Last updated: December 17th, 2024 5:34 PM

Last updated: December 17th, 2024 5:34 PM

Linking PAN with Aadhaar for Income Tax Filing

Linking PAN with Aadhar is considered to be one of the major announcements made by the Income Tax Department in recent times. The Government, under the Finance Act 2017, has made it mandatory for taxpayers to quote Aadhaar or the enrolment ID of Aadhaar application form for filing income tax returns. The Income Tax Department has launched an e-facility to link Aadhaar with Permanent Account Number (PAN). It should be noted by taxpayers that linking of PAN with Aadhar is a mandatory procedure for filing income tax returns.Why should PAN be linked to Aadhaar?

Linking PAN with Aadhar card will become a game-changer for the Income Tax Department and help increase e-filing of income tax returns. Since the Income Tax legislation is voluminous, Income Tax filings are usually a cumbersome process and part of the complexity can be reduced once Aadhaar and PAN are linked. Once the two identities are linked, taxpayers will be relieved of the burden of submitting IT acknowledgement to the Department of Income Tax, as the identity of the filer would be authenticated using the Aadhaar mechanism. As a result, a lot of hassles will be eliminated for the taxpayers and this arrangement will also reduce costs incurred by the Income Tax Department in areas of compliance and execution like receiving the hard copy returns and reconciling it with e-filed returns. Thus, Linking PAN card with Aadhar will make the process simple for both the taxpayer and the Government.Procedure to Link PAN with Aadhaar Card

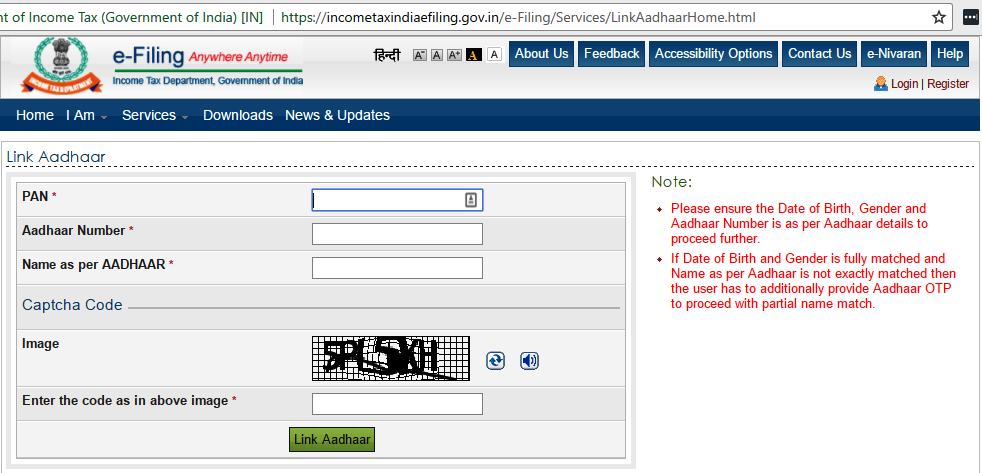

There is no need to log in or be registered on E-filing website. This facility can be used by anyone to link their Aadhaar with PAN. After responding to grievances of taxpayers regarding difficulties in linking PAN with Aadhaar since their names did not match in both systems (for instance, names with initials in one and expanded initials in another), the Department has come out with a simple solution as part of the 2017 budget.- Taxpayers can go to the Income Tax website and click on the link on the left pane which states ‘Link Aadhaar’, as shown below.

Illustration: Step 1 - Go to Income Tax Website

Illustration: Step 1 - Go to Income Tax Website

- After clicking on Link Aadhaar, a new page will open where the assessee needs to provide PAN, Aadhaar card number. Please enter the name exactly as given in the Aadhaar card. One should avoid making spelling mistakes. After filling in the details, click on submit.

Step 2: Update Aadhaar Information

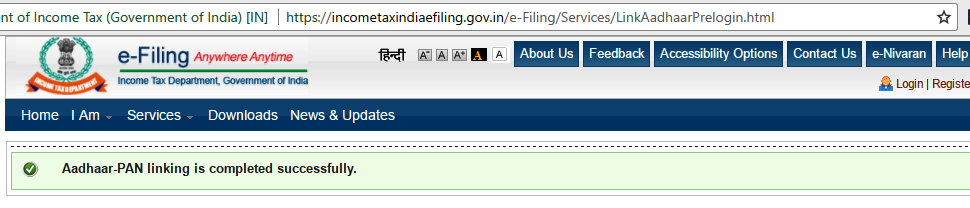

3. After verification from UIDAI, the linking will be confirmed and it will display Aadhaar-PAN linking is completed successfully.

