Last updated: December 17th, 2019 5:23 PM

Last updated: December 17th, 2019 5:23 PM

Input Service Distributor Registration

An Input Service Distributor is an office of persons registered under GST, where tax invoices are received for distribution of input tax credit to branches of the same business. Hence, the concept of input service distributor would be applicable only for entities having multiple branches and multiple GSTINs. Also, the GST input service distributor concept is very similar to the input service distributor concept under service tax. In this article, we look at the procedure for obtaining GST registration for an input service distributor.Should I get Input Service Distributor registration?

Businesses having multi-branch operation or multi-state operations normally centralise the purchasing of goods or services out of one office. In such cases, to effectively set-off GST liability, the GST input tax credit accrued at the purchasing office must be distributed to the branch office, in proportion to the consumption of services. In this scenario, the taxpayer can register the centralised purchasing office as an input service distributor. Once the purchases are made, by issuing an invoice, the input service distributor can transfer IGST, CGST and SGST input tax credit to the branches. It is important to note that only input tax credit pertaining to input services can be distributed. Input tax credit on input goods and capital goods cannot be distributed by an Input Service Distributor. Know more about GST registration for branches.Input Service Distributor Registration

According to the CGST Act, all Input Service Distributors must be compulsorily registered under GST. The procedure for obtaining GST registration for Input Service Distributor is similar to that of obtaining GST registration for a normal GST taxpayer. To obtain GST registration for an input service distributor, a separate application must be submitted in the GST portal in form GST REG-01. There is no turnover limit or threshold for registering as an input service distributor. Hence, any GST payer who needs to distribute input tax credit on input services can be registered as an input service distributor.[maxbutton id="7" ]

Input Service Distributor Return Filing

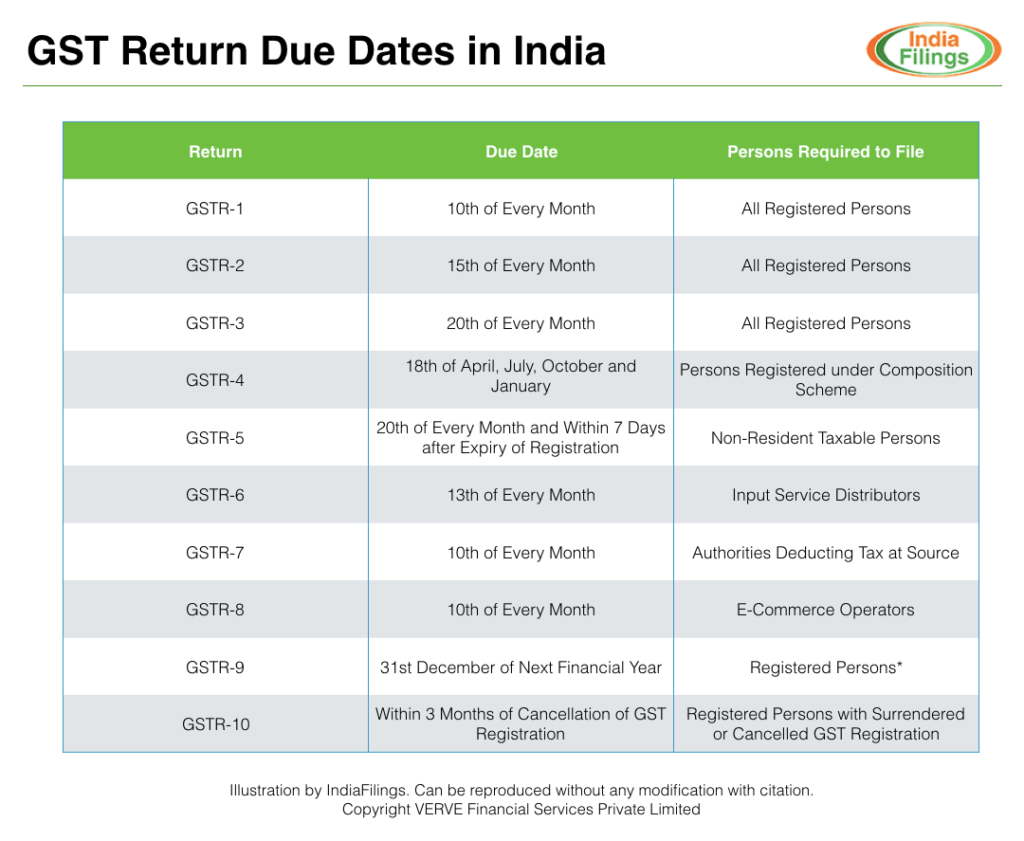

All GST taxpayers registered as an Input Service Distributor must file GSTR 6 every month before the 13th. Also, the input tax credit from the invoices received must be distributed in the same month by issuing a GST invoice in the format specifically mentioned for input service distributors. GST Return Filing Due Dates

GST Return Filing Due Dates

Invoice Format for Input Service Distributors

The invoice format used by Input Service Distributors for distributing input tax credit must contain the following information:- Name, address and Goods and Services Tax Identification Number of the Input Service Distributor.

- Consecutive serial number not exceeding sixteen characters, in one or multiple series, containing alphabets or numerals or special characters.

- Date of its issue.

- Name, address and Goods and Services Tax Identification Number of the recipient to whom the credit is distributed.

- Amount of the credit distributed.

- Signature or digital signature of the Input Service Distributor or his authorised representative.

Popular Post

In the digital age, the convenience of accessing important documents online has become a necessity...

The Atalji Janasnehi Kendra Project that has been launched by the Government of Karnataka...

The Indian Divorce Act governs divorce among the Christian couples in India. Divorce...

When an individual has more than a single PAN card, it may lead to that person being heavily penalised, or worse,...

Employees Provident Fund (PF) is social security and savings scheme for employee in India. Employers engaged...