Last updated: May 24th, 2024 2:38 PM

Last updated: May 24th, 2024 2:38 PM

IndusInd Bank Current Account

IndusInd Bank Current Account is a type of bank account that is offered to people in business and traders. IndusInd Bank has an array of carefully crafted current accounts for regular businesses, large corporate, importers & exporters, and even for niche industries. One of the most significant benefits of a current bank account is that the account holders can easily avail overdraft facility up to an agreed limit. In this article, we will look at IndusInd Bank Current Account in detail.Benefits of IndusInd Bank Current Account

Benefits and features of opening an IndusInd Bank current account are listed below:- Current account enables businesspeople and traders to make direct payments using cheques, demand drafts, or pay orders

- IndusInd bank current account allows for prompt business transactions

- No limit on withdrawals

- No limit on deposits in the IndusInd bank home branch

- This type of account provides an overdraft facility

- Provides internet banking and mobile banking facilities

Applicability – IndusInd Bank Current Account

The following types of individuals/entities are allowed to open IndusInd Bank current account- Individuals

- Professionals

- Self Employed Individuals

- Sole-Proprietorship firms

- Government & Semi-Government bodies

- Private Limited & Public Limited Companies

- Partnership Firms

- Clubs & Societies

- Trusts & Administrators

- Local Authorities

- Hindu Undivided Family

IndusInd Bank Current Account Products

As stated above the IndusInd bank has an array of current account services, you can choose any current account as per your specific needs. The IndusInd Bank offers the followings current account services.- Forex Current Account

- Indus Edge Current Account

- Niche Current Accounts – Industry-Specific Needs

- Customized Current Account

Forex Current Account

Forex current account is specially designed for trade and foreign exchange. A current trade account with IndusInd Bank offers best-in-class transactions and cash deposit limits while enabling transactions in 7 different currencies. Further Forex current account provides four more services. Indus EXIM Trade current account IndusInd Bank INDUS EXIM Trade current account is a one-stop account that will take care of all the cross-border transactions. This account gives trader an extra-edge that caters to traders need to succeed in today’s challenging cross-border business environment and enhances client delight by delivering the timely resolution to the needs.Variants of Indus EXIM Trade Current Account:

| S.No | Account Type | Quarterly throughput Volume |

| 1 | Indus EXIM – Basic | USD 20,000 |

| 2 | Indus EXIM – Advantage | USD 50,000 |

Benefits

- No minimum balance maintenance requirement

- Dedicated relationship manager

Indus Dollar One - Trade Account

Focusing the ever-evolving global business scenario, IndusInd Bank is offering the Indus Dollar One - Trade Account. It is specially designed for international business. The IndusInd Bank Dollar One Trade current account is a complete value for money proposition offering:- Average monthly balance requirement of Rs.1 lakh

- The pricing is of only Rs. 60 for key trade transactions

- Other trade transactions such as Inward Remittances, SWIFT, FIRC & BRC Issuance, LC advising at a nominal charge

Benefits

- Substantial free domestic transaction limits and services

- Five payable at Par cheque book free per month

- Free RTGS/NEFT

Exchange Earners Foreign Currency Account

For firms engaged in regular export and import from the exchange rate fluctuations, IndusInd bank formed an Exchange Earners Foreign Currency Account (EEFC). It is for sectors like software, biotechnology, gems, jewellery, textiles. Note: Currently, EEFC deposits are in the form of a current account and do not attract any interest earning.Advantages:

- Deposit foreign currency cheques payable anywhere in the world

- Purchase foreign currency drafts in USD, GBP, EURO, AUD and CAD

Special Foreign Currency Account

An individual foreign currency account is designed for residents, overseas tour operates and resident foreign currency (Domestic).Indus Edge Current Account

It is a comprehensive suite of seven current account variants to cater to the needs of local traders, start-ups, and established corporate. Indus Edge current account comprises of Indus Prestige current account, Indus Blue, Indus Silver, Indus Silver Plus, Indus Aspire, Indus Gold, Indus Gold Plus, and variants to serve entities at different stages of business life cycle.Indus Prestige current account

