Last updated: May 23rd, 2024 6:12 PM

Last updated: May 23rd, 2024 6:12 PM

Kerala eStamp - Online Purchase Procedure

To register a property in India, the buyer needs to pay some charges in the form of stamp duty for registration. Previously, stamp duties were paid by purchasing stamp papers from authorised stamp vendors at the time of document registration. The Registration Department of the Government of Kerala has now introduced eStamping for document registration. In this article, we look at the Kerala eStamp and produce for purchasing eStamp online in Kerala.Stamp Duty

Stamp duty is a kind of tax that needs to be paid at the time of document registration. It is a legal tax payable as a proof for any purchase of a property or registration of the document. Know more about property registration and stamp duty in KeralaStamp Paper

Stamp paper is the traditional way of paying stamp duty and registration charges. The owner needs to purchase a non-judicial stamp paper from an authorised vendor. Once the non-judicial stamp paper obtained, the transaction details will be written or typed on them.Kerala eStamp

e-Stamp is a computer-generated alternative for conventional stamp paper. To avoid counterfeit stamp papers and to make property registration easy, the Government introduced e-stamping. As per Kerala Stamp (Amendment) Rules 2017, transaction above Rs. 1 lakh should be paid only with e-stamp.Benefits of eStamp Paper

The benefits of using eStamp paper are listed below:- e-stamping is a convenient method

- Usage of e-stamping eliminates the need of non-judicial stamp papers for document registration

- All details of stamping can be obtained from a single online portal

- e-stamping makes the registration process quick

- e-stamping is tamper-proof

- Validation is straightforward with e-stamp

Generate Kerala eStamp Online

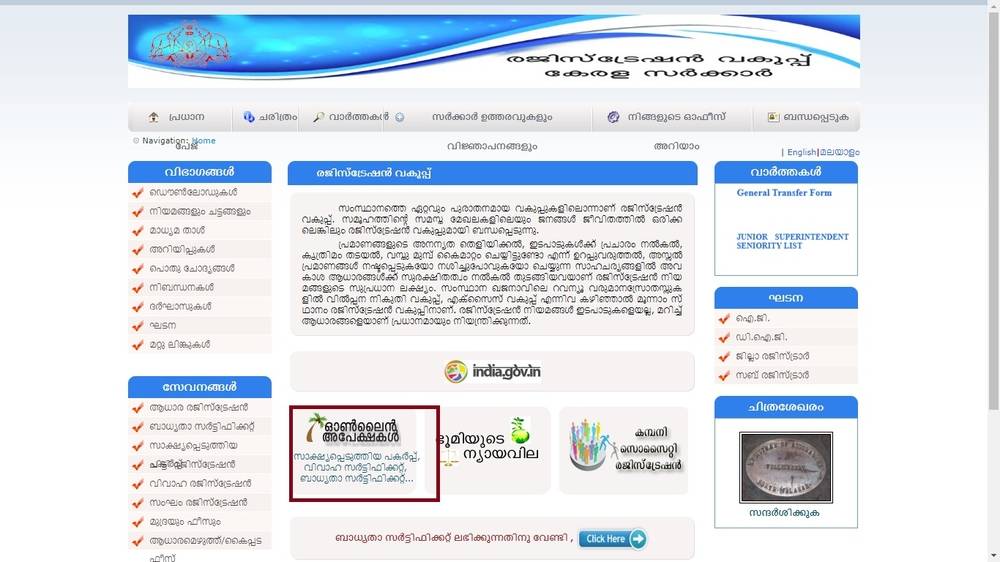

The steps for generating e-stamp online in Kerala are explained here: Step 1: Visit the official webpage of the Registration Department of Kerala. Step 2: Click on Online Applications option. Image 1 Online e-stamp paper in Kerala

Image 1 Online e-stamp paper in Kerala

Login to the Portal

Step 3: Login into the portal using user name and password. Image 2 Online e-stamp paper in Kerala

Image 2 Online e-stamp paper in Kerala

Image 3 Online e-stamp paper in Kerala

Image 3 Online e-stamp paper in Kerala

Token Creation

Step 4: After login to the portal select new token. Step 5: In this section, select below mentioned details:- District

