Last updated: May 22nd, 2024 5:39 PM

Last updated: May 22nd, 2024 5:39 PM

Form ITR-V - How to Download ITR Acknowledgement Form?

ITR filing is not considered valid without the final verification process. The verification proves that the provided information is true and accurate to the taxpayer's knowledge. ITR returns can be verified electronically using a digital signature, Aadhaar OTP, electronic verification code (EVC), etc. It can also done physically by logging into the income tax e-filing website, downloading a copy of the ITR-V acknowledgement form and submitted to the Centralized Processing Center (CPC) in Bangalore. This article mentions the procedure for generating and forwarding ITR-V to the Income Tax Department. IndiaFilings helps you to file the ITR return & verify it with expert assistance!! [shortcode_102]What is ITR-V Acknowledgement?

Form ITR-V acknowledgement is a one-page document generated after filing your income tax return (ITR) electronically in India. It acts as a verification receipt and doesn't require a digital signature. You can download it from the income tax e-filing website or receive it via email. While online verification methods exist, submitting a signed hard copy of ITR-V to a specific address within 30 days of filing is an alternative way to complete your ITR process. The ITR-V acknowledgement form includes an acknowledgement number and basic details about your filed income tax return.How to Download the ITR Acknowledgement Form?

When an income tax return is filed, the Income Tax department automatically generates the ITR Acknowledgement form and sends it to the registered email address. If the acknowledgement is not received, the assessee can easily done the process ITR acknowledgement download from the Income Tax E-Filing portal by logging in to the online account and following the steps given below: Step 1: Visit the Income Tax Department's e-filing portal itr acknowledgement step 1

Step 2: Log in using your credentials.

itr acknowledgement step 1

Step 2: Log in using your credentials.

ITR Acknowledgement step 2

Step 3: Navigate to "e-File" > "Income Tax Returns" > "View Filed Returns".

Step 4: You'll see a list of your filed ITRs. Locate the assessment year you want the ITR-V and click "Download Form" next to your return details.

Step 5: After downloading the receipt, send it to the CPC (Centralized Processing Center) Bangalore within 30 days of filing the returns.

This is the brief process of ITR acknowledgement download. Now, let's look at the sample and procedure for submitting the ITR acknowledgement to the CPC in Bangalore.

ITR Acknowledgement step 2

Step 3: Navigate to "e-File" > "Income Tax Returns" > "View Filed Returns".

Step 4: You'll see a list of your filed ITRs. Locate the assessment year you want the ITR-V and click "Download Form" next to your return details.

Step 5: After downloading the receipt, send it to the CPC (Centralized Processing Center) Bangalore within 30 days of filing the returns.

This is the brief process of ITR acknowledgement download. Now, let's look at the sample and procedure for submitting the ITR acknowledgement to the CPC in Bangalore.

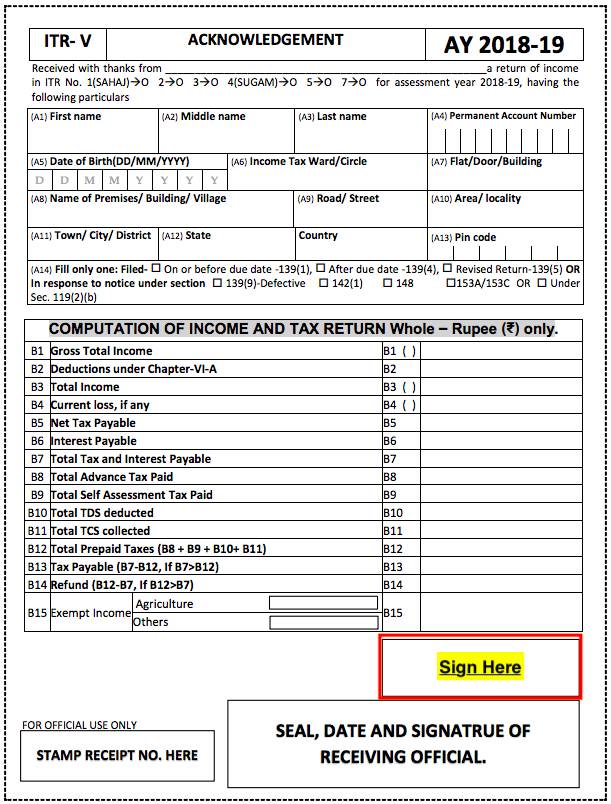

ITR Acknowledgement Sample

Here's the sample of the ITR acknowledgement for your reference, [caption id="attachment_45660" align="aligncenter" width="611"] ITR-V

