Last updated: December 13th, 2024 11:57 AM

Last updated: December 13th, 2024 11:57 AM

How do I pay my Tax Demand online?

Paying taxes online is a convenient and secure way to stay on top of your tax payments in India. With the help of the government’s e-filing portal, you can quickly and easily manage income tax demand payment obligations. In this article, we will explain the process step-by-step, ensuring you understand how to pay demand of income tax online effectively. So, if you’re looking for guidance on how to pay income tax demand online, you’ve come to the right place.Benefits of paying Tax Demand online

Convenience

Paying taxes online is a convenient way to ensure your taxes are paid on time. With the option to manage your income tax demand payment from home or the office, you save time and effort.Speed

Paying taxes online is a much faster way to make payments. Whether you're learning how to pay demand notice from income tax or settling other dues, payments can be processed in minutes.Accuracy

When you pay taxes online, you can be sure that your payment is accurate and up-to-date. Following the right steps ensures no errors while handling how to pay demand of income tax online.Security

Paying taxes online is a secure way to make payments. When you complete the payment through the e-filing portal, your data is protected with bank-level encryption.Record Keeping

Online tax payments offer seamless record management. After completing how to pay income tax demand online, you’ll receive an official receipt for your records.Steps to pay Tax Demand Online

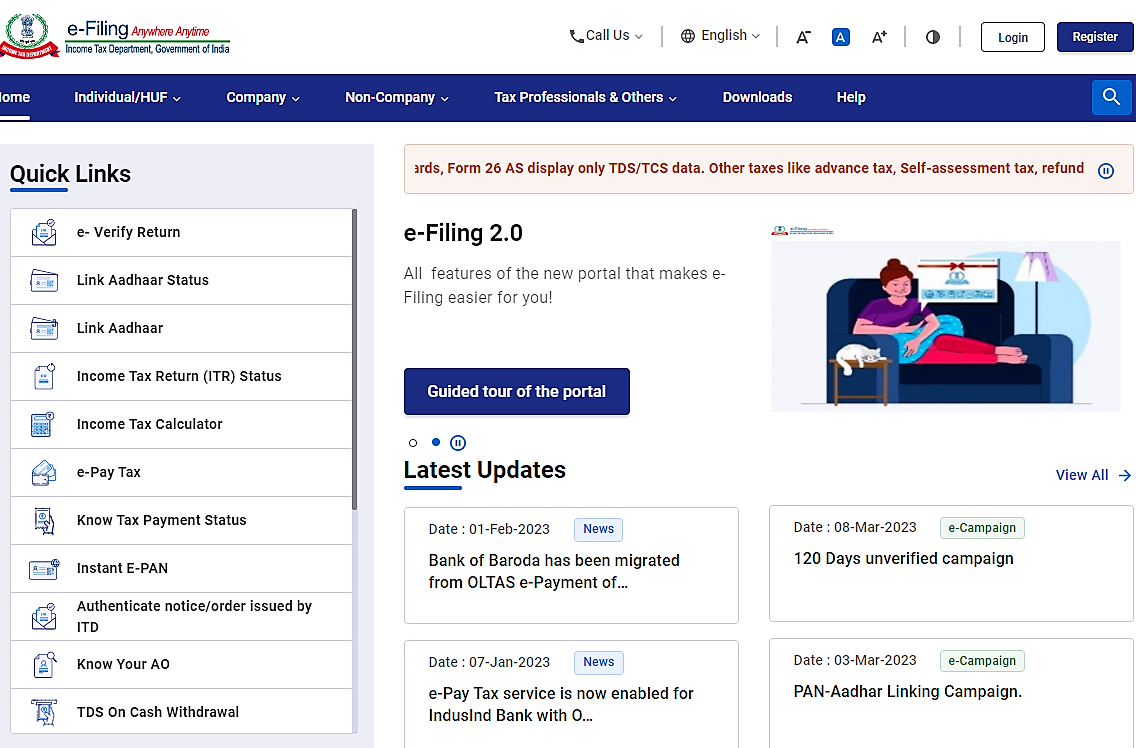

- Visit the official website of the Income Tax Department of India

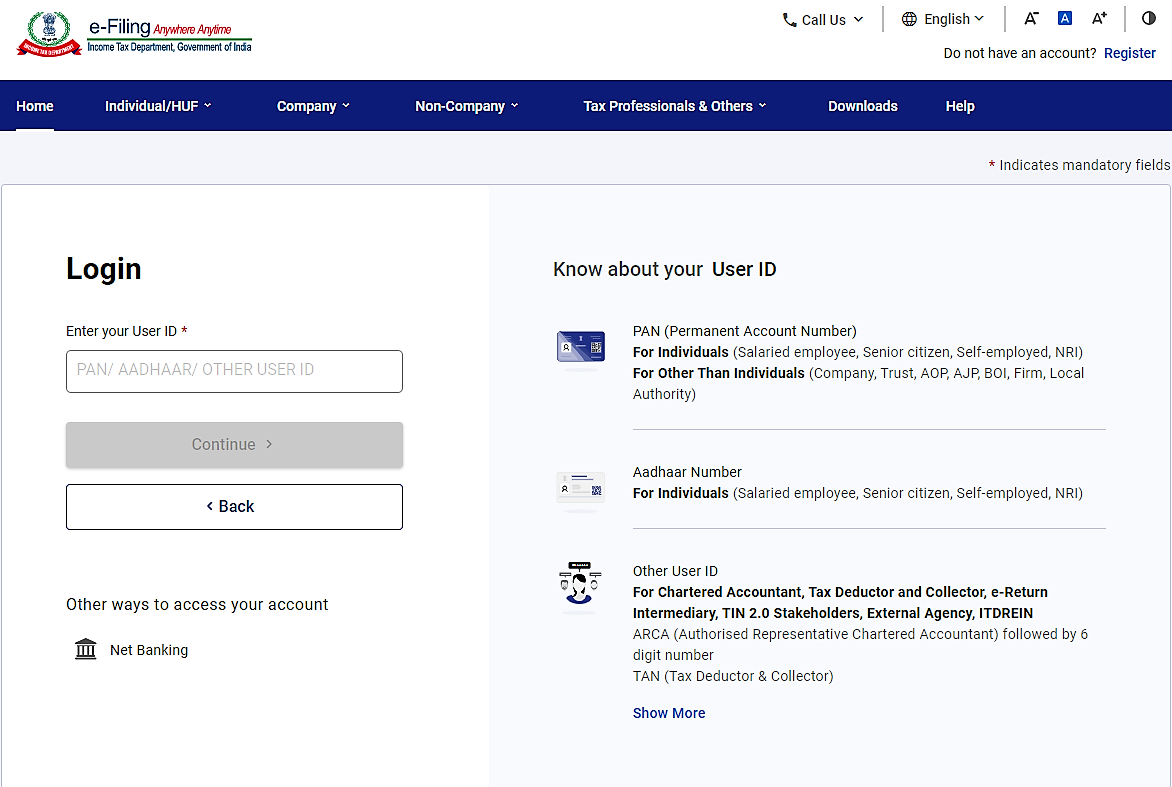

- Log in with your registered user ID and password.

