Last updated: December 17th, 2019 5:44 PM

Last updated: December 17th, 2019 5:44 PM

Jaipur Property Tax

Jaipur property tax is a tax levied by the Municipal Corporation on the value of a property or real estate. Owners of properties in the state are responsible for paying property tax to the Municipal Corporation which is regulated by the Municipal Corporation of Jaipur. The property tax imposed on property varies with the municipal corporation. In this article, we look at the various aspects of Jaipur property tax in detail.Uses of Property Tax

Property tax is one of the primary revenue sources for the respective Municipal Corporations. Any residential, commercial, industrial located within the limits of the Municipal Corporation are subject to levy of property tax. In Jaipur, property tax is imposed on every financial year of the same month, and a citizen is liable is file return on the same day.Applicability for Property Tax

The following persons are required to pay property tax:- A person whose is above 18 years of age.

- An individual who is a permanent resident of Jaipur.

- Any person who owns a property in Jaipur is entitled to pay a property tax.

Categories of property tax

The following are the kinds of property that are liable to be taxed in Jaipur.- Residential

- Commercial

- Industrial

- Institutional

- Government properties

Exemption on Property Tax

The following persons are exempt from paying Jaipur property tax:- The land or property owned by the Devasthan Department of the respective Government.

- Any area or property maintained for public worship or civic purpose.

- Property used by an educational institution solely for purposes of education.

- Land controlled for the purposes connected with the disposal of dead bodies.

- Property for the cause of public parks public libraries or public museums.

Registration of Property Owners

The person who is liable to pay tax for their property has to make an application in the designated form to the assessing authority and also along with the amount of fifty rupees for the registration fee to the respective government. The assessing authority after verification when satisfied with the application proposed and payment made for registration will give a certificate of registration to the property owner in the prescribed form.Required Document

The applicant will be expected to submit the property tax invoice details at the time of making payment for property tax.Online Payment Procedure for Property Tax

To make payment for property tax online in Jaipur, follow the steps specified here.Visit Official Portal

Step 1: Please visit the official portal of the Municipal Corporation of Jaipur. Step 2: Click on “Urban Development tax” option which is under the citizen services tab on the homepage of the portal. [caption id="attachment_73157" align="aligncenter" width="488"] Jaipur Property Tax -Image 1

Jaipur Property Tax -Image 1

Service Number

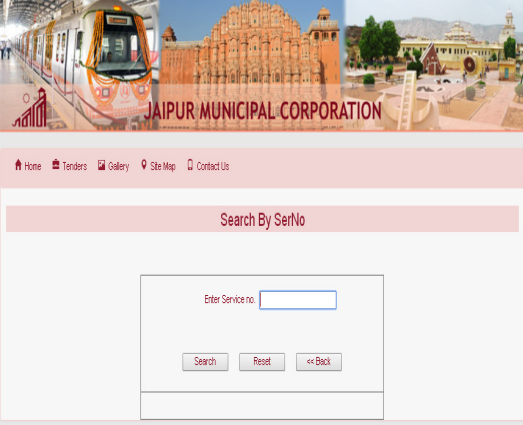

Step 3: On the next page, you have to select the “Yes” or “No” option for the question if you hold service number. [caption id="attachment_73159" align="aligncenter" width="492"] Jaipur Property Tax -Image 2

Step 4: If yes and then enter your service number in the text box and click on the “Search” button.

[caption id="attachment_73160" align="aligncenter" width="523"]

Jaipur Property Tax -Image 2

Step 4: If yes and then enter your service number in the text box and click on the “Search” button.

[caption id="attachment_73160" align="aligncenter" width="523"] Jaipur Property Tax -Image 3

Jaipur Property Tax -Image 3

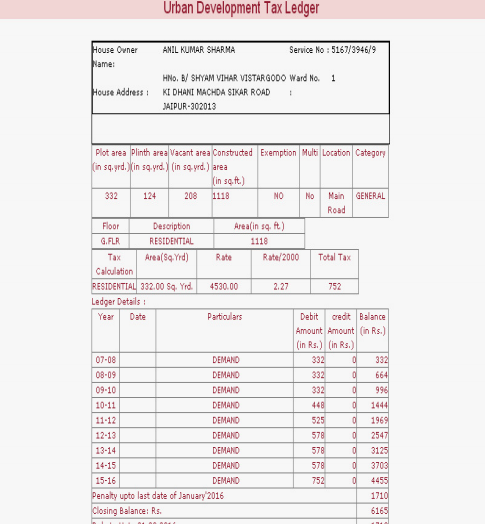

Urban Development Tax Ledger

Step 5: The Urban Development Tax Ledger will displays on the present screen along with the corresponding amount of property tax. [caption id="attachment_73161" align="aligncenter" width="485"] Jaipur Property Tax -Image 4

