Updated on: March 14th, 2020 4:05 PM

Updated on: March 14th, 2020 4:05 PM

How to Create an Invoice?

Creating, issuing and tracking invoices is an important part of doing business and essential for having steady cashflow into the business. Hence, it is important for all Entrepreneurs to know how to create an invoice and the basic contents included in an invoice. In this article, we review the process for creating an invoice in India?Why Create an Invoice?

Creating an invoice is required to indicate the items or services provided and the rates applicable to various stakeholders. An invoice is required to collect payment from the customer, account for sales, create financial statements and pay proper taxes to the government. Further, invoices also serve as a supporting document for a registered dealer and can be used to claim input service tax or VAT credit. Hence, invoicing plays a key role in any business.Contents of an Invoice

All invoices must contain the following elements:- Name, address and registration number (service tax or VAT or others) of the supplier

- Name, address and registration number of the buyer

- Date of invoice

- Nature of goods or services supplied or rendered

- Quantity of goods or service supplied or rendered

- Value of goods or services supplied or rendered

- Rate of taxes (service tax or VAT), as applicable

- Discount offered, if any

- Total amount excluding taxes

- Total taxes payable

- Total amount including taxes

When to Create an Invoice?

Invoice can be created once the supply of goods / service is made or advance for supply of goods / service is received. In case of continuous supply of goods or service, invoice can be raised within a prescribed period from the date of completion of a milestone or as per agreement. It is best to create an invoice as early as possible to ensure timely payment is made by the buyer. However, it is important to note that once an invoice is created, a tax liability is also created. Hence, it is recommended that invoice be raised only for those good/services for which payment is likely or has already been made.Invoice Format

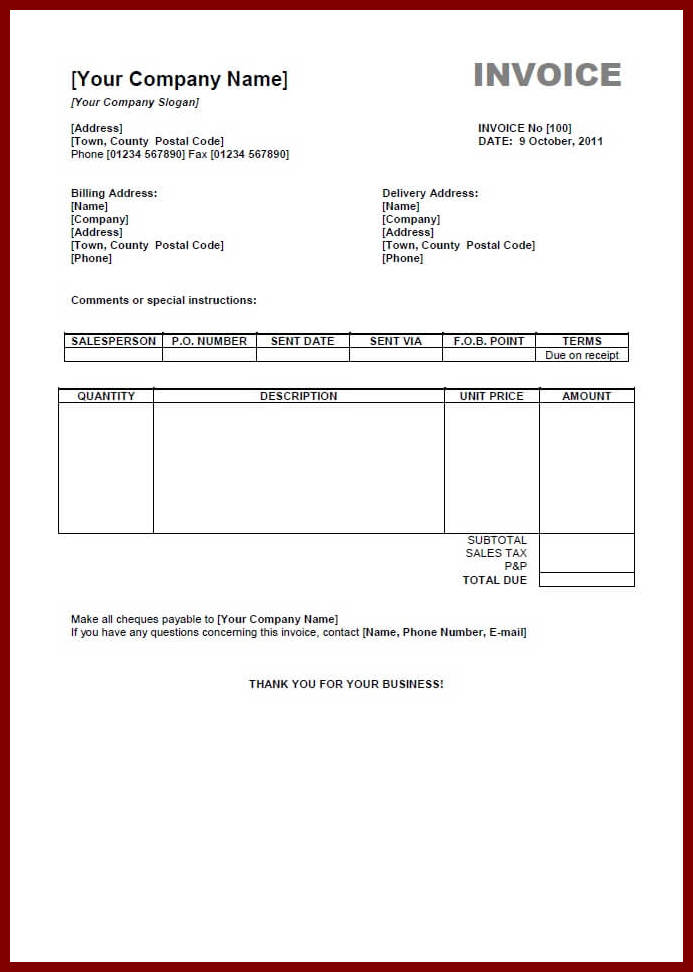

Invoice can be issued to the buyer in either electronic or printed format. There are no specific format specified by the Government. However, all invoices must have the essential details listed above as mandated by law. Further, all invoices must have a serial number and the same serial number must not be used in more than one invoice. [caption id="attachment_8367" align="aligncenter" width="693"] Invoice Format

Invoice Format

Invoicing Best Practices

- Invoices can be raised in triplicate with an original provided to the buyer, duplicate for transporter, triplicate for supplier and an extra copy, if required.

- All invoices must be supported by purchase order of the buyer, packing list (if applicable) and delivery challan.

- Invoice should be authenticated by an authorised signatory of the supplier.

Popular Post

In the digital age, the convenience of accessing important documents online has become a necessity...

The Atalji Janasnehi Kendra Project that has been launched by the Government of Karnataka...

The Indian Divorce Act governs divorce among the Christian couples in India. Divorce...

When an individual has more than a single PAN card, it may lead to that person being heavily penalised, or worse,...

Employees Provident Fund (PF) is social security and savings scheme for employee in India. Employers engaged...