[caption id="" align="aligncenter" width="970"]

Step 2: Update Aadhaar Information

3. After verification from UIDAI, the linking will be confirmed and it will display Aadhaar-PAN linking is completed successfully.

[caption id="" align="aligncenter" width="970"] Step 3: Confirmation is received

If there is a minor mismatch in Aadhaar name provided by an individual when compared to the actual data in Aadhaar, One Time Password (Aadhaar OTP) will be sent to the mobile registered with Aadhaar, as per the press release provided by the Income Tax department. The taxpayers should ensure that the date of birth and gender in PAN and Aadhaar are exactly the same. In rare cases where Aadhaar name is completely different from name in PAN database, linking would fail and the taxpayer will be prompted to change the name in either the Aadhaar or PAN database before linking.

Taxpayers have been requested by the Income Tax Department to use the simplified process to complete the linking of Aadhaar with PAN immediately. This will be useful for E-Verification of Income Tax returns using OTP sent to their mobile registered with Aadhaar. Till now over 1.18 crore Aadhaar numbers have been linked with PAN database, a report by news agency Press Trust of India said.

Step 3: Confirmation is received

If there is a minor mismatch in Aadhaar name provided by an individual when compared to the actual data in Aadhaar, One Time Password (Aadhaar OTP) will be sent to the mobile registered with Aadhaar, as per the press release provided by the Income Tax department. The taxpayers should ensure that the date of birth and gender in PAN and Aadhaar are exactly the same. In rare cases where Aadhaar name is completely different from name in PAN database, linking would fail and the taxpayer will be prompted to change the name in either the Aadhaar or PAN database before linking.

Taxpayers have been requested by the Income Tax Department to use the simplified process to complete the linking of Aadhaar with PAN immediately. This will be useful for E-Verification of Income Tax returns using OTP sent to their mobile registered with Aadhaar. Till now over 1.18 crore Aadhaar numbers have been linked with PAN database, a report by news agency Press Trust of India said.

Mismatch between PAN and Aadhaar Information

In case of name or other information mismatches between PAN or Aadhaar, an application for correction can be made to either UIDAI or the Income Tax Department. This means that either the information on your Aadhaar will change or the information on your PAN will change. In the case of Aadhaar, only your name, date of birth, your residence address etc. can be changed. In other words, every other information other than your biometric information can be changed on your Aadhaar Card. If you are asking for changes in your PAN Card, there is no biometric information and therefore, only the information a person can see on the card can be changed. In either case, one has to provide valid documents that will give the correct information that needs to be reprinted on either card. Know more about PAN name change.Document Required for Linking PAN with Aadhaar

No document is necessary for linking PAN with Aadhaar. All that is required is that the information (non-biometric) on the Aadhaar Card and the PAN Card are a perfect match. Only if they match, can the assessee ask for a linking or else, one has to have the information edited and corrected before the taxpayer can have the two linked with each other. Hence, prior to starting the process, the assessee should ensure that the PAN and Aadhaar cards will have the following information in common:- Name

- Gender

- Birth Date

Latest Update

As per notification on 30th December 2019 from the CBDT, Ministry of Finance (Notification No.107/2019), the deadline for linking PAN & Aadhaar is 31st March 2020. The respective notification can be found below: Learn more: Advance Tax PaymentUpdate on 23/12/2022

CBDT announced that Unlinked PAN Will Become Inoperative From 01.04.2023. As per sec 139AA of the income tax act 1961, every person who has been allotted PAN as of 01.07.2017 and who is eligible to obtain an Aadhaar Number has compulsorily linked their Aadhaar and pan on or before 31st March 2023 With paying the late fee as per Circular No. 7/2022 dated 30/3/2022.Popular Post

In the digital age, the convenience of accessing important documents online has become a necessity...

The Atalji Janasnehi Kendra Project that has been launched by the Government of Karnataka...

The Indian Divorce Act governs divorce among the Christian couples in India. Divorce...

When an individual has more than a single PAN card, it may lead to that person being heavily penalised, or worse,...

Employees Provident Fund (PF) is social security and savings scheme for employee in India. Employers engaged...