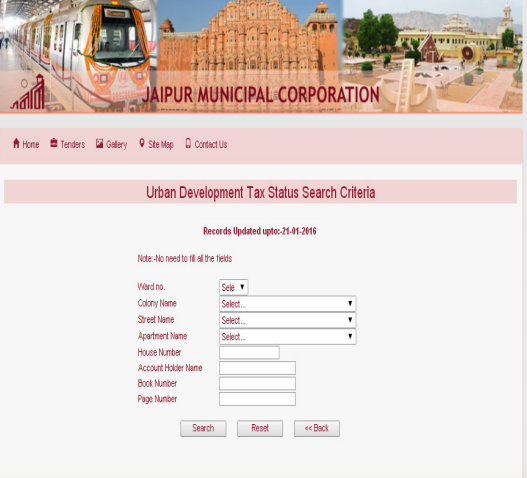

Step 6: In case of not holding service number select “No” option and the current page will be redirected to the "Urban development tax status search criteria" page.

[caption id="attachment_73162" align="aligncenter" width="495"]

Jaipur Property Tax -Image 4

Step 6: In case of not holding service number select “No” option and the current page will be redirected to the "Urban development tax status search criteria" page.

[caption id="attachment_73162" align="aligncenter" width="495"] Jaipur Property Tax -Image 5

Jaipur Property Tax -Image 5

Enter Property Details

Step 7: Enter the details regarding your property such as ward number, colony name, apartment name, account holder name, book number and page number and then click on “Search” button to view your property tax rate. [caption id="attachment_73163" align="aligncenter" width="527"] Jaipur Property Tax -Image 6

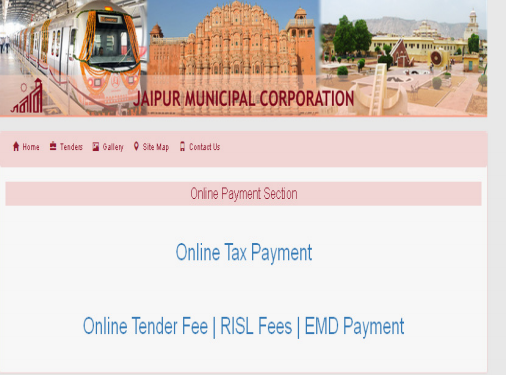

Step 8: Navigate to your homepage of the Jaipur Municipal Corporation and then click Pay Online button.

[caption id="attachment_73165" align="aligncenter" width="521"]

Jaipur Property Tax -Image 6

Step 8: Navigate to your homepage of the Jaipur Municipal Corporation and then click Pay Online button.

[caption id="attachment_73165" align="aligncenter" width="521"] Jaipur Property Tax -Image 7

Jaipur Property Tax -Image 7

Online Tax Payment

Step 9: Click on “Online Tax Payment” link and select the tax to be paid and enter the service number and click on the “Go” button. [caption id="attachment_73169" align="aligncenter" width="506"] Jaipur Property Tax -Image 8

Step 10: Click on “Verify information” and enter your mobile number, amount and to make a payment click on the “Pay” button.

[caption id="attachment_73171" align="aligncenter" width="584"]

Jaipur Property Tax -Image 8

Step 10: Click on “Verify information” and enter your mobile number, amount and to make a payment click on the “Pay” button.

[caption id="attachment_73171" align="aligncenter" width="584"] Jaipur Property Tax -Image 9

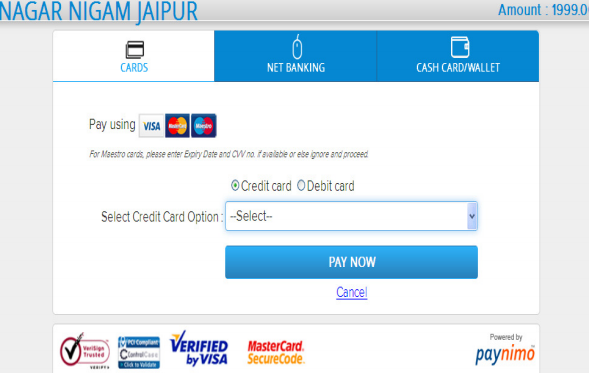

Make Payment

Step 11: Select your Payment option and click on “Pay now” button to make payment for property tax.

Jaipur Property Tax -Image 9

Make Payment

Step 11: Select your Payment option and click on “Pay now” button to make payment for property tax.

Jaipur Property Tax -Image 10

Penalty for Not Paying Tax

If a taxpayer refuses to pay the tax within the specified time limit, the assessing authority may impose a penalty which will not be more than one thousand rupees.

Jaipur Property Tax -Image 10

Penalty for Not Paying Tax

If a taxpayer refuses to pay the tax within the specified time limit, the assessing authority may impose a penalty which will not be more than one thousand rupees.

Popular Post

In the digital age, the convenience of accessing important documents online has become a necessity...

The Atalji Janasnehi Kendra Project that has been launched by the Government of Karnataka...

The Indian Divorce Act governs divorce among the Christian couples in India. Divorce...

When an individual has more than a single PAN card, it may lead to that person being heavily penalised, or worse,...

Employees Provident Fund (PF) is social security and savings scheme for employee in India. Employers engaged...