Last updated: December 17th, 2019 4:41 PM

Last updated: December 17th, 2019 4:41 PM

ICICI Bank Loan Against Property

A loan against property is a convenient way to fund business if the promoters have a property available that can be pledged. A loan against property can be raised easily by giving residential or commercial property as collateral security to ICICI bank. The funds raised by way of loan against property can be used for business or personal needs. The ICICI customer can avail loan against property with comfortable EMIs with a long tenure of up to 15 years. In this article, we will look at the ICICI Bank Loan Against Property in detail. Know more about the Bank Loan for Startup BusinessPurpose of Loan Against Property

The business loan against the property can be obtained for the following purposes:- To meet the credit needs of the business or commercial activity

- To purchase a plot of land for the construction of premises for business

- For repayment of existing loan availed from other banks or Financial Institutions (FI) conforming to the extant guidelines regarding the takeover of account.

- To undertake repairs, renovation, an extension to the commercial property

- For business expansion

- Long-term working capital

- For purchasing equipment for the unit

Eligibility Criteria

The following persons are eligible to get the business loan against property:- People engaged in trade, commerce and business

- Professionals/Salaried Employees

- Self-employed

- Minimum Age of Borrower: 25 Years

- Maximum Age of Borrower: 65 Years or retirement age whichever is earlier

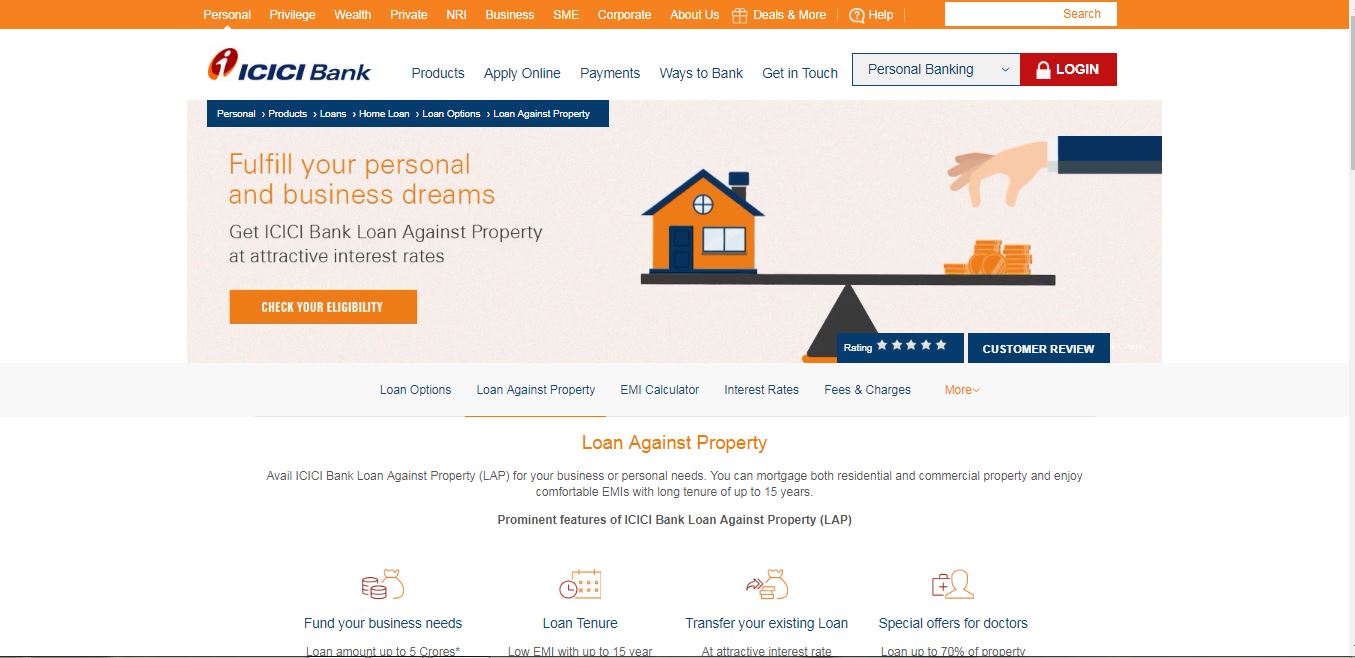

Image 1 ICICI Bank Loan Against Property

The borrower has to fill out the form given on the official website. The applicant is required to furnish the details of Name, Mobile number, Email ID, Date of Birth, Address, Approximate property value, Monthly income and EMI of existing loans.

