Last updated: February 14th, 2020 12:36 PM

Last updated: February 14th, 2020 12:36 PM

Limited Liability Protection in LLP

Limited liability protection for the firm and partners is one of the major draws for many Entrepreneurs opting to register an LLP instead of a regular partnership firm. In this article, we review the extent and limitation of liability of limited liability partnership (LLP) and partners in an LLP.

Limited Liability Protection Explained

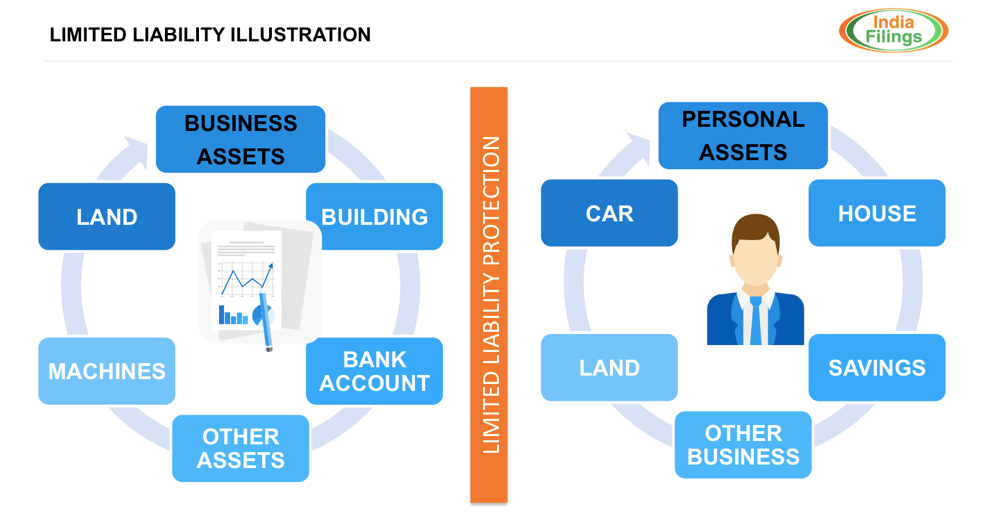

In an entity that provides "limited liability", the business owners are not personally responsible for business debts, liabilities and obligations. Therefore, if the business is sued, then only the assets owned by the business are at risk. The personal assets of the promoters like houses, cars, personal savings, etc., cannot be attached or taken. Running a business and limited liability provides legally limits the liability of Entrepreneurs in business thereby promoting risk-taking and Entrepreneurship.

[caption id="attachment_3269" align="aligncenter" width="1000"] Limited Liability Illustration

Limited Liability Illustration

In India, Proprietorships and Partnership Firms do not offer limited liability protection to promoters. Entities like Limited Liability Partnership, Private Limited Company, One Person Company and Limited Company offer limited liability protection.

Partner is an Agent of the LLP

In an LLP, it considers the Partners of the LLP as an agent of the LLP and not of the other partners. Therefore, a Partner in an LLP will not be personally liable for the wrongful act or omission of any other partner of the LLP.

Extent of Liability of Partner

A partner is not personally liable, directly or indirectly for any obligation of the limited liability partnership whether arising in contract or otherwise. The sole obligation of the liability of the LLP will rest with the limited liability partnership or with its authority.

However, in the event of an act carried out by a limited liability partnership, or any of its partners, with intent to defraud creditors of the LLP or any other person, or for any fraudulent purpose, the liability of the LLP and partners who acted with intent to defraud creditors or for any fraudulent purpose shall be unlimited for all or any of the debts or other liabilities of the LLP. In case any fraudulent activity is carried out by a partner, then the LLP is liable to the same extent as the partner unless it is established by the LLP that such act was without the knowledge or authority of the LLP.

Further, in case of fraud, every person who was knowingly a party to the carrying on of the business in the manner aforesaid shall be punishable with imprisonment for a term which may extend to two years and a fine which shall not be less than fifty thousand rupees to rupees five lakhs.Extent of Liability of LLP

- A Limited Liability Partnership (LLP) is not bound by anything done by a partner in dealing with a person, if:

- the Partner, in fact, had no authority to act for the limited liability partnership in doing a particular act; and

- the person knows that he has no authority or does not know or believe him to be a partner of the limited liability partnership.

- The limited liability partnership is liable if a partner of a limited liability partnership is liable to any person as a result of a wrongful act or omission on his part in the course of the business of the limited liability partnership or with its authority.

- An obligation of the limited liability partnership whether arising in contract or otherwise shall be solely the obligation of the limited liability partnership.

- The liabilities of the limited liability partnership shall be met out of the property of the limited liability partnership.

Popular Post

In the digital age, the convenience of accessing important documents online has become a necessity...

The Atalji Janasnehi Kendra Project that has been launched by the Government of Karnataka...

The Indian Divorce Act governs divorce among the Christian couples in India. Divorce...

When an individual has more than a single PAN card, it may lead to that person being heavily penalised, or worse,...

Employees Provident Fund (PF) is social security and savings scheme for employee in India. Employers engaged...