Last updated: March 14th, 2020 4:04 PM

Last updated: March 14th, 2020 4:04 PM

How to become a Paytm seller

Paytm backed by the Chinese Alibaba Group and a new entrant into the indian ecommerce market is fast growing backed by the innovative mobile wallet concept. Paytm which started by offering online mobile and DTH recharging services has evolved into a full blown ecommerce website offering a range of goods and services from electronics to bus ticket bookings. With the platform recording strong growth in sales and number of customers, now is the best time to become a seller on Paytm. In this article, we look at the procedure for becoming a Paytm seller and completing the Paytm seller registration process.

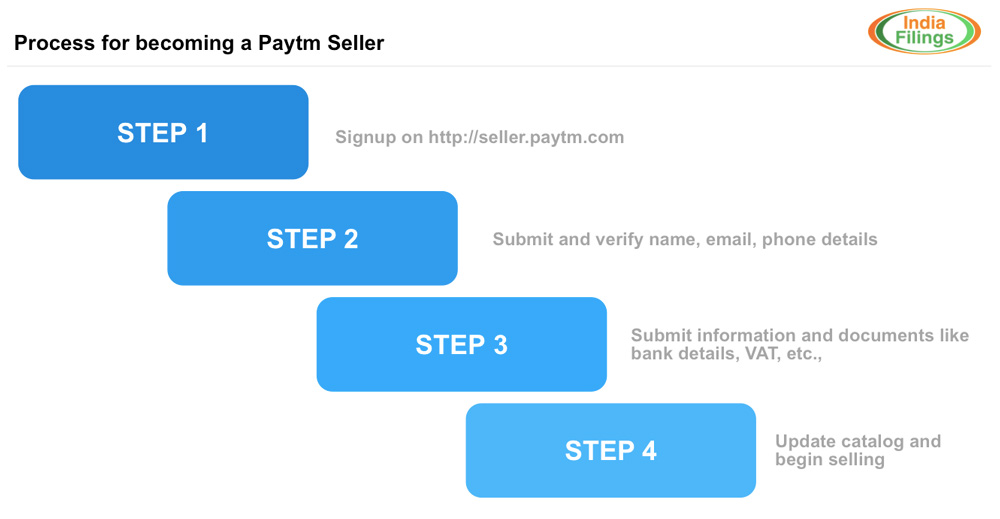

Process for becoming Paytm seller

Process for becoming Paytm seller

Why register as a Paytm Seller?

Ecommerce is witnessing a huge boom in India fueled by discounts and cash-backs. Paytm is the latest entrant into this market already having on board over 10 crore plus customers and 60,000 plus sellers serving 500 plus product categories across 39000 pin codes in India. By becoming a seller on Paytm, the merchant need not worry about developing and maintaining a ecommerce website; but, rather focus on fulfilling customer order quickly. Further, since becoming a seller on Paytm requires minimal or no investment, anybody could become a seller and gradually scale up. The following video from Paytm shows a Paytm Seller success story:

https://www.youtube.com/watch?t=61&v=OVi_pPhaXoAPaytm Seller Registration

Before starting to sell on Paytm, a seller must first complete the Paytm seller registration process on Paytm's website. Becoming a Paytm seller is free and the seller registration process takes only a few minutes.

Step 1: Go to Paytm seller registration. Step 2: Provide your name, phone, email and choose a password for the account. Step 3: Complete the email verification process. Step 4: Complete the mobile number verification process. Step 5: Update business information and address. Step 6: Provide KYC Documents (More on this below) Step 7: Approve the terms and conditions. Step 8: Update your catalog of products Step 9: Begin selling on PaytmDocuments required for Paytm seller registration

To complete the Paytm seller registration process, the following documents and information are required:Information & Documents Required

- Name of the Business

- Private Limited Company / Partnership / LLP / Proprietorship

- Phone number

- Email address

- Address

- PAN number

- PAN card scan copy

- Bank account number

- Account name

- Bank name

- Bank branch name

- Bank IFSC code

- Copy of cancelled cheque

- VAT registration

- In case VAT registration is not available, then the seller must submit a Paytm VAT registration undertaking.

- Scan copy of address proof

- Electricity bill

- Bank statement

- Aadhar card

- Passport copy

- Certificate of incorporation

- Rental agreement

Should I register a company or LLP for becoming a Paytm seller?

