Updated on: December 17th, 2019 4:56 PM

Updated on: December 17th, 2019 4:56 PM

Interest Subvention Scheme for MSMEs 2019

In the Union Budget 2019, Union Minister of Finance informed that under the interest subvention scheme, Rs. 350 crore would be allotted to all GST registered Micro, Small and Medium Enterprises (MSMEs) for fresh and incremental loans.Goal of the Scheme

To provide Rs. 1 crore loans in 59 minutes to all GST registered MSME sector through a separate online portal to enhance loan access.Objective of the Scheme

- To enhance credit access for all GST registered MSME sector

- To increase productivity and foreign investments

- To provide support for technology upgradation

- To increase employment opportunities and

- To encourage MSME sectors to use GST platforms by providing incentives

Interest Subvention Scheme

The Ministry of MSME implemented interest subvention scheme for MSMEs from 2018-2020. This scheme plays an important role by proving credit loans for MSMEs to boost and influence export growth and maintain day-to-day expenses. GoI allotted Rs. 6000 crore to support this scheme and it will be distributed through hubs/online portals. For information on Interest Subvention Scheme, click here.Benefits of the Scheme

- GoI provides 2% interest subsidy per annum for all GST registered MSMEs

- Scheme extended for the year 2019-20 for all fresh, incremental or working capital loans

- GoI provides interest subvention up to maximum financial assistance of Rs.100 lakh

Eligibility for the Scheme

The MSME should have a valid Udyog Aadhar Number (UAN) and GSTN Number The term loan or the incremental loan should have been extended by the commercial banks scheduled by the RBI. Note: This scheme is not applicable for exporters who have availed credit through the Department of Commerce for pre-shipment or post-shipment To apply for UAN or GSTN, click here.Interest Calculation

The interest is calculated at 2% per annum on the availed loaned amount for this scheme. For read detailed information on interest calculation, half-yearly claims, nodal agency click here.How to Claim

The MSMEs can claim the subsidy through Small Interest Development Bank of India (SIDBI) with a fee of 0.25% per annum. The eligible MSMEs should fill the following forms and should be submitted in the following format:Annex-I

Annex-I form is used to mention the half-yearly claim through this scheme. The sample copy of Annex-1 is provided below: Annex-1

Annex-1

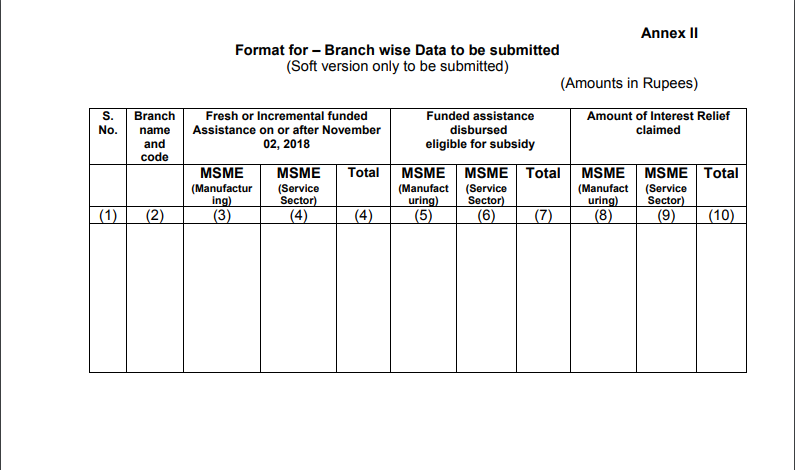

Annex-II

Annex-II form is used to provide the branch wise details and a soft copy should be submitted in excel format. Sample of Annex-II is produced below: Annex-2

Annex-2

Annex-III

Annex-III form should be provided by the concerned MSME to the Controlling branches or Head Offices for the compilation of data by the branches. The Haly yearly claims can be submitted to the Chief General Manager, Institutional Finance Vertical, SIDBI and the funds can be collected after released from MoMSME. For more details on annexure forms, click here.Documents Required for the Scheme

- Annex-I, Annex-II, Annex-III forms

- Certificate from statutory auditors of the eligible institutions (should include verification of accounts with regard to amount, incremental or fresh lending, the interest charged and the amount claimed)

- Details of PAN card, Aadhar card of the applicant

- Utility bill and Property tax bill

- Trade Licence

- Ownership documents

- Copy of the partnership deeds or MOA

- Copy of IT returns for the three financial years

- Statement of capital and loan expenditure

Popular Post

In the digital age, the convenience of accessing important documents online has become a necessity...

The Atalji Janasnehi Kendra Project that has been launched by the Government of Karnataka...

The Indian Divorce Act governs divorce among the Christian couples in India. Divorce...

When an individual has more than a single PAN card, it may lead to that person being heavily penalised, or worse,...

Employees Provident Fund (PF) is social security and savings scheme for employee in India. Employers engaged...