Last updated: March 13th, 2023 8:38 PM

Last updated: March 13th, 2023 8:38 PM

How to get a Business Loan under CGTMSE Scheme without Collateral

The CGTMSE Scheme is an important scheme that every Indian Entrepreneur and Business Owners must know about and understand. To start and manage a business, the availability of an investment in the form of debt or equity is a must and CGTMSE scheme provides easy access to debt funds. In this article, we look at the CGTMSE Scheme in detail and the process for obtaining a bank loan without collateral:

CGTMSE Organization

Availability of bank loan without any collateral is a major requirement for boosting first Generation Entrepreneurship in India. To help millions of first-generation Entrepreneurs start their business with a bank loan (without the hassles of collateral), the Ministry of Micro, Small & Medium Enterprises (MSME) launched the CGTMSE Scheme. The CGTMSE scheme or Credit Guarantee Fund Trust for Micro and Small Enterprises (CGTMSE) is operationalized by SIDBI and the Government of India.

CGTMSE Scheme

The main objective of the CGTMSE scheme is that banks should give importance to project viability or business model validation and secure the loan facility only based on the assets financed by the bank loan. In the event a Micro or Small Business (MSME), which availed loan under the CGTMSE scheme, fails to repay the loan commitment to the bank, the CGTMSE organization would make good the loss incurred by the bank up to 85% of the credit facility.

Under the CGTMSE scheme, a bank loan of up to Rs.1 crore provided to a startup or an existing business in the form of term loan or working capital or both can be covered. Businesses in the manufacturing sector and service sector are eligible. However, retail trade, educational institutions, agriculture, Self Help Groups (SHGs) and training institutions will not be eligible to obtain a loan under CGTMSE Scheme.

CGTMSE Scheme Cover

For a loan to be covered under the CGTMSE Scheme, the borrower is required to pay an additional CGTMSE Guarantee and CGTMSE Service fee on top of the interest rate charged by the Bank. Presently, CGTMSE guarantee fee is payable at 1.5% (0.75% in case of North Eastern Region including the state of Sikkim) on the credit facility agreed to be covered by the CGTMSE Scheme. Similarly, the CGTMSE annual service fee would be payable @0.75% on the guaranteed amount. However as per the "Policy package for stepping up credit to Small and Medium Enterprises", Public Sector Banks are encouraged to absorb the Annual Service Fee in excess of 0.25% p.a. for all the borrowers falling under the following categories:

- Loans of up to Rs. 2.00 lakh;

- Loans provided to eligible women entrepreneurs;

- Loans provided to eligible borrowers located in the North Eastern Region (including the State of Sikkim) and Jammu & Kashmir.

How to get Loan under CGTMSE Scheme

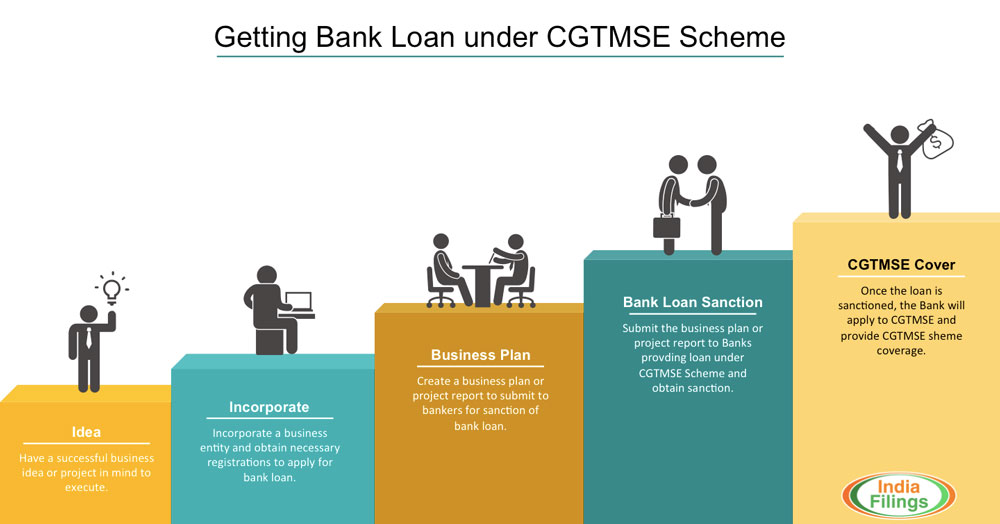

To get a loan under CGTMSE Scheme without any collateral security, the following steps must be followed: [caption id="attachment_2348" align="aligncenter" width="744"] Process for getting bank loan under CGTMSE Scheme

Process for getting bank loan under CGTMSE Scheme

Business Entity Formation

Prior to applying for a loan under the CGTMSE Scheme, incorporate a Private Limited Company or LLP or One Person Company or Proprietorship, as per the requirements of the business and obtain the necessary tax registrations and approvals for doing business / executing the project.

Prepare Business Plan or Project Report

Conduct a market analysis for the market and prepare a business plan or project report containing information like business model, promoter profile, projected financials, etc., It is important that the business plan or project report is prepared by professionals with prior experience, as "The main objective of the CGTMSE scheme is that banks should give importance to project viability or business model validation and secure the loan facility without any collateral.". IndiaFilings can help you prepare a business plan or project report as per the CGTMSE Scheme.

Obtain Sanction for Bank Loan

Submit the business plan or project report with the necessary banks that provide loan under CGTMSE Scheme and request for sanction of bank loan from Banks providing loan under CGTMSE Scheme. The request for a bank loan can contain term loan and working capital facilities. The banks will process the loan application and accord sanction as per the Bank's policy.