The Indus Prestige current account is a specialized product for the manufacturers, C & F agents and bulk trader segment. This current account has premium services and exclusive benefits.Benefits

- Unlimited Free fund transfer option

- Free cheque transaction across all IndusInd bank location

Indus Gold Plus current account

Indus Gold Plus current account is specialized service for the Retail Wholesalers, Showroom owners and Job Work Industries, Service Industries, Manufacturers, Exporters and Importers.Advantages

- Free PAP cheque books

- Free intercity account to account fund transfer within Induslnd bank

Indus Gold current account

Indus Gold current account is a unique product that crafted for traders, retailers, small and mid-sized manufacturers, hotels, travel agencies, exporters, importers and logistics firms. For adding value to the business, Induslnd bank is providing this best product in the SME segmentAdvantages

- The business transactions will be managed by the IndusInd bank, using an IndusInd network of 210 branches spread across 155 locations.

- To transfer and collect funds faster across cities to facilitate the business and manage the working capital cycle, one can choose this product

- 100 Free cheque leaves per month

- Free demand draft and pay orders up to Rs.50 lakh per month on Induslnd location

Indus Silver current account

With a minimum of AMB requirement of Rs.25 on Indus Silver, this account helps to manage the banking transaction at a minimum cost.Benefits

- Free collection of cheques deposited at Induslnd location up to Rs.30 lakhs per month

- Free corresponding bank DD up to Rs.5 lakh per month

Niche Current Accounts

Niche current accounts are a unique product for industry-specific needs; this product comprises three more services as given below:Indus Grain Merchant Flexi

This type of IndusInd current account is an ideal offering for traders and dealers in agricultural commodities during all seasons.Benefits:

- High transaction limit

- This type of account offers completely flexible and fungible cash deposit limits between home and non-home deposits

Indus Textile Current Account

Indus Textile current account offers best-in-class cash deposit limits for non-home textile locations. The IndusInd bank provides special waivers on outward cheque returns.Indus Infotech Current Account

The Indus Infotech Current Account is a comprehensive package of banking solutions that include Trade & Forex services, Salary Accounts, and Retail Forex solutions. Provide all these at very competitive pricing.Customized Current Account

Customized Current Account is a Made to Order Current Account type. By using this product the trader/businessman will have freedom & flexibility to design the own bouquet of banking services. You can define the transactional limits as per the demands of the business. Eligibility Criteria: For opening a customized IndusInd bank current account, the minimum balance should be Rs. 1 lakhsBenefits

- The applicant can set a limit of transactions as per the business requirements

- The customer can quickly increase or decrease the transaction limits

- The flexibility of choosing the minimum balance across accounts

- Hassle-free banking with minimum transaction cost

Loan Against TD

The IndusInd bank offers loan facility against existing term deposits. The interest rates for such loan and other charges related will be available on the IndusInd bank official website and updated from time to time.Nomination facility

Nomination facility is available for IndusInd bank current accounts operated by individuals including sole proprietorship account. Such a nomination cannot be obtained for accounts held in a representative capacity as the holder of any other office. In cases where the sole current account holder dies or is declared incompetent, the proceeds of the IndusInd bank current account will only be processed to the registered nominee.Applicable Fee

Charges in connection with the operation of the IndusInd bank current account and the services will be levied at the rates as indicated on the Induslnd bank official portal from time to time and as per the current account services offered to the businessman/trader. Note: The charges will be debited from the account at defined frequencies as per banks internal policies.Documents Required

Documents need to be furnished for opening IndusInd Bank Current Account is given below:- Aadhaar Card

- PAN Card

- Proof of Identity – Aadhaar Card, Passport, Voter Identity Card, Driving License

- Proof of Address – Passport, Voters Identity Card, Ration Card, Registered Lease or Sale Agreement of Residence, Driving License, Statement for the last three months, Utility Bills (Electricity Bills/Telephone Bills/ Gas Bills) which is not more than three months old.

