Pradesh Liquor License-Image 1

Provide Login Details

Step 3: Enter your login id, password and captcha to log in the portal.New User Registration

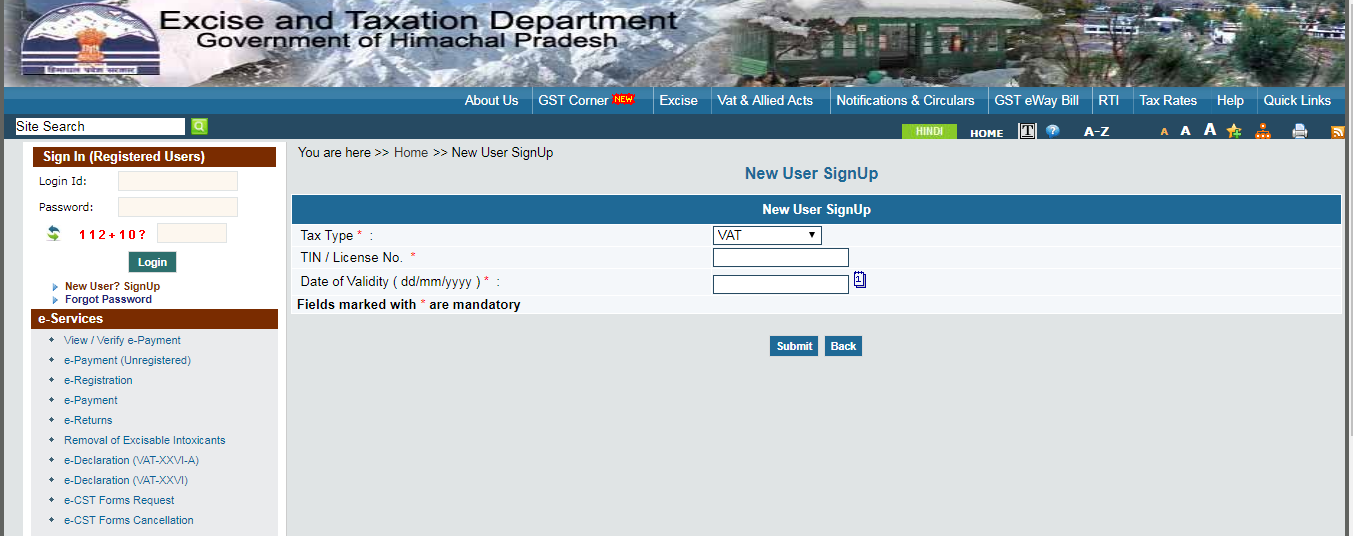

Step 4: If you were not a new user then the applicant has to click on “New User” tab, and you will be directed to the next page where you need to provide the required details like type of tax, TIN or license number, date of validity and then click on “Submit” button. [caption id="attachment_71374" align="aligncenter" width="630"] Himachal Pradesh Liquor License-Image 2

Step 5: Now, the applicant details regarding his/her license will be shown on the current screen. Then the applicant will receive the login id and password to the registered mail id.

Himachal Pradesh Liquor License-Image 2

Step 5: Now, the applicant details regarding his/her license will be shown on the current screen. Then the applicant will receive the login id and password to the registered mail id.

