Last updated: June 2nd, 2020 3:09 AM

Last updated: June 2nd, 2020 3:09 AM

Instant PAN Facility – Get e-PAN Using Aadhaar

On May 28, 2020, Honourable Finance Minister – Smt. Nirmala Sitharaman has launched a new facility for instant allotment of e-PAN to further ease the process of allotment of Permanent Account Number. The official launch of the Instant PAN facility follows the announcement made by Finance Minister in the Union Budget 2020–2021. Under this new system, PAN will be instantly allotted online based on Aadhaar number based e-KYC details without any requirement for filing up of detailed application form. The launch of the Instant PAN facility is another important step of the Income Tax Department towards Digital India campaign and it’s creating further ease of compliance for the taxpayers. [caption id="attachment_107630" align="aligncenter" width="487"] Free instant PAN card through Aadhaar

Free instant PAN card through Aadhaar

Note on Instant e-PAN

e-PAN is a digitally signed Permanent Account Number (PAN) card issued in electronic format by the Income Tax Department using Aadhaar e-KYC (electronic Know Your Customer) details. Aadhaar based e-KYC is an online service provided by the Unique Identification Authority of India (UIDAI) for verification of identity and address of Aadhaar holder. Income Tax Department holds this Aadhaar based e-KYC for instant e-PAN allotment.Applicability

This facility is now available for all Permanent Account Number holders who possess a valid Aadhaar card and have a mobile number registered in the Unique Identification Authority of India's (UIDAI) database. This facility is not available for Minors and others covered under Section 160 of Income Tax Act, 1961.Note on Beta version for Instant Allotment of PAN

The 'beta version' for instant allotment of PAN on a trial basis was launched on 12.02.2020 and it was made available on the e-filing website of the Income Tax Department. Know more about e-PANBenefits for obtaining Instant e-PAN

- Taxpayers can avail the PAN card through the paperless process and allotment of e-PAN is based on the real-time facility.

- The applicant does not need to submit the detailed application form to avail of the PAN card.

- According to the notification of the income tax department, the time frame of allotting the e-PAN through this new facility is 10 minutes. Hence the new instant PAN process will consume less time than the old process.

- The taxpayers who have a valid Aadhaar number and have a mobile number registered with Aadhaar can easily use this facility to obtain the e-PAN.

- The applicant can get the electronic PAN at free-of-cost

Eligibility Criteria

To get the new free instant e-PAN Using Aadhaar, the applicant mush full fill the following condition.- The applicant does not obtain a PAN

- The applicant’s mobile number should be linked with Aadhaar number

- The applicant’s complete date of birth (DD-MM-YYYY) format should be available on Aadhaar card

- The applicant should not be minor as on the date of application of the PAN.

Procedure to Get free, instant e-PAN Using Aadhaar

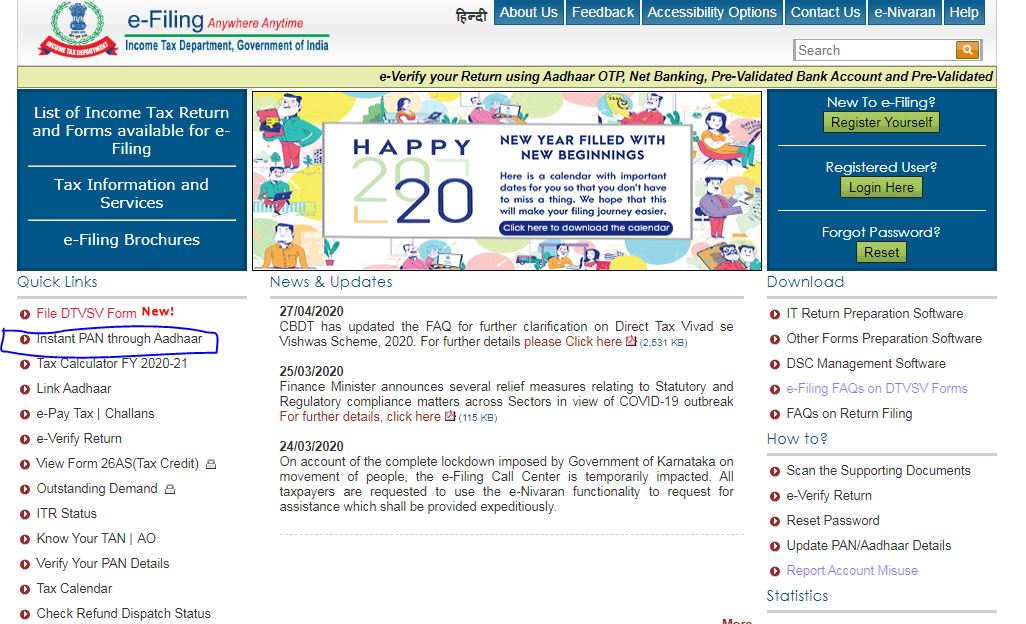

The instant PAN applicant is needed to access the official e-filing website of the income tax department. From the home page, under the 'Quick Links' option, click on 'Instant PAN through Aadhaar' option. Instant PAN facility - IT Home Page