- Copies of rule or bye-laws (Company / Society)

The opening of Current Accounts for Non-Individuals

If a non-individual is willing to open an IndusInd bank current account and if he/she has a credit facility with other banks, a No Objection Certificate (NOC) is required from the existing lending banks. A letter will be sent to the consortium leader if under consortium, or the concerned bank, if under multiple banking arrangements seeking a NOC.No encumbrance

The businessman/trader who wishes to open an IndusInd bank needs to ensure that no encumbrance or third party interest is created or permitted over the account (including the credit available in the account) held with the Induslnd Bank without an explicit written agreement with the bank.Procedure to open an IndusInd Bank Current Account

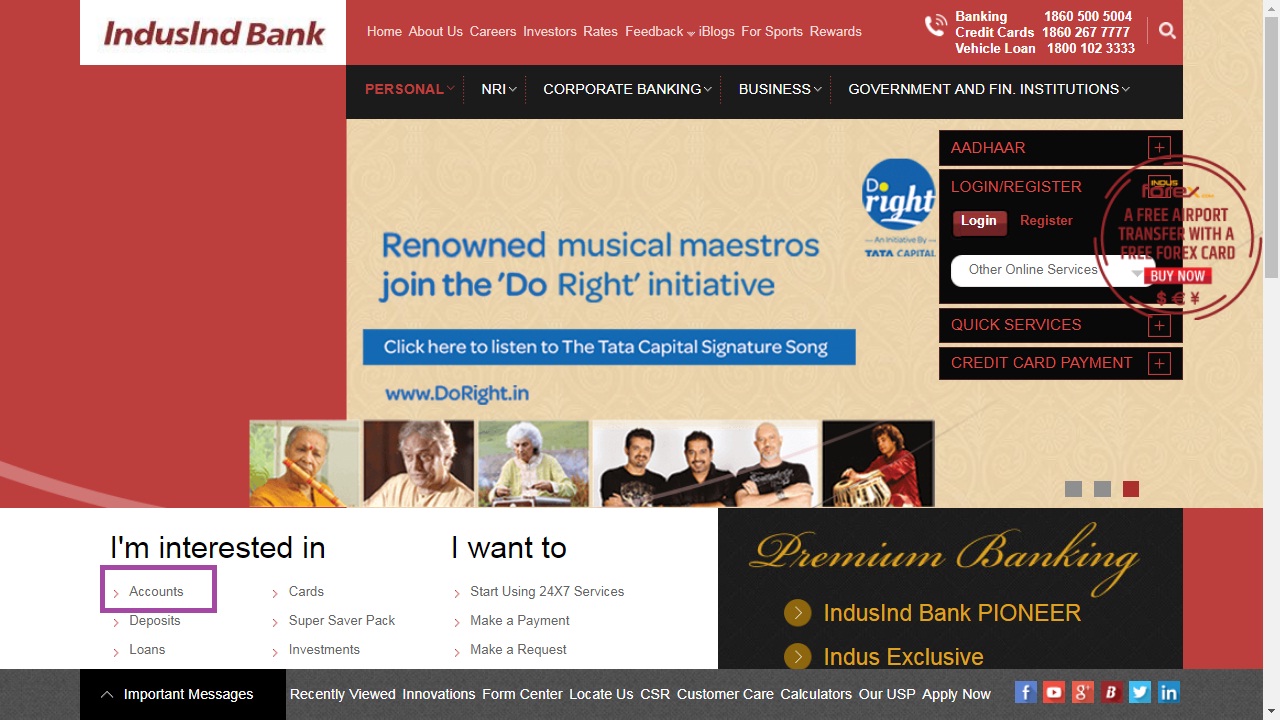

Persons desiring to open an IndusInd Bank current account can follow the procedure explained below: Step 1: Access the home page of the IndusInd bank official web portal. Image 1 IndusInd Bank Current Account

Step 2: From the account tab, select the current account option. By clicking on this list of IndusInd bank, current accounts will be displayed.

