Last updated: December 17th, 2019 5:11 PM

Last updated: December 17th, 2019 5:11 PM

How to Obtain Service Tax Registration Online

Service tax registration is required for any person or entity providing taxable services of over Rs.9 lakh. Service tax registration helps the Service Tax Department identify assesses and track all aspects of service tax compliance. For the assesse, service tax registration is required to deposit service tax, file service tax returns and maintain compliance with service tax regulations. Failure to obtain service tax registration would attract penalty in terms of section 77 of the Finance Act, 1994.

Documents Required for Obtaining Service Tax Registration

The following documents are required for obtaining service tax registration in India:

- Self-attested copy of the PAN Card of the Proprietor or Company or LLP or Legal entity;

- Photograph and proof of identity of the person filing the service tax registration application

- PAN card;

- Passport;

- Voter Identity Card;

- Aadhar Card;

- Driving license;

- Any other Photo-identity card issued by the Central Government, State Government or Public Sector Undertaking.

- Address proof for the address submitted along with proof of ownership, lease or rent agreement, allotment letter from Government.

- No Objection Certificate from the legal owner.

- Bank Account Details

- Memorandum of Association (For Company)

- Articles of Association (For Company)

- List of Directors (For Company)

- Authorisation by the Board of Directors/Partners/Proprietor for the person filing the application.

- Business transaction numbers obtained from other Government departments or agencies such as Customs Registration No. (BIN No), Import Export Code (IEC) number, State Sales Tax Number (VAT), Central Sales Tax Number, Company Index Number (CIN) which have been issued prior to the filing of the service tax registration application.

Procedure for Applying for Service Tax Registration

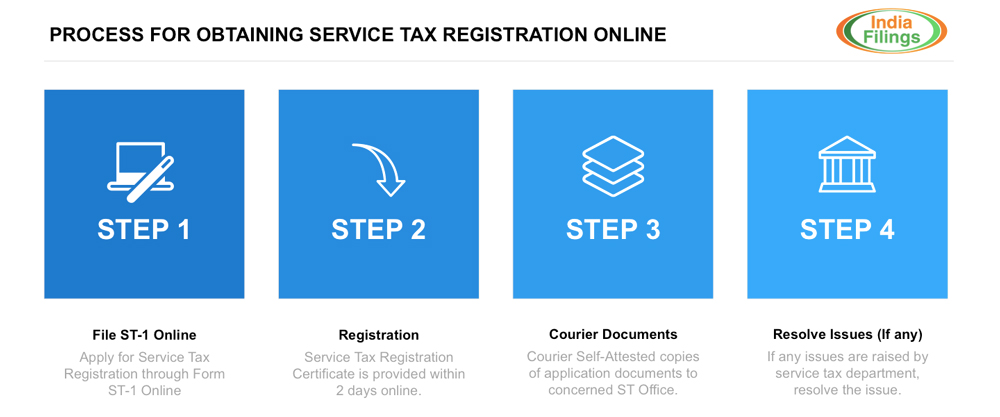

Process for obtaining service tax registration online

Process for obtaining service tax registration online

To obtain service tax registration, the applicant can file the ST-1 application for service tax through the Automation of Central Excise and Service Tax (ACES) website. The documents listed above along with the requisite information must be submitted online.

On filing the ST-1 service tax registration application online, the applicant must submit a self attested copy of the above documents by registered post/speed Post to the concerned Division, within 7 days for the purposes of verification.

If the documents and information submitted are acceptable, service tax registration would be granted within 2 days of filing ST-1 online - based on trust. The service tax applicant can use the electronic service tax registration certificate as proof of registration and begin electronic payment of taxes.

In case there is a need for verification of the premises or documents submitted, the same can be requested by an authorised Service Tax Officer. Further, under the following circumstances, the service tax registration certificate may be revoked by the service tax department:

- The premises are found to be non existent or not in possession of the assessee.

- No documents are received within 15 days of the date of filing the registration application.

- The documents are found to be incomplete or incorrect in any respect.

Therefore, care must be taken while applying for service tax registration online. IndiaFilings can help you easily obtain service tax registration online.

Popular Post

In the digital age, the convenience of accessing important documents online has become a necessity...

The Atalji Janasnehi Kendra Project that has been launched by the Government of Karnataka...

The Indian Divorce Act governs divorce among the Christian couples in India. Divorce...

When an individual has more than a single PAN card, it may lead to that person being heavily penalised, or worse,...

Employees Provident Fund (PF) is social security and savings scheme for employee in India. Employers engaged...