Last updated: August 28th, 2024 1:14 PM

Last updated: August 28th, 2024 1:14 PM

ICICI Gold Loan

ICICI bank offers gold loan scheme to provide loan against gold jewellery which can be used for several requirements such as marriage, business expansion, education of the child, building a property, etc. Under this scheme, any existing or new ICICI customers can avail gold loan of up to Rs.15 lakhs by pledging of gold ornaments which includes gold coins sold by banks. In this article, we look at the ICICI gold loan scheme in detail.Eligibility Criteria

Any individual within the age group of 18 to 70 years is eligible to avail gold loan from the ICICI bank.Amount of Loan

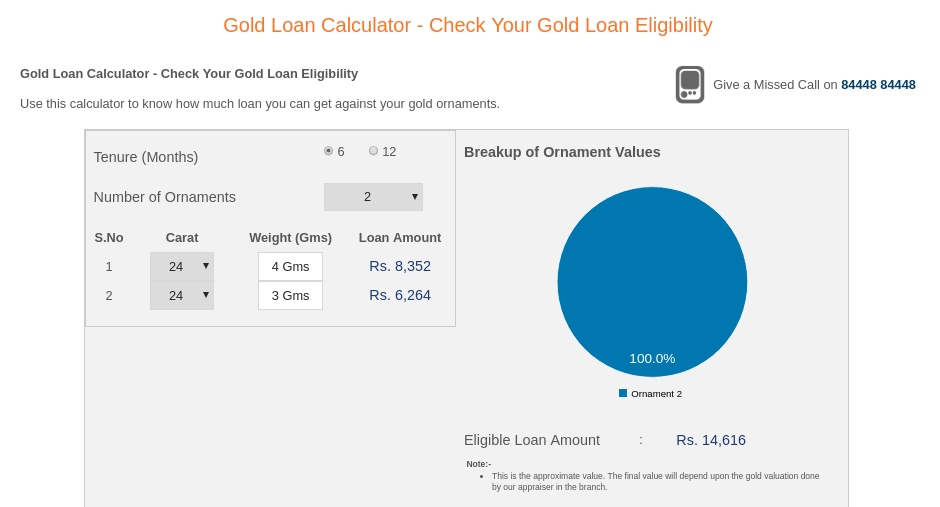

The minimum and maximum amount of loan can be acquired as specified below: Minimum: The minimum loan amount of Rs. 10,000 can be obtained. Maximum: The maximum loan amount of up to Rs. 15 Lakhs can be obtained.ICICI Gold Loan Calculator

Use ICICI gold loan calculator to know about your loan amount against your gold ornaments. The individual can access the ICICI official portal with the required details such as tenure, number of ornaments, carat and weight. After entering the details, the available loan amount is displayed for the borrower. [caption id="attachment_82273" align="aligncenter" width="940"] ICICI Gold Loan - Image 1

ICICI Gold Loan - Image 1

Processing Fee

The charge required for processing your loan application will be around 1.0% of the loan amount.Renewal Fee

The bank charges renewal fees in case the applicant wants to renew his/her existing loan with the bank are as follows:| S.no | Loan amount | Renewal Fee |

| 1. | Up to Rs.50,000 | Rs.300 |

| 2. | Above Rs.50,000 and up to Rs.1 lakhs | Rs.350 |

| 3. | Above 1 lakhs and up to Rs.2 lakhs | Rs.500 |

| 4. | Above Rs.2 lakhs | Rs.1000 |

Prepayment Charges

The bank offers the prepayment facility wherein the customer can repay the entire loan amount before completion of the original tenure. The prepayment charges required for the gold loan are given below.| Prepayment Charges | Twelve months tenure | Six months tenure |

| 1%, if the account is closed within 11 months. | 1%, if the account is closed within 5 months. | |

| NIL, if the account is closed after 11 months | NIL, if the account is closed after 5 months |

Loan Tenure

ICICI gold loans can be availed for a minimum period of 6 months to a maximum of 12 months.Rate of Interest

ICICI bank provides attractive interest rates on the Gold Loan based on the market situations on gold loan. The interest rate for ICICI gold loan ranges from a minimum of 10% to a maximum of 16.5%.Documents Required

The following are the documents which are necessary for processing your loan.- Identity Proof: Driving License or PAN Card or Form 60/61 or Passport or Voter ID Card or Aadhaar Card or Ration Card.

