Updated on: January 27th, 2020 6:25 PM

Updated on: January 27th, 2020 6:25 PM

Income Tax e-assessment

The Ministry of Finance (MoF) notified the e-assessment scheme to conduct faceless assessments to review or evaluate income-tax returns through online process. As this scheme applies to all national and regional centres, the physical appearance of the taxpayers is not required. The evaluation can be in the form of scrutiny or persuing to collect details from the taxpayer. The MoF notified on the faceless e-assessment scheme on 12th September 2019. The e-assessment scheme shall be monitored by National e-assessment (NEC) for verification, modification and assigning cases. Any notices from the NEC to the assessee will be served under sub-section(2) of Section 143.Reasons for Scrutiny from the Income-tax Department

As per the Income-tax act of 1961, the assessment is set to carry out to identify errors and misfilings. The following are the reasons for conducting scrutiny from the I-T department:- A discrepancy in TDS credit

- Irregular income levels

- Failing to file income tax returns

- Contradicting value among the transactions

- Mismatch in income tax payments

Types of Notices from the I-T Department

If the tax filings match with any of the irregularities above, the taxpayer will receive the following notices from the I-T department:- Limited Scrutiny

- Complete Scrutiny

- Manual Scrutiny

Format of e-assessment Scheme

Previously, the taxpayer should visit the I-T department in-person with all the required documents upon receiving notice. The format of providing documents/details in-person have ceased to exist. Hence the taxpayer shall henceforth provide all the documents online, through the registered account.Objectives of the e-assessment scheme

- To remove any form of human interference for the Income-tax assessment procedure

- Create specified assessment units to review the returns by the automated allocation system

- Create a platform for complete anonymous online process

- Eliminate the process of requiring physical presence at IT departments for verification

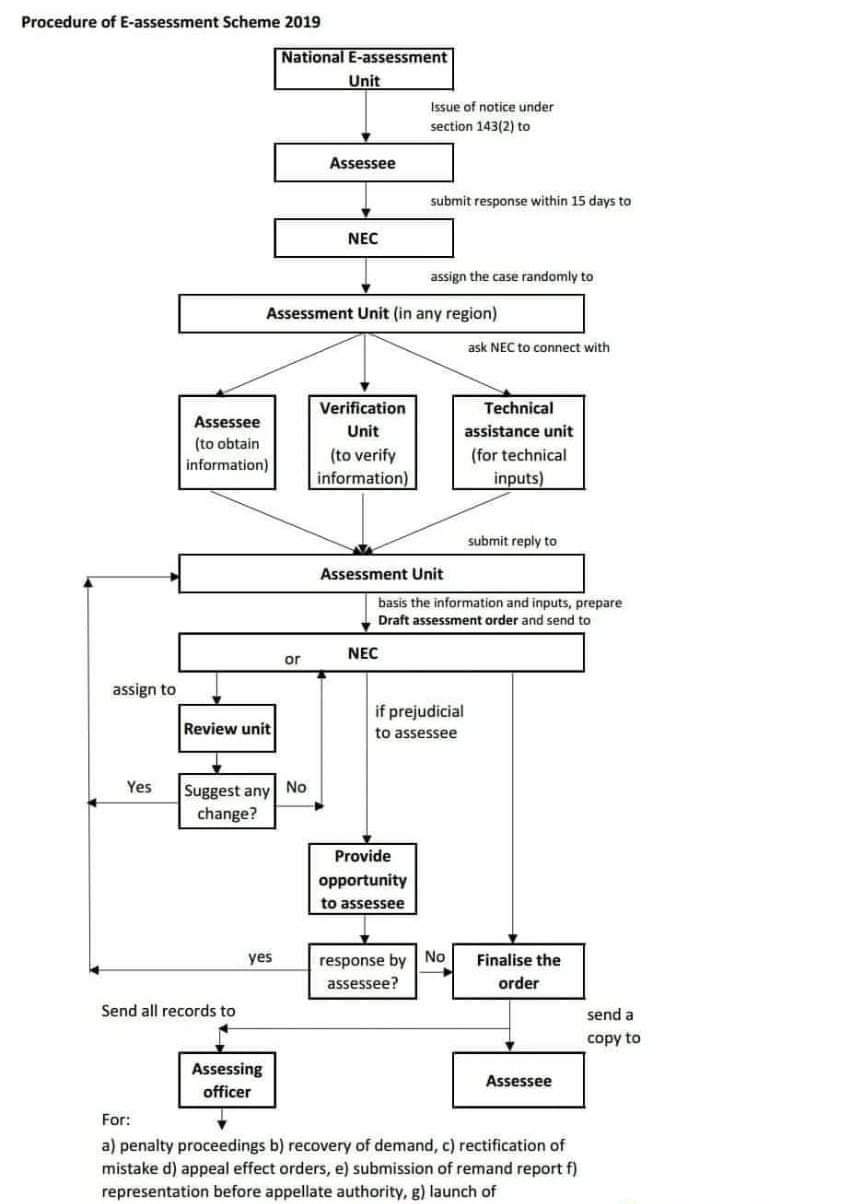

Flowchart of NEC

The following flowchart explains the process of NEC Income Tax eAssessment

Income Tax eAssessment

e-assessment Centres

The following centres will be established to conduct e-assessment proceedingsNational e-assessment Center (NEC)

