Updated on: March 5th, 2020 5:13 PM

Updated on: March 5th, 2020 5:13 PM

Madhya Pradesh Land Diversion (Conversion)

Agricultural land cannot be utilized for residential or commercial purpose except on diversion of the same into non-agricultural land. The process of diverting agricultural land into non-agricultural land is called as land conversion. As per the provision of Madhya Pradesh Land Revenue Code (Amendment) Act, 2011, agricultural land can be diverted for non-agriculture purposes only by taking prior permission from the competent authorities in the state. In this article, we look at the procedure for Madhya Pradesh land conversion in detail.Madhya Pradesh Land Revenue Code Act

Government of Madhya Pradesh has introduced Madhya Pradesh Land Revenue Code, Act in the year 1959. Madhya Pradesh Land Revenue Code (Amendment) Act, 2011 regulates the process of conversion of agriculture land to non-agriculture land in Madhya Pradesh. As per the provision of Madhya Pradesh Land Revenue Code, all land will be treated as irrigated agricultural land in the calculation of premium.Madhya Pradesh Ceiling on Agricultural Holdings Ordinance

Under provisions of Madhya Pradesh Ceiling on Agricultural Holdings (Amendment) Ordinance, 2015, a buyer must intimate in writing to the competent authority (District Collector) within 90 days from the date of acquisition that he will get his land converted for non-agricultural purpose. Buyer must convert his land in accordance with MP Land Revenue Code, 1959, within a year from date of acquisition and commence proposed non-agricultural land usage within three years from the date of conversion.Exempted Lands

Following types of land are exempted for the conversion as per the provisions of this code:- Lands held by a local authority or a University established within Madhya Pradesh

- Lands held by the Madhya Pradesh Agro Industries Development Corporation Ltd

- Land of a Corporation, if the State or Central Government manages such corporation, it cannot be converted

- If the land is the property of the public trust, such land cannot be converted. As per the Madhya Pradesh Code Act.

- Lands used for the religious purpose are not permissible for conversion.

- Land held by a Bhoodan Yagna Board under the Madhya Pradesh Bhoodan Yagna Adhiniyam, 1968.

- Land held by a co-operative land development bank or co-operative bank registered or under the Madhya Pradesh Co-operative Societies Act.

- Land held by a banking company as defined in section 5 of the Banking Regulation Act, 1949.

Document Required

Document required for applying for Madhya Pradesh land conversion is provided below:- 7/12 extract

- Land Mutation document

- Extract of village form-8A

- Land Map

- Site Plan

- NOC from concerned Grama panchayat

Premium for Land Conversion

Landowners who intend to convert agriculture land for non-agriculture purposes is liable for pay tax for land conversion. If a land assessed for non-agricultural purpose is converted to agricultural purpose, no premium will be imposed. As per Madhya Pradesh Land Revenue code act, no premium will be imposed for the conversion of land for a charitable purpose, such as institution for physically or mentally challenged, orphanages, hostels for girls and working women, old age homes, developing sports facility. Rate of premium for various purposes are below:|

S.No |

Use of Land |

Rate of Premium |

|

1 |

For the residential purpose for dwelling house | 1% of Market Value of agricultural land |

|

2 |

For educational purpose | |

| If the area diverted is up to t hectare | 1% of Market Value of agricultural land | |

| For excess land, if the area diverted is more than t hectare | 0.5 % of Market Value of agricultural land | |

|

3 |

For industrial purpose | 1% of Market Value of agricultural land |

|

4 |

For commercial purpose | 2% of Market Value of agricultural land |

|

5 |

For mining purpose specified in clause (f) of sub-section (1) of Section 59 | 1% of Market Value of agricultural land |