- Taluk

- Sub Register Office

- Transaction Type

- Sub Transaction Type

- Book No

- Document Amount

- Original District, Village, Taluk, Local body or SRO

- The licence number of the document writer

- Presentation Type

Generate e-stamp

Step 12: In the mode of e-stamp payment, select the e-stamp option. Step 13: Enter stamp date, date of execution and all other mandatory details. Step 14: Click on save; the fee details will be shown. The applicant can purchase now eStamp. Step 15: After entering all other required details and completing self-verification, submit the application for eStamp generation by clicking on Submit Application for e-Stamp.Fee Payment

Step 16: Click on Online payment icon on this screen. Step 17: The fee can be paid as follows:- Stamp duty only

- Registration fee only ( Note: this case is applicable only after paying the stamp duty)

- Stamp duty and Registration fee together

- e-payment

- Direct treasury payment

Download e-stamp

Step 24: After successful payment, revisit the registration portal and confirm the payment. Step25: The applicant can see the details of the fees. To download eStamp Paper, click on the e-stamp button. Step 26: Enter GRN to cross verify the challan with eStamp.Select the time slot

Step 27: The final steps are to select a time slot and submit the application to SRO.Details in eStamp Paper

The e-stamp will contain below-mentioned details:- e-stamp Serial number

- Government Receipt Number (GRN)

- Department Reference Number

- Payment Date and Time

- Nature of Instrument

- Value of Instrument

- Amount of stamp duty paid

- Name of payee

Verify e-Stamp Online

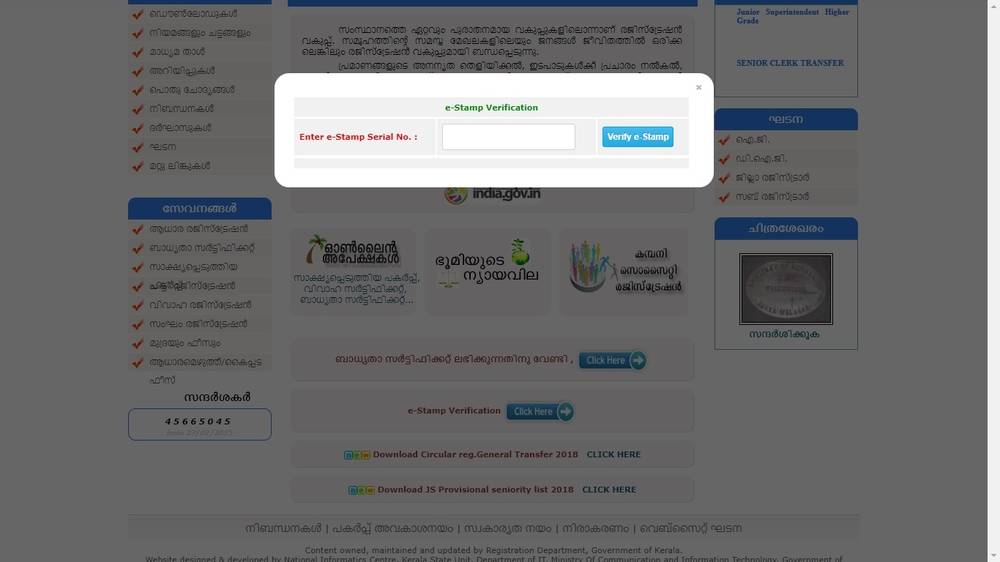

To very e-stamp details, Click on e-stamp verification option in the home page of Kerala Registration Department. Image 4 Online e-stamp paper in Kerala

Enter the e-stamp Serial number and click on e-stamp.

Image 4 Online e-stamp paper in Kerala

Enter the e-stamp Serial number and click on e-stamp.

Image 5 Online e-stamp paper in Kerala

The details of e-stamp will be displayed.

Image 5 Online e-stamp paper in Kerala

The details of e-stamp will be displayed.

Popular Post

In the digital age, the convenience of accessing important documents online has become a necessity...

The Atalji Janasnehi Kendra Project that has been launched by the Government of Karnataka...

The Indian Divorce Act governs divorce among the Christian couples in India. Divorce...

When an individual has more than a single PAN card, it may lead to that person being heavily penalised, or worse,...

Employees Provident Fund (PF) is social security and savings scheme for employee in India. Employers engaged...