Last updated: April 17th, 2019 1:42 AM

Last updated: April 17th, 2019 1:42 AM

Jio PoS

The Reliance Industries have come up with the Jio PoS devices to process payments at stores. Reliance has never failed to take on great ventures to advance themselves with upgrading technologies. Jio, the new pursuit of Reliance Industries Chairman Mukesh Ambani, has undoubtedly brought about a significant impact in terms of data consumption amongst Indian users. In continuation of this, Reliance has chosen to try its might with the Jio Point-of-Sales (PoS) devices.Jio PoS

Jio PoS is an electronic device provided by various banks to merchants for collecting payments from clients or customers. This device incorporates different digital payment methods and other payment options such as ATM Cards, Credit Cards, etc. Usually, the banks charge a certain percentage of the entire transaction amount as the Processing Fee. But, considering the welfare of the merchants of our country, Jio is offering PoS devices at very less price and with free processing charges. Jio has partnered with Hindustan Unilever Limited (HUL) for acquiring merchants. As HUL is one among the largest FMCG brand, the reach for Jio PoS devices will be more and will quickly get momentum to the business.How to get Jio-PoS

- Retail provision stores and Merchants are expected to deposit INR 3,000 in order to avail a Jio PoS device.

- Since Jio has partnered with Hindustan Unilever Limited (HUL), if the merchant is registered with HUL as a Prime Merchant, you may be able to receive the Jio PoS machine much more easily.

- In other cases, you should become a Jio Prime Partner Merchant in order to avail the Jio PoS Machine.

Jio PoS Features

- Jio PoS consists of a high-speed barcode scanner which makes it convenient for the merchants to scan the barcode provided by the customer to accept payments.

- Jio Prime Partner Mobile application and Tap & Pay features are also available in the machine.

- A complimentary welcome pack which will be active for 56 days is provided to the merchant immediately after the deposit is done.

- The Merchant Discount Rates (MDR) for any credit and debit transaction that ranges up to INR 2000 would be absolutely zero.

- For any transaction above INR 2000, the processing Fee would be set between 0% and 0.4%.

- At present, only Jio Money and National Payments Corporation of India’s BHIM are accepted by the PoS devices. However, it is expected to add other wallets very soon.

Documents Required

At present, there has been no official information stated by Jio yet, it is mandatory that the merchants looking forward to buy Jio-PoS devices possess the following documents in order to complete the registration process.- Aadhar Card

- Trade License

- Bank Passbook Copy and

- A set of two photographs

Why get a PoS?

- With appropriate Point-of-Sales devices, estimating and indicating the amount owed by the customer, preparing an invoice and specifying the available modes for payment can be made feasible by the merchant to their clients.

- The PoS devices also generate and issue receipts for transactions and transmit it electronically.

- On account of using these systems, it is possible to directly link the selling price of the product to the corresponding product code.

- This process can be executed during the accumulation of stock, and that is one of the most significant reasons why organisations prefer PoS software over diverse traditional methods.

Registration Procedure for Jio PoS

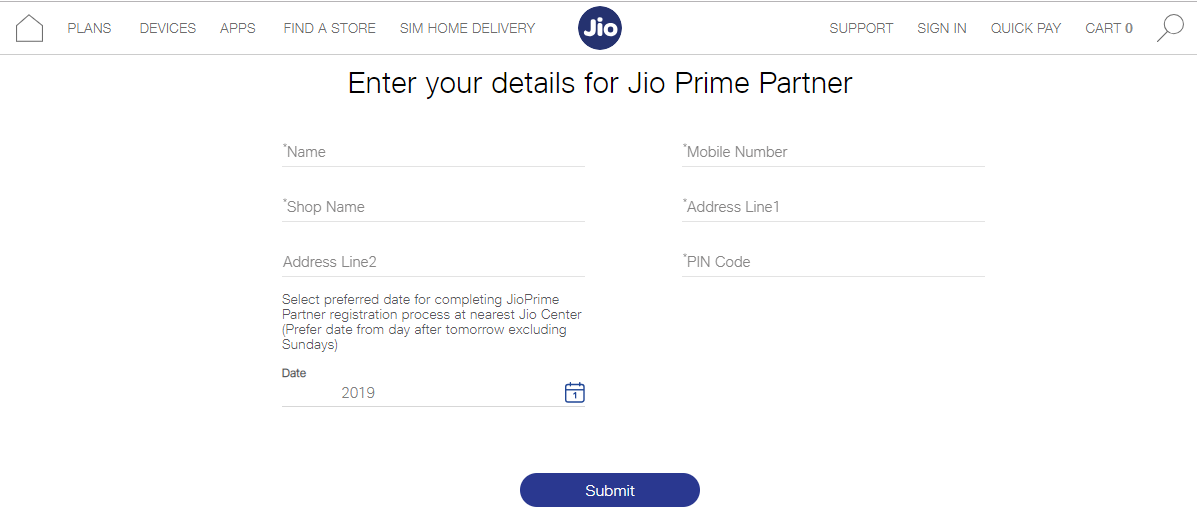

To register for a Jio PoS device, Step 1: Visit the official Jio PoS Page or dial 1800-896-2000 Step 2: Enter the details such as Name, Mobile Number, Address and the other required information and click on submit option. Jio PoS Image

For any clarifications on the registration process or for further assistance, kindly visit the Jio Center.

Jio PoS Image

For any clarifications on the registration process or for further assistance, kindly visit the Jio Center.

Popular Post

In the digital age, the convenience of accessing important documents online has become a necessity...

The Atalji Janasnehi Kendra Project that has been launched by the Government of Karnataka...

The Indian Divorce Act governs divorce among the Christian couples in India. Divorce...

When an individual has more than a single PAN card, it may lead to that person being heavily penalised, or worse,...

Employees Provident Fund (PF) is social security and savings scheme for employee in India. Employers engaged...