Market Value of Agricultural land

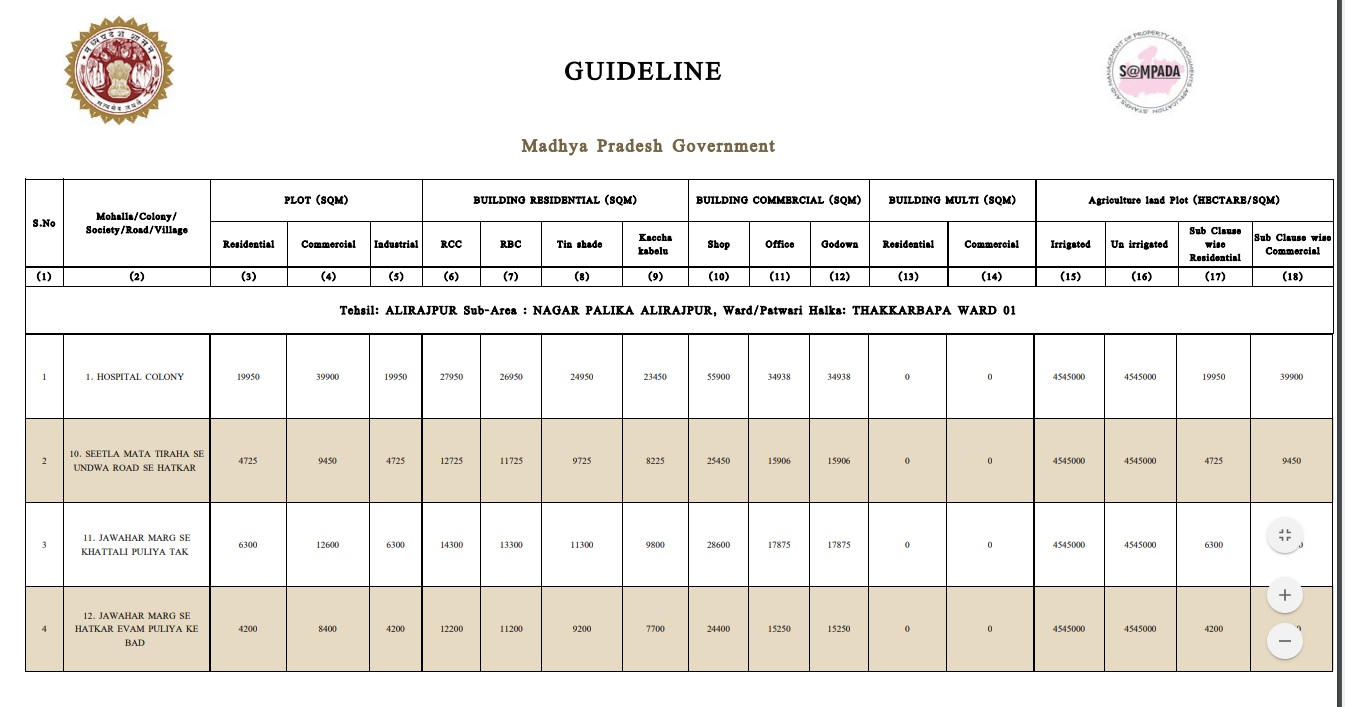

To get the market value of agriculture land in Madhya Pradesh, follow the procedure explained here: Step 1: Visit the home page of the MP Department of Registration and Stamps. District wise market valuation draft Madhya Pradesh Land Diversion

Step 2: In this page, select the corresponding district of the agriculture land.

District wise market valuation draft Madhya Pradesh Land Diversion

Step 2: In this page, select the corresponding district of the agriculture land.

Guideline Madhya Pradesh Land Diversion

The market value of agriculture land in a particular district will be in the tabulation.

Guideline Madhya Pradesh Land Diversion

The market value of agriculture land in a particular district will be in the tabulation.

