Last updated: March 14th, 2020 3:52 PM

Last updated: March 14th, 2020 3:52 PM

How to apply for a Business Loan

So, you have your business plan put together including a detailed projection of the income you will earn from your business. All you need is bank loan in order to get started. Clearly, the first and safest option is to approach your nearest bank or the bank you maintain a financial relationship with to apply for a loan. But, beforehand, do some research and have answer to following question to ensure your chances of getting a bank loan are maximized. In this article we look at the procedure for applying business loan and answers to some of the Banker's FAQ during the initial discussion.

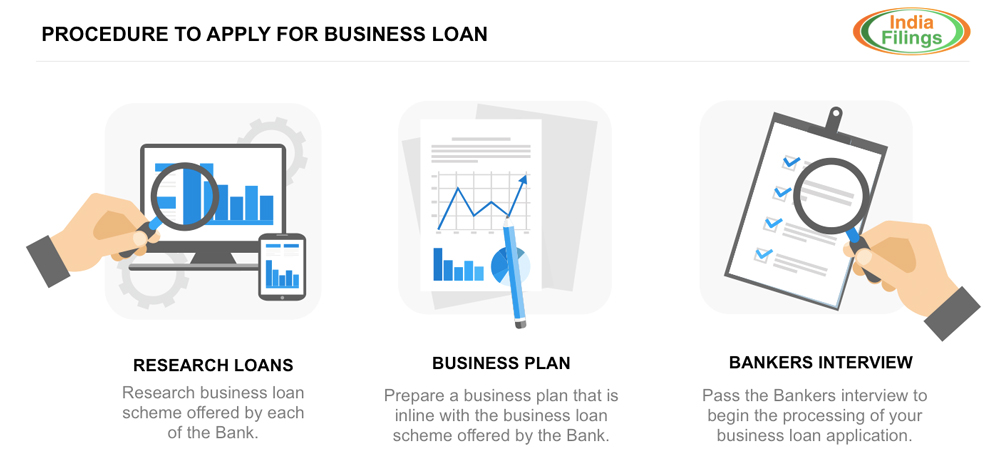

Procedure to apply for business loan

Procedure to apply for business loan

Research the Available Schemes

Unlike Venture Capitalists and Private Equity Firms, Bankers provide business loan under specific schemes offered by the Bank. Therefore, the best place to start the research for business loan would be the Banks website. On the Banks website, research the Corporate Banking and MSME Banking areas which provide a list of business loan schemes offered by the Bank for Small and Medium Sized Business. Some of the schemes under which Bankers provide business loan are:

- Term loan

- Working capital

- CGTMSE Scheme

- Scheme for Financing against Warehouse Receipts

- Loan for Professionals

- Scheme for loans to Owner-Drivers of Taxi Cars, Three Wheeler, Station Wagons, Tempos, Etc.

Have a Business Plan Ready

Once you have researched the business loan schemes available with the Bank, prepare a business plan that is inline with the Bank's scheme. For instance, if the business loan scheme requires a margin of 30% for term loan, ensure that you have accounted for the margin of 30% in the financials prepared as a part of the business plan. You can refer to the article on Business Plan Template for more information about creating a good business plan or contact IndiaFilings for Business Plan Preparation.

Passing the Bankers Interview

The Bankers Interview is the next step in the business loan syndication process. As they say, "First impression is the best impression", it is important to be well prepared for the Bankers interview to maximize the chances of securing the bank loan. Most seasoned Bankers make credit decisions quickly based on the first interview with the Promoters of the Company. Hence, be ready to answer the following questions:

Do you have collateral?

Unless you apply for a loan under CGTMSE scheme or your loan amount is less than Rs.25 lakhs, be ready to offer the bank a collateral security. Collateral security helps the banks reduce the risk of default on the loan and is required for a majority of the loans. Offering a collateral security for the loan will be greatly improve the chances of securing the bank loan as it shows commitment from the Promoter towards the business.

In case, you cannot offer a collateral security, provide explanation on why you are unable to offer collateral security. Hint: Telling the Banker you do not want to risk your personal asset on the business in NOT a good answer. Bankers are usually not interested in funding businesses wherein the Promoters who are not sure about the success of their Business.

Do you have margin money?

Most bank loans require the promoter to invest equity funds in the business against the bank loan. For instance, if a business loan is sanctioned with a margin of 30%, the promoters must infuse Rs.30 for every Rs.100 funded by the Bank. Therefore, the promoter must have some money that is will be invested into the business as equity from savings, friend, family or investors to match the margin money requirement.

So your business plan needs a term loan of Rs.10 crores? Do you then have 3 crores to fund the margin requirement will be the Bankers question. Be ready with sources of funds for the margin money.

What is the present and projected financial performance?

Bankers will delve into the financial portion of the business plan wherein the present and/or projected financial and operational performance of the Company is discussed in detail. Unlike venture capitalists or private equity firms, Banks typically do not fund losses and businesses that incur losses. Also, Bankers are also averse to businesses that scale up too fast and prefer businesses that grow steadily. Hence, prepare a business plan that is both realistic and conservative, and discuss the same with the Banker.

If you are able to pass the Bankers Interview, the Banker will usually keep a copy of the business plan and request for more documents like financial statements, tax returns, etc., to begin processing the loan application. The chance of obtaining sanction of bank loan is good for proposals that pass the Bankers interview, as most Bankers are seasoned and can quickly spot businesses that would be eligible for bank loan.

For more information about Business Loan Syndication, visit IndiaFilings.com

Popular Post

In the digital age, the convenience of accessing important documents online has become a necessity...

The Atalji Janasnehi Kendra Project that has been launched by the Government of Karnataka...

The Indian Divorce Act governs divorce among the Christian couples in India. Divorce...

When an individual has more than a single PAN card, it may lead to that person being heavily penalised, or worse,...

Employees Provident Fund (PF) is social security and savings scheme for employee in India. Employers engaged...