Serious sellers or those having an existing business venturing as a Paytm seller can register a private limited company or LLP while becoming a seller. Having a separate legal entity will ensure that the promoters are protected from any liability in case of any litigation. Since, most ecommerce sellers sell to consumers across India, it is recommended that they have limited liability protection.

Is VAT registration required to sell on Paytm?

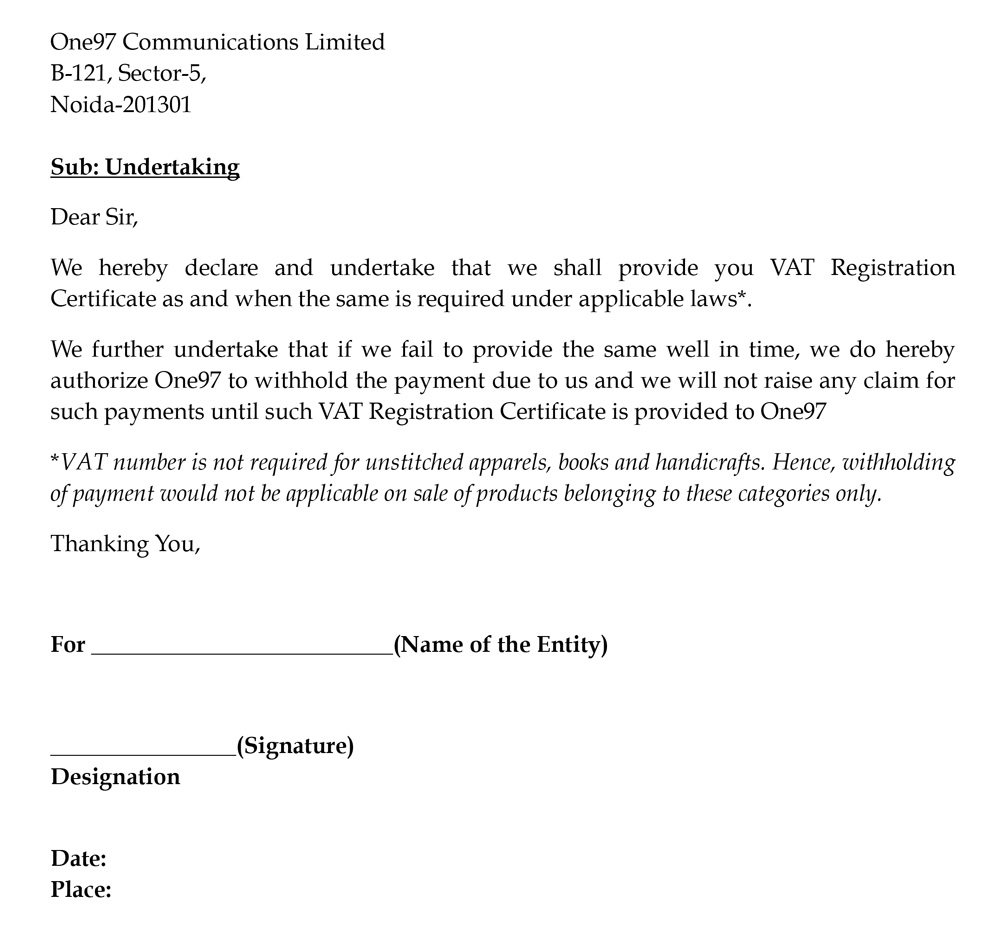

Yes, VAT registration is required for selling on Paytm. However, in case the seller only wishes to sell unstitched apparels, books and/or handicrafts, then VAT registration is not required. On the other hand, a seller can also begin selling on Paytm without a VAT registration by providing an undertaking to obtain VAT registration. However, Paytm will hold payments to the seller until VAT registration proof is submitted to Paytm.

[caption id="attachment_3383" align="aligncenter" width="1000"] Paytm undertaking to obtain VAT registration

Paytm undertaking to obtain VAT registration

Becoming a seller on other platforms

The basic documents for becoming a seller on most of the ecommerce platforms are the same. Hence, once a person becomes a seller on Paytm, he/she can also become a seller on Flipkart, Snapdeal and Amazon India to boost their revenue.

Popular Post

In the digital age, the convenience of accessing important documents online has become a necessity...

The Atalji Janasnehi Kendra Project that has been launched by the Government of Karnataka...

The Indian Divorce Act governs divorce among the Christian couples in India. Divorce...

When an individual has more than a single PAN card, it may lead to that person being heavily penalised, or worse,...

Employees Provident Fund (PF) is social security and savings scheme for employee in India. Employers engaged...