Updated on: August 28th, 2024 5:55 PM

Updated on: August 28th, 2024 5:55 PM

Income Tax Demand Notice

If a taxpayer’s income tax return is in conflict with the assessment made by an Income Tax Officer, the taxpayer will be issued an income tax demand notice. Income tax demand notice is issued if the taxpayer has deposited lesser tax than what the assessee is liable to pay. In this article, we look at the procedure for responding to an income tax demand notice.Responding to Demand Notice

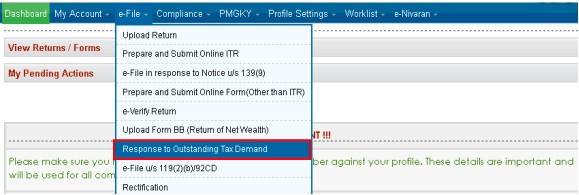

Responding to an income tax demand notice has now become easier, thanks to the digitization of the Income Tax portal and introduction of E-Assessment under the Centralised Communication Scheme, 2018. This takes away the time-consuming and painstaking manual processes of the past. Taxpayers can now view the outstanding tax demand by following the procedures listed below: Step 1: Log in to the e-filing portal of the official website of the Income-tax department. If you do not have a username and password, please create a new user identification on the website. Step 2: On the drop-down menu of My Accounts Section, choose the option ‘Respond to Outstanding Tax Demand’. Income Tax Demand Notice

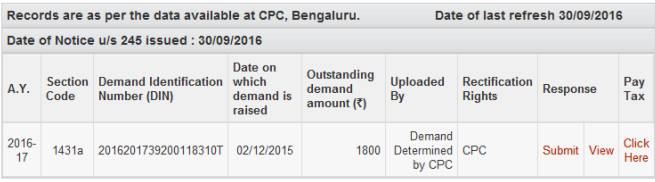

Step 3: Details pertaining to the Assessment year, Section Code, Demand Identification Number (DIN), Date of issue of demand will be displayed. Select the income tax demand from the list to which you would like to respond.

Income Tax Demand Notice

Step 3: Details pertaining to the Assessment year, Section Code, Demand Identification Number (DIN), Date of issue of demand will be displayed. Select the income tax demand from the list to which you would like to respond.

List of Demands

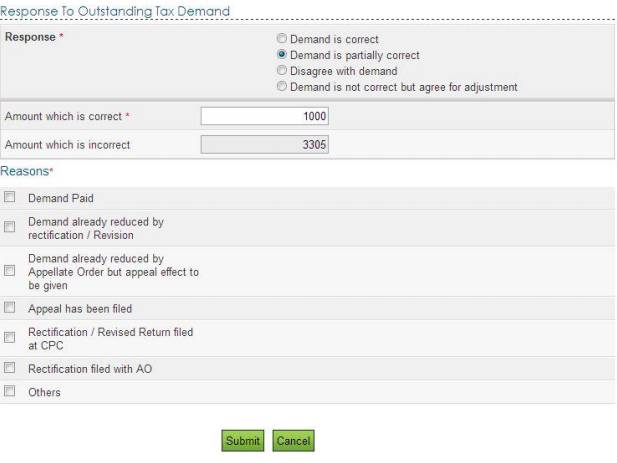

Step 4: The taxpayer, after clicking ’Submit’ is entitled to choose the response among the options available:

List of Demands

Step 4: The taxpayer, after clicking ’Submit’ is entitled to choose the response among the options available:

- Demand is correct

- Demand is partially correct

- Disagree with demand

- Demand is not correct but agree for adjustment

Demand is Correct

Choosing this option prohibits you from disagreeing with the demand later. To start the process under this choice, click on ‘Submit'. A success message will be displayed. If you are eligible for a refund, the outstanding amount along with interest will be adjusted against the refund due. If not, the dues should be immediately remitted. For payment of dues, click on the hyperlinked option ‘Pay Tax’, and then click on ‘Confirm’. You will be redirected to the TIN website of NSDL, where your outstanding taxes can be paid. Now click on ‘submit to bank’ option on the page to the payment.Demand is Partially Correct

On selecting this option, two amount fields will be displayed on the screen. You must enter the correct and incorrect amount. In addition to it, you will have to choose the reason cited in the portal. You will be required to provide additional information based on the selected choice. The following reasons are cited in the portal, among which the choice should be made:- Demand paid.

- Demand paid and challan has CIN.

- Demand paid and challan has no CIN.

- Demand already reduced by rectification/revision.

- Demand already reduced by the Appellate order but appeal effect to be given.

- Appeal has been filed.

- Stay petition filed with.

- Stay granted by.

- Instalment granted by.

- Rectification/Revised return filed at Central Processing Centre (CPC).

- Rectification filed with Assessing Officer (AO).

- Others.

Demand is Partially Correct

Demand is Partially Correct

Additional Documents to be Submitted

Any taxpayer who chooses the "Demand is Partially Correct" option would have to provide additional information as provided below:| Reason Demand is Partially Correct | Additional Information |

| Demand paid and challan has CIN |

|

| Demand paid and challan has no CIN |

|

| Demand already reduced by rectification / Revision |

|

| Demand already reduced by Appellate Order but appeal effect to be given |

|

| Appeal has been filed: Stay petition has been filed |

|

| Appeal has been filed: Stay has been granted |

|

| Appeal has been filed: Instalment has been granted |

|

| Rectification / Revised Return filed at CPC |

|

Demand is not Correct

This option can be selected if you have apprehensions on the correctness of the demand, after which you will be required to choose among the many options specified in the option "Demand is partially correct". Some of the option that can be selected for citing demand is not correct include:- Demand paid

- Demand already reduced by rectification/revision

- Demand already reduced by Appellate Order but appeal effect to be given

- Appeal has been filed

- Rectification / Revised Return Filed at CPC

- Rectification filed with AO

- Others

Demand is not Correct but Agree for Adjustment

In this case, you will have to specify the reasons for your disagreement with the demand, which again could be any of the following:- Demand paid

- Demand already reduced by rectification/revision

- Demand already reduced by Appellate Order but appeal effect to be given

- Appeal has been filed

- Rectification / Revised Return Filed at CPC

- Rectification filed with AO

- Others

Tracking Status of Response

After completing all the above procedures and successfully submitting the information to the Income Tax department, a transaction ID will be generated. The response can be checked by clicking on the ‘transaction ID’ on the income tax e-filing portal. Transaction ID

The demand position will be updated every day. Further, interest demand u/s 220(2) is linked to the principal demand of the same assessment year. This indicates that principal demand is already adjusted/ paid and interest demand is the only outstanding value. Hence does not require any confirmation.

In case you require assistance with an income tax notice, get in touch with an IndiaFilings Advisor at sales@indiafilings.com.

Transaction ID

The demand position will be updated every day. Further, interest demand u/s 220(2) is linked to the principal demand of the same assessment year. This indicates that principal demand is already adjusted/ paid and interest demand is the only outstanding value. Hence does not require any confirmation.

In case you require assistance with an income tax notice, get in touch with an IndiaFilings Advisor at sales@indiafilings.com.

FAQs - Tax Demand

How do you respond to tax demand?

What happens if income tax demand is not paid?

How do I pay my tax demand online?

Popular Post

In the digital age, the convenience of accessing important documents online has become a necessity...

The Atalji Janasnehi Kendra Project that has been launched by the Government of Karnataka...

The Indian Divorce Act governs divorce among the Christian couples in India. Divorce...

When an individual has more than a single PAN card, it may lead to that person being heavily penalised, or worse,...

Employees Provident Fund (PF) is social security and savings scheme for employee in India. Employers engaged...