Updated on: July 1st, 2024 5:31 PM

Updated on: July 1st, 2024 5:31 PM

Legal Entity Identifier for Large Value Transactions

The Reserve Bank of India (“RBI”) recently issued a circular introducing the Legal Entity Identifier (LEI) for all payment transactions of the value of Rs.50 crore and above undertaken by entities using the Central Processing System run by RBI – Real Time Gross Settlement (RTGS) and National Electronic Funds Transfer (NEFT). The current article briefs the Legal Entity Identifier for Large Value Transactions.The Gist of RBI Circular

RBI vide a Circular dated January 05, 2021, announced that, from April 1, 2021, RBI has mandated to mention Legal Entity Identifier (LEI) number & expiry for all initiating or receiving transactions of value INR 50 crore & above for entities (non-individuals) using Real Time Gross Settlement (RTGS) and National Electronic Funds Transfer (NEFT)Legal Entity Identifier

The Legal Entity Identifier (LEI) is a 20-digit number used to uniquely identify parties to financial transactions worldwide.- LEI has been implemented to improve the quality and accuracy of financial data reporting systems for better risk management.

- It is used to create a global reference data system that uniquely identifies every legal entity in any jurisdiction that is a party to a financial transaction.

- LEI can be obtained from any of the Local Operating Units (LOUs) accredited by the Global Legal Entity Identifier Foundation (GLEIF)

Benefits of Obtaining Legal Entity Identifier

- The key objective of the legal entity identifier is that the same being a global reference number it helps to uniquely identify every legal entity that is a party to a financial transaction in any jurisdiction.

- Legal entity identifiers would also serve as proof of identity for a financial entity. It will help to abide by regulatory requirements and it will facilitate transaction reporting to trade repositories.

List of Entities Eligible to Apply for LEI Codes

An entity registered in India needs to apply for an LEI code from time to time. The list of entities eligible to apply for LEI codes are given below:- Sole Proprietorships, Limited Liability Partnerships, Partnership Firms, and Trusts

- Private Limited Companies, Public Limited Companies, and Government Companies

- One Person Company, Insurance Companies, and Housing Finance Companies

- Non-Banking Finance Companies and Non-profit companies

- Special Purpose Vehicles – Trusts

- Special Purpose Vehicles – Companies

- SPV - Partnership Firms, SPV – Co-operative Societies or Multistate Co-operative Societies

- Mutual Fund, Mutual Funds-Sub Scheme

- Alternative Investment Fund (AIF), AIF- Sub Scheme

- Nationalized Banks, Scheduled Urban Cooperative Bank, Banking Companies,

- Stand-Alone Primary Dealers, Public Financial Institutions, and Unlimited Companies

- Cooperative Societies or Multistate Cooperative Societies

- Government Organizations and Companies Limited by Guarantee

Transactions included in LEI information

All single payment transactions of Rs.50 crore and above undertaken by entities (non-individuals) should include remitter and beneficiary LEI information. This applies to transactions undertaken through the NEFT and RTGS payment systems.Important Announcement to Banks

RBI announced that, in preparation for the wider introduction of Legal Entity Identifier (LEI) across all payment transactions, banks should advise entities who undertake large value transactions (₹50 crores and above) to obtain LEI in time, if they do not already have one;- The bank should include remitter and beneficiary LEI information in RTGS and NEFT payment messages

- The bank needs to maintain records of all transactions of ₹50 crores and above through RTGS and/or NEFT.

Guidelines for Populating LEI in NEFT and RTGS

In NEFT payment messages, the field 7495 is a free format optional field consisting of 6 lines with 35 characters each with alphanumeric options. The first two lines of this field shall be used for capturing sender and beneficiary customer LEI information. When LEI information is captured, narration, remarks, etc., shall be part of the last 4 lines of the field. The sender and beneficiary information shall be captured in the following format: 7495: line 1 -> SL/20 digit sender LEI/ line 2 -> BL/20 digit beneficiary LEI/Guidelines for Populating LEI in RTGS

In RTGS customer payment and inter-bank messages, the optional field “<-RmtInf->” has 4 repeat tags with each having 140 characters. The first two loops of this field shall be used for capturing sender and beneficiary customer LEI information, in that order, where applicable and available. When LEI information is captured, narration, remarks, etc., shall be part of the last two repeating loops of the field. The sender and beneficiary information shall be captured in the following format: <-RmtInf-> loop 1 -> /SL/20 digit sender LEI/ loop 2 -> /BL/20 digit beneficiary LEI/Procedure to get Legal Entity Identifier