Obtaining CGTMSE Cover

Once the bank loan is sanctioned by the Bank, the bank will apply to CGTMSE organization and obtain CGTMSE scheme cover for the loan sanctioned. Once approved by the CGTMSE organization, the loan will be under the CGTMSE scheme and the borrower will be required to pay the CGTMSE guarantee and CGTMSE service fee.

Note: To obtain a loan under CGTMSE Scheme, visit IndiaFilings.com and talk to an IndiaFilings Loan Advisor.

List of Banks providing business loan under CGTMSE Scheme

- Allahabad Bank

- Allahabad UP Gramin Bank

- Andhra Bank

- Andhra Pradesh Grameena Vikas Bank

- Andhra Pradesh State Financial Corporation

- Andhra Pragathi Grameena Bank

- Aryavart Gramin Bank

- Assam Gramin Vikash Bank

- Axis Bank Limited

- Baitarani Gramya Bank

- Ballia Etawah Gramin Bank

- Bangiya Gramin Vikash Bank

- Bank of Bahrain and Kuwait

- Bank of Baroda

- Bank of India

- Bank of Maharashtra

- Barclays Bank Plc

- Baroda Gujarat Gramin Bank

- Baroda Rajasthan Gramin Bank

- Baroda Uttar Pradesh Gramin Bank

- Bharatiya Mahila Bank

- Bihar Kshetriya Gramin Bank

- Canara Bank

- Catholic Syrian Bank

- Cauvery Kalpatharu Grameena Bank

- Central Bank of India

- Chaitanya Godavari Grameena Bank

- Chattisgarh Gramin Bank

- Chikmagalur-Kodagu Gramin Bank

- City Union Bank

- Corporation Bank

- Deccan Gramin Bank

- Delhi Financial Corporation

- Dena Bank

- Dena Gujarat Gramin Bank

- Deutsche Bank

- Development Credit Bank

- Durg Rajnandgaon Gramin Bank

- Export Import Bank of India

- Guargaon Gramin Bank

- Hadoti Kshetriya Gramin Bank

- Haryana Gramin Bank

- HDFC Bank Limited

- Himachal Gramin Bank

- ICICI Bank Limited

- IDBI Bank Limited

- Indian Bank

- Indian Overseas Bank

- IndusInd Bank

- ING Vysya Bank

- Jaipur Thar Gramin Bank

- Jammu & Kashmir Development Finance Corporation

- Jammu & Kashmir Gramin Bank

- Jharkhand Gramin Bank

- Karnataka Bank

- Karnataka Vikas Grameena Bank

- Kashi Gomti Samyut Gramin Bank

- Kerala Financial Corporation

- Krishna Grameena Bank

- Lakshmi Vilas Bank

- Langpi Dehangi Rural Bank

- Madhya Bharat Gramin Bank

- Madhya Bihar Gramin Bank

- Maharashtra Gramin Bank

- Malwa Gramin Bank

- Meghalaya Rural Bank

- MGB Gramin Bank

- Mizoram Rural Bank

- Nainital-Almora Kshetriya Gramin Bank

- Narmada Malwa Gramin Bank

- National Small Industries Corporation Limited

- Neelachal Gramya Bank

- North Eastern Development Finance Corporation Limited

- North Malabar Gramin Bank

- Oriental Bank of Commerce

- Pallavan Gramin Bank

- Pandyan Grama Bank

- Parvatiya Gramin Bank

- Pragathi Gramin Bank

- Prathama Bank

- Puduvai Bharathiar Grama Bank

- Punjab & Sind Bank

- Punjab Gramin Bank

- Punjab National Bank

- Purvanchal Gramin Bank

- Rajasthan Gramin Bank

- Rewa Siddhi Gramin Bank

- Rushikulya Gramya Bank

- Samastipur Kshetriya Gramin Bank

- Saptagiri Grameena Bank

- Sarva UP Gramin Bank

- Satpura Narmada Kshetriya Gramin Bank

- Saurashtra Gramin Bank

- Sharda Gramin Bank

- Shreyas Gramin Bank

- Small Industries Development Bank of India [SIDBI]

- South Malabar Gramin Bank

- Standard Chartered Bank

- State Bank of Bikaner & Jaipur

- State Bank of Hyderabad

- State Bank of India

- State Bank of Mysore

- State Bank of Patiala

- State Bank of Travancore

- Surguja Kshetriya Gramin Bank

- Sutlej Gramin Bank

- Syndicate Bank

- Tamilnadu Mercantile Bank

- The Dhanalakshmi Bank

- The Federal Bank

- The Jammu & Kashmir Bank

- The Karur Vysya Bank

- The Nainital Bank

- The Ratnakar Bank

- The South Indian Bank

- The Tamil Nadu Industrial Investment Corporation [TIIC]

- Tripura Gramin Bank

- Triveni Kshetriya Gramin Bank

- UCO Bank

- Union Bank of India

- United Bank of India

- Uttar Bihar Gramin Bank

- Uttaranchal Gramin Bank

- Uttarbanga Kshetriya Gramin Bank

- Vananchal Gramin Bank

- Vidharbha Kshetriya Gramin Bank

- Vidisha Bhopal Kshetriya Gramin Bank

- Vijaya Bank

- Visveshvaraya Grameena Bank

- Wainganga Krishna Gramin Bank

- Yes Bank

How IndiaFilings can help you get loan under CGTMSE Scheme

[embed]https://vimeo.com/102423613[/embed]Popular Post

In the digital age, the convenience of accessing important documents online has become a necessity...

The Atalji Janasnehi Kendra Project that has been launched by the Government of Karnataka...

The Indian Divorce Act governs divorce among the Christian couples in India. Divorce...

When an individual has more than a single PAN card, it may lead to that person being heavily penalised, or worse,...

Employees Provident Fund (PF) is social security and savings scheme for employee in India. Employers engaged...