Updated on: January 20th, 2024 7:47 PM

Updated on: January 20th, 2024 7:47 PM

IEC Modification - Update IEC Yearly

The Importer Exporter Code (IEC) is a pivotal 10-digit identification number issued by India's Directorate General of Foreign Trade (DGFT), essential for businesses importing and exporting goods. It is a key for entering the global trade arena and is mandatory for all Indian importers and exporters. IEC modification, an important aspect of maintaining this code, involves updating crucial business and bank details and ensuring that all information remains current and complies with trade regulations. IndiaFilings specialises in assisting businesses with the IEC modification process, offering expert guidance and streamlined services to navigate these updates effortlessly. If you want to update your IEC, IndiaFilings is your go-to solution. Contact our experts today to ensure your business remains compliant and poised for international trade success.Importer Exporter Code (IEC)

The Importer Exporter Code (IEC) is a unique 10-digit code issued by the Directorate General of Foreign Trade and Industry, Government of India. It is a key business identification number mandatory for Indian companies to commence a business that involves exporting and importing goods. The IEC is a prerequisite for any entity looking to enter the global market, as the customs recognise it, the Export Promotion Council, and other trade authorities.Benefits of IEC

The benefits of obtaining an IEC are significant.- Facilitates Global Trade: The IEC is essential for importing and exporting goods, acting as a gateway for global market access.

- Customs Clearance: Simplifies clearing shipments at customs for imports and exports.

- Eligibility for Government Schemes: Enables businesses to avail themselves of benefits under various export-promotion schemes by the DGFT and other related authorities.

- No Filing of Returns: Once obtained, IEC does not require filing any returns, easing administrative burdens.

- Lifetime Validity: IEC, once issued, is valid for the lifetime of the entity, eliminating the need for renewal.

- Bank Transactions: Necessary for all foreign trade transactions and dealings with banks.

- Easy Processing: A straightforward and digitalised application process makes it accessible and efficient for businesses.

- Recognition: Recognized by most trade and export promotion bodies, adding credibility to business transactions.

What Is an IEC Modification?

All holders of the Importer Exporter Code (IEC) are now mandated to update and verify their IEC details annually, regardless of whether there have been changes. The online system must complete this process between April and June each year. Non-compliance will result in the deactivation of the IEC, consequently blocking any import or export activities. Following Notification No. 58/2015-2020, the Directorate General of Foreign Trade made significant amendments to the Importer Exporter Code (IEC) provisions in chapters 1 and 2 of the Foreign Trade Policy (FTP). These amendments include the following key points:- Mandatory Annual Update: Every IEC holder must ensure their IEC details are updated electronically annually during April-June.

- Confirmation of Unchanged Details: In cases with no changes to the IEC details, this status must be confirmed online within the same period.

- Deactivation for Non-Update: An IEC will be de-activated if it is not updated within the stipulated timeframe.

- Reactivation Post Deactivation: A de-activated IEC can be reactivated upon successful updating. However, this reactivation is subject to compliance with other FTP provisions, and non-compliance may invite additional actions.

- Scrutiny and Compliance: IECs may be flagged for scrutiny. The IEC holder is responsible for promptly addressing any risks or issues flagged by the system. Failure to do so will result in the deactivation of the IEC.

What are the details that can be modified in IEC?

The annual renewal of the Importer Exporter Code (IEC) is not just a regulatory requirement; it also provides an opportunity to update all previously submitted information on the Directorate General of Foreign Trade (DGFT) portal. During the IEC renewal process, you can modify key aspects of your certificate, including.- Registered Address: Changes to the official business address.

- Branch Address: Addition or deletion of branch addresses.

- Contact Information: Updates to mobile numbers and email IDs.

- Bank Account Details: Changes in bank account numbers and related financial information.

- Directors/Partners: Addition or deletion of directors or partners in the business.

- Nature of Business: Modifications in the type or nature of the business activities conducted.