Instant PAN facility - IT Home Page

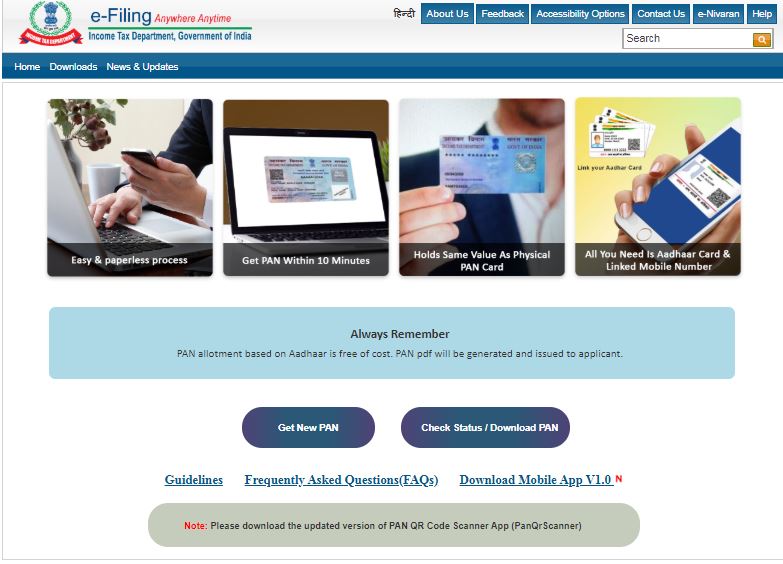

- The link will redirect to the new page, click on the 'Get New PAN' option.

Instant PAN facility - PAN Application Page

Instant PAN facility - PAN Application Page

- Furnish the Aadhaar number, captcha code, and confirm. The applicant needs to select a tick box. The tick box will confirm the following

- Details of PAN card issued

- Details of the mobile number are linked with Aadhaar number

- Complete date of birth in (DD-MM-YYYY) format as available on Aadhaar card

- Details of a minority of applicant

- The terms and conditions

Instant PAN facility - PAN Application Page2

Instant PAN facility - PAN Application Page2

- Click on the 'Generate Aadhaar OTP' option to get a one-time password (OTP) on the applicant’s mobile number registered in the Aadhaar database.

- After receiving the OTP, provide the same in the required space.

- The system will validate the Aadhaar details and Check if the name, date of birth, and other details shown are correct.

- Once the details are furnished successfully, an acknowledgement number (15 digits) will be generated and it will send to the applicant through SMS and email.

Check the status of the instant e-PAN request

If wanted, the applicant can check the status of the instant e-PAN request anytime using the valid Aadhaar number and on the successful allotment, can download the e-PAN.Download e-PAN

Follow the steps mentioned below to download the e-PAN, once the applicant has applied for PAN using this facility: Access the official website of the Income Tax Department and click on the 'Instant PAN through Aadhaar' under the 'Quick Links' section. Select the 'Check Status of PAN' and provide the Aadhaar number in the required space, an OTP will be sent to the UIDAI registered mobile number. After providing the OTP, check whether the e-PAN is allotted. If it has been allotted, the applicant can get the instant e-PAN by clicking on the download link.Instant e-PAN Validity Details

According to the frequently asked questions section on the Income Tax e-filing website, this instant e-PAN is valid for all purposes and it is not different from the PAN issued by the income tax department via other modes of application. However, this instant e-PAN paperless, online, and free of cost. Further, the e-PAN contains a Quick Response code that contains demographic details of the PAN holder such as name, date of birth, and photograph and such details are accessible through a QR code reader.Popular Post

In the digital age, the convenience of accessing important documents online has become a necessity...

The Atalji Janasnehi Kendra Project that has been launched by the Government of Karnataka...

The Indian Divorce Act governs divorce among the Christian couples in India. Divorce...

When an individual has more than a single PAN card, it may lead to that person being heavily penalised, or worse,...

Employees Provident Fund (PF) is social security and savings scheme for employee in India. Employers engaged...