Last updated: October 27th, 2022 5:03 PM

Last updated: October 27th, 2022 5:03 PM

Is Physical Verification Required for GST Registration?

GST registration is required for a taxable person under GST. A taxable person under GST could be a business incorporated in India falling under any of the mandatory registration criteria or qualifying due to the aggregate turnover criteria. Any business incorporated outside of India shall also obtain GST registration in India if they supply goods or services to residents in India. Hence we look at the requirement of physical verification for GST Registration.Physical Verification NOT Required for all GST Registration

The Ministry of Finance (MoF) informed that all the taxpayers both in India and abroad shall register under GST. Further, the Ministry expects that the number of entities to register for GST shall exceed Rs.1 crore upon consolidating the VAT, Service Tax and Central Excise. However, to transfer from VAT or for GST registration, the applicant shall provide the following documents to prove the use of the place of business:- For Own premises – Any document in support of the ownership of the premises like the latest Property Tax Receipt or Municipal Khata copy or copy of Electricity Bill.

- For Rented or Leased premises – A copy of the valid Rent/Lease Agreement with any document in support of the ownership of the premises of the Lessor like Latest Property Tax Receipt or Municipal Khata copy or copy of Electricity Bill.

- Premises not covered in the above category – A copy of the Consent Letter with any document in support of the ownership of the premises of the Consenter like Municipal Khata copy or Electricity Bill copy. The user shall upload the same document also for shared properties.

- For rented/leased premises where the Rent/lease agreement is not available, an affidavit to that effect along with any document in support of the possession of the premises like copy of Electricity Bill.

- The applicant should upload the necessary documents or certificates issued by the Government if the principal place of business operates at SEZ or the applicant categorized as an SEZ developer.

Digital Verification of Premises for GST Registration

Though the GST registration process normally does not require physical verification of premises for grant of GST registration, an officer could request physical verification. However, if the concerned officer needs to validate the registration by physical verification of the place of business of the concerned applicant, then the Officer can request for a GST verification report with other documents.Verification Report for GST Registration

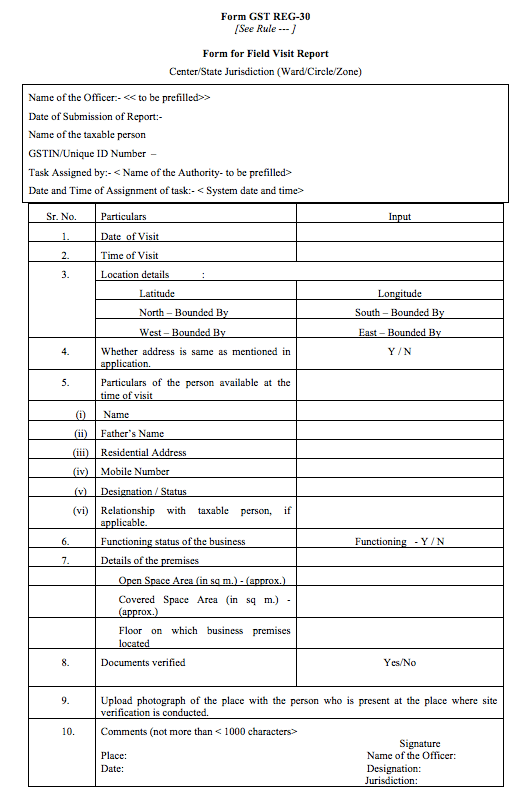

In cases, where the GST Officer orders for physical verification of premises during GST registration, a concerned GST officer would conduct a field verification and provide a verification report along with other documents, including photographs in FORM GST REG-30. The applicant shall submit the verification report for GST registration on the GST Common Portal within 15 working days. A sample GST physical verification: GST Physical Verification Report

Click here for GST registration

GST Physical Verification Report

Click here for GST registration

Popular Post

In the digital age, the convenience of accessing important documents online has become a necessity...

The Atalji Janasnehi Kendra Project that has been launched by the Government of Karnataka...

The Indian Divorce Act governs divorce among the Christian couples in India. Divorce...

When an individual has more than a single PAN card, it may lead to that person being heavily penalised, or worse,...

Employees Provident Fund (PF) is social security and savings scheme for employee in India. Employers engaged...