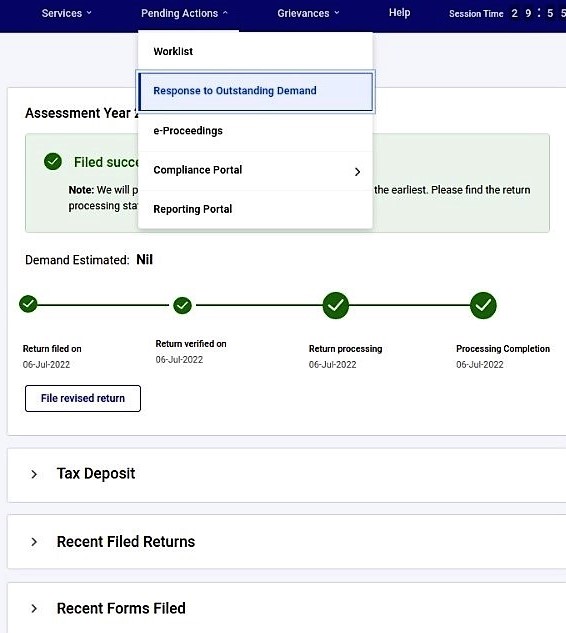

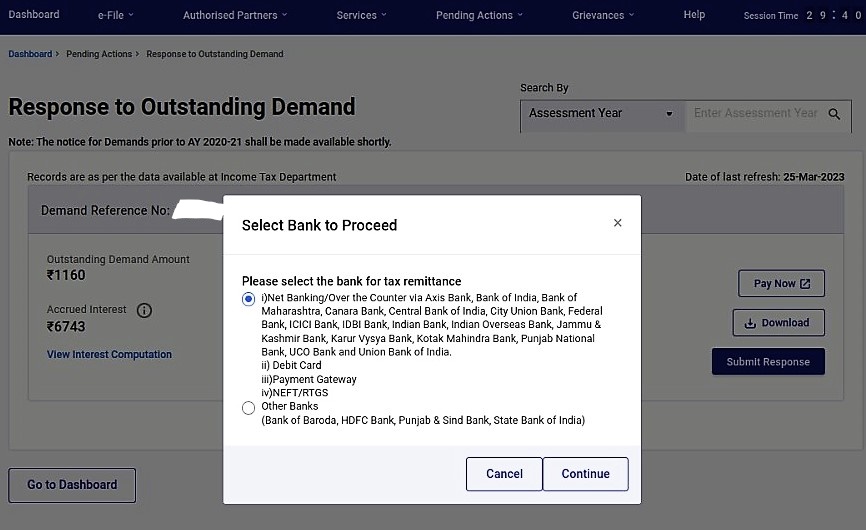

- Under ‘Pending Actions’, select ‘Response to Outstanding Demand’.

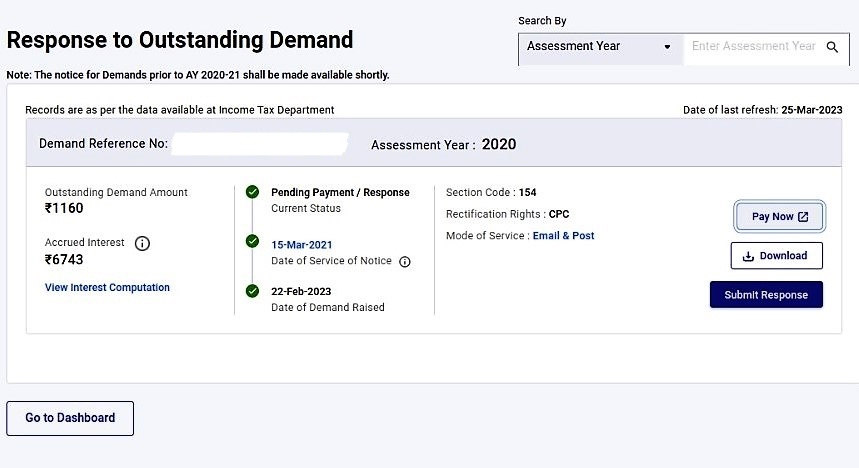

- Click on ‘Pay Now’.

- Select your Bank option and click on ‘Continue’.