The NEC will act as a regulatory committee to implement rules and regulations and monitor regional centres. It also assesses, verifies, modifies and send show-cause notices to the assessee if necessary.Regional e-assessment Centers

The regional e-assessment centres will be established to implement the actions as informed by the NEC. The Principal Chief Commissioner shall monitor the division to assess regulation and process.Assessment Unit

The following are the critical functions of Assessment Units:- To verify the modifications in the draft,

- Suggest and assess modifications to NEC,

- Identifying details regarding payments or refund,

- Request information or to provide for the issues raised,

- Scrutinise the information provided by the assessee.

Verification Units

The verification units perform the following functions as per the regulation of NEC:- Cross verification,

- Examination of books of accounts,

- Examining the statements or recordings of witness,

- Sending enquiry to assessment or technical units for clarification on documents.

Technical Units

The technical units are established to assist with legal, forensic and accounting. Similarly, information technology, data analytics, valuation, transfer pricing and other related technical requirements have also been established.Review Units

The review units play an essential role by performing the following functions:- Assessing all the documents sent by the assessee,

- Reviewing the draft assessment order,

- Cross verification of the material evidence,

- Reviewing the relevant points has been added as per the guidelines of NEC.

Procedures of Serving Notice through e-assessment Scheme

|

S. No. |

Procedure |

Rule/Act |

|

1 |

Serving e-assessment notice to the taxpayer upon the discrepancy | sub-section(2) of Section 143 |

|

2 |

The individual must reply within 15 days from the date mentioned on the receipt | sub-clause(i) |

|

3 |

The individual should respond to the notice only through the registered account. The response shall be notified by National e-assessment centre | |

|

4 |

Individuals no longer have to visit any I-T departments with regards to the notice received for submitting any documents | |

|

5 |

All communication between the individual and the department for verification or enquiry will only be through online | |

|

6 |

If the regional I-T departments require assistance from verification or technical unit, it will be processed through an automated system. The requirements such as:

|

|

|

7 |

The NEC can assign scrutiny case to any regional centres through an automated allotment system |

Procedures of Penalty Proceedings through e-assessment Scheme

|

S. No. |

Procedure |

Rule/Act |

|

1 |

Any draft order that initiates penalty proceedings should follow the following regulations:

|

|

|

2 |

The assessee should be notified in case of any modifications | |

|

3 |

The draft order can be assigned to any of the regional e-assessment centres through an automated allotment system | |

|

4 |

The assessee shall reply, upload or request the details through registered account only (online) |

Procedures of Review Proceedings through e-assessment Scheme

|

S. No. |

Procedure |

Rule/Act |

|

1 |

The draft order or the proceedings can be reviewed in the case of:

|

|

|

2 |

The NEC can apply, change or modify the draft order as per the suggestions received from the review unit as stated by the procedure | Sub-paragraph (a), (b) or (x) |

|

3 |

Upon revisions to the draft stated by the review unit, the NEC forwards to the Assessment unit | |

|

4 |

Assessment unit shall review the suggestions, modify if necessary and prepares the final draft to the NEC | |

|

5 |

The NEC finalise the revised order by the procedure | Sub-paragraph (a), (b) or (x) |

Procedures of Show-cause Notice through e-assessment Scheme

|

S. No. |

Procedure |

Rule/Act |

|

1 |

The assessee should respond to the show-cause notice within the stipulated time to the NEC |

Sub-paragraph (b) of paragraph (x) |

|

2 |

In case of no response, the NEC finalises the assessment as per the procedure |

Sub-paragraph (a) of paragraph (x) |

|

3 |

If the assess sends the details for the notice, NEC forwards to the Assessment unit |

Finalising the Draft

|

S. No. |

Procedure |

Rule/Act |

|

1 |

The Assessment unit verifies the details sent by the assessee and forwards to the NEC for finalising the draft |

|

|

2 |

In the modification of the NEC has no prejudicial interest towards the assessee, the NEC shall follow as per the procedure |

Sub-paragraph (a) of paragraph (x) |

|

3 |

Upon having a prejudicial interest towards the assessee, the NEC should provide an opportunity as per the procedure |

Sub-paragraph (b) of paragraph (x) |

|

4 |

The response should be reviewed/assessed as per NEC committee procedure |

Paragraphs (xvi), (xvii) and (xviii) |

Popular Post

In the digital age, the convenience of accessing important documents online has become a necessity...

The Atalji Janasnehi Kendra Project that has been launched by the Government of Karnataka...

The Indian Divorce Act governs divorce among the Christian couples in India. Divorce...

When an individual has more than a single PAN card, it may lead to that person being heavily penalised, or worse,...

Employees Provident Fund (PF) is social security and savings scheme for employee in India. Employers engaged...