Last updated: September 11th, 2024 4:56 PM

Last updated: September 11th, 2024 4:56 PM

How to Close a LLP - Winding Up of LLP

LLP or Limited Liability Partnership is a new form of business entity introduced in India through the LLP Act, 2008. LLP enjoys audit exemption, if the annual turnover of the LLP is less than Rs.40 lakhs and/or the capital contribution is less than Rs.25 lakhs. This feature has made LLP popular amongst many entrepreneurs. However, due to a number of reasons, it may be necessary to close a LLP or windup a LLP. In this article, we cover the procedure for voluntary wingding up of LLP in India.

LLP Winding up Overview

A LLP winding up can be initiated voluntarily or by a Tribunal. If a LLP is to initiate winding up voluntarily, then the LLP must pass a resolution to wind up the LLP with approval of at least three-fourths of the total number of Partners. If the LLP has lenders, secured or unsecured, then the approval of the lenders would also be required for winding up of the LLP.

Winding up of LLP by Tribunal

Winding up of LLP can be initiated by a Tribunal for the following reasons:

- The LLP wants to be wound up.

- There are less than two Partners in the LLP for a period of more than 6 months.

- The LLP is not in a position to pay its debts.

- The LLP has acted against the interests of the sovereignty and integrity of India, the security of State or public order.

- The LLP has not filed with the Registrar Statement of Accounts and Solvency or LLP Annual Returns for any five consecutive financial years.

- The Tribunal is of the opinion that it is just and equitable that the LLP should be wound up.

Winding Up of LLP Procedure

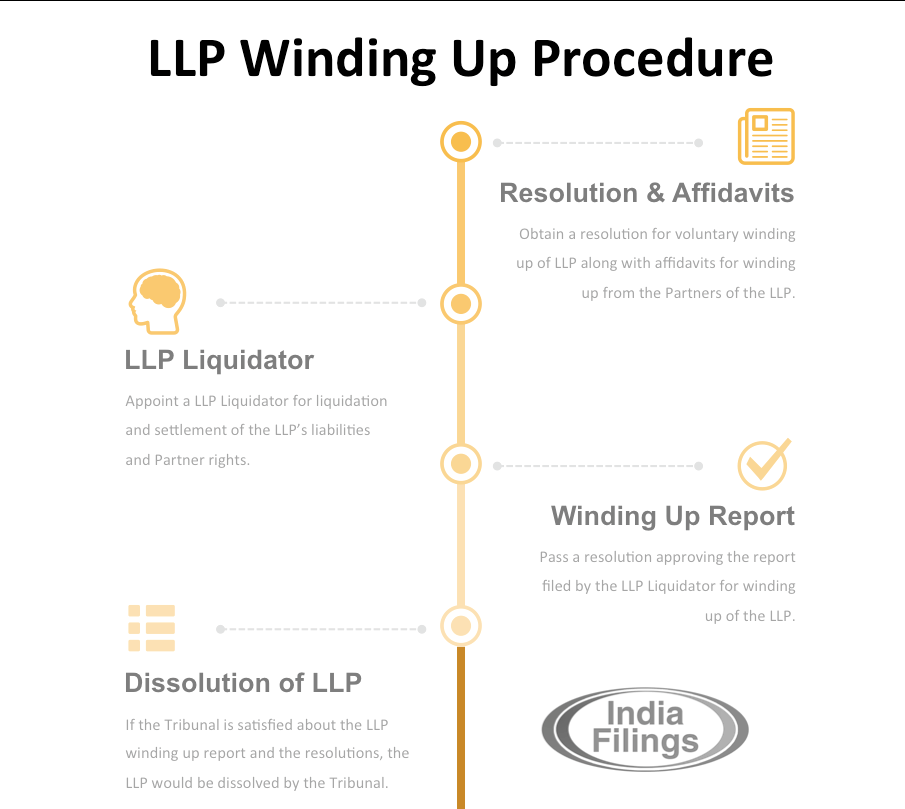

[caption id="attachment_2334" align="aligncenter" width="819"] LLP Winding Up Procedure

LLP Winding Up Procedure

To begin the process for winding up of LLP, a resolution for winding up of LLP must be passed and filed with the Registrar within 30 days of passing of the resolution. On the date of passing of resolution of winding up of LLP, the voluntary winding up shall be deemed to commence.

Once, the resolution for winding up of LLP is filed with the Registrar, the majority of Partners (not less than two) shall make a declaration verified by an Affidavit to the effect that the LLP has no debt or that it will be in a position to pay its debts in full within a period, as mentioned in the declaration, but not exceeding one year from the date of commencement of winding up of LLP. Along with the Affidavit signed by the majority Partners, the following documents must be filed with the Registrar within 15 days of passing of the resolution for winding up of LLP:

- Statement of assets and liabilities for the period from last accounts closure to date of winding up of LLP attested by atleast two Partners

- Report of valuation of the assets of the LLP prepared by a valuer, if there are any assets in the LLP.

Winding up of LLP with Creditors

If a LLP under winding up has any secured or unsecured creditors, then before taking any action for winding up of LLP, the approval for winding up of LLP must be requested from the creditors. Creditors are required to provide their opinion on winding up of LLP within 30 days of receipt of request for approval for winding up. If it is in the interest of all partners and all creditors that the LLP be wound up, then the LLP can proceed with voluntary winding up procedure.

Appointment of LLP Liquidator

A LLP Liquidator must be appointed within thirty days of passing of resolution of voluntary winding up through a resolution. In case there are any creditors, then the appointment of LLP Liquidator shall be valid only if it is approved by two thirds of the creditors in value of the LLP.

It is then the duty of the LLP Liquidator to perform the functions and duties for winding up of LLP. The LLP Liquidator would settle the creditors and adjust the rights of the partners, as the case may be. While discharging his duties, the LLP Liquidator is required to maintain proper books of accounts pertaining to the winding up of the LLP.

Filing of Winding Up Report by LLP Liquidator

Once, the affairs of the LLP is fully wound up, the LLP Liquidator would prepare a report stating the manner in which the winding up of LLP has been conducted and property of the LLP has been disposed off. If two thirds of the number of Partners and Creditors in value are satisfied with the winding up report prepared by the LLP Liquidator, then a resolution for winding up of accounts and explanation for dissolution must be passed by the Partners.

The LLP Liquidator must then send the LLP winding up report along with the resolution to the Registrar and file an application with the Tribunal.

Dissolution of the LLP

If the Tribunal is satisfied that procedures have been followed in winding up of the LLP, then the Tribunal would pass an order that the LLP shall stand dissolved. The LLP Liquidator is required to file the copy of the order from the Tribunal with the Registrar for winding up of LLP. The Registrar on receiving the copy of the order passed by the Tribunal for winding up of LLP would publish a notice in the Official Gazette that the LLP stands dissolved.

For more information about Private Limited Company Registration, LLP Registration or LLP Winding Up, visit IndiaFilings.com or talk to an IndiaFilings Business Advisor.

Popular Post

In the digital age, the convenience of accessing important documents online has become a necessity...

The Atalji Janasnehi Kendra Project that has been launched by the Government of Karnataka...

The Indian Divorce Act governs divorce among the Christian couples in India. Divorce...

When an individual has more than a single PAN card, it may lead to that person being heavily penalised, or worse,...

Employees Provident Fund (PF) is social security and savings scheme for employee in India. Employers engaged...