As mentioned above, Entities can obtain LEI from any of the Local Operating Units (LOUs) accredited by the Global Legal Entity Identifier Foundation (GLEIF). LEI can be obtained from Legal Entity Identifier India Ltd. (LEIL), which is also recognized as an issuer of LEI by the Reserve Bank under the Payment and Settlement Systems Act, 2007. Steps for obtaining a legal entity identifier are given below.Applicable Fee

The fee required to obtain the Legal Entity Identifier for Large Value Transactions is explained below:New Registration Fees

In order to obtain a Legal Entity Identifier, it is required to make a payment of INR 7,080 (INR 6,000 fees + INR 1,080 GST).Renewal Fees

In order to get the renewal of the Legal Entity Identifier, it is required to make a payment of INR 4,130 (INR 3,500 fees + INR 630 GST).Documents Required

The list of documents and formats required for LEI registration as per the respective legal form of the legal entities are given here:- The list of documents and formats required for registration as per the respective legal form of the legal entities is available on the official website of LEIL.

Legal Entity Identifier - Documents Required1

Legal Entity Identifier - Documents Required1

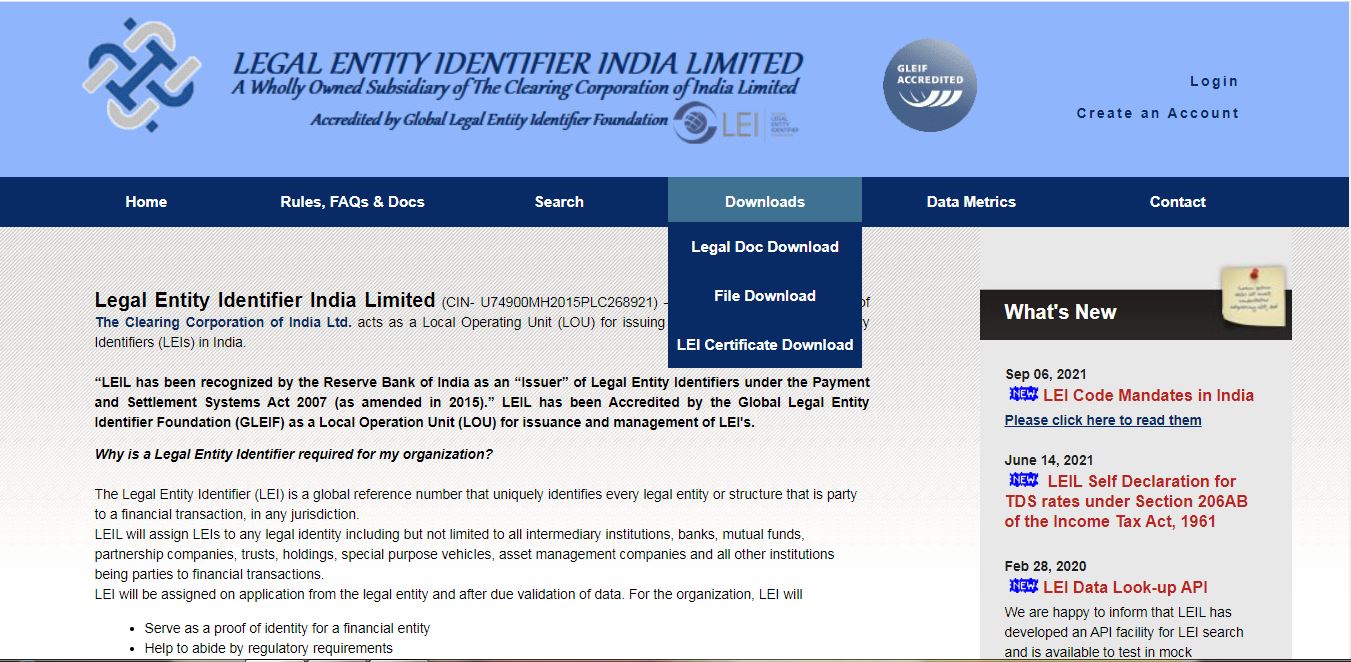

- Access the homepage of LEIL and click on the download tab and select the “Legal Doc Download” option. The link will redirect to a new page.

Legal Entity Identifier - Documents Required2

On the new page, select the request type and legal form from the drop-down menu. The list of documents required for the LEI application will be displayed.

Legal Entity Identifier - Documents Required2

On the new page, select the request type and legal form from the drop-down menu. The list of documents required for the LEI application will be displayed.