- Address Proof: Driving License / Voter ID Card / Ration Card / Aadhaar Card / Passport / registered lease agreement utility bills in the landlord name.

- Proof of landholding in case of agriculture loan of more than Rs.1 Lakh

- Two passport size photographs

Application Procedure

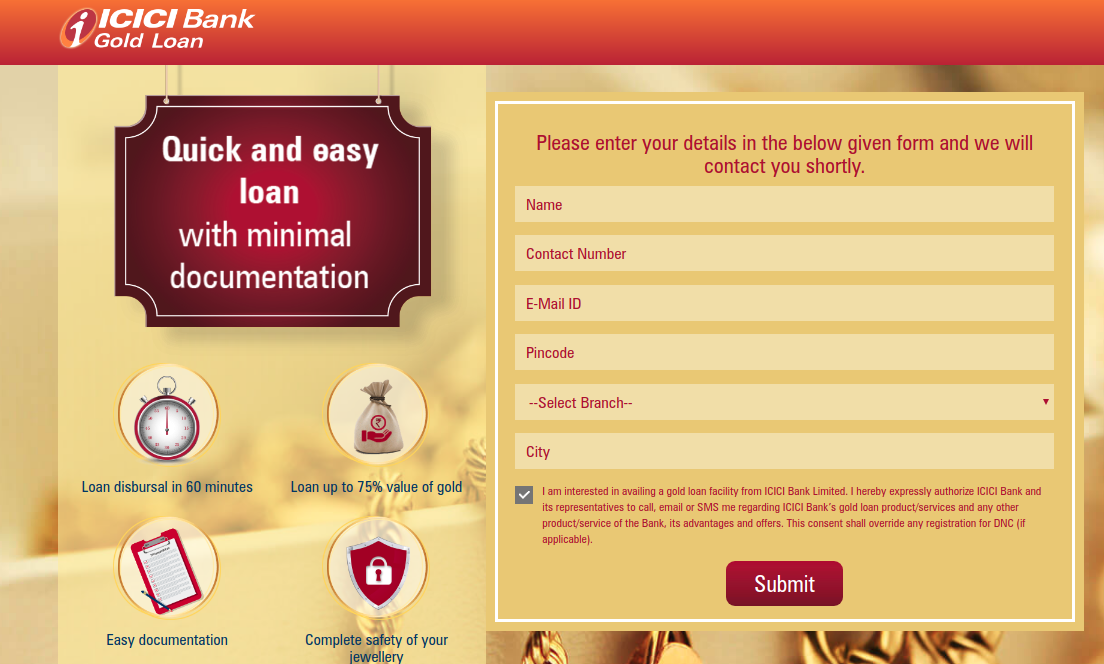

To apply for an ICICI gold loan, the borrower can directly visit the branch or fill an online application form. Complete the application form with the necessary details such as name, contact number, email id, pin code, branch name, city and submit your application by clicking the “Submit” button. The concerned branch will verify the documents and details provided for processing your loan application. [caption id="attachment_82274" align="aligncenter" width="1104"] ICICI Gold Loan - Image 2

Also, know about GST rates for Gold & Jewellery

ICICI Gold Loan - Image 2

Also, know about GST rates for Gold & Jewellery

Popular Post

In the digital age, the convenience of accessing important documents online has become a necessity...

The Atalji Janasnehi Kendra Project that has been launched by the Government of Karnataka...

The Indian Divorce Act governs divorce among the Christian couples in India. Divorce...

When an individual has more than a single PAN card, it may lead to that person being heavily penalised, or worse,...

Employees Provident Fund (PF) is social security and savings scheme for employee in India. Employers engaged...