Image 1 ICICI Bank Loan Against Property

The borrower has to fill out the form given on the official website. The applicant is required to furnish the details of Name, Mobile number, Email ID, Date of Birth, Address, Approximate property value, Monthly income and EMI of existing loans.

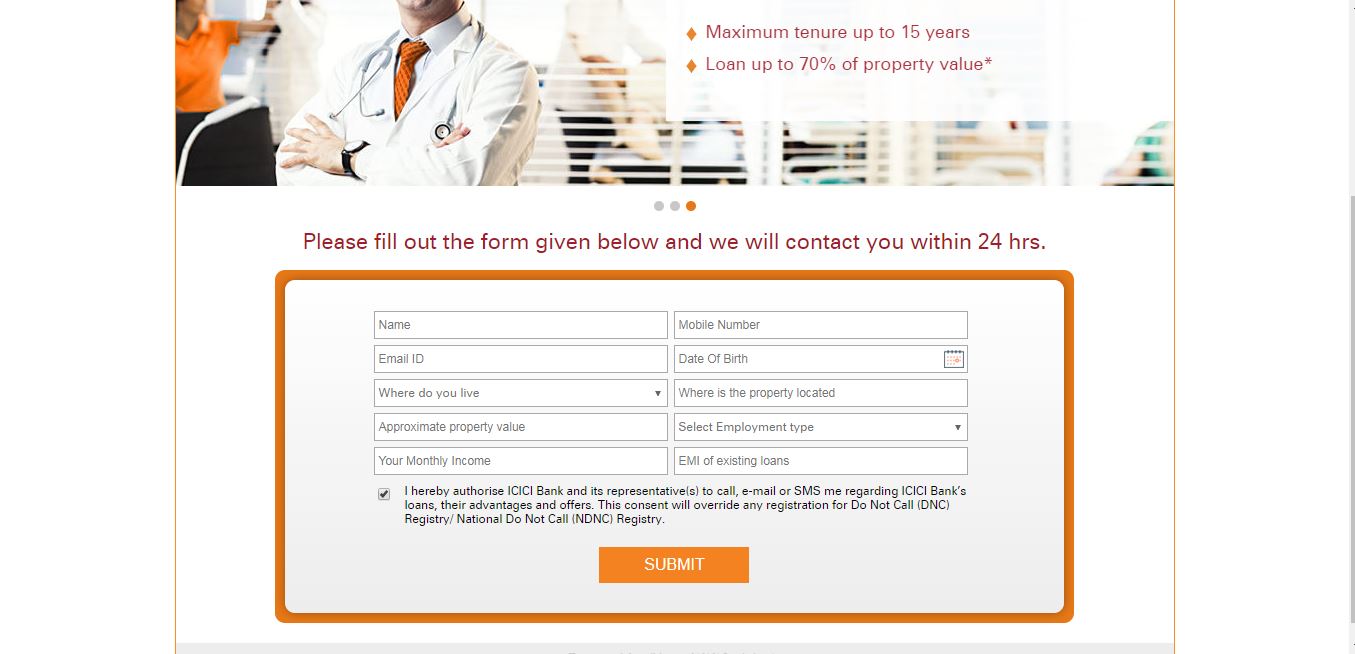

Image 2 ICICI Bank Loan Against Property

ICICI bank executive will contact the borrower within 24 hrs.

Image 2 ICICI Bank Loan Against Property

ICICI bank executive will contact the borrower within 24 hrs.

Amount of Loan

The minimum and maximum amount of loan against property can be acquired as specified below: Minimum: The minimum loan amount of Rs. 10 lakhs can be obtained. Maximum: The maximum loan amount of up to Rs. 5 crores can be obtained.Tenure Details

ICICI bank offers business loan against property with comfortable EMIs with a long tenure of up to 15 years.Assessment of Loan Amount

The ICICI Bank Loan amount against the property will be assessed based on the financials of the customer and the value of the property being offered as collateral.Type of Property to be Mortgaged

The applicant can mortgage both residential and commercial property for availing ICICI loan against property. However, the property should be free from any charge, i.e. there should be no other loan running on the property offered as a security for a loan against property.Overdraft Facility

The eligible customer can avail up to 90% of the total loan against property as an overdraft.Percentage of Property Value for Loan

The ICICI customer can avail up to 70% of the property value as a loan against property. However, the amount will depend on the property type and other checks.ICICI Bank Loan Against Property EMI Calculator

