Last updated: January 10th, 2023 6:31 PM

Last updated: January 10th, 2023 6:31 PM

Input Tax Credit for Imports

Under the GST regime, the input tax credit is provided for the IGST and GST Compensation Cess paid during the import of goods into India. From 1st July 2017, after the implementation of GST, all imports of goods into India would be treated as inter-state supply. Hence, IGST would be applicable. In this article, we look at the input tax credit for imports in detail.GST Registration is Required for Importers

From 1st July 2017, the procedure for importing goods into India is set to change with the implementation of GST. The new GST Bill of Supply requires the GSTIN of the importer for levying IGST, GST Compensation Cess and tracking input tax credit. Hence, all importers would be required to obtain GST registration before arrival of goods into India.Filing GST Bill of Entry

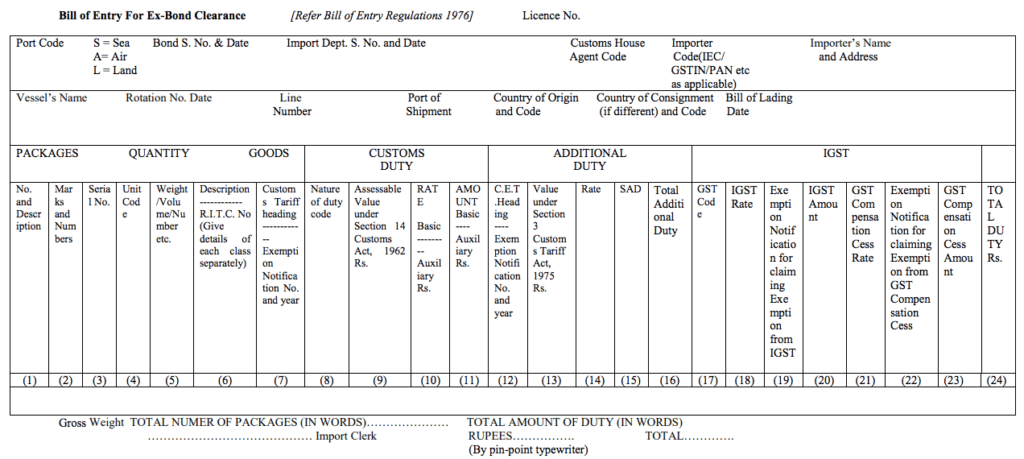

Once, GST is implemented, the Bill of Entry would change to take on record the importers GST. Importers having GSTIN can mention GSTIN on the bill of entry. Importers having provisional GSTIN can mention the provisional GSTIN on the GSTIN. All goods arriving in India from 1st July, 2017 would have to comply with the new regulations and pay IGST and GST Compensation Cess as applicable. Filing GST Bill of Entry

Filing GST Bill of Entry

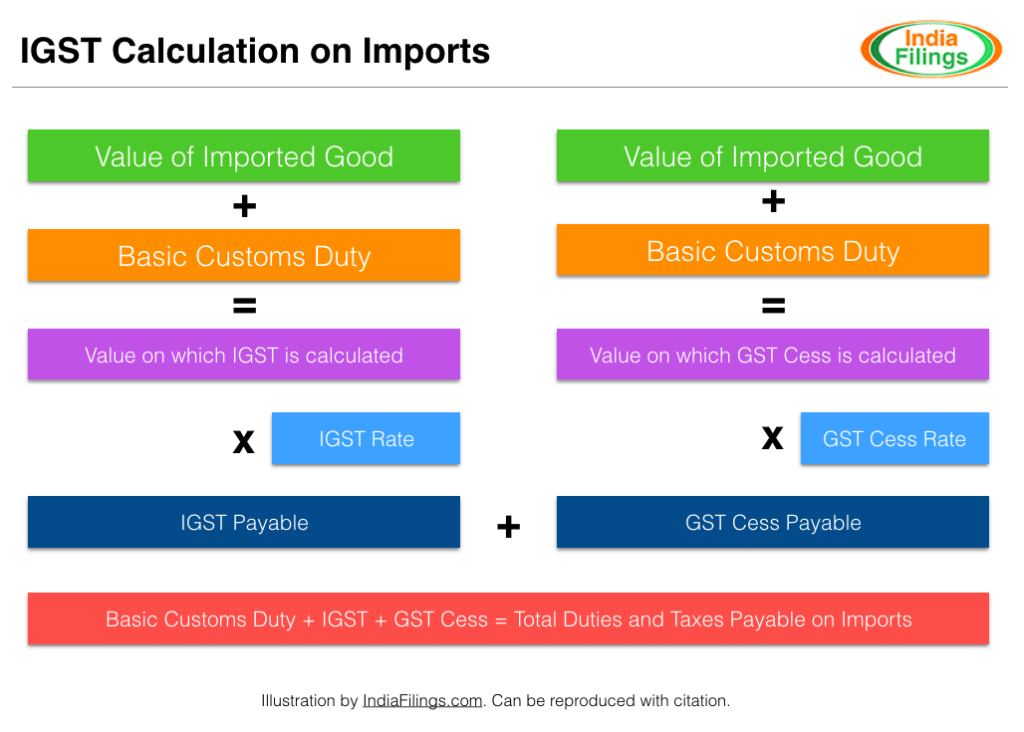

IGST Calculation for Imports

IGST and GST compensation cess is levied on the value of the imported goods. Value of imported goods is the aggregate of:- Value of imported article as determined under the Customs Act, 1962

- Duty of Customs chargeable on that article under Customs Act, 1962 and any sum chargeable on that article under any law for the time being in force as an addition to.

IGST on Imports - Calculation Methodology

IGST on Imports - Calculation Methodology

Input Tax Credit for Imports

Input tax credit of the integrated tax (IGST) and GST Compensation Cess is made available to the importer and later to the recipients in the supply chain. In order to avail input tax credit of IGST and GST compensation cess, an importer has to mandatorily declare GST Registration number (GSTIN) in the Bill of Entry. Further, GSTR-2 must be filed by the importer along with GST tax invoice and other relevant documents for claiming input tax credit. Its important to note that Basic Customs Duty (BCD) paid cannot be claimed as input tax credit.Know more about GST in India at the IndiaFilings GST Portal.

Import Export Code

The Import Export Code is a primary document necessary for commencing Import-export activities. The IE code is to be obtained for exporting or importing goods or services. IEC has numerous benefits for the growth of the business. Indeed, you cannot ignore the necessity of IE code registration, as it is mandatory. You can apply for an Import Export code through IndiaFilings and obtain it within 6 to 7 days.Popular Post

In the digital age, the convenience of accessing important documents online has become a necessity...

The Atalji Janasnehi Kendra Project that has been launched by the Government of Karnataka...

The Indian Divorce Act governs divorce among the Christian couples in India. Divorce...

When an individual has more than a single PAN card, it may lead to that person being heavily penalised, or worse,...

Employees Provident Fund (PF) is social security and savings scheme for employee in India. Employers engaged...