The Importance of IEC Modification

The necessity of updating the Importer Exporter Code (IEC) has become more pronounced post-2021. Before this, once an IEC was issued, it remained valid throughout the business's lifespan without requiring annual updates. This practice, however, led to complications as the information on the IEC certificate became outdated whenever there were changes within the firm. The significance of updating the IEC lies in the following:- Ensuring Current and Accurate Information: Updating your IEC means refreshing essential details like addresses, phone numbers, and information about the firm's owners and shareholders. This is crucial for the Directorate General of Foreign Trade (DGFT), as it helps maintain an up-to-date and accurate database, essential for efficient management and regulatory purposes.

- Preventing Deactivation of the IEC Certificate: If the IEC is not updated as required, it risks deactivation. In India, it is well-known that a valid IEC is mandatory for engaging in any import or export trade outside the country's borders. Therefore, keeping the IEC current is vital for any business involved in international trade to avoid disruptions and legal complications.

Deadline for IEC Modification

Updating the Importer Exporter Code (IEC) annually is a crucial requirement. The designated period for this update falls between April and June each year, corresponding to the financial year. The final deadline for completing the IEC modification is June 30th. Businesses must adhere to this timeframe to ensure compliance and avoid the deactivation of their IEC.Required Documents for IEC Modification

When modifying your Importer Exporter Code (IEC), the documentation needed is similar to what you would provide for the initial application. The required documents include- A Photograph of the Applicant and a recent, clear photo of the individual applying for the IEC modification.

- Self-Attested PAN Card of the Entity: The business entity's Permanent Account Number (PAN) card, self-attested by the applicant.

- Proof of Address for the Entity: This can include a variety of documents such as the Sale Deed, Rent Agreement, Latest Electricity Bill, Latest Mobile Bill, and Latest Landline Bill. These documents should reflect the current address of the entity.

- Pre-printed Cancelled Cheque or Bank Certificate: A cancelled cheque or a certificate verifying the applicant's bank details.

Procedure to Update IEC

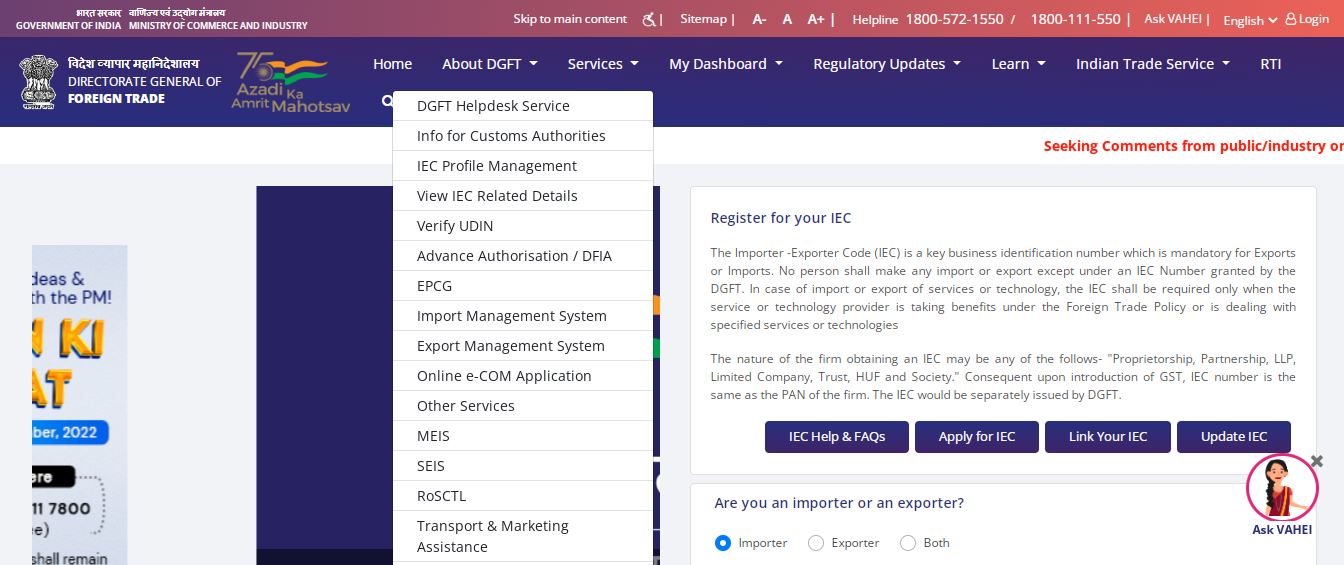

The procedure to update the Importer Exporter Code is explained in detail below:- Access the official website of DGFT and select the IEC profile management option from the services list.