If you want, do the ITR acknowledgement PDF.

ITR-V

If you want, do the ITR acknowledgement PDF.

ITR-V Submission to CPC in Bangalore

If the assessee is manually verifying the income tax returns filed, printing a copy of the ITR-V form received by email or on the income tax portal is necessary. The printed acknowledgement should be signed by the taxpayer and kept inside an A4-size envelope. Each envelope should contain only one ITR-V only. There is no requirement to keep any other document other than the signed ITR-V document. The envelope must then be sent by post (forwarding through courier service is unacceptable) to CPC in Bangalore within 120 days of filing income tax returns. The address for sending ITR-V is:1st Floor, Prestige Alpha No 48/1 48/2, Beratenaagrahara Begur, Hosur Rd, Uttarahalli Hobli, Bengaluru, Karnataka 560100

Consequence of late ITR-verification

As per the CBDT notification of March 27, 2024, if taxpayers verify their returns within 30 days of filing returns, the date of ITR submission will be taken as the date of filing the ITR. If the taxpayer is verified after 30 days, the verification date will be counted as the filing date. Then, it comes under the late filing of ITR (belated ITR). You will get a late filing fee of up to Rs.5000 for a belated ITR. So, verifying your ITR returns within 30 days of filing your returns is important.How long does receiving a receipt for ITR Acknowledgement from CPC take?

Typically, you will receive the ITR-V acknowledgement receipt in your e-mail ID within 3 weeks of submitting the form. If you didn't receive it, you must mail another copy of your income tax returns to the CPC income tax department.Points to remember when submitting ITR-V Acknowledgement to CPC:

ITR-V Acknowledgement is an important part of filing an income tax return. Hence, taxpayers are suggested to follow the points listed below while preparing and sending ITR-V to CPC:- When sending an ITR-V in an envelope, each envelope must have one ITR-V of the taxpayer.

- The ITR-V form must be signed and submitted within 30 days of filing the IT

- ITR-V should be printed in dark blank ink and clear to read.

- ITR-V should have an original signature in blue ink.

- The signature should not be on the form's barcode. The barcode and numbers below it should be clearly seen.

- A stapler should not be used on Form ITR-V.

- Do not fold this signed ITR-V.

- Enclose the ITR-V form in an A-4 size white envelope.

- Please send ITR-V to the CPC address mentioned above by speed post or ordinary post within 30 days from the date of filing.

ITR-V Submission vs EVC Verification

On submitting an income tax return online through the income tax e-filing website, the return must be verified by submitting an ITR-V form to the Income Tax Central Processing Centre (CPC) or through EVC Mode.EVC Verification

To improve the ease of filing income tax returns and to avoid the physical submission of ITR-V, the income tax department has introduced EVC verification. The ITR EVC Verification can be done in 6 different ways as follows:- EVC generation using email ID and mobile number

- EVC generation using an Aadhaar card

- EVC generation using net banking

- EVC generation using ATM

- EVC generation using bank account details

- EVC generation using a Demat account

Popular Post

In the digital age, the convenience of accessing important documents online has become a necessity...

The Atalji Janasnehi Kendra Project that has been launched by the Government of Karnataka...

The Indian Divorce Act governs divorce among the Christian couples in India. Divorce...

When an individual has more than a single PAN card, it may lead to that person being heavily penalised, or worse,...

Employees Provident Fund (PF) is social security and savings scheme for employee in India. Employers engaged...