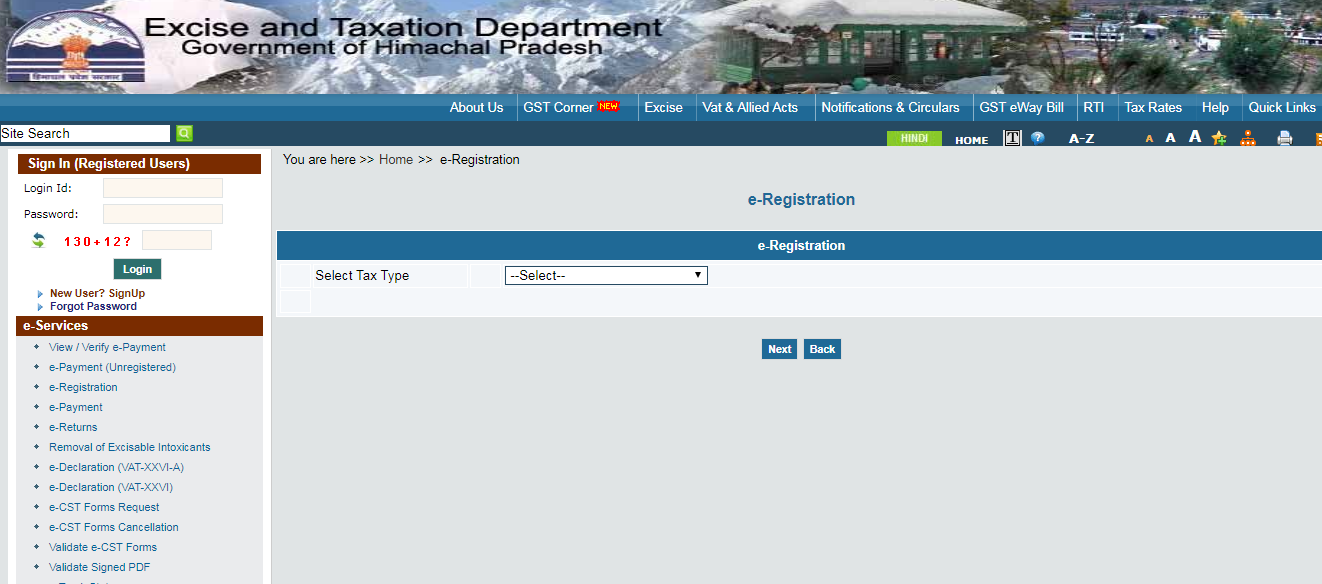

e-Registration

Step 6: You need to click on “e-Registration” tab which is present on the home screen of the portal. Excise Registration Step 7: Select tax type as Excise Registration from the dropdown list and then click on “Next” button to proceed further. [caption id="attachment_71376" align="aligncenter" width="642"] Himachal Pradesh Liquor License-Image 3

Step 8: Select the liquor license option from the drop-down list for the issuance of the license.

[caption id="attachment_71377" align="aligncenter" width="642"]

Himachal Pradesh Liquor License-Image 3

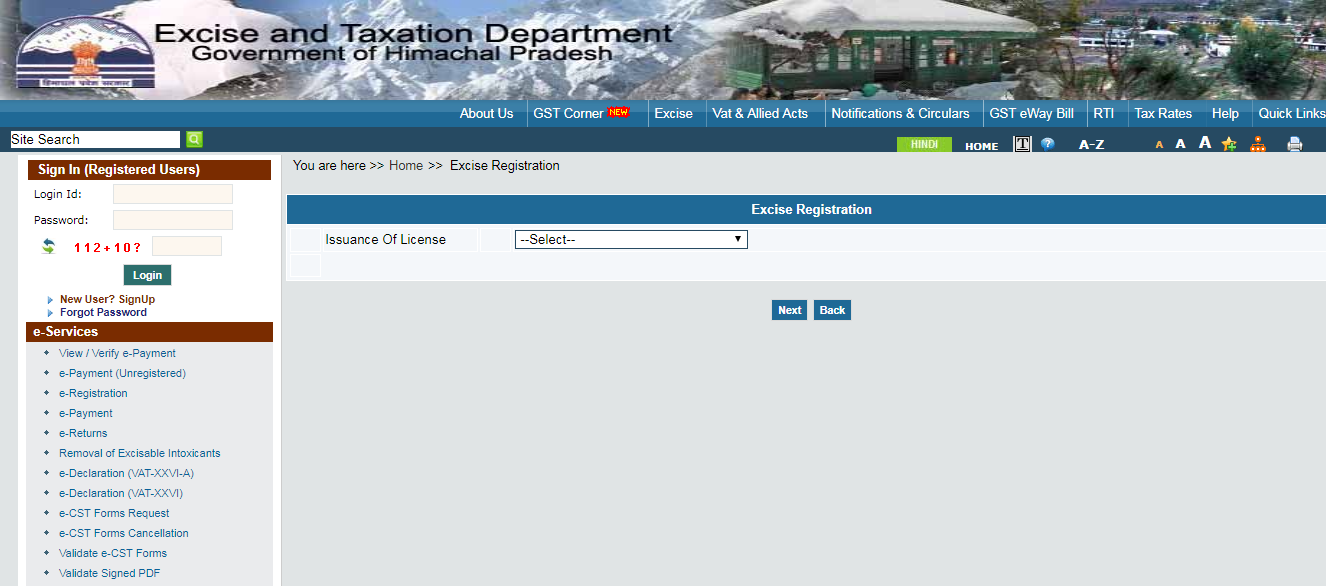

Step 8: Select the liquor license option from the drop-down list for the issuance of the license.