Application Procedure to get Legal Entity Identifier Code

The application procedure to get the Legal Entity Identifier code is explained below.User Registration

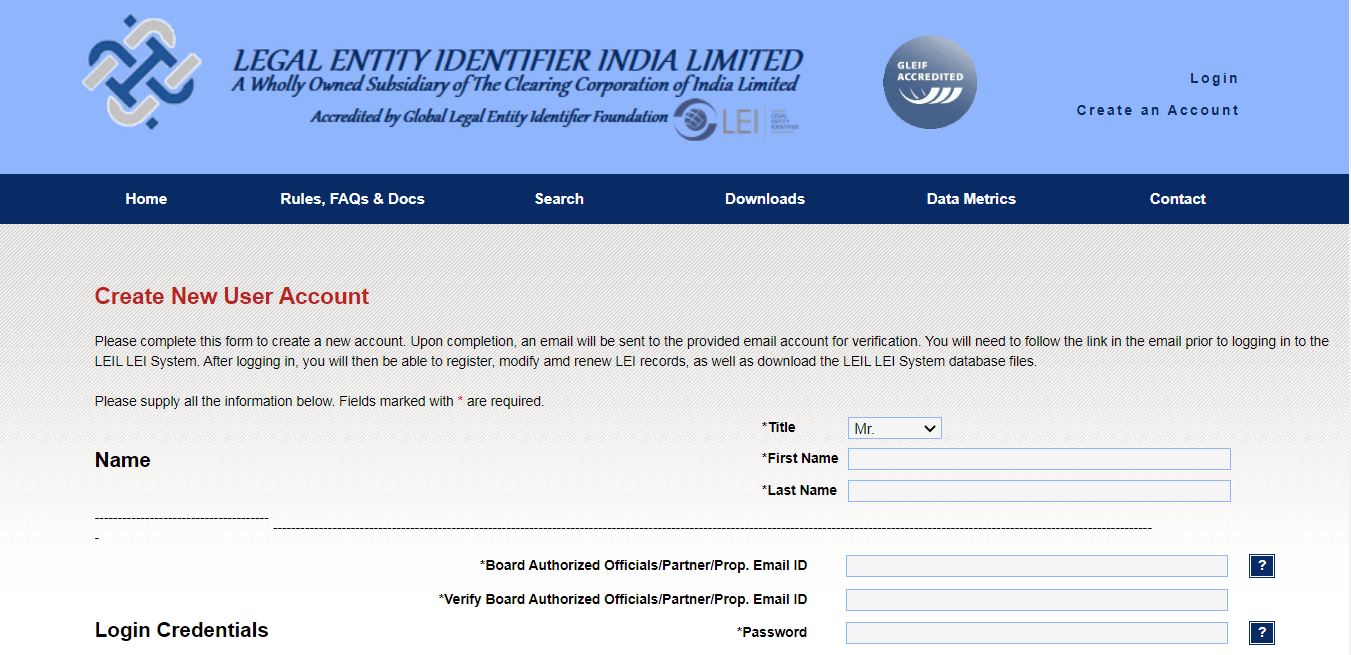

Access the official webpage LEIL, the legal entity needs to create an account for Legal entity identifier registration. Legal Entity Identifier for Large Value Transactions - User Registration1

Note: The account at the above-referred site needs to be created by Board Authorized Officials/ Partners/ Proprietor. The application will not be accepted in case the same is filed by an unauthorized official.

Legal Entity Identifier for Large Value Transactions - User Registration1

Note: The account at the above-referred site needs to be created by Board Authorized Officials/ Partners/ Proprietor. The application will not be accepted in case the same is filed by an unauthorized official.

- After filing up all the details on the account creation page, the login details would be sent to the email address mentioned in the application.

