Last updated: August 10th, 2021 6:00 PM

Last updated: August 10th, 2021 6:00 PM

IEPF Amendment Rules, 2021 - Revised Form IEPF - 4 & IEPF-7

Ministry of Corporate Affairs notifies the Investor Education and Protection Fund (IEPF) Authority (Accounting, Audit, Transfer, and Refund) Amendment Rules, 2021 to amend the IEPF Rules, 2016. With this amendment, MCA has announced the Procedure of transfer of shares to the Investor Education and Protection Fund (IEPF) Authority and notified the revised form IEPF -4 and IEPF-7. IEPF Amendment Rules, 2021 shall come into force as of the date of its publication in the Official Gazette. Know more about Form IEPF-1 and IEPF-2Synopsis of IEPF Amendment Rules, 2021

- With this amendment, MCA inserts a new clause (fa) in Rule 3 sub-rule 2 of IEPF Rules, 2016

- MCA also inserts a new Rule 6A which specifies the Manner of transfer of shares under sub-section (9) of section 90 of the Act to the Fund.

- Revised form IEPF -4 and IEPF-7 also notified

- FORM NO. IEPF-4 – Statement of shares transferred to the Investor Education and Protection Fund

- FORM NO. IEPF-7 Statement of amounts credited to IEPF on account of shares transferred to the fund

Section 90 of the Companies Act 2013 - Register of Significant Beneficial Owners in a Company

Let us learn about Section 90 of the Companies Act 2013 before discussing the IEPF Amendment Rules, 2021 As per section 90 of the Companies Act, 2013, every individual who holds beneficial interests, of not less than 25% in shares of a company or the right to exercise, or the actual exercising of significant influence or control over the company (namely significant beneficial owner) is required to make a declaration to the company, specifying the nature of his interest and other prescribed particulars.- Further company is required to give notice calling prescribed information to any person whom it believes to be a significant beneficial owner of the company.

- On failure of such individual to give satisfactory information as required, the company may apply to the Tribunal for an order directing that the shares in question be subject to restrictions concerning the transfer of interest, suspension of all rights attached to the shares, and such other matters and the Tribunal may pass such order.

- The company or the person aggrieved by the order of the Tribunal may make an application to the Tribunal for relaxation or lifting of the restrictions placed.

Transfer of Shares to IEPF

However if no such application is filed within one year such shares shall be transferred to the Investor Education and Protection Fund (IEPF) created by the Central Government under section 125 of the Companies Act, 2013 for the promotion of investors’ awareness and protection of the interests of investors.List of Amounts - Amendments Under the Rule 3 of IEPF Rules

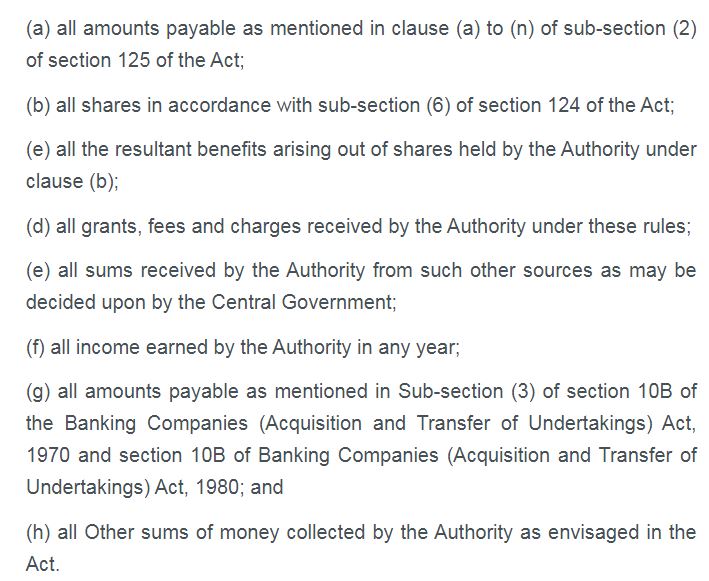

In addition to the existing list of amounts which shall be credited to the fund (Rule 3 sub-rule 2), a new clause is inserted, which states that all shares held by the Authority following proviso of Section 90(9) of the Companies Act and all the resultant benefits arising out of such shares shall also be credited to the fund. The existing list of amounts that shall be credited to the fund as per Rule 3 of Investor Education and Protection Fund Authority (Accounting, Audit, Transfer, and Refund) Rules, 2016 is as follows: IEPF Amendment Rules, 2021 - Existing list of amounts which shall be credited

IEPF Amendment Rules, 2021 - Existing list of amounts which shall be credited

The procedure of Transfer of Shares to IEPF Authority - New Rule 6A

New Rule 6A of IEPF Amendment Rules, 2021 specifies Procedure of Transfer of Shares to IEPF Authority- The shares will be credited to the DEMAT account of the IEPF Authority within a period of 30 days of such shares becoming due to be transferred.

- Further transfer of shares by the Companies to the Fund shall be deemed to be the transmission of shares.

- Furthermore, such transfers will be free from any restrictions and cannot be claimed back.

Procedure for Transferring the Share

Shares held in electronic form

- The Company shall inform the depository. On receipt of such intimation, the depository shall effect the transfer of shares in favor of the DEMAT account of the Authority.

- Shares held in physical form

- Company Secretary or the person authorized by the Board shall make an application, on behalf of the concerned shareholder, to the Company, for the issue of a new share certificate.

- On receipt of the application, a new share certificate (in Form SH-1) shall be issued and it shall be stated on the face of the certificate that: 'Issued instead of share certificate No..... for transfer to IEPF under subsection (9) of section 90 of the Act'

- Further, the same be recorded in the register maintained for the purpose.

- After the issue of a new share certificate, the Company shall inform the depository and place a request to convert the share certificates into DEMAT form and transfer in favor of the Authority.

Form IEPF-4

The Company shall send a Statement to the Authority in Form IEPF-4 within 30 days of the corporate action taken containing details of such transfer along with a copy of the order of the Tribunal under Section 90(8) of the Act and a declaration that no application under Section 90(9) of the Act has been made or is pending before the Tribunal.- Voting Rights: The voting rights on shares transferred to the Fund shall remain frozen. Further, for SEBI (SAST) Regulations, 2011, the shares which have been transferred to the Authority shall not be excluded while calculating the total voting rights.

- Benefits: All benefits accruing on such shares (including dividend), except right issue, shall also be credited to such DEMAT account

- Delisting of securities: If the company is getting delisted, the Authority shall surrender shares on behalf of the shareholders

- Winding-up: In case the Company is being wound up, the Authority may surrender the securities to receive the amount entitled on behalf of the security holder and credit the amount to the Fund.

Form IEPF-7

Any amount required to be credited by the Companies to the Fund shall be remitted into the specified account of the IEPF Authority maintained in the Punjab National Bank. The details thereof shall be furnished to the Authority in Form IEPF-7 within 30 days from the date of remittance. IEPF Amendment Rules, 2021 is reproduced below for reference:Popular Post

In the digital age, the convenience of accessing important documents online has become a necessity...

The Atalji Janasnehi Kendra Project that has been launched by the Government of Karnataka...

The Indian Divorce Act governs divorce among the Christian couples in India. Divorce...

When an individual has more than a single PAN card, it may lead to that person being heavily penalised, or worse,...

Employees Provident Fund (PF) is social security and savings scheme for employee in India. Employers engaged...