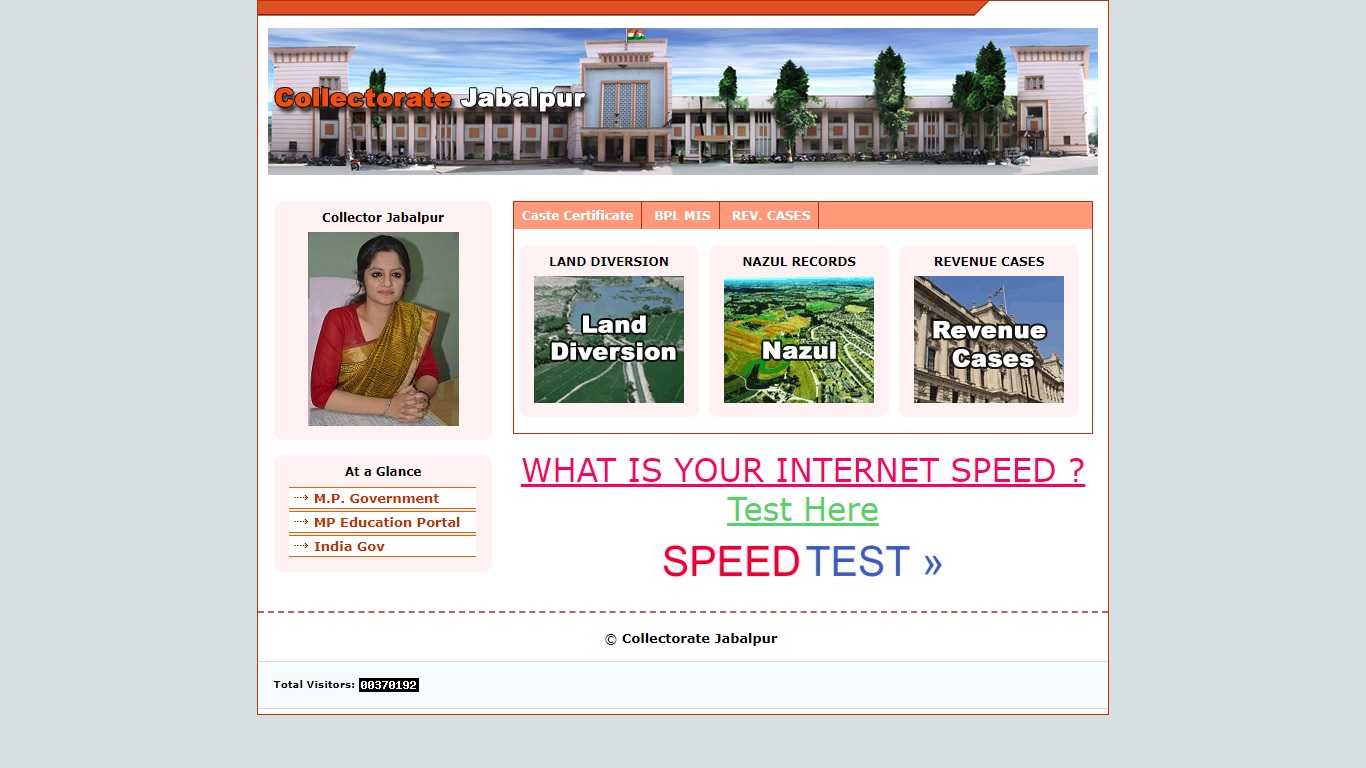

Madhya Pradesh Land Conversion Procedure

Procedure for conversion of land usage in Madhya Pradesh is explained in detail below. Earlier people have to apply District Collector office directly with an application form in prescribed format along with all documents. Now according to the new MP Land Revenue Code act amendment, the land shown in the master plan can be converted by filling the online application. The landowner can calculate the fees and deposit it online. The fee receipt of the land conversion will be the certificate of land conversion. Step 1: Go to home page collectorate of Jabalpur. Step 2: Click on Land Diversion option from the home page. The link will redirect to the new page. Homepage Madhya Pradesh Land Diversion

