Last updated: February 15th, 2020 4:07 PM

Last updated: February 15th, 2020 4:07 PM

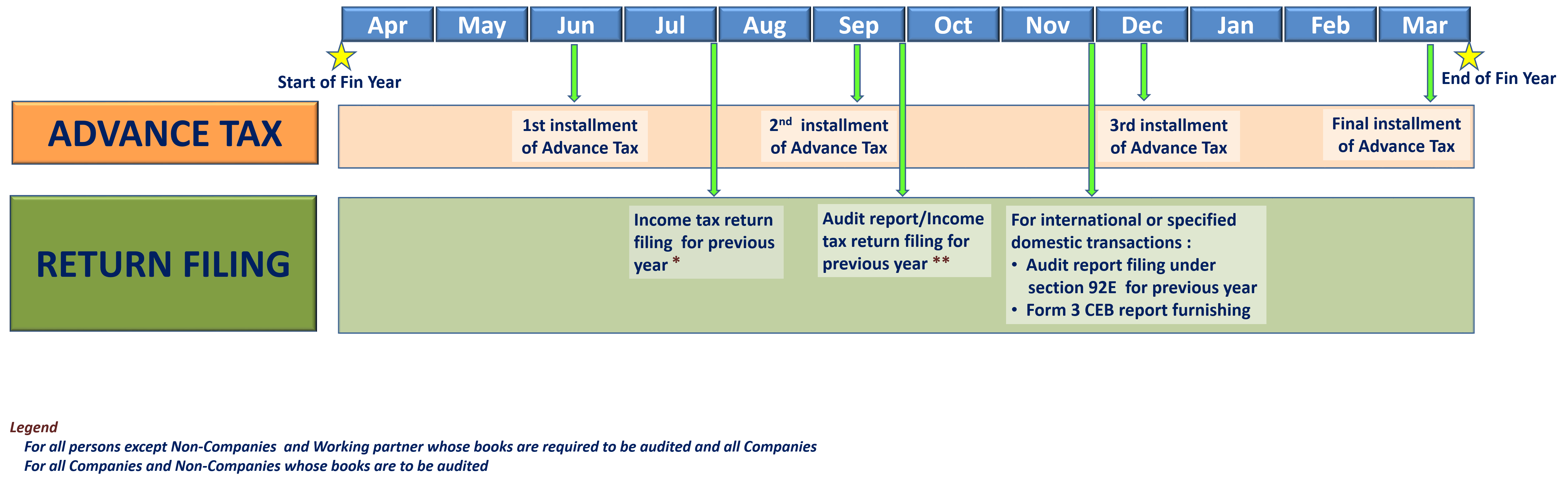

Income Tax Calendar

The Income Tax Department of India requires a person to complete various kinds of compulsory tax formalities, such as filing income tax returns before the due date, paying advance tax on time, and replying to notices sent by the Income Tax Department within the specified due dates prescribed. Hence, it is important to understand the timelines for Income Tax Payment to avoid paying interest for Income Tax Late Payment. The actual due date for each of the tax formalities varies slightly from year to year. However, the tentative timeline for filing Income Tax Return is as below :- 31st Jul for Individuals

- 30th Sep for Businesses

Income Tax Calendar

The Indian Income Tax Calendar with key due dates for Income Tax Return Filing are as follows :

| Due Date | Milestone | Advance Tax (Current FY) | Return Filing (Past FY) |

| 1st April | Start of Financial Year | - | - |

| 15th June | Due date for the First instalment of Advance Tax (15 % Payable) for current Financial Year | Yes | |

| 31st July | Due date for filing income tax return for financial year for all persons except (i) Companies (ii) Non-Companies whose books are required to be audited and (iii) Working partner of a firm whose accounts are required to be audited | Yes | |

| 15th September | Due date for the second installment of Advance Tax (45 % Payable) for current Financial Year | Yes | |

| 30th September | Due date for filing of Audit report/Income tax return for financial year for the following: (i) Companies (II) Non-Companies whose books are required to be audited | Yes | |

| 30th November |

|

Yes | |

| 15th December | Due date for the Third installment of Advance Tax (75 % Payable) for current Financial Year | Yes | |

| 31st March |

|

Yes |

Popular Post

In the digital age, the convenience of accessing important documents online has become a necessity...

The Atalji Janasnehi Kendra Project that has been launched by the Government of Karnataka...

The Indian Divorce Act governs divorce among the Christian couples in India. Divorce...

When an individual has more than a single PAN card, it may lead to that person being heavily penalised, or worse,...

Employees Provident Fund (PF) is social security and savings scheme for employee in India. Employers engaged...