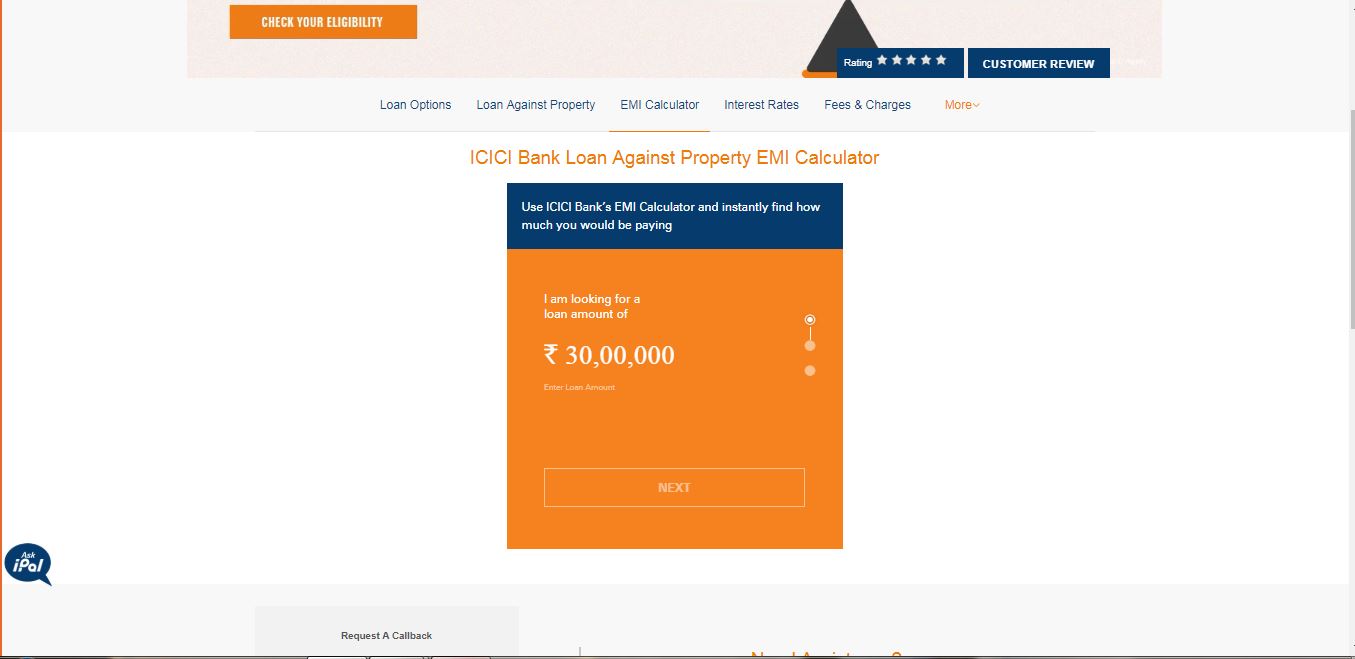

Use ICICI Bank’s EMI Calculator and instantly find how much you would be paying for a loan against property: Access the official website of ICICI ban and then select the EMI Calculator option. Enter the loan amount By clicking on the next button; you will be required to enter the tenure details. Image 3 ICICI Bank Loan Against Property

Provide the interest rate; the monthly EMI details will be displayed on the screen as depicted in the image:

Image 3 ICICI Bank Loan Against Property

Provide the interest rate; the monthly EMI details will be displayed on the screen as depicted in the image:

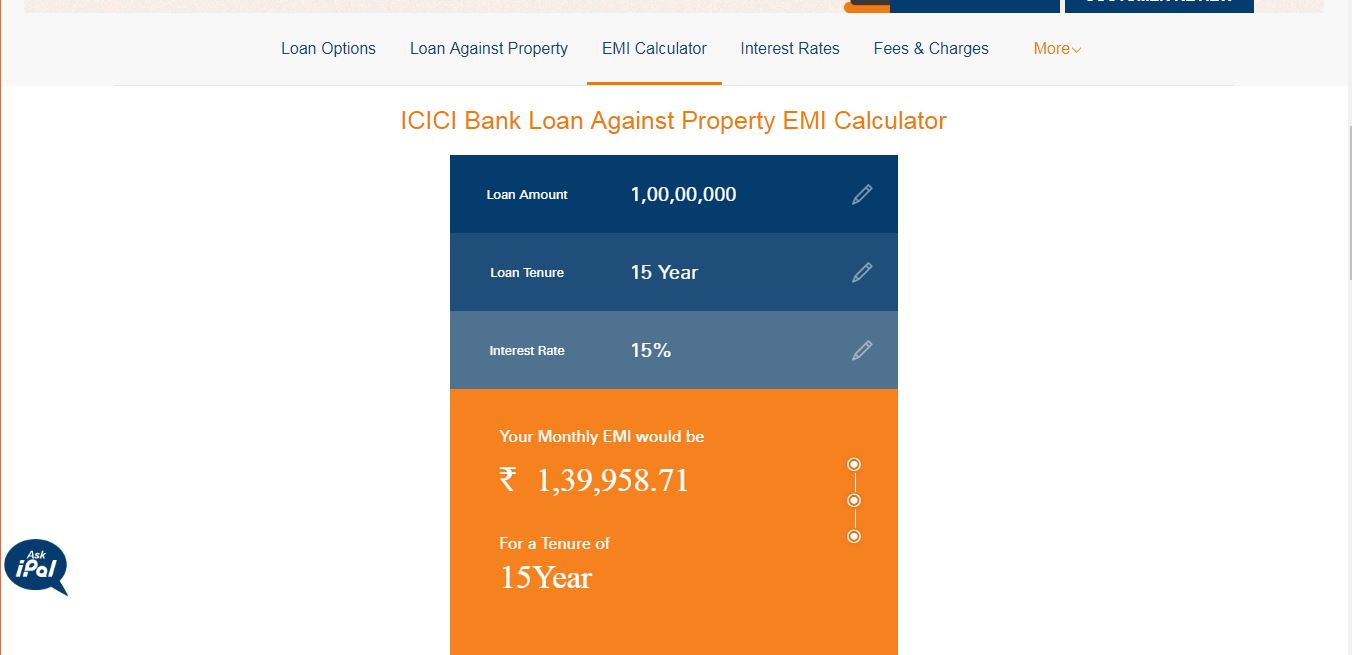

Image 4 ICICI Bank Loan Against Property

Image 4 ICICI Bank Loan Against Property

Interest Rates

The interest rates for ICICI bank loan against property is explained in detail below:The interest rate for Self - Employed Borrower

| Sl.No | Slab | Floating Interest Rate | Fixed Interest Rate |

| 1 | Up to 50 Lakhs | 10.30% | 11.95% |

| 2 | 50 lakhs to 1 crore | 10.25% | 11.95% |

| 3 | More than 1 Crore | 10.20% | 11.95% |

The interest rate for Salaried Borrower

| Sl.No | Slab | Floating Interest Rate | Fixed Interest Rate |

| 1 | Up to 50 Lakhs | 10.30% | 11.95% |

| 2 | 50 lakhs to 1 crore | 10.25% | 11.95% |

| 3 | More than 1 Crore | 10.20% | 11.95% |

The interest rate for ICICI Group / Infosys Employees

| Sl.No | Slab | Floating Interest Rate |

| 1 | Up to 50 Lakhs | 9.85% |

| 2 | 50 lakhs to 1 crore | 9.85% |

| 3 | More than 1 Crore | 9.85% |

Fees

Following are all the fees applicable while availing the ICICI bank loan against property:| Sl.No | Fees & Charges | |

| 1 | Loan Processing Charges / Renewal Charges | 1.00 % + Applicable taxes |

| 2 | CIBIL Report Charges | Rs.50 + Applicable taxes |

| 3 | Administrative Charges | Rs. 5000 + Applicable taxes or 0.25% + Applicable taxes (whichever is lower) |

| 4 | ICICI Group | NIL |

Pre-Payment Charges

The Pre-payment charges mentioned below are applicable on full repayment of the loan. The charges will be deliberated on the principal outstanding on the property loan closure date- Floating Rate of Interest – 4% + Applicable Charges

- Fixed Rate of Interest - 4% + Applicable Charges

Conversion Charge

| Floating to Floating | Dual Fixed Rate to Floating | Floating to Dual Fixed Rate | Lifetime Fixed to Floating |

| 0.5 % of the Outstanding + applicable taxes | 0.5 % of the outstanding + applicable taxes | 0.5 % of the outstanding + applicable taxes | 1.75 % of the outstanding + applicable taxes |

Other Charges

| Sl.No | Other Charges | |

| 1 | Repayment Mode Swap Charges | Rs.500 |

| 2 | Documents Retrieval Charges | Rs.500 |

| 3 | Cheque / AD / ECS / Bounce Charges | Rs.500 |

| 4 | Duplicate No Objection Certificate / No Due Certificate | Rs.100 |

| 5 | Revalidation of No Objection Certificate | Rs.100 |

| 6 | Late payment chargers - Home Loan | 2% per month |

Documents Required

Following documents need to be furnished to get the ICICI bank loan against property:KYC and other documents

- Application Form with photograph duly signed

- Identity, residence and age proof

- Processing fee cheque

- Office address proof

- Copy of title documents for the property being mortgaged

- Proof of business stability/existence

- Business profile

Income documents

- Latest 6 months’ bank statement (salary account for salaried, Current Account for self-employed)

- Latest 3 months’ salary slips

- Form 16/ Income Tax Returns

Educational qualification certificate

- Latest 3 years’ Financials Computation of Income

- Latest 3 years’ Balance Sheet and Profit & Loss Account (with Schedules and Audit Report) – Audited or CA certified

- Repayment Track Record (RTR) for existing loans for the last 12 months.