[caption id="attachment_71377" align="aligncenter" width="642"] Himachal Pradesh Liquor License-Image 4

Himachal Pradesh Liquor License-Image 4

Select Liquor license Sub Type

Step 9: Select the particular Liquor license subtype from the list of options displayed and then click on “Next” button to continue with the process.Select License Type

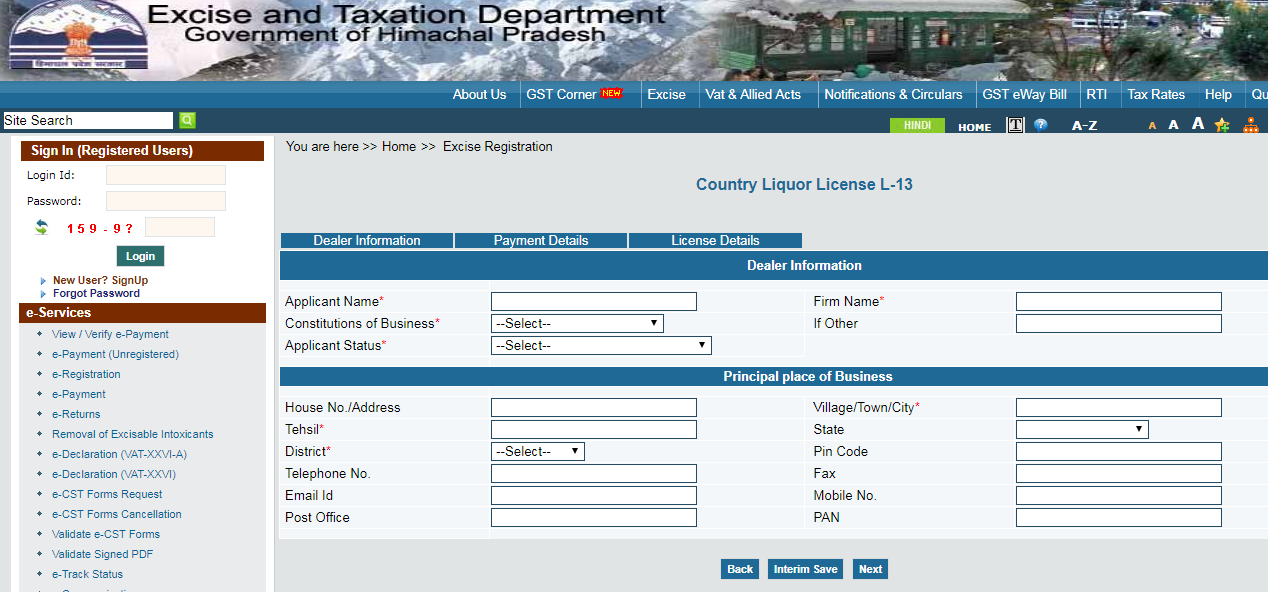

Step 10: Choose the license type and need to answer for the yes or no question such as Continue with previously filled form, already registered dealer and then click on “Next” button. [caption id="attachment_71378" align="aligncenter" width="646"] Himachal Pradesh Liquor License-Image 5

Step 11: Then the applicant needs to provide dealer information with are necessary for registration such as

Himachal Pradesh Liquor License-Image 5

Step 11: Then the applicant needs to provide dealer information with are necessary for registration such as

- Applicant name

- Firm name

- Constitution of business

- Applicant Status

- Firm address

- Mobile number

- Email id

- State

Himachal Pradesh Liquor License-Image 6

Himachal Pradesh Liquor License-Image 6

Payment Gateway

Step 13: You will be forwarded to the payment details page will appear which shows applicable excise fee or duties and the Excise and Taxation Department Development Fund if applicable for the selected movement.Choose Payment Option

Step 14: The Licensee has to pay all the duties and Excise and Taxation Department Development Fund before proceeding further. There are two methods for making the payment under License fee/retail excise duty:- The Licensee can pay online payment by clicking on the e-pay treasury button. By clicking on the e-pay treasury option official portal will redirect the licensee to e-pay treasury website where the licensee can make the payment towards respective heads.