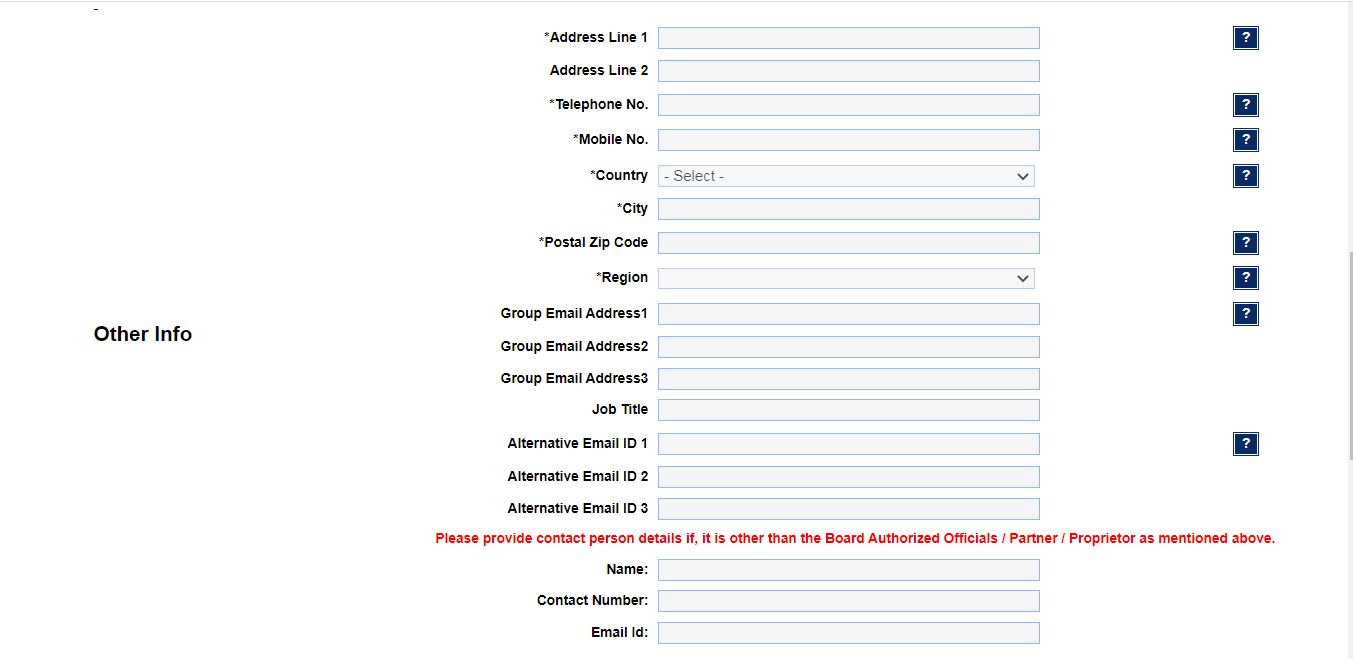

Legal Entity Identifier for Large Value Transactions - User Registration2

Legal Entity Identifier for Large Value Transactions - User Registration2

- On clicking the link which has been e-mailed, the account of the legal entity would be activated.

Provide Details

Once the account has been activated, the legal entity has to log in through the user id/e-mail id and password. The LEI registration involves four pages of information as follows:- Company Information Page

- Direct Parent Page (Holding Company Information)

- Ultimate Parent Page

- Payment Page

- Upload page.

Make Payment

- After filling up all the requisite details on the first three pages, the user has to go to the payment page.

- If the user selects “Net Banking/Credit/Debit Card” as payment mode and ‘Save & Submit’ the payment details, a payment link will be sent through e-mail and SMS to the authorized person.

- Once payment is received by LEIL, a reference number is generated and an email detailing the documents to be sent to LEIL is sent to the authorized person

- . The reference number will become an interface for any further communication between LEIL and the legal entity.

- If the user selects “Demand Draft” as payment mode and ‘Save & Submit’ the payment details, a reference number is generated and an email detailing the documents to be sent to LEIL is sent to the authorized person.

- Demand Drafts and should be sent along with other required documents to LEIL.

- After making payment online or updating DD details in the payment tab, the entity can upload the required document(s) on the online form.

Upload or Courier the documents

The entity will be required to upload the necessary documents on the online form If the legal entity is unable to upload documents, then they can courier the hard file of required documents to LEIL. The entity has to send the Demand draft in case if they have selected “Demand Draft” as the payment mode. The address to courier the document is: Legal Entity Identifier India Limited (LEIL) (The Clearing Corporation of India Ltd.) CCIL Bhavan, 3rd Floor, S. K. Bole Road, Dadar west Mumbai 400028 Dadar (West),Verification of Application

After receiving the documents and payment, LEIL will verify the mandatory list of documents. LEIL may ask for additional documents if necessary during the verification process. LEIL may suggest certain online form changes if there are any. For making changes legal entity has to login into the online application form or portal and click on view/edit details. After making suggested changes click on the ‘Save’ button of the respective page to save the changes. LEI Issuance: After successful payment and document verification, an LEI number is issued. An email, containing the LEI number is sent to the legal entity which is to be provided to all the banks. A digitally signed invoice will be provided to the legal entity through e-mail after the issuance of the LEI number.Popular Post

In the digital age, the convenience of accessing important documents online has become a necessity...

The Atalji Janasnehi Kendra Project that has been launched by the Government of Karnataka...

The Indian Divorce Act governs divorce among the Christian couples in India. Divorce...

When an individual has more than a single PAN card, it may lead to that person being heavily penalised, or worse,...

Employees Provident Fund (PF) is social security and savings scheme for employee in India. Employers engaged...