De-Activation of IECs and Procedure to Update IEC -DGFT Home Page

De-Activation of IECs and Procedure to Update IEC -DGFT Home Page

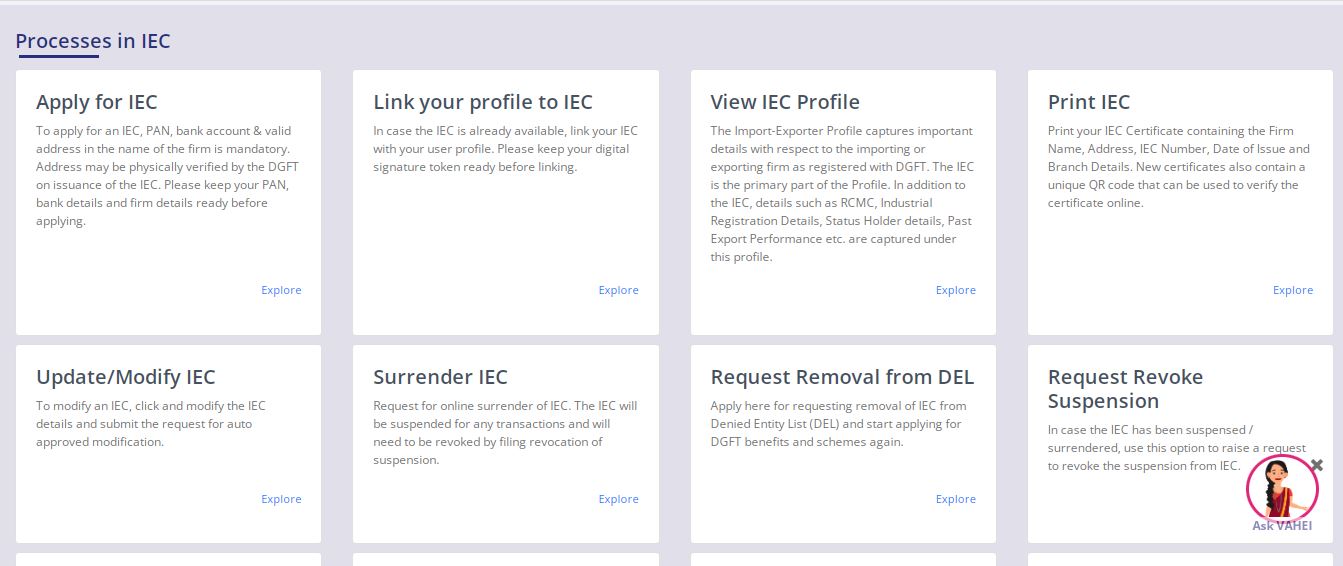

- From the new page, click on the “update IEC” option.

-

De-Activation of IECs and Procedure to Update IEC

De-Activation of IECs and Procedure to Update IEC - After clicking on “update IEC”, the login tab will open.

