Last updated: December 17th, 2024 4:21 PM

Last updated: December 17th, 2024 4:21 PM

HSN Code on Invoice

Under GST Invoice Rules and Format, suppliers are required to mandatorily display the HSN code or SAC code of the goods or services supplied on an invoice. However, in order to make compliance easier for small and medium-sized enterprises, the requirement for disclosing HSN code on invoice has been relaxed. In this article, we look at the rules concerning the display of HSN code on the invoice in detail.What is the HSN Code?

HSN Code acts as an internationally accepted goods classification system, used in over 200 countries. Under the HSN code system, goods have been classified into 97 different chapters. HSN code consists of 6 digits. The first two digits of the HSN codes represent the HSN code chapter. The heading of the goods is represented in the third and fourth digit of the HSN code. The sub-heading of the goods is represented in the fifth and sixth digit of the HSN code. With the HSN code acting as a universal classification for goods, the Indian Government has decided to adopt the use of HSN code for classification of goods under GST and levy of GST. Find HSN Code and GST Rate for all goods.GST Tax Invoice Format

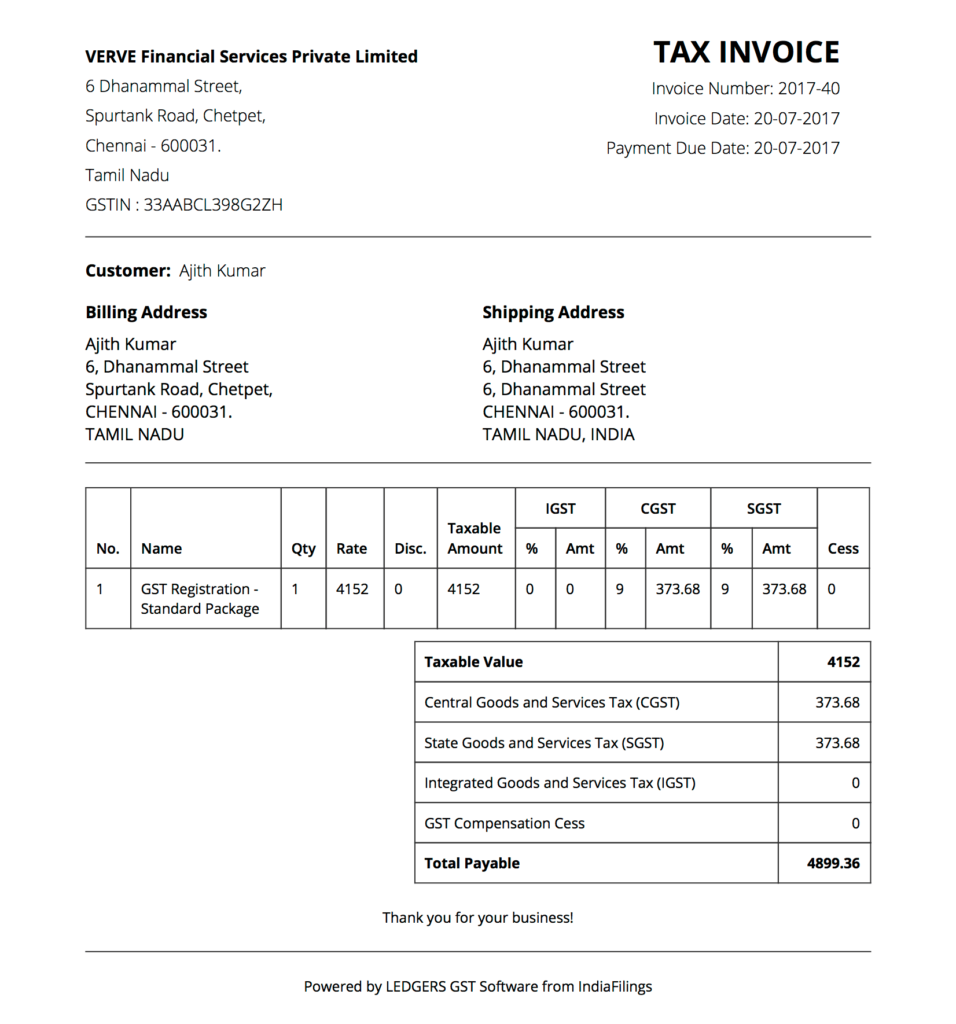

According to the GST rules and regulations, all suppliers of goods or services should issue a tax invoice mandatorily, when the value of supply exceeds Rs.200. The tax invoice issued by the supplier under GST should contain the following information:- Name, address and GSTIN of the supplier.

- Invoice number not exceeding sixteen characters.

- Date of the tax invoice.

- Name, address and GSTIN of the customer, if available.

- HSN code for goods or SAC code for services.

- Description of goods or services.

- Quantity supplied.

- Total value of supply.

- Taxable value of the supply.

- Rate and amount of GST

- Place of supply

Sample GST Invoice

Also read: Transfer of GST Input Tax Credit

Sample GST Invoice

Also read: Transfer of GST Input Tax Credit

HSN Code on Invoice

Many small businesses might find it cumbersome to find and update HSN code for the goods supplied. Hence, to reduce the compliance burden of small businesses, the GST Council has relaxed the requirement for displaying HSN code on invoices based on the sales turnover. As per Notification No. 12/2017 – Central Tax dated 28th June 2017, the concerned individual shall display the HSN code on the invoice by the following:- Entities having less than Rs.1.5 crores annual turnover in the preceding financial year will not be required to display the codes on the invoice.

- Entities having Rs.1.5 crores to Rs.5 crores annual turnover in the preceding financial year will be required to display the first two-digit (Chapter) of the HSN code on the invoice.

- Entities having more than Rs.5 crore as annual turnover in the preceding financial year should display the first two-digit (Chapter) and chapter heading of the HSN code on the invoice. Thus, only entities having more than Rs.5 crore of annual turnover shall display 4 digit the codes as displayed in the invoice.

Popular Post

In the digital age, the convenience of accessing important documents online has become a necessity...

The Atalji Janasnehi Kendra Project that has been launched by the Government of Karnataka...

The Indian Divorce Act governs divorce among the Christian couples in India. Divorce...

When an individual has more than a single PAN card, it may lead to that person being heavily penalised, or worse,...

Employees Provident Fund (PF) is social security and savings scheme for employee in India. Employers engaged...