Last updated: February 15th, 2023 3:13 PM

Last updated: February 15th, 2023 3:13 PM

How to Apply for a GST Number?

The GST was introduced in India on 1st July 2017 and has since replaced various previously imposed indirect taxes such as Service Tax, Excise, VAT, etc. GST registration is necessary for all taxable persons conducting business in India and providing goods with an aggregate turnover exceeding Rs. 40 lacs. Persons providing services must register if their aggregate turnover exceeds Rs. 20 lacs. Regarding GST, the foremost thing any business must do is apply for the GST Registration Number. GST registration is PAN-based and state specific depending upon the location of the business/supplier.Decoding the GST Number

All businesses registered for GST Registration receive a unique GST Registration number, also known as a GST Identification Number (GSTIN). GSTIN is a 15-digit PAN-based identification number issued by the tax department after your application is approved. GSTIN consists of the following elements:- The first two digits denote the State code.

- The next ten digits denote the owner’s PAN identification number.

- The following two digits denote the Entity code.

- The fifteenth digit denotes the Checksum digit.

Types of GST

- Required Registration- Under some circumstances, the dealer may need to register for GST regardless of revenue.

- Voluntary Registration- Businesses that do not need to register for GST compulsorily can do so voluntarily.

- Composition Scheme- Any taxpayer with a turnover of less than Rs. 1.5 crore may opt for this scheme.

- No Registration- The following category of persons are exempt from GST Registration:

-

- Businesses whose annual turnover does not exceed Rs.40 lacs for goods or Rs.20 lacs for services.

- Businesses that are exempt from mandatory registration.

- Persons providing goods or services exempt from GST or not subject to GST.

- Agriculturists providing crops obtained by land cultivation.

Benefits of GST Registration-

Persons registered under the GST can access the following benefits:- Unlike the former VAT and Service Tax, only one consolidated return must be filed under the GST.

- Being officially acknowledged as a provider of goods or services.

- Complication-free inter-state movement of goods for e-commerce operators.

- Reduction in unnecessary transportation costs due to relaxation of previous restrictions on inter-state movement of goods.

- Obtaining eligibility to use various advantages and benefits provided by the GST Laws.

Apply for GST Number through the official portal-

- Visit the GST Portal through the official link - https://www.gst.gov.in/ and select the "Register Now" option under the "Taxpayers" tab.

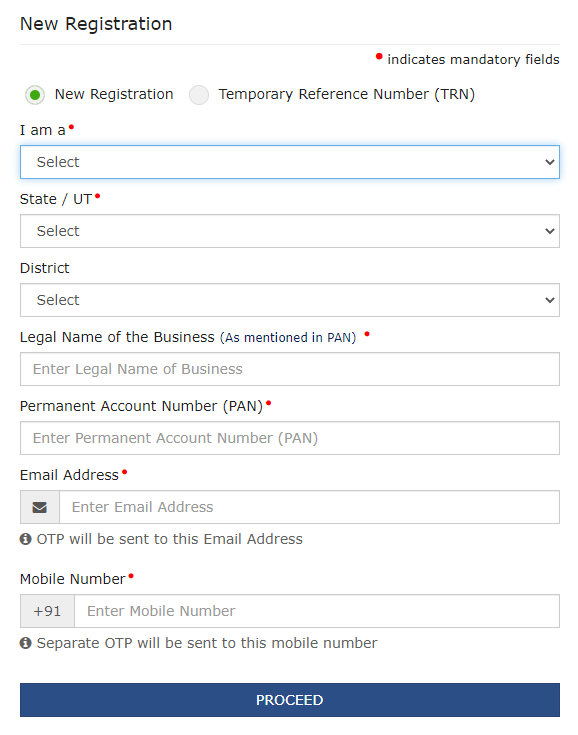

- Select the "New Registration" option and fill out the required details. Click “Proceed.”

- Next, the OTP verification page appears. Enter the two OTPs sent to the email ID and mobile number, then click "Proceed."

- The Temporary Reference Number (TRN) will be displayed on the screen. Make a note of the TRN for further use in the process.

- Go to the GST portal again and select "Register" from the "Taxpayers" option.

- Select "Temporary Reference Number (TRN)" and enter your TRN number and the captcha input. Click "Proceed".

- Next, complete the OTP verification through email and mobile and click “Proceed.”

- The next page will display the status of your application. Click on the edit icon in red to start the GST registration process.

- On the next page, submit the necessary documentation and business details to proceed to verification.

- Review the declaration on the “Verification” page and apply for DSC (Digital Signature Certificate) or EVC. You can also use the e-sign method, where the phone number associated with the Aadhaar card will receive an OTP.

- A success message will appear on the screen after completion. The registered email address and phone number will receive the Application Reference Number (ARN) and an acknowledgment. You can also check the ARN status using the GST Portal.

Popular Post

In the digital age, the convenience of accessing important documents online has become a necessity...

The Atalji Janasnehi Kendra Project that has been launched by the Government of Karnataka...

The Indian Divorce Act governs divorce among the Christian couples in India. Divorce...

When an individual has more than a single PAN card, it may lead to that person being heavily penalised, or worse,...

Employees Provident Fund (PF) is social security and savings scheme for employee in India. Employers engaged...