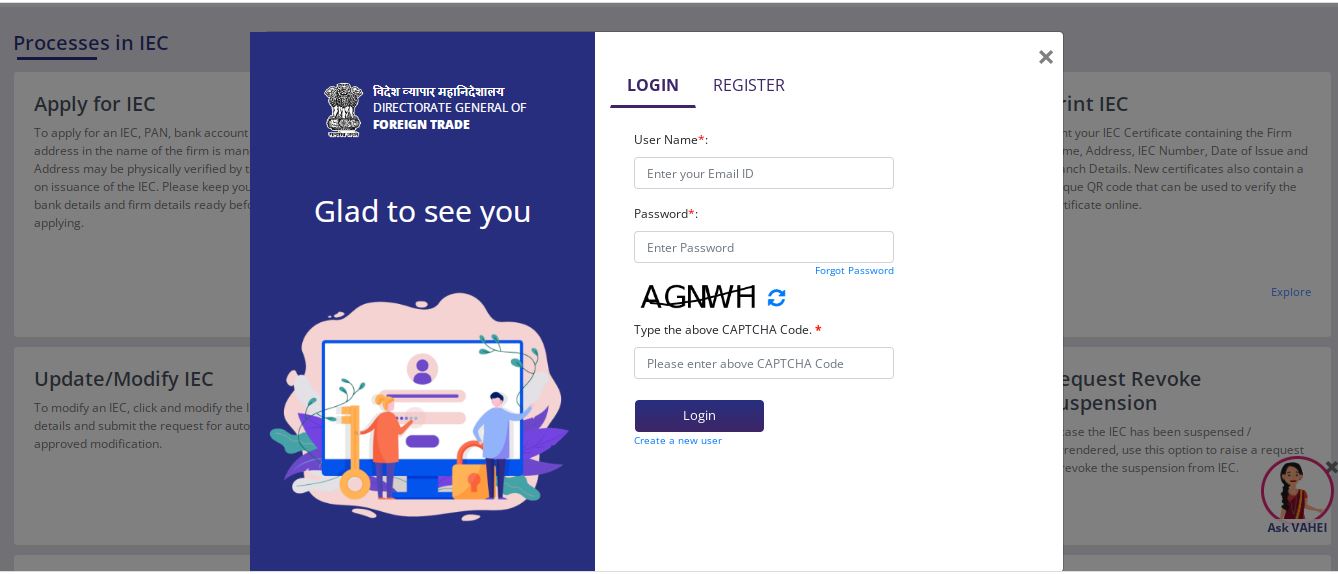

De-Activation of IECs and Procedure to Update IEC Login

De-Activation of IECs and Procedure to Update IEC Login

- Provide login details if registered. If not, then register it first by putting in the required details. The user can use forgot password option also in case do not remember the password. (New password will be sent on registered mail ID)

- After logging into the portal, link your IEC if it is not linked yet. To link to IEC, OTP will go to the registered mail ID.

- After successfully linking, click the “Update/Modified IEC option.” After clicking on Update IEC, a tab will pop up that will show your IEC code details in the manner below. I

- If the user wants to change any details, change them in their respective heads. If there is nothing to change, then save every head of information.

- At the end of the process, check the application summary and submit it.

- To submit the summary, attach the DSC of the registered person.

Consequences of non-renewal of IEC number

It is essential to update the Importer Exporter Code (IEC) annually between April and June for the corresponding financial year, with June 30th being the final deadline. Timely updating of the IEC is crucial for uninterrupted import-export operations. If the IEC is not renewed by the deadline, it deactivates the IEC certificate. A deactivated IEC number necessitates reactivation through an update process. During deactivation, import or export activities are prohibited except for businesses exempt from IEC requirements. Therefore, to avoid disruptions in trade activities, traders should prioritise the timely renewal of their IEC.Why choose IndiaFilings for IEC modification?

Choosing IndiaFilings for your IEC modification needs offers numerous advantages.- Expertise in Business and Legal Services: Specialized knowledge in handling IEC modifications and compliance with DGFT regulations.

- Seamless Process: Streamlined and efficient process for modifying IEC, reducing complexity and saving time.

- Professional Assistance: Access to a team of experienced professionals who provide accurate and personalised guidance.

- Compliance Assurance: Ensuring all modifications meet the current legal requirements and guidelines.

- Responsive Customer Service: Quick and helpful response to queries, enhancing the overall experience.

- Convenient Online Platform: Easy-to-use digital services that make the process accessible and straightforward.

- Timely Execution: Commitment to completing modifications quickly to minimise disruptions to business operations.

- Focus on Business Needs: Understanding diverse business requirements, catering to businesses of all sizes.

Popular Post

In the digital age, the convenience of accessing important documents online has become a necessity...

The Atalji Janasnehi Kendra Project that has been launched by the Government of Karnataka...

The Indian Divorce Act governs divorce among the Christian couples in India. Divorce...

When an individual has more than a single PAN card, it may lead to that person being heavily penalised, or worse,...

Employees Provident Fund (PF) is social security and savings scheme for employee in India. Employers engaged...