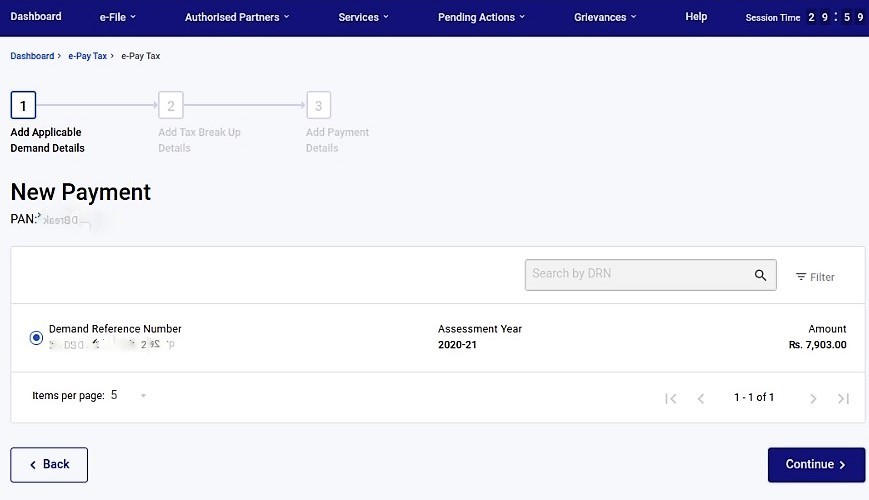

- Click on ‘Continue’.

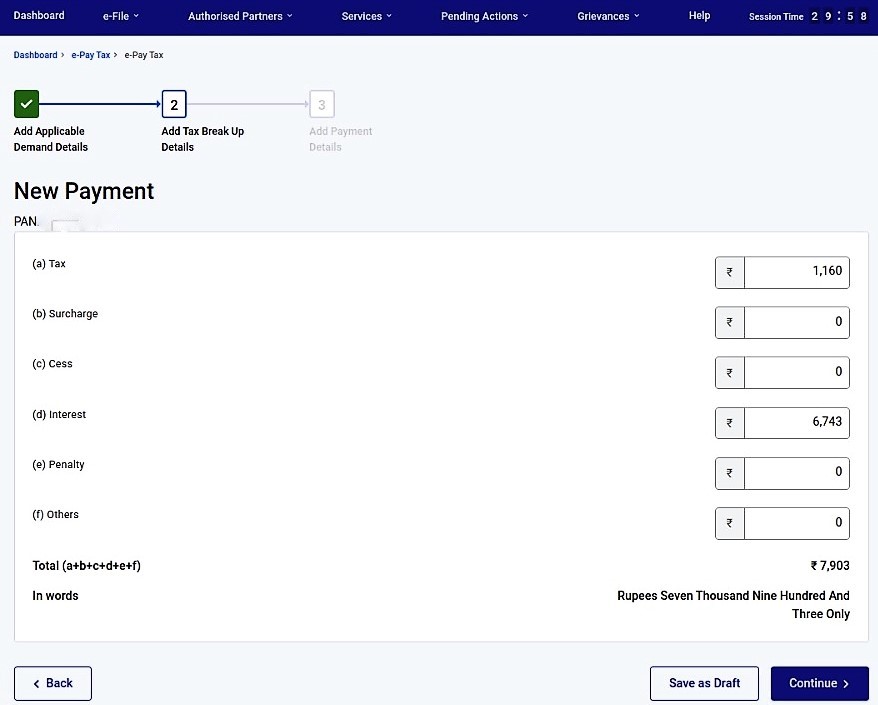

- Check your dues and click on ‘Continue’.