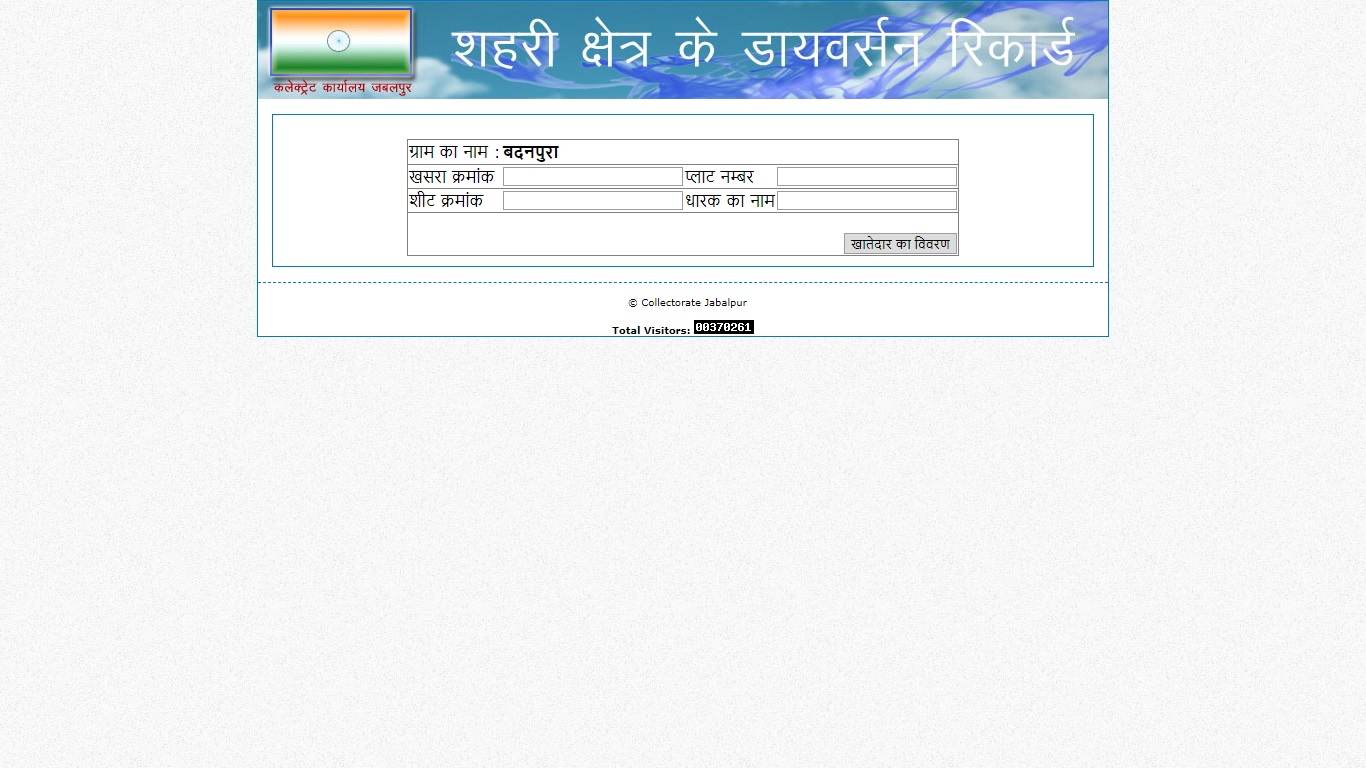

Step 3: Select the village from the drop-down menu and click on choose.

Homepage Madhya Pradesh Land Diversion

Step 3: Select the village from the drop-down menu and click on choose.

Select village Madhya Pradesh Land Diversion

Step 4: Provide the following details on the new page.

Select village Madhya Pradesh Land Diversion

Step 4: Provide the following details on the new page.

- Measles Number

- Street Number

- Plot Number

- Holder’s Name

Personal details Madhya Pradesh Land Diversion

Step 4: After providing all the information, click on the account holder details button.

Step 4: Application for land diversion will appear. Provide the details such as Landowner name, 7/12 extract details, the purpose of land conversion etc.

Step 8: The calculation of the online rate of premium is based on the market value of the agriculture land. (Refer above table for calculation).

Once the premium has been paid successfully, the fee receipt of the land diversion will be displayed after the request is approved by the concerned District Collector. This fee receipt can be used as a certificate of land diversion. After obtaining the fee receipt, the landowner will divert agricultural land to non-agriculture purposes such as industrial, commercial and residential purposes.

Personal details Madhya Pradesh Land Diversion

Step 4: After providing all the information, click on the account holder details button.

Step 4: Application for land diversion will appear. Provide the details such as Landowner name, 7/12 extract details, the purpose of land conversion etc.

Step 8: The calculation of the online rate of premium is based on the market value of the agriculture land. (Refer above table for calculation).

Once the premium has been paid successfully, the fee receipt of the land diversion will be displayed after the request is approved by the concerned District Collector. This fee receipt can be used as a certificate of land diversion. After obtaining the fee receipt, the landowner will divert agricultural land to non-agriculture purposes such as industrial, commercial and residential purposes.

Diverted Land Assessment

In case of land already diverted to a non-agricultural purpose and re-assessed on that basis is re-diverted to an agricultural purpose, the assessment as re-fixed will be equal to the agricultural assessment on the land as fixed at the last settlement. If a land already diverted to a non-agricultural purpose and assessed on that basis is re-diverted to an agricultural purpose, the assessment on re-diversion will be fixed at a rate adopted for that village or in the neighbouring village at the last settlement. In the case of land assessed for one purpose is diverted to any other purpose, the assessment will be revised, and the land revenue will be fixed in accordance with the rates specified for re-assessing. If the land is diverted into more than one non-agricultural purposes, i.e., mixed-use, the assessment will depend on the proportion of these purposes. Rate of re-assessing the land revenue are:| S.No | Use of Land | Rate of Re-assessing the land Revenue |

|

1 |

For the residential purpose for dwelling house | 0.2 % of Market Value of agricultural land |

|

2 |

For educational purpose | |

| If the area diverted is up to t hectare | 0.2 % of Market Value of agricultural land | |

| For excess land, if the area diverted is more than t hectare | 0.1 % of Market Value of agricultural land | |

|

3 |

For industrial purpose | 0.2 % of Market Value of agricultural land |

|

4 |

For commercial purpose | 0.4 % of Market Value of agricultural land |

|

5 |

For mining purpose specified in clause (f) of sub-section (1) of Section 59 | 0.2 % of Market Value of agricultural land |

|

6 |

For Charitable purpose | 0.2% of the Market Value of agricultural land |

Popular Post

In the digital age, the convenience of accessing important documents online has become a necessity...

The Atalji Janasnehi Kendra Project that has been launched by the Government of Karnataka...

The Indian Divorce Act governs divorce among the Christian couples in India. Divorce...

When an individual has more than a single PAN card, it may lead to that person being heavily penalised, or worse,...

Employees Provident Fund (PF) is social security and savings scheme for employee in India. Employers engaged...