Image 1 IndusInd Bank Current Account

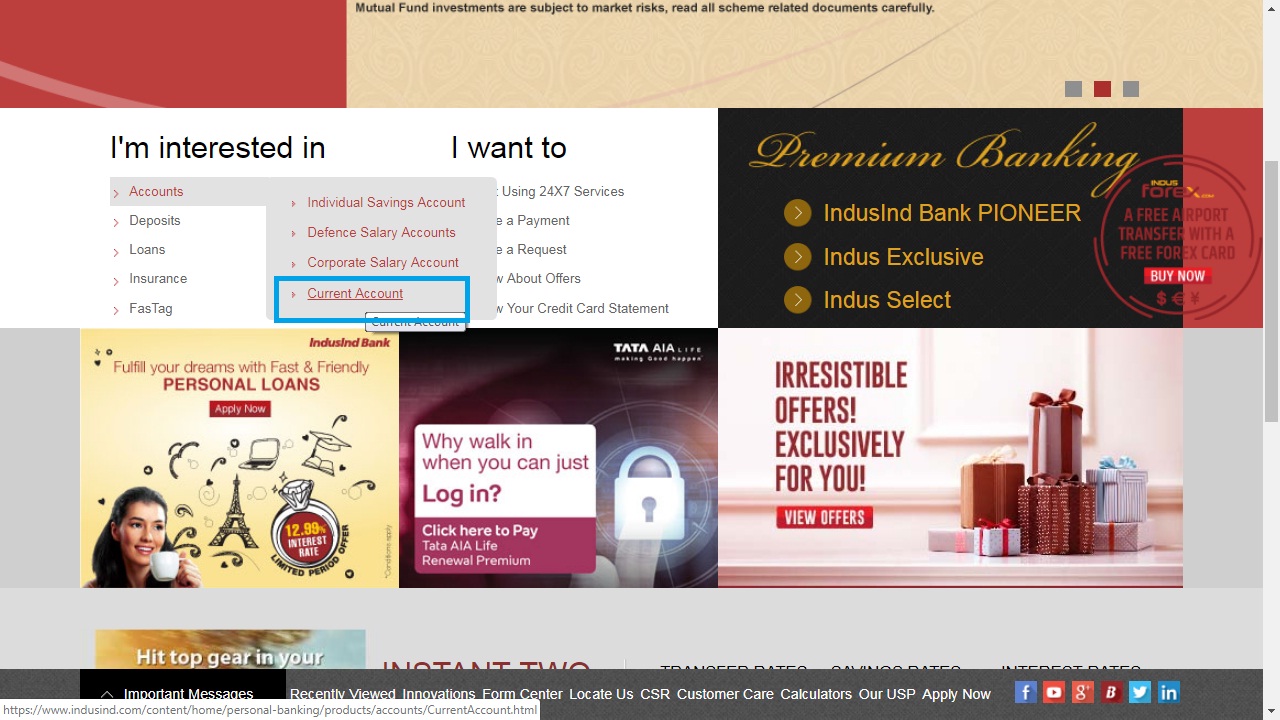

Step 2: From the account tab, select the current account option. By clicking on this list of IndusInd bank, current accounts will be displayed.

Image 2 IndusInd Bank Current Account

Step 3: As per business-specific needs, click on the ‘Apply now’ option from the appropriate current account.