ICICI Bank Loan Against Property Application Process

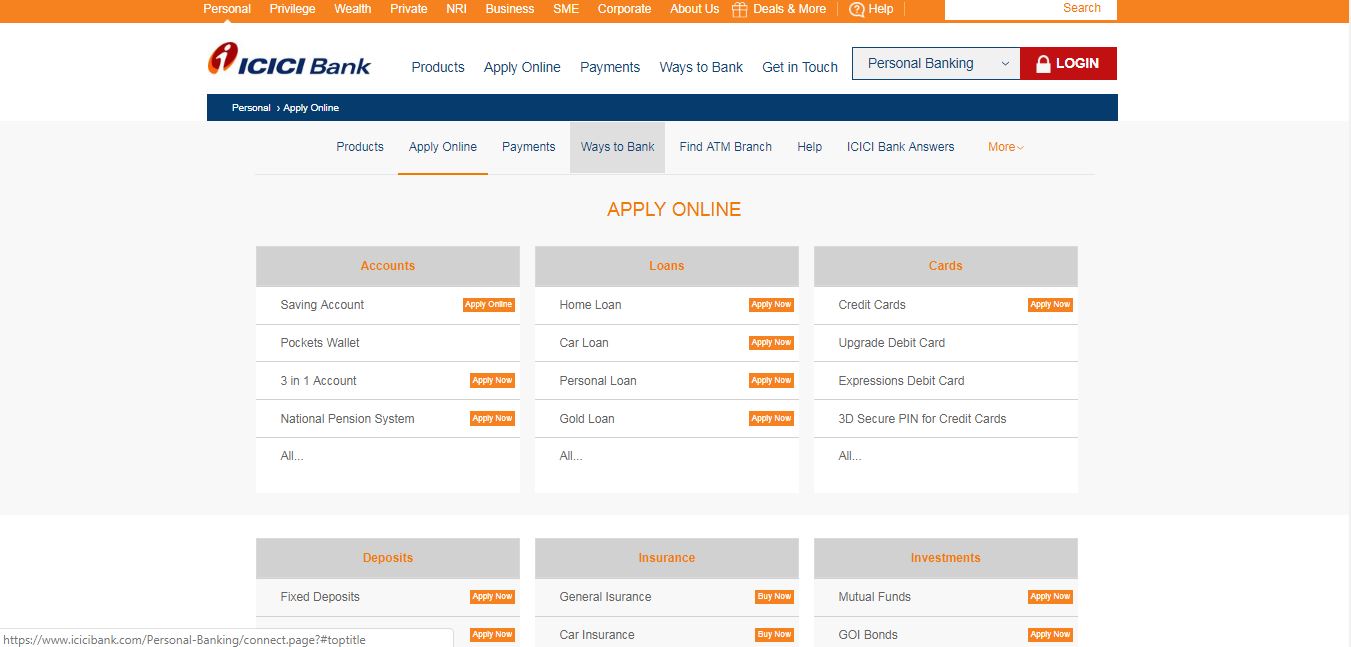

The procedure to apply for ICICI Bank Loan Against Property is explained in detail here: From the home page of ICICI bank, click on Apply Online Option and select the Home loan option from the list of services. Image 5 ICICI Bank Loan Against Property

Provide the details of personal information, loan details, Employment details and Loan details.

After providing all the details and uploading the documents, click on submit. The concerned ICICI bank branch will contact the applicant for further processing of ICICI bank loan against property.

Get in touch with IndiaFilings to Easily Obtain Collateral Free Loan

Image 5 ICICI Bank Loan Against Property

Provide the details of personal information, loan details, Employment details and Loan details.

After providing all the details and uploading the documents, click on submit. The concerned ICICI bank branch will contact the applicant for further processing of ICICI bank loan against property.

Get in touch with IndiaFilings to Easily Obtain Collateral Free Loan

Popular Post

In the digital age, the convenience of accessing important documents online has become a necessity...

The Atalji Janasnehi Kendra Project that has been launched by the Government of Karnataka...

The Indian Divorce Act governs divorce among the Christian couples in India. Divorce...

When an individual has more than a single PAN card, it may lead to that person being heavily penalised, or worse,...

Employees Provident Fund (PF) is social security and savings scheme for employee in India. Employers engaged...