- If the licensee has paid all payments manually, then the licensee has to visit their respective circle authority office for getting his payment recorded into the system so that the licensee can apply for e-pass.

Payment for the Excise and Taxation Department Development Fund

Step 15: For making the payment under Excise and Taxation Department Development Fund, the licensee has to visit their respective circle authority office for getting ETD Development Fund payment recorded into the system. The Licensee has to show the manual challan receipt to the authority so that that authority can verify and record the payment quickly.Make e-Payment

Step 10: Upon payment, the applicant will receive acknowledgement as the confirmation. Step 11: After verification by the concerned authority the license will be issued to the applicant.Track Application Status

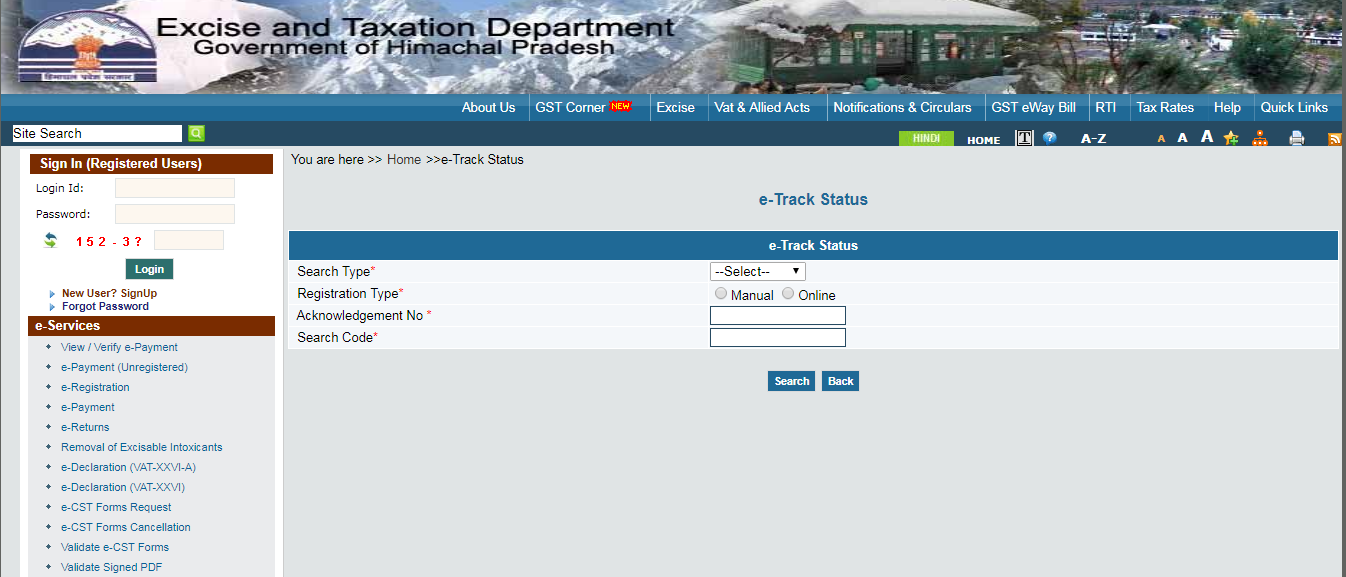

The official portal also facilities its user to verify the status of the application, follow the steps specified here. Step 1: On the home page click on the e-Track Status option.Track Application Status

Step 2: On the next page you need to fill the required details to check the status of your application.Provide complete details

Step 3: Enter the registration type, registration type, acknowledgement number, search code and select the search type and then click on the ‘Search’ button. [caption id="attachment_71380" align="aligncenter" width="649"] Himachal Pradesh Liquor License-Image 7

Himachal Pradesh Liquor License-Image 7

View application status

Step 4: Now the status of your application can be viewed by the applicant. Know about Bar License in Tamil Nadu and Chennai.Popular Post

In the digital age, the convenience of accessing important documents online has become a necessity...

The Atalji Janasnehi Kendra Project that has been launched by the Government of Karnataka...

The Indian Divorce Act governs divorce among the Christian couples in India. Divorce...

When an individual has more than a single PAN card, it may lead to that person being heavily penalised, or worse,...

Employees Provident Fund (PF) is social security and savings scheme for employee in India. Employers engaged...