Image 2 IndusInd Bank Current Account

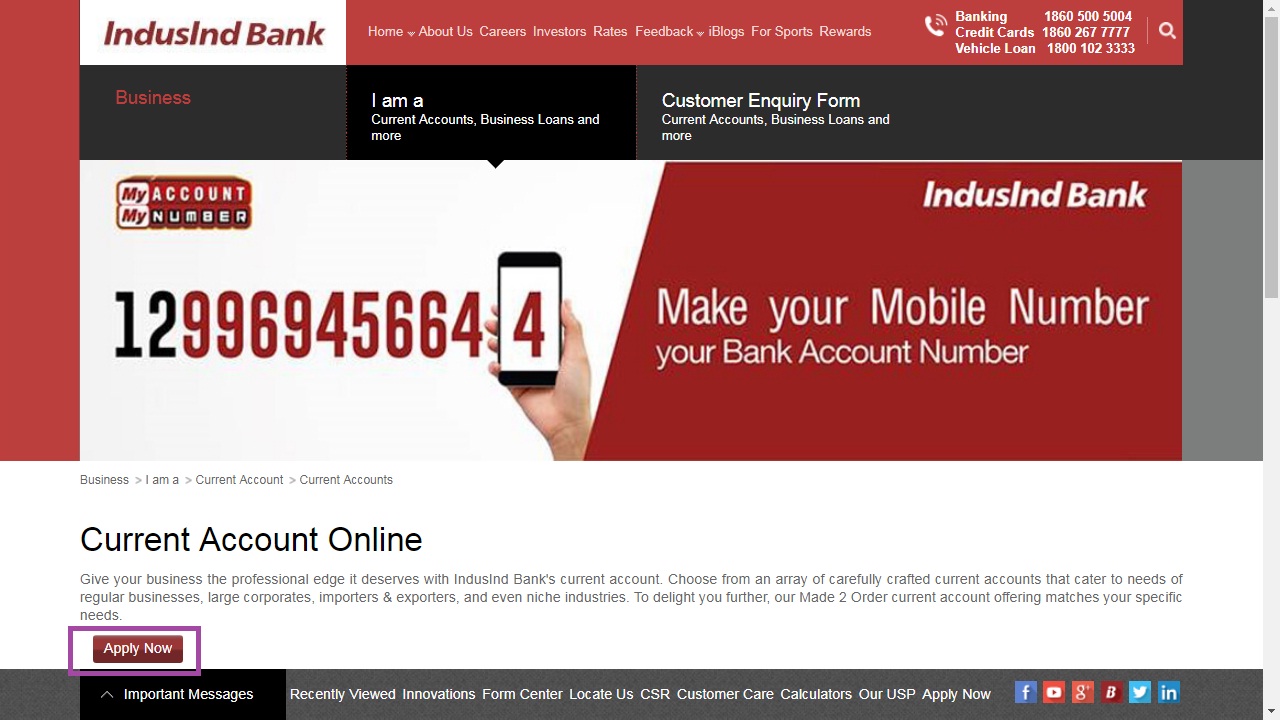

Step 3: As per business-specific needs, click on the ‘Apply now’ option from the appropriate current account.

Image 3 IndusInd Bank Current Account

Step 4: In the new page you need to provide details of Name, Firm Name, Nature of business, Email ID, Mobile number, State, City, Branch and referral code.