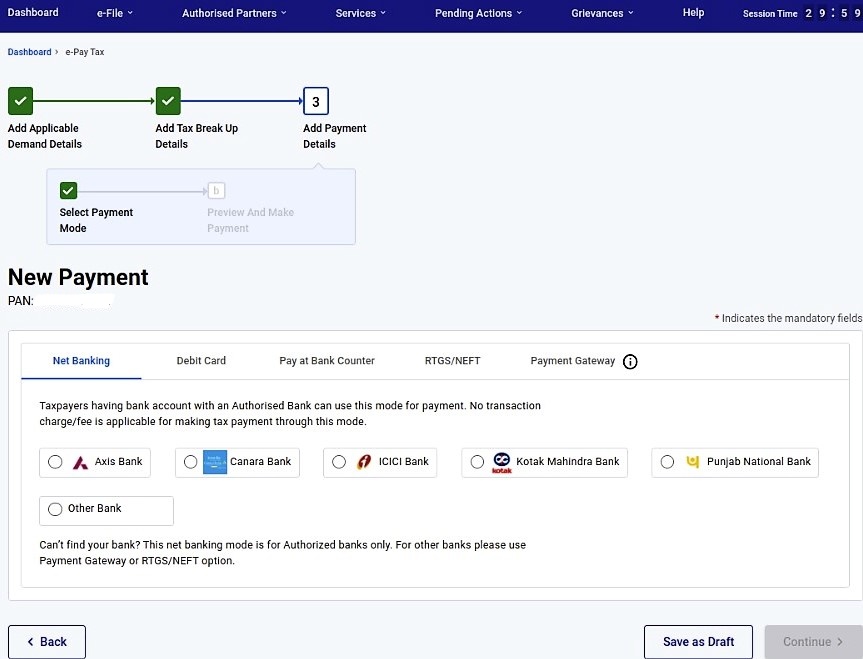

- Select the payment mode from the available options and click ‘Continue’.

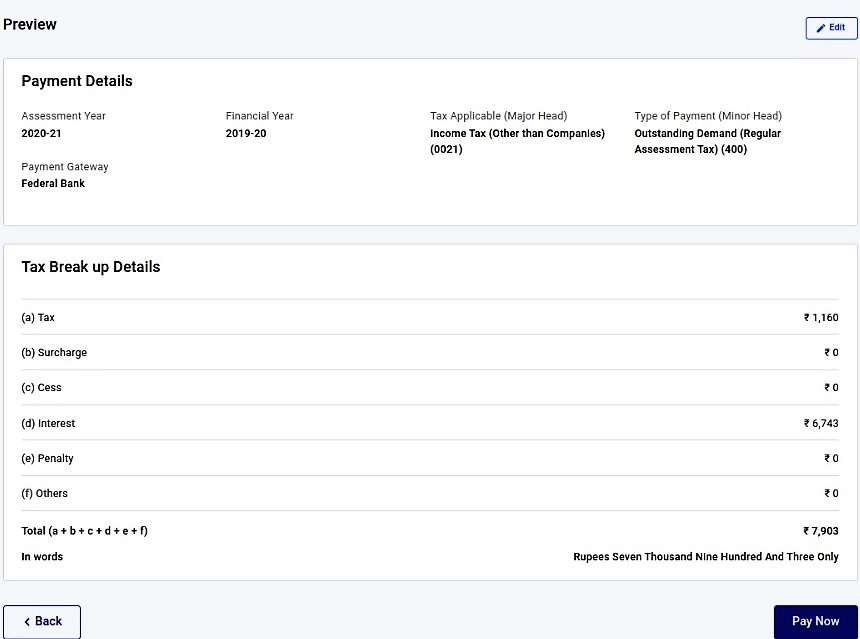

- Check the payment details and click on ‘Pay Now’.

- Once the payment is successful, you will receive an acknowledgement.

- Download and save the acknowledgement for future reference.

Latest Update on the Pay Later Option for Income Tax Filing

The Income Tax e-filing portal has recently rolled out a 'Pay Later' option, allowing you to complete your tax filing process before making any tax payments. You can pay taxes after you are done filing. For additional information, please refer to our guide – Pay later option for the Income tax return filing. IndiaFilings provides a comprehensive solution for filing your Income Tax Returns (ITR) and other ITR-related services. With IndiaFilings, you can avoid tax demands, pay your returns timely, and receive the best quality service at the most competitive prices. So go ahead and visit IndiaFilings to get your ITR done, and rest assured that all your tax-related needs are taken care of.Popular Post

In the digital age, the convenience of accessing important documents online has become a necessity...

The Atalji Janasnehi Kendra Project that has been launched by the Government of Karnataka...

The Indian Divorce Act governs divorce among the Christian couples in India. Divorce...

When an individual has more than a single PAN card, it may lead to that person being heavily penalised, or worse,...

Employees Provident Fund (PF) is social security and savings scheme for employee in India. Employers engaged...