Last updated: August 28th, 2024 5:54 PM

Last updated: August 28th, 2024 5:54 PM

Income Tax Deduction for Rent Paid

Taxpayers can claim an income tax deduction for any amount paid as rent under Section 80GG of the Income Tax Act. Section 80GG is a facility introduced in the Act for providing a tax-deduction to taxpayers who are not obtaining a House Rent Allowance (HRA). The deduction under this section can be availed exclusively by assessees who are resident individuals. To be eligible to claim a deduction under this section, the individual should not be obtaining any HRA from the employer. Further, self-employed persons can also avail of this deduction. Also, the individual should have actually paid rent for residential accommodation. The accommodation can be used by the assessee or by the family members; in either case, the deduction under this section will be allowed. The assessee or the specified category of persons may own a residential property in the location where the taxpayer resides, is employed or carries on any business or profession. In such cases, it is not possible to claim any deduction under this section. The present article provides an overview of the tax deduction offered by Section 80GG.Section 80GG Deduction Eligibility

For a taxpayer to claim Section 80GG deduction, the following conditions must be satisfied:- HRA has not been claimed by the taxpayer.

- The taxpayer or spouse or minor child of the taxpayer should not own a residential house property in the location where the taxpayer resides, is employed or carries on any business or profession.

- If the taxpayer is a member of a HUF then the HUF should not own a residential house property in the location where the taxpayer resides, is employed or carries on any business or profession.

- If the taxpayer owns a residential house property at any place other than the location where the taxpayer resides, is employed or carries on any business or profession, then the taxpayer should not claim any benefits under Income Tax Act as self-occupied property.

- A declaration in Form 10BA regarding the eligibility of availing this deduction should be filed with the Income Tax Authorities on demand.

Amount of Deduction under Section 80GG

Under Section 80GG, the taxpayer can claim a deduction that is the lowest of the following three amounts:- Rs. 5000 per month (Budget 2016 increased the limit of rent from Rs. 2000 per month to Rs. 5000 per month)

- 25% of the individual’s total income

- Rent paid in excess of 10% of the individual’s total income (i.e., Rent paid minus 10% of total income)

- Long-term Capital Gains

- Short-term Capital Gains which have been mentioned under Section 111A

- Deductions under Chapter-VIA, from Section 80C to 80U, with the exception of Section 80GG

- Income under Section 115A

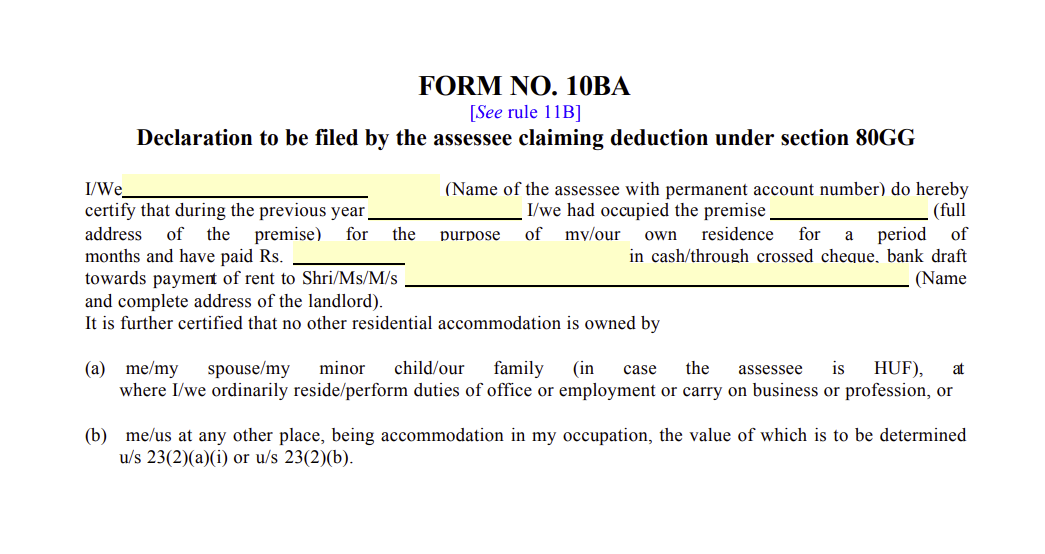

Form 10BA - Format

Form 10BA should be used by an assessee who is claiming a deduction under this section. The form should NOT be attached to the return of income. The form should be submitted to the Income Tax Department only when it is demanded by the tax authorities. The format of Form 10BA is given below for reference: [caption id="attachment_101693" align="aligncenter" width="1045"] Form-10BA

Form-10BA

Form 10BA - Procedure

To claim deduction under Section 80GG, the taxpayer must file a declaration in Form 10BA. Form 10BA should be submitted only in response to a notice from the Income Tax authorities. In the absence of such a notice, there is no need to use this form. Taxpayers can prepare and file Form 10BA on the Income Tax E-Filing website. To prepare and file Form 10BA, follow the steps mentioned below:- Login to income tax e-filing website.

- Click on ‘Prepare and Submit Online Form (other than ITR)’ under Tab ‘e-file’.

- Select Form 10BA from the dropdown list and proceed to fill in the form and submit.

Popular Post

In the digital age, the convenience of accessing important documents online has become a necessity...

The Atalji Janasnehi Kendra Project that has been launched by the Government of Karnataka...

The Indian Divorce Act governs divorce among the Christian couples in India. Divorce...

When an individual has more than a single PAN card, it may lead to that person being heavily penalised, or worse,...

Employees Provident Fund (PF) is social security and savings scheme for employee in India. Employers engaged...