Image 3 IndusInd Bank Current Account

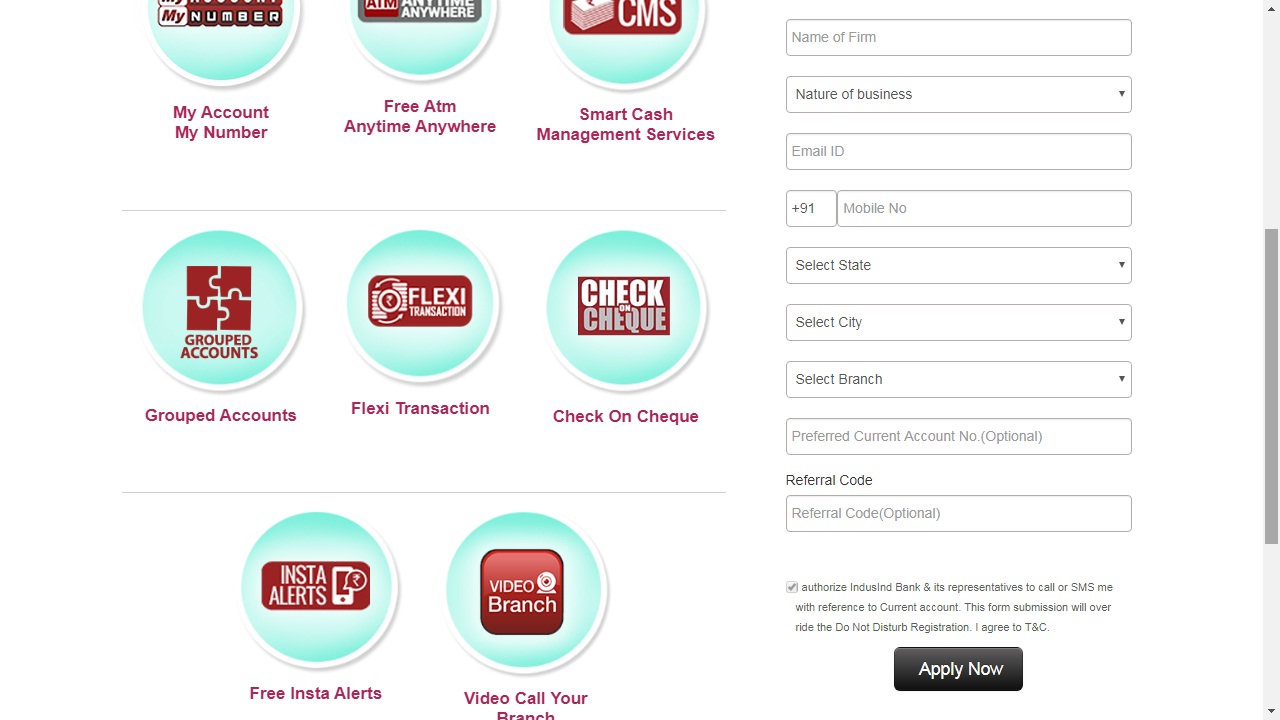

Step 4: In the new page you need to provide details of Name, Firm Name, Nature of business, Email ID, Mobile number, State, City, Branch and referral code.

Image 4 IndusInd Bank Current Account

After providing details click on Apply now option. After providing all necessary aspects click on submit button.

Once the application is submitted, the customers will have to deposit initial deposit amount by cheque (drawn on the name of individual/entity) as initial funding. After the verification account will be opened in the name of the applicant. The IndusInd bank manager will issue Cheque Book and other documents.

Image 4 IndusInd Bank Current Account

After providing details click on Apply now option. After providing all necessary aspects click on submit button.

Once the application is submitted, the customers will have to deposit initial deposit amount by cheque (drawn on the name of individual/entity) as initial funding. After the verification account will be opened in the name of the applicant. The IndusInd bank manager will issue Cheque Book and other documents.

Interest Rate

IndusInd bank current accounts are non-interest bearing accounts, and the Reserve Bank of India regulates this.Account Operating Rules

- If an IndusInd bank current account is opened in the middle of a term (month, quarter, etc.) the number of permissible transactions will be calculated pro-rata basis.

- If the current account is closed within six months from the date of its opening, an incidental fee will be charged.

- If the number of current account transactions exceeds the permitted limits, service charges will be levied

- Cash transactions can be done in an amount rounded to rupee only.

- The bank will allow cash withdrawal by cheque just for an amount higher than Rs 50.

- As stated there is no upper limit for the amount that can be drawn by a single cheque, but branch officials will necessarily authenticate such withdrawal as per the banks passing power policy.

Transfer of Account

The IndusInd bank current account and the services are non-transferable under any circumstance and will be used applicant only. The IndusInd bank though reserves the right to transfer, assign, or sell its rights, benefits or obligations to any other person.Dormant account

If there is no customer induced transactions for 12 consecutive months, the IndusInd bank current account becomes inactive. If there is no customer induced transactions for 24 straight months in the account, that is if no customer-induced transactions for 12 months after the account had become inactive.Closure of the account

IndusInd Bank reserves the right to close or freeze the current account, after due notice to the applicant or customer about the notice.Popular Post

In the digital age, the convenience of accessing important documents online has become a necessity...

The Atalji Janasnehi Kendra Project that has been launched by the Government of Karnataka...

The Indian Divorce Act governs divorce among the Christian couples in India. Divorce...

When an individual has more than a single PAN card, it may lead to that person being heavily penalised, or worse,...

Employees Provident Fund (PF) is social security and savings scheme for employee in India. Employers engaged...