Updated on: February 11th, 2020 11:55 AM

Updated on: February 11th, 2020 11:55 AM

LLP Form 17 Conversion of Partnership to LLP

More and more partnership firms are being converted into a Limited Liability Partnership (LLP). LLP offers a host of features such as unlimited partners, limited liability protection, transferability, survivability, etc., - making it more attractive than a partnership firm. In this article, we look at the procedure for conversion of Partnership Firm into LLP in a step by step manner.

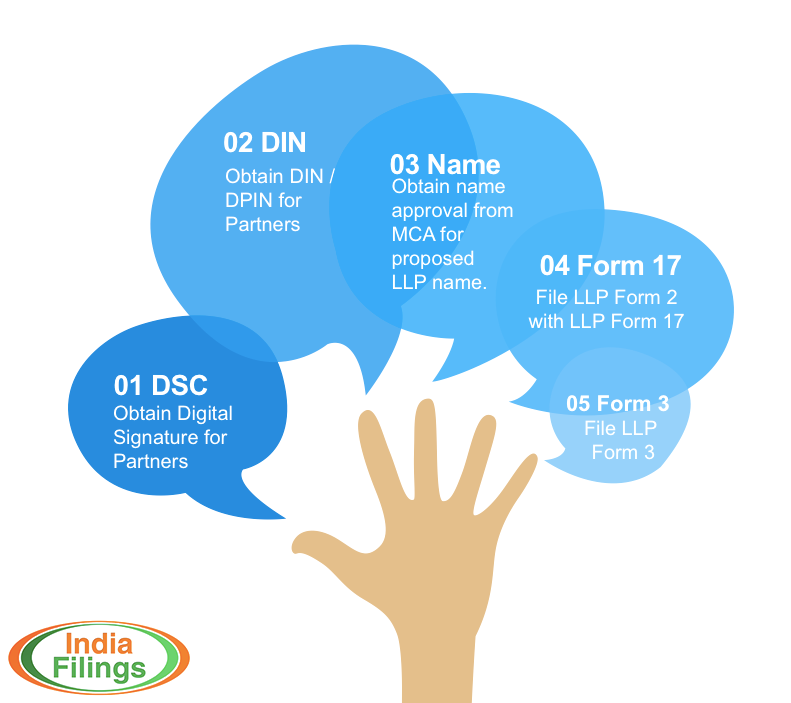

[caption id="attachment_2716" align="aligncenter" width="791"] Five steps for converting Partnership to LLP

Five steps for converting Partnership to LLP

Digital Signature

Typically Partners in a Partnership Firm would not have a digital signature as the same is not necessary for the registration of a partnership firm. However, if the Partners decide to convert the Partnership Firm into a Limited Liability Partnership, then Digital Signatures would be required for all the Partners. Click here to know more about Class 2 Digital Signatures.

DIN or DPIN

Partners in an LLP or Directors in a Private Limited Company require a DIN / DPIN. A DIN is a unique number for each person who is an LLP Partner or Director. On issuance of a DIN or DPIN, a person can use it for a lifetime without any renewal or compliance filing. Click here to know more about DIN.Name Approval

Once, two DIN or DPIN numbers are available, make the application for name reservation to the Ministry of Corporate Affair. Obtain the reservation of name of the LLP before filing the forms for the conversion of the Partnership Firm into LLP. Click here to know more about LLP Name Approval.

Filing LLP Form 17 - Conversion of Partnership into LLP

A person must file LLP Form 17 (Application and Statement for the Conversion of Partnership Firm into Limited Liability Partnership (LLP)) along with the incorporation application and subscribers sheet while converting a partnership firm into an LLP. Further, attach the following documents the LLP Form 17:

-

Statement of the consent of partners of the firm;

-

Statement of assets and liabilities of the firm duly certified as true and correct by the Chartered Accountant in practice;

-

Copy of acknowledgement of latest income tax return (Mandatory);

-

Approval from any regulatory body/ authority (Mandatory, in case applicable approvals from the concerned body/ authority or authorities is required and have been obtained);

-

List of all the secured creditors along with their consent to the conversion (Mandatory in case consent of all the secured creditors for the conversion of the firm into limited liability partnership has been);

- Clearance or No Objection Certificate from Tax Authorities;

Filing for Incorporation & Conversion of Partnership into LLP

For the conversion of Partnership Firm into LLP, along with LLP Form 17, LLP Form 2 and LLP Form 3 must also be filed. LLP Form 2 contains incorporation document and subscriber’s statement. Along with LLP Form 2, the following documents must be submitted:

- Proof of address of registered office of LLP;

- Subscribers' sheet including consent;

- In-principle approval of regulatory authority, if required

- Detail of LLP(s) and/ or company(s) in which partner/ designated partner is a director/ partner (if any).

Successful Conversion of Partnership into LLP

On successful conversion of Partnership Firm into LLP, the Registrar would issue Certificate of Incorporation of LLP. Once, the LLP is incorporated and the Partnership Firm is converted, the Partnership Firm would be deemed to be dissolved. Further, on the conversion of Partnership into LLP, all properties, assets, interests, rights, privileges, liabilities, obligations of the firm are transferred to the LLP. In other words, the whole of the undertaking of the firm is transferred to the LLP.

However, any approvals, permit or license issued under any written law to the Partnership Firm will not be transferred automatically to the LLP. Therefore, fresh licenses or registrations may be required. Before the conversion process, it is necessary to consider the aspect of the conversion of Partnership into LLP

Know more about Conversion of Partnership to LLP

To know more about the Conversion of Partnership to LLP, refer to the following articles:- Conversion of Partnership to LLP

- LLP vs Partnership Firm

- Reasons to Convert Partnership Firm into LLP

Click here to know more about registering an LLP in India.

Popular Post

In the digital age, the convenience of accessing important documents online has become a necessity...

The Atalji Janasnehi Kendra Project that has been launched by the Government of Karnataka...

The Indian Divorce Act governs divorce among the Christian couples in India. Divorce...

When an individual has more than a single PAN card, it may lead to that person being heavily penalised, or worse,...

Employees Provident Fund (PF) is social security and